Coating Agents For Synthetic Leather Market Size 2024-2028

The coating agents for synthetic leather market size is forecast to increase by USD 254.8 million at a CAGR of 8.51% between 2023 and 2028.

- The market is experiencing significant growth, driven by the shifting consumer preference towards sustainable and ethical alternatives to animal-hide leather. This trend is fueled by increasing environmental concerns and ethical considerations, leading to a surge in demand for synthetic leather products. Moreover, the availability of a wide range of synthetic leather options catering to various industries, including fashion, automotive, and furniture, further boosts market expansion. However, market growth is not without challenges. Regulatory hurdles impact adoption as stringent regulations governing the use of certain chemicals in synthetic leather production can limit the availability of compliant coating agents.

- Additionally, supply chain inconsistencies, particularly in raw material availability and pricing, can temper growth potential. Intense competition among companies, driven by price wars and product differentiation, further complicates the strategic landscape. Companies seeking to capitalize on market opportunities must navigate these challenges effectively by focusing on innovation, regulatory compliance, and supply chain resilience.

What will be the Size of the Coating Agents For Synthetic Leather Market during the forecast period?

- The market is experiencing significant advancements in coating technologies, driven by the increasing demand for sustainable and high-performance leather alternatives. Leather finishing chemicals play a crucial role in enhancing the aesthetic and functional properties of synthetic leather. Renewable resources, such as bio-based polymers, are gaining popularity as coating materials due to their eco-friendly nature and improved coating adhesion. Manufacturers are focusing on durability testing to ensure the longevity of synthetic leather products. Antimicrobial agents and pigment dispersion technologies are being integrated into coating formulations to address coating defects and improve colorfastness. Hydrophobic properties and breathability testing are essential to create synthetic leather with optimal water resistance and comfort.

- Coating optimization is a key trend, with a focus on reducing VOC emissions and improving coating uniformity, flexibility, and UV stability. Flame retardant additives and abrasion resistance testing are critical for ensuring product safety and performance. Circular economy principles are driving innovation in solvent recovery and the development of plant-based leather alternatives. Stain resistance testing is also essential to meet consumer expectations for easy-to-clean synthetic leather products. Synthetic leather alternatives, such as those made from renewable resources, are gaining traction as process control and water resistance testing become increasingly important for manufacturers.

How is this Coating Agents For Synthetic Leather Industry segmented?

The coating agents for synthetic leather industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Automotive

- Footwear

- Furniture and domestic upholstery

- Others

- Geography

- North America

- US

- Europe

- Germany

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By End-user Insights

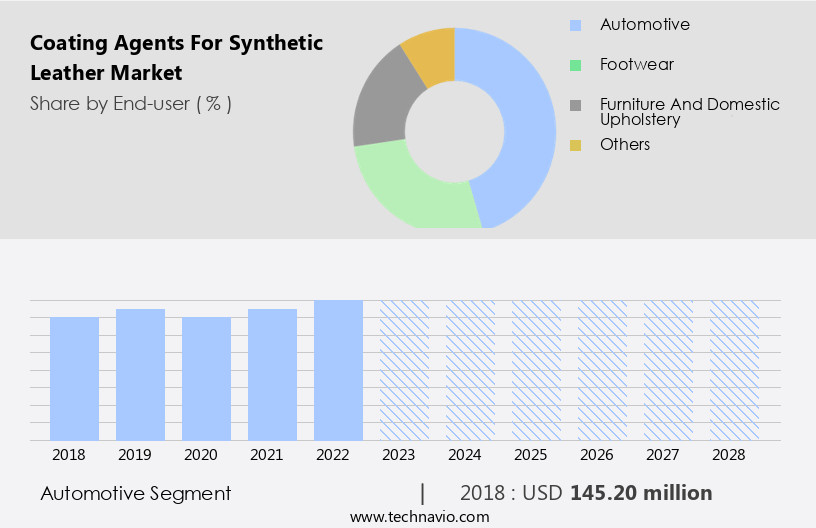

The automotive segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth, particularly in the automotive segment, due to the increasing preference for eco-friendly and cost-effective alternatives to animal-hide leather. Coating agents play a crucial role in enhancing the performance and durability of synthetic leather. UV resistance is a key feature sought after in coatings for synthetic leather, especially in applications for outdoor leather goods and sports equipment. Coating processes, such as dip coating and roll coating, are commonly used to apply these agents. Solvent-based coatings have traditionally been used, but there is a growing trend towards waterborne and eco-friendly coatings due to environmental concerns.

Coating thickness and application techniques are essential factors that impact the overall quality of the synthetic leather. Coating agents are also used to improve flame retardancy, scratch resistance, stain resistance, and abrasion resistance. Microfiber leather, a type of synthetic leather, has gained popularity due to its softness and texture. Coating processes require careful surface preparation to ensure proper adhesion of the coating. Sustainable coatings, such as those derived from bio-based materials, are becoming increasingly popular due to their environmental benefits. Performance testing and adherence to testing standards are essential to ensure the quality and consistency of the coatings.

Antibacterial properties are also desirable in coatings for certain applications, such as automotive upholstery. In textile manufacturing, synthetic leather is used in various applications, including leather finishing and upholstery. PVC leather, a type of synthetic leather, is widely used in the production of coated fabrics.PU leather, another type of synthetic leather, is commonly used in the production of clothing and footwear. Coating agents are essential in enhancing the properties of these materials and ensuring their longevity. Quality control is a critical aspect of the synthetic leather industry, and the use of advanced coating technologies and testing methods is helping to improve the consistency and reliability of synthetic leather products.

The market for coating agents for synthetic leather is expected to continue growing as the demand for synthetic leather in various industries, including automotive, sports goods, and textile manufacturing, continues to increase.

The Automotive segment was valued at USD 145.20 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

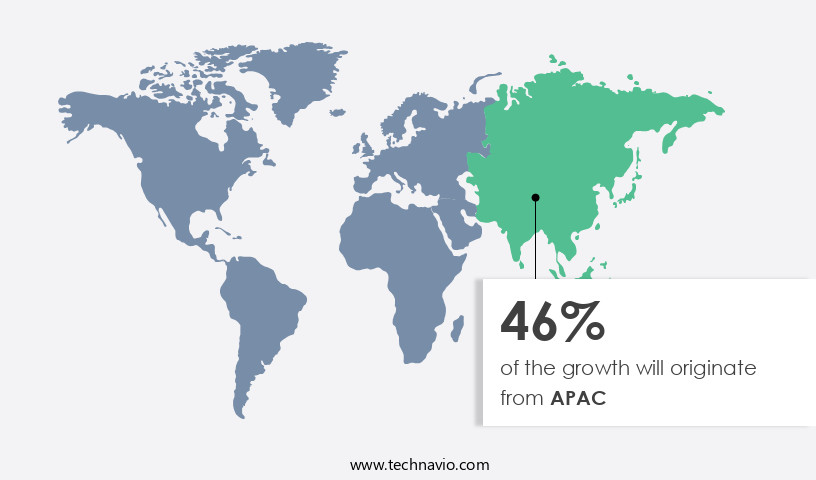

APAC is estimated to contribute 46% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The coating agents market for synthetic leather in Asia Pacific is experiencing significant growth due to the expanding industries, particularly in footwear, apparel, automotive, furnishing, and bag manufacturing. Key countries, including China, Japan, and India, lead the market in sales within the region. China stands out as a significant manufacturing hub for coating agents for synthetic leather, driven by increasing consumer preference for eco-friendly alternatives to animal-hide leather. UV resistance, scratch resistance, stain resistance, and flame retardancy are essential coating performance attributes in demand for various applications, from leather goods and sports equipment to automotive upholstery and textile manufacturing.

Coating processes, such as dip coating, roll coating, and spray coating, are employed to enhance leather finishing, with waterborne coatings and solvent-based coatings being popular choices. Sustainable coatings and bio-based coatings are gaining traction due to their environmental benefits. Coating thickness, abrasion resistance, and performance testing against established standards are crucial factors in ensuring quality control. Antibacterial properties are also desirable in certain applications.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Coating Agents For Synthetic Leather market drivers leading to the rise in the adoption of Industry?

- The significant shift in consumer preferences towards synthetic leather products over animal hides serves as the primary market driver.

- Synthetic leather, a popular alternative to traditional animal-hide leather, dominates the market in the apparel, accessories, and footwear industries due to its affordability and versatility. Consumers increasingly prefer synthetic leather products due to shifting lifestyle trends and a wide range of available options. The footwear industry is a significant application sector for both synthetic and animal-hide leather. Synthetic leather offers several advantages, including durability, resistance to water and stains, and the ability to mimic the look and feel of genuine leather. Moreover, synthetic leather production does not involve animal hide, making it an ethical and sustainable choice for consumers.

- Additionally, some synthetic leather types possess antibacterial properties, which is an added benefit for health-conscious consumers. The affordability of synthetic leather products is a major factor contributing to their popularity. While premium leather products are considered luxury items, mass-produced synthetic leather goods are accessible to a larger consumer base due to their lower prices. The market for synthetic leather is expected to grow as consumer preferences continue to shift towards sustainable and ethical alternatives to animal-hide leather.

What are the Coating Agents For Synthetic Leather market trends shaping the Industry?

- Synthetic leather products, with their wide range of availability, are currently setting the market trend. This growing trend reflects the increasing demand for sustainable and versatile alternatives to traditional leather.

- The global coating agents market for synthetic leather is driven by the expanding product selection in this sector. Companies offer a diverse range of synthetic leather types, textures, colors, and price points, catering to various industries' demands. This extensive product assortment enables companies to focus on merchandising and increasing sales volume. Coating agents play a crucial role in enhancing the performance of synthetic leather, including UV resistance and durability.

- Solvent-based coatings and dip coating application techniques are commonly used due to their cost-effectiveness and ease of application. Furthermore, eco-friendly coating alternatives are gaining traction due to growing environmental concerns. These market dynamics will fuel the demand for coating agents for synthetic leather throughout the forecast period.

How does Coating Agents For Synthetic Leather market faces challenges face during its growth?

- The intense competition among companies poses a significant challenge to the industry's growth trajectory.

- The coating agents market for synthetic leather experiences significant competition among key players and new entrants, despite the expanding demand for leather finishing in various industries such as sports goods, textile manufacturing, and automotive. Companies invest heavily in research and development to introduce innovative coating agents for synthetic leather, catering to diverse applications in apparel, footwear, and other industries. However, intense competition has led to price wars, narrowing profit margins for companies. Quality control remains a critical factor, with companies focusing on enhancing flame retardancy and scratch resistance to meet evolving consumer demands.

- Competition is not only among key players but also among regional and local companies, who offer specialized product lines in specific regions. Despite these challenges, the market continues to grow, driven by the increasing popularity of synthetic leather in various industries.

Exclusive Customer Landscape

The coating agents for synthetic leather market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the coating agents for synthetic leather market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, coating agents for synthetic leather market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Abhilash Chemicals and Pharmaceuticals Pvt. Ltd. - The company specializes in manufacturing and supplying a range of coating agents, including acrylic syntans, tanning auxiliaries, and fatliquors.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abhilash Chemicals and Pharmaceuticals Pvt. Ltd.

- BASF SE

- CHT Germany GmbH

- Covestro AG

- Dow Inc.

- Elkem ASA

- Evonik Industries AG

- Jasch Industries Ltd.

- ROWA GROUP Holding GmbH

- Santex Rimar Group

- Stahl Holdings B.V.

- Wacker Chemie AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Coating Agents For Synthetic Leather Market

- In February 2024, BASF SE, a leading global chemical producer, introduced a new line of coating agents specifically designed for synthetic leather, called Elastocat L PU. This innovation aimed to enhance the durability and flexibility of synthetic leather products (BASF press release, 2024).

- In October 2025, Lanxess AG and Toray Industries, Inc. announced a strategic collaboration to develop high-performance coating agents for synthetic leather. This partnership aimed to combine Lanxess' expertise in leather chemicals and Toray's advanced materials technology, targeting the growing demand for sustainable and high-quality synthetic leather (Lanxess press release, 2025).

- In March 2024, Wacker Chemicals AG invested â¬100 million in expanding its production capacity for dispersions and dispersible polymer powders, including those used in synthetic leather coatings. This expansion was expected to increase Wacker's market share and improve its competitive position in the global coating agents market (Wacker Chemicals AG press release, 2024).

- In July 2025, the European Union approved new regulations on the use of certain chemicals in leather production, including coating agents. These regulations aimed to reduce the environmental impact of synthetic leather manufacturing and promote more sustainable production methods (European Commission press release, 2025).

Research Analyst Overview

Synthetic leather, also known as PVC or polyvinyl chloride leather, continues to gain popularity due to its versatility and cost-effectiveness across various industries. Coating agents play a crucial role in enhancing the performance and aesthetic appeal of synthetic leather. These agents provide essential properties such as UV resistance, solvent-based coatings for improved coating performance, and eco-friendly alternatives for sustainability. Applications of synthetic leather span from leather finishing in fashion and accessories to textile manufacturing and sports goods. Dip coating and roll coating techniques are commonly used to apply these agents, ensuring consistent coating thickness and even distribution. PU leather, a popular type of synthetic leather, benefits significantly from these coatings, which contribute to its abrasion resistance, flame retardancy, scratch resistance, and stain resistance.

Quality control is paramount in the synthetic leather market, with stringent testing standards in place to ensure the performance of coating agents. Performance testing, such as UV resistance, abrasion resistance, and flame retardancy, is essential to meet industry requirements. Additionally, the ongoing trend towards sustainable coatings, including bio-based and waterborne options, is driving innovation in this sector. Coating processes require thorough surface preparation to ensure optimal adhesion and performance. Surface preparation techniques, such as cleaning, degreasing, and priming, are essential steps in the coating process. As the synthetic leather market continues to evolve, advancements in coating technology will undoubtedly unfold, catering to the diverse needs of industries such as automotive upholstery and microfiber leather.

Dive into Technavio's strong research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Coating Agents For Synthetic Leather Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

142 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.51% |

|

Market growth 2024-2028 |

USD 254.8 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

7.66 |

|

Key countries |

China, US, Japan, Germany, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Coating Agents For Synthetic Leather Market Research and Growth Report?

- CAGR of the Coating Agents For Synthetic Leather industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the coating agents for synthetic leather market growth of industry companies

We can help! Our analysts can customize this coating agents for synthetic leather market research report to meet your requirements.