Cold Cuts Market Size 2024-2028

The cold cuts market size is forecast to increase by USD 174.2 billion at a CAGR of 9.45% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand for convenient and packaged food options. Consumers' preference for healthy and natural cold cuts is another key trend driving market growth. However, competition from alternative protein sources, such as plant-based and lab-grown meats, poses a challenge to market players. To stay competitive, companies must focus on product innovation, sustainability, and transparency to meet evolving consumer preferences. The market analysis also highlights the importance of strategic partnerships and collaborations to expand product offerings and reach new customer bases. Overall, the market is expected to continue its growth trajectory, driven by these key trends and challenges.

What will be the Size of the Market During the Forecast Period?

- The market encompasses a wide range of precooked and cured meat products, including luncheon meats, deli meats, and sliced meats. These meat varieties are popular for their convenience and versatility, finding their way into sandwiches, salads, and appetizers. Urban populations, particularly working women from the upper middle class, frequently opt for these chilled cold cuts as a quick and convenient lunch option. The demand for high-quality ingredients and health awareness has led to the emergence of specialty markets catering to consumers seeking natural cuts, hormone-free, and antibiotic-free options. Clean labeling is a priority for many consumers, leading to an increased preference for meatless choices and plant-based diet alternatives in the market.

- Moreover, the market dynamics of cold cuts are influenced by various factors, such as changing consumer preferences, health trends, and the rise of packaged food. The convenience and versatility of cold cuts make them a staple in many households, and their popularity is expected to continue. However, the increasing awareness of health and wellness is driving the demand for healthier alternatives, including gluten-free and vegetarian options. In summary, the market is a dynamic and evolving industry, shaped by consumer preferences, health trends, and the convenience factor. The market caters to a diverse range of consumers, from urban populations to health-conscious individuals, and offers a variety of meat and meatless choices to meet their needs. The industry continues to innovate and adapt to changing consumer demands, offering high-quality, natural, and healthier options to meet the evolving needs of consumers.

How is this market segmented and which is the largest segment?

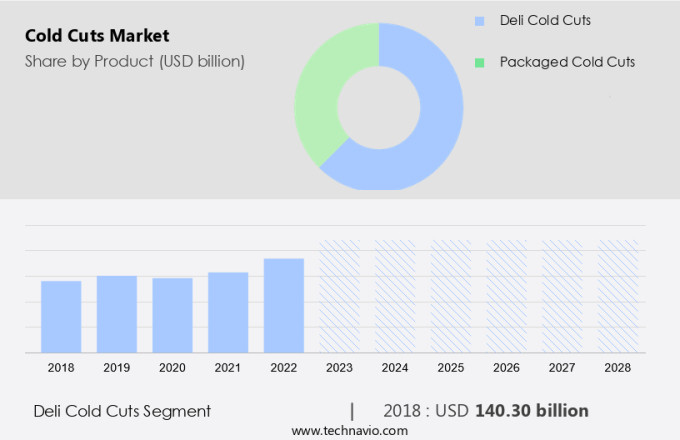

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Deli cold cuts

- Packaged cold cuts

- Distribution Channel

- Offline

- Online

- Geography

- Europe

- Germany

- France

- Sweden

- North America

- US

- APAC

- Middle East and Africa

- South America

- Europe

By Product Insights

- The deli cold cuts segment is estimated to witness significant growth during the forecast period.

Deli cold cuts, including ham, sausages, chicken breast, and various other varieties such as corned beef, bologna, and salami, are preferred over prepackaged options due to their perceived freshness and minimal preservatives. These chilled, high-quality ingredients are popular among urban populations for their convenience and versatility. Deli cold cuts are sliced freshly for customers, ensuring a natural, hormone-free, and antibiotic-free product. Consumers prioritize clean labeling and heritage breeds when making purchasing decisions, reflecting a growing health consciousness. Deli cold cuts are an excellent source of proteins, vitamin B12, and minerals like Zinc and iron. Their freshness sets them apart from packaged cold cuts, making them a convenient and nutritious choice for busy individuals.

Get a glance at the market report of share of various segments Request Free Sample

The deli cold cuts segment was valued at USD 140.30 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

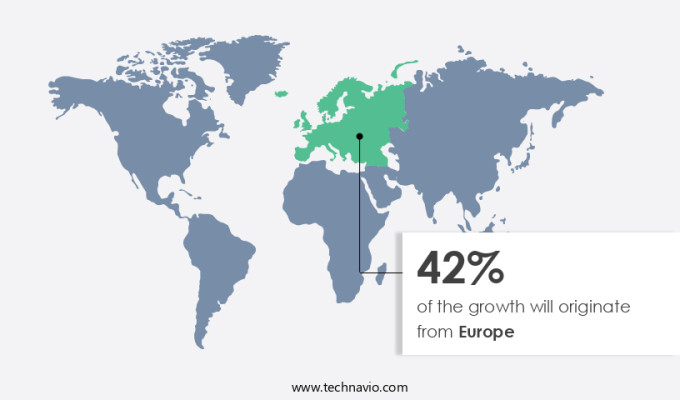

- Europe is estimated to contribute 42% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The European market for cold cuts, including luncheon meats, deli meats, and sliced meats, holds a significant share in the global industry. Key European countries, such as Germany, Italy, the UK, and France, are major contributors to the market's revenue. The deli meat sector in Europe is fragmented due to the presence of numerous global and regional players catering to consumers' increasing demand for healthy food and high-protein diets. In Europe, raw cold cuts, like salami, and brewed cold cuts, such as extrawurst and mortadella, remain popular. Moreover, the market for healthy cold cuts, including clean-labeled, vegetarian, and organic deli meats, is experiencing strong growth.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Cold Cuts Market?

Growing demand for convenient and packaged food is the key driver of the market.

- The market is experiencing significant growth due to various market dynamics. The increasing preference for convenience and quick meal options among urban populations and the rising number of health-conscious consumers are key drivers. Cold cuts, also known as deli meats or sliced meats, include a range of precooked, cured meat products such as ham, roast beef, salami, bologna, pastrami, and Turkey breast. These meat varieties are available in various forms, including specialty, artisanal, and fresh cold cuts, and are used in sandwiches, salads, appetizers, and other dishes. The market caters to diverse consumer preferences, offering meat choices from beef, pork, chicken, and Turkey.

- In addition, consumers are increasingly seeking clean label products, and packaging technology, such as vacuum sealing, plays a crucial role in maintaining product freshness and safety. The foodservice industry and grocery stores are significant market players, with charcuterie counters and specialty meat shops offering a wide range of cold cuts. The market also caters to consumers with dietary restrictions, offering plant-based alternatives, sustainable sourcing, and ethical practices. Consumer awareness about the nutritional value, sodium content, and potential health risks associated with processed meats, such as heart disease and diabetes, is driving demand for low-sodium, hormone-free, antibiotic-free, and organic cold cuts. The convenience of cold cuts, their versatility, and their ability to cater to various dietary habits make them a popular choice for working women, upper-middle-class consumers, and those following plant-based diets.

What are the market trends shaping the Cold Cuts Market?

Increasing demand for healthy and natural cold cuts is the upcoming trend in the market.

- The market is witnessing significant growth due to shifting consumer preferences towards healthier and more natural food options. This trend is driving the demand for clean-labeled, vegetarian, and organic cold cuts. Consumers are increasingly conscious of their dietary habits and are reducing their consumption of precooked, cured meat products such as deli meats and sliced meats. According to the People for the Ethical Treatment of Animals (PETA), approximately 2.5% of the US population follows a vegan lifestyle, and this number is expected to rise. In response, the market is offering a wide range of meatless alternatives, including vegan and vegetarian cold cuts.

- In addition, the convenience offered by cold cuts as quick meal options, especially for urban populations and working women, continues to be a key factor in their popularity. However, health-conscious consumers are also demanding transparency in packaging technology, such as vacuum sealing and clean labeling, to ensure product safety and meat quality regulations. The foodservice industry is also adapting to these trends by offering fresh cold cuts and specialty cold cuts, including artisanal and heritage breed options. The market for cold cuts includes a variety of meat types, such as beef, pork, chicken, and Turkey, as well as specialty meats like ham, roast beef, salami, bologna, pastrami, and more.

What challenges does Cold Cuts Market face during the growth?

Competition from alternatives is a key challenge affecting the market growth.

- The market is witnessing significant changes due to evolving consumer preferences. With an increasing focus on health, sustainability, and ethical practices, consumers are seeking out convenient and quick meal options that align with their dietary habits and restrictions. This shift has led to the growth of plant-based meat substitutes, which are gaining popularity for their health benefits, environmental friendliness, and cruelty-free production. Cold cut producers are responding to this trend by innovating and developing healthier and more sustainable products. These include clean label products, vacuum-sealed deli cold cuts, and specialty cold cuts made from organic food products.

- In addition, the foodservice industry and grocery stores are also adapting to these changes by offering a wider range of convenience foods, including refrigerated products and charcuterie counters. However, the competition from plant-based substitutes is putting pressure on cold cut producers to meet these shifting consumer preferences. Failure to do so could result in lost market share. The market dynamics are further influenced by factors such as meat quality regulations, local and international brands, and consumer preferences for protein-rich foods. The convenience and versatility of cold cuts make them a popular choice for sandwiches, salads, appetizers, and more. However, concerns over sodium content, sodium nitrite, and other additives have led some consumers to seek out natural cuts, hormone-free, antibiotic-free, and organic cold cuts.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alfa Corporativo S.A. de C.V.

- Andrews Smokehouse

- Boars Head Brand

- BRF SA

- Bridgford Foods Corp.

- Butcher On The Block

- Cargill Inc.

- CrisTim Group

- Evans Meats and Seafood Inc.

- German Butchery Retail Pty Ltd.

- Hormel Foods Corp.

- JBS SA

- Maple Leaf Foods Inc.

- Pocino Foods Co.

- Seaboard Corp.

- Sierra Meat and Seafood

- The Kraft Heinz Co.

- The Wursthutte

- Tyson Foods Inc.

- WH Group Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a wide array of precooked, cured meat products, including luncheon meats, deli meats, sliced meats, and specialty cold cuts. These versatile offerings cater to various applications, such as sandwiches, salads, appetizers, and more. The market's scope extends to meat varieties like beef, pork, chicken, Turkey, ham, roast beef, salami, bologna, pastrami, and an assortment of other options. Consumer preferences continue to evolve, with an increasing focus on convenience, clean label products, and health consciousness. Cold cuts, as quick meal options, have gained popularity among urban populations and working women.

However, dietary restrictions and health awareness have led to the emergence of plant-based alternatives, sodium reduction, and sustainable sourcing. Packaging technology plays a significant role in the market, with vacuum sealing and refrigerated products ensuring product freshness and safety. Grocery stores, charcuterie counters, specialty meat shops, and the foodservice industry are key distribution channels for these offerings. Health consciousness and dietary habits have influenced consumer preferences, leading to an emphasis on protein-rich foods, hormone-free, antibiotic-free, and clean labeling. Local and international brands have responded to these trends, offering organic cold cuts, plant-based proteins, and customization options. The market is subject to various regulations, ensuring product safety and meat quality.

Furthermore, these regulations apply to both retail locations and the foodservice sector. Consumer trust and ethical practices are essential in maintaining market share. Ecommerce and online grocery shopping have transformed the way consumers access cold cuts, offering convenience and accessibility. However, offline shopping remains a significant portion of the market, with specialty markets and local brands catering to niche consumer preferences. Flavor combinations and nutritional value are essential factors in the market, with pre-cooked meats and salted meats offering diverse taste profiles. Processed meats have faced scrutiny due to their association with health concerns, such as heart disease and diabetes.

As a result, vegan cold cuts, vegetarian options, and meatless choices have gained traction in the market. In conclusion, the market is a dynamic and evolving industry, influenced by consumer preferences, technological advancements, and regulatory requirements. The market's continued growth relies on its ability to cater to various dietary needs, offer convenience, and prioritize product safety and quality.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

170 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.45% |

|

Market growth 2024-2028 |

USD 174.2 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.42 |

|

Key countries |

US, Germany, France, Sweden, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch