Coatings for Medical Devices Market Size 2024-2028

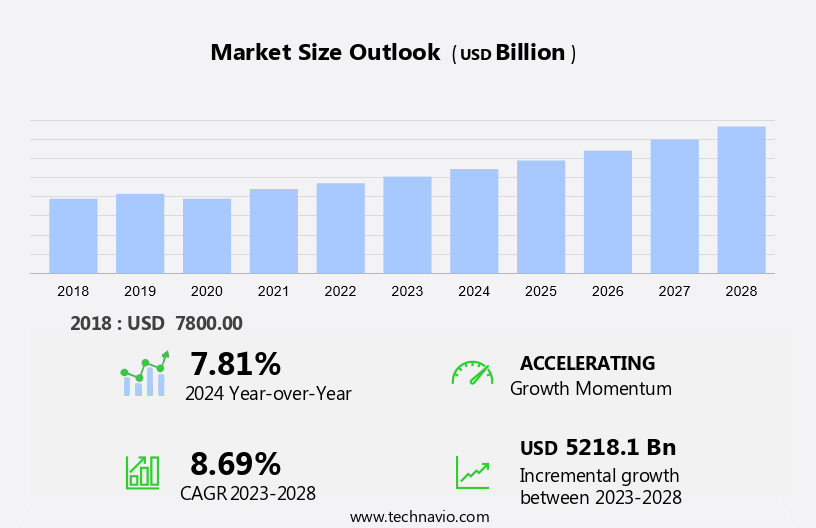

The coatings for medical devices market size is forecast to increase by USD 5,218.1 billion at a CAGR of 8.69% between 2023 and 2028.

- The coatings for medical devices market is experiencing significant growth due to several key trends. The increasing demand for cardiovascular and orthopedic implants is driving market growth, as these devices often require advanced coatings to improve their performance and durability. Additionally, the rise in popularity of minimally invasive surgeries is leading to an increased demand for coatings that enable easier implantation and reduce the risk of complications.

- However, stringent government regulations on coatings used in medical devices pose a challenge to market growth. Regulators require extensive testing and approval processes to ensure the safety and efficacy of these coatings, which can add significant time and cost to the development and manufacturing process.

- Despite these challenges, the market is expected to continue growing as the benefits of advanced coatings become more widely recognized In the medical device industry.

What will be the Size of the Coatings For Medical Devices Industry Market During the Forecast Period?

- The medical devices industry market for coatings is experiencing significant growth due to the increasing demand for advanced and biocompatible coatings in various medical devices such as ventilators, catheters, cardiovascular devices, guide wires, sutures, syringes, mandrels, stents, and more. These coatings offer enhanced functionality, improved biocompatibility, and increased resistance to pathogens, making them essential in medical applications.

- Hydrogels, nanotechnology, and multifunctional coatings are among the latest trends in this market. Passive coatings, including hydromer and N8 Medical, are widely used for their ability to modify the physiochemical properties of substrates, reducing frictional resistance and improving the performance of Class I and II devices.

- Medical device developers and manufacturers continue to invest in surface modification technologies to create high-performance, biocompatible coatings that meet stringent medical device regulations in the home healthcare sector and beyond.

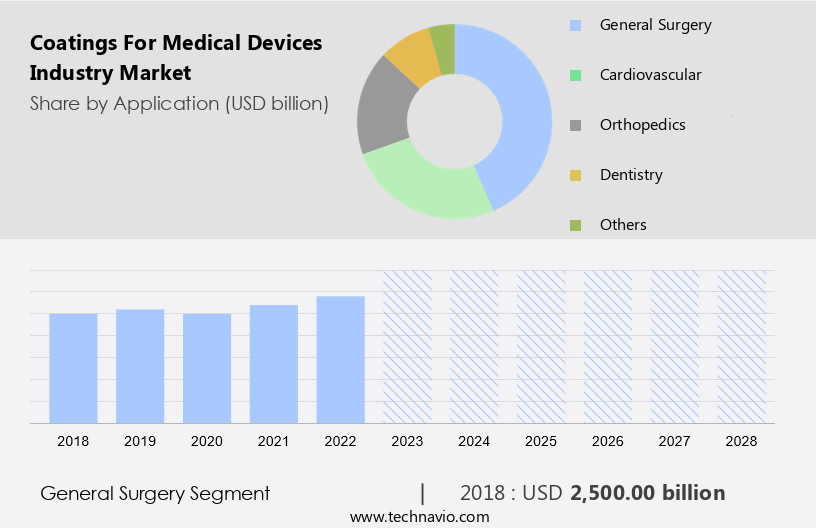

How is this Coatings For Medical Devices Industry segmented and which is the largest segment?

The coatings for medical devices industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- General surgery

- Cardiovascular

- Orthopedics

- Dentistry

- Others

- Type

- Antimicrobial coating

- Drug-eluting coating

- Hydrophilic coating

- Others

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- India

- Middle East and Africa

- South America

- North America

By Application Insights

The general surgery segment is estimated to witness significant growth during the forecast period. Medical device coatings play a crucial role in enhancing the performance and functionality of various medical devices used in numerous medical fields. These coatings are applied to devices such as ventilators, catheters, cardiovascular devices, guide wires, sutures, syringes, mandrels, stents, and tubes, among others. The primary purpose of these coatings is to provide antimicrobial properties to prevent hospital-acquired infections, including pneumonia and ventilator-associated infections. Coatings are also applied for friction reduction, optical clarity, durability, and lubricity. Medical devices are used extensively in various sectors, including neurology, orthopedics, general surgery, cardiovascular, dentistry, gynecology, cardiometabolic disorders, and home healthcare. The increasing prevalence of chronic diseases and infectious diseases, coupled with the aging global population, has led to a higher demand for medical devices.

Coatings are applied using various methods, such as hydrophilic coatings, hydrophobic coatings, polymer coatings, and fluoropolymers, among others. Coating technologies include passive coatings, active coatings, and multifunctional coatings. Materials used for coatings include carbon fiber, metal, stainless steel, plastic, and implantable devices. Coating equipment includes physical vapor deposition, thermal curing, microblasting, and dip coating equipment. Medical device developers and manufacturers use biocompatible coatings and high-performance coatings to improve the physicochemical properties of their devices. Class I, II, and III medical devices require specific coating protocols to ensure sterilization and maintaIn the desired surface properties.

Get a glance at the share of various segments. Request Free Sample

The general surgery segment was valued at USD 2,500 billion in 2018 and showed a gradual increase during the forecast period.

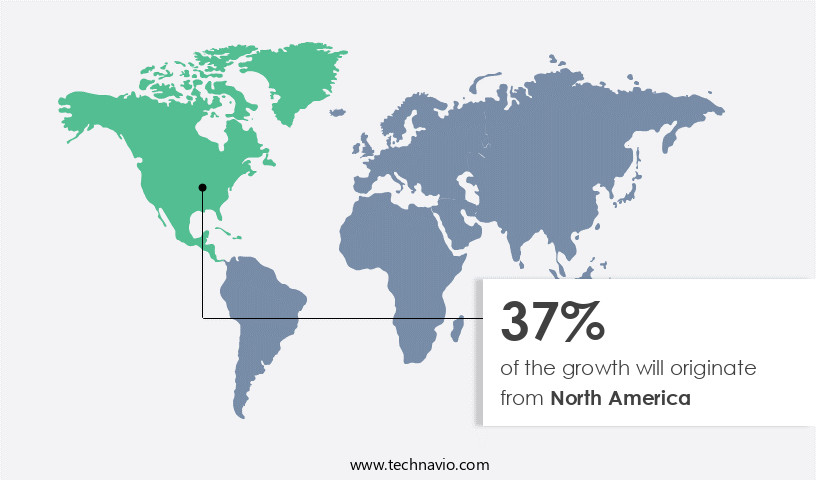

Regional Analysis

North America is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The medical devices industry market in North America is projected to experience substantial growth due to the increasing demand for advanced medical devices with coatings. Factors driving this growth include an aging population, technological advancements, and a growing focus on minimally invasive surgeries. Hydrophilic and antimicrobial coatings are particularly in demand, as they enhance the functionality and durability of various medical devices. These coatings are essential for preventing hospital-acquired infections, such as pneumonia and ventilator-associated infections, which are major concerns in healthcare settings. Medical devices with coatings are used extensively in various sectors, including cardiovascular devices, neurology, orthopedics, and general surgery.

The demand for these coatings is further driven by the increasing prevalence of chronic diseases, infectious diseases, and the need for implantable devices and surgical equipment. The use of nanotechnology and multifunctional coatings, including passive and active coatings, hydrophobic and polymer coatings, and fluoropolymers, is also on the rise. Medical device manufacturers are continuously innovating to develop biocompatible and high-performance coatings to meet the evolving needs of the healthcare industry. The adoption of surface modification technologies and coating protocols is crucial for ensuring the physiochemical properties, such as frictional resistance, sterilization, and thermal stability, of medical devices.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Coatings For Medical Devices Industry?

Growing demand for cardiovascular and orthopedic implants is the key driver of the market.

- Medical device coatings play a crucial role in enhancing the performance and functionality of various medical devices, including ventilators, catheters, guide wires, sutures, syringes, mandrels, stents, pacemakers, and implantable devices. These coatings help mitigate the risk of hospital-acquired infections by protecting against pathogens and microbial factors. With the increasing prevalence of chronic diseases such as cardiovascular disorders, deep vein thrombosis, and infectious diseases, the demand for medical device coatings is on the rise. Antimicrobial coatings, made from composite materials like carbon fiber, metal, stainless steel, and plastic, are gaining popularity due to their antimicrobial properties. These coatings prevent the growth of bacteria and fungi, thereby reducing the risk of healthcare infections such as pneumonia and ventilator-associated infections.

- Hydrophilic coatings, which improve lubricity and sterilization, are commonly used in tubes and endoscopic devices. Medical device manufacturers are increasingly focusing on developing high-performance coatings with physiochemical properties such as friction, optical clarity, durability, and sterilization compatibility. Nanotechnology and multifunctional coatings are being explored to create passive and active coatings with hydrophobic and polymer coatings, such as fluoropolymers, silicone, and parylene. These coatings offer improved corrosion resistance, thermal stability, and biocompatibility for various medical devices used in neurology, orthopedics, general surgery, cardiovascular, dentistry, gynecology, and cardiometabolic disorders. The home healthcare market, driven by private health insurance and the increasing preference for home healthcare services, is also fueling the demand for medical device coatings.

What are the market trends shaping the Coatings For Medical Devices Industry?

Increased awareness of minimally invasive surgeries is the upcoming market trend.

- Medical device coatings play a crucial role in enhancing the functionality and durability of various medical devices, including ventilators, catheters, cardiovascular devices, guide wires, sutures, syringes, mandrels, stents, and implantable devices. These coatings offer protection against pathogens and microbial factors, reducing the risk of hospital-acquired infections such as pneumonia and ventilator-associated infections. Antimicrobial coatings made of composite materials like carbon fiber, metal, and stainless steel, as well as plastic, are gaining popularity due to their antimicrobial properties. Hydrophilic coatings are used to improve the lubricity and sterilization of medical devices, ensuring optimal performance in surgeries related to neurology, orthopedics, general surgery, cardiovascular, dentistry, gynecology, and cardiometabolic disorders.

- Coatings are also used to protect against deep vein thrombosis and In the home healthcare market. Medical device developers and manufacturers employ various surface modification technologies, such as physical vapor deposition, thermal curing, microblasting, and precision coating, to create high-performance coatings with desirable physiochemical properties like frictional resistance, optical clarity, durability, and sterilization compatibility. These coatings are essential for Class I, II, and III devices, including tubes, pacemakers, and surgical equipment. Antimicrobial, hydrophobic, and polymer coatings, such as those made of fluoropolymers, silicone, parylene, and polyurethanes, are used in various medical devices, including orthopedic devices, optical devices, endoscopic devices, radiological devices, and protective clothing.

What challenges does the Coatings For Medical Devices Industry face during its growth?

Stringent government regulations on coatings used in medical devices is a key challenge affecting the industry growth.

- Medical device coatings play a crucial role in enhancing the performance and functionality of various medical devices, including ventilators, catheters, cardiovascular devices, guide wires, sutures, syringes, mandrels, stents, and implantable devices. These coatings offer protection against pathogens and microbial factors, reducing the risk of hospital-acquired infections such as pneumonia and ventilator-associated infections. Antimicrobial coatings made of composite materials like carbon fiber, metal, stainless steel, plastic, and implantable devices are gaining popularity due to their antimicrobial properties. Hydrophilic coatings, such as those used in pacemakers, offer improved friction, optical clarity, durability, and lubricity. Sterilization methods like thermal curing, microblasting, and physical vapor deposition are used to apply these coatings.

- In the healthcare sector, medical device developers are focusing on biocompatible coatings, high-performance coatings, and surface modification technologies to meet the demands of the home healthcare market and private health insurance. Nanotechnology and multifunctional coatings, including passive and active coatings, hydrophobic coatings, and polymer coatings like fluoropolymers, silicone, and parylene, are also being used in orthopedic devices, optical devices, endoscopic devices, radiological devices, protective clothing, implants, and surgical equipment.

Exclusive Customer Landscape

The coatings for medical devices market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the coatings for medical devices market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, coatings for medical devices industry market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Advanced Plating Technologies - The medical device industry relies on advanced coatings for enhancing the performance and biocompatibility of their products. The company provides a range of such coatings, including biocompatible duplex gold plating and electrolytic as well as electroless nickel plating.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Advanced Plating Technologies

- Applied Medical Coatings LLC

- AST Products Inc.

- Biocoat Inc.

- Covalon Technologies Ltd.

- Endura Coatings

- Freudenberg and Co. KG

- Harland Medical Systems Inc.

- HTI Technologies Inc.

- Hydromer Inc.

- Katahdin Industries

- KISCO Ltd.

- Koninklijke DSM NV

- Materion Corp.

- Medical Surface Inc.

- Medicoat AG

- Merit Medical Systems Inc.

- N2 Biomedical LLC

- Sono Tek Corp.

- Surmodics Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Medical device coatings play a crucial role in enhancing the performance and functionality of various medical devices In the healthcare industry. These coatings offer numerous benefits, including improved antimicrobial properties, enhanced durability, and increased lubricity. Coatings for medical devices are typically applied to substrates such as metals, plastics, and composite materials. The choice of coating material depends on the specific application and the desired properties. For instance, carbon fiber and metal coatings may be used for orthopedic devices due to their high strength and durability. Hydrophilic coatings are often used for tubes and catheters to improve their compatibility with biological fluids.

Antimicrobial coatings are a significant area of focus in medical device coatings due to the growing concern over hospital-acquired infections. These coatings can help prevent the growth of pathogens on medical devices, reducing the risk of healthcare-associated infections such as pneumonia and ventilator-associated infections. The medical device industry is continually evolving, with new technologies and coatings being developed to address various challenges. For instance, nanotechnology is being used to create multifunctional coatings that offer both passive and active properties. Passive coatings provide a barrier against microbial growth and corrosion, while active coatings release antimicrobial agents to actively kill bacteria and viruses.

Hydrophobic coatings are another type of coating gaining popularity In the medical device industry. These coatings repel water and other liquids, making them ideal for use in surgical equipment and implantable devices. Hydrophobic coatings can also improve the optical clarity of optical devices and reduce friction in moving parts. Biocompatible coatings are essential for medical devices that come into direct contact with the body. These coatings must be non-toxic and non-reactive to ensure the safety and effectiveness of the medical device. High-performance coatings, such as fluoropolymers and parylene, are often used for implantable devices due to their excellent biocompatibility and durability.

Surface modification technologies are also used to enhance the physiochemical properties of medical device coatings. Techniques such as physical vapor deposition, thermal curing, and microblasting can be used to create coatings with specific properties, such as increased corrosion resistance and thermal stability. Medical device developers and manufacturers are continually seeking new and innovative coating solutions to meet the evolving needs of the healthcare industry. The use of coatings can help improve the functionality, durability, and biocompatibility of medical devices, ultimately leading to better patient outcomes. The medical device coatings market is expected to grow significantly In the coming years, driven by the aging global population, the increasing prevalence of chronic diseases and infectious diseases, and the growing demand for home healthcare and private health insurance.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

181 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.69% |

|

Market growth 2024-2028 |

USD 5,218.1 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.81 |

|

Key countries |

US, China, Germany, India, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Coatings For Medical Devices Market Research and Growth Report?

- CAGR of the Coatings For Medical Devices industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the coatings for medical devices market growth of industry companies

We can help! Our analysts can customize this coatings for medical devices market research report to meet your requirements.