Commercial Aircraft Avionic Systems Market Size 2024-2028

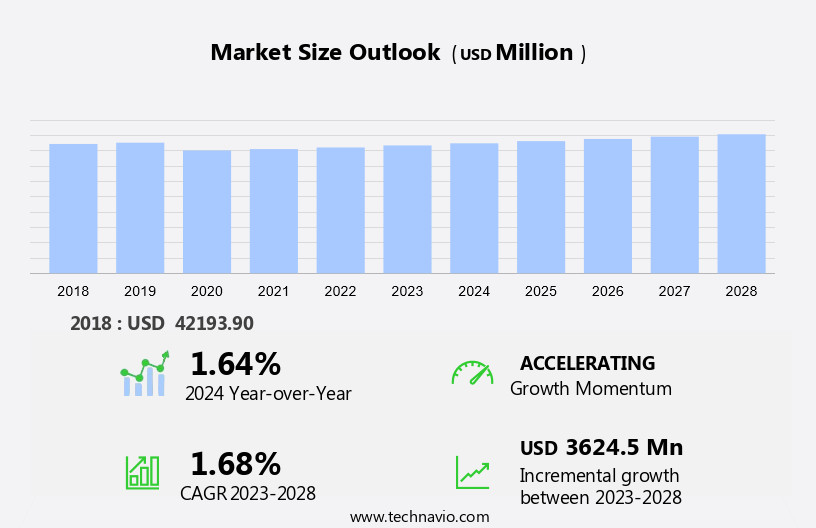

The commercial aircraft avionic systems market size is forecast to increase by USD 3.62 billion at a CAGR of 1.68% between 2023 and 2028.

- The market is witnessing significant growth due to the increasing demand for commercial aircraft and the preference for satellite-based cockpit connectivity. These advanced systems enable real-time communication between aircraft and ground control, enhancing safety and efficiency. However, the market faces challenges from the complications associated with malfunctioning avionic systems. These issues can lead to flight disruptions and potential safety hazards, necessitating continuous research and development efforts to ensure system reliability. Additionally, the integration of artificial intelligence and machine learning technologies in avionic systems is a key trend, aiming to improve system performance and reduce maintenance costs. Overall, the market is expected to experience steady growth, driven by these factors and the ongoing modernization of commercial aircraft fleets.

What will be the Size of the Commercial Aircraft Avionic Systems Market During the Forecast Period?

- The market is experiencing significant growth, driven by increasing passenger traffic and expanding aircraft fleets. Aircraft Original Equipment Manufacturers (OEMs) and Maintenance, Repair, and Overhaul (MRO) providers continue to invest in advanced avionic systems for both widebody jets and narrowbody aircraft. These innovations include flight management systems, flight control, navigation & surveillance systems, electrical & emergency systems, and digital cockpits. Regulatory bodies, such as the Federal Aviation Administration (FAA), play a crucial role in market dynamics, implementing stringent regulations and certifications to ensure safety and compliance. Low-cost carriers, in particular, are adopting these advanced systems to enhance operational efficiency and reduce costs.

- Innovative technologies, such as connectivity solutions and cyber threat mitigation, are also gaining traction In the market. However, economic downturns, emissions concerns, fuel consumption, and compatibility issues pose challenges. The avionics manufacturers must navigate these complexities while maintaining regulatory compliance and addressing the evolving needs of the industry. The avionic systems market is influenced by trends In the automotive electronics market and the integration of advanced technologies, such as artificial intelligence and machine learning, to improve aircraft performance and reduce maintenance costs. Despite these opportunities, the market faces challenges, including cyber threats, regulatory requirements, and economic uncertainties.

How is this Commercial Aircraft Avionic Systems Industry segmented and which is the largest segment?

The commercial aircraft avionic systems industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- FCS

- CN and S

- FMS

- AHMS

- Distribution Channel

- Line fit

- Aftermarket

- Geography

- North America

- US

- Europe

- Germany

- UK

- France

- APAC

- China

- Middle East and Africa

- South America

- North America

By Application Insights

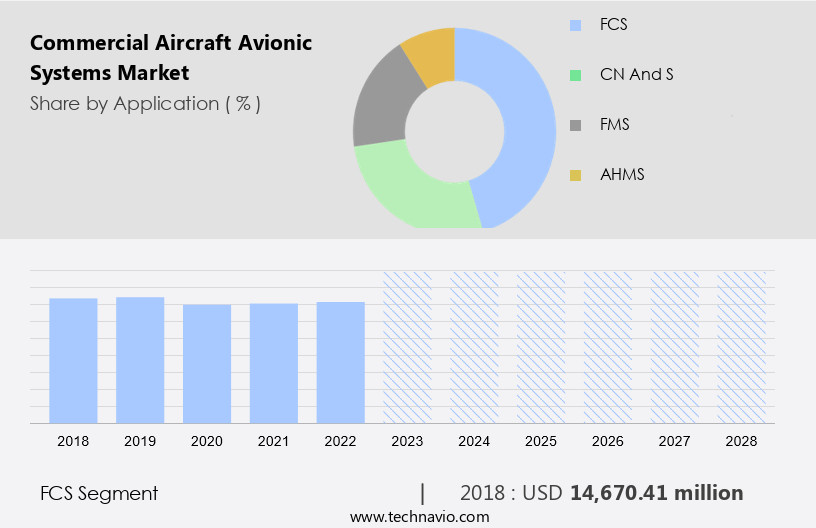

- The FCS segment is estimated to witness significant growth during the forecast period.

Commercial aviation's avionic systems market encompasses a range of advanced technologies that ensure flight safety, efficiency, and connectivity. These systems include flight management, flight control, navigation & surveillance, electrical & emergency, communication, and systems electronics. Aircraft OEMs, regulatory bodies like the FAA, and MRO providers are key market participants. The widebody and narrowbody segments dominate the market due to fleet expansion and the rise of low-cost carriers. Next-generation aircraft, freight volume growth, and increasing passenger traffic drive market demand. Advanced air mobility, real-time data, and regulatory frameworks are shaping the market. Vulnerability to cyber-attacks, economic downturns, and emissions concerns pose challenges.

Innovative technologies like digital cockpits, connectivity solutions, and avionics upgrade packages continue to evolve. The market is influenced by emerging economies, aviation safety, and environmental sustainability initiatives. Key players include aircraft manufacturers, airlines, military agencies, and operators. Regulatory requirements, flight safety, and situational awareness remain top priorities.

Get a glance at the market report of share of various segments Request Free Sample

The FCS segment was valued at USD 14.67 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

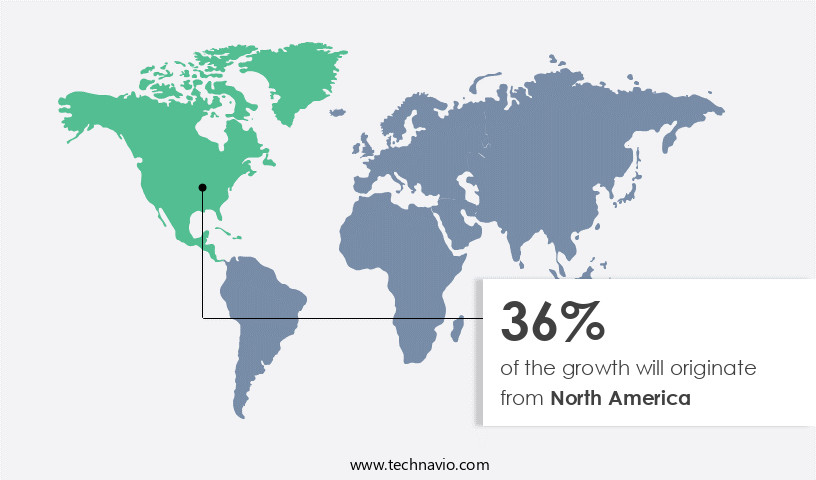

- North America is estimated to contribute 36% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The North American market is driven by the region's advanced aviation infrastructure and the increasing demand for new aircraft. Technologically advanced aerospace companies In the region supply parts, systems, and components, making significant investments in manufacturing avionic components and related technologies. The growing order books for next-generation aircraft from regional airlines are expected to fuel market growth. In addition, the global increase in airline passengers and freight volume, particularly in emerging economies, will further boost demand for advanced avionic systems. The market encompasses various sub-systems, including flight management, flight control, navigation & surveillance, electrical & emergency, communication, systems electronics, engine controls, and flight management systems.

Key stakeholders include aircraft OEMs, MRO providers, fleet expansion initiatives, and regulatory bodies such as the FAA. The market faces challenges from cyber threats, compatibility issues, and economic downturns, necessitating stringent regulations and certifications. Innovative technologies like digital cockpits, connectivity solutions, and real-time data are transforming the aviation industry, including commercial aviation networks, defense organizations, and uncrewed aerial vehicles.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Commercial Aircraft Avionic Systems Industry?

Increasing demand for commercial aircraft is the key driver of the market.

- The market is experiencing significant growth due to increasing passenger traffic and expanding aircraft demand. Aircraft Original Equipment Manufacturers (OEMs) are investing heavily in advanced avionic systems for new aircraft models, while Maintenance, Repair, and Overhaul (MRO) providers focus on upgrading existing fleets. Widebody jets and narrow-body aircraft segments, including those used by low-cost carriers, are major consumers of these systems. Flight management, flight control, navigation & surveillance systems, electrical & emergency, communication, and systems electronics are key sub-systems. Engine controls and aircraft operations computers are also essential components. Freighters and regional & business jets also utilize these systems.

- Further, fit in new aircraft deliveries and fleet expansion in emerging economies is driving market growth. In-flight entertainment and real-time data systems are increasingly important for enhancing passenger experience and improving network capacities. The regulatory framework, including FAA guidelines, is shaping the market. Vulnerability to cyber-attacks is a concern, leading to increased focus on Nextgen aircraft and commercial aviation networks. Freight volume and airline passenger growth, driven by the expanding middle-class population and low-cost airlines, are significant factors. System expenditure is expected to increase as airlines invest in advanced technologies to optimize operations and improve safety. Mosaic ATM and other initiatives aim to streamline air traffic management. Thus, such factors are driving the growth of the market during the forecast period.

What are the market trends shaping the Commercial Aircraft Avionic Systems Industry?

Preference for satellite-based cockpit connectivity is the upcoming market trend.

- The market is experiencing significant growth due to increasing passenger traffic and aircraft demand. Aircraft Original Equipment Manufacturers (OEMs) are continuously innovating to meet the needs of fleet expansion and regulatory requirements set by the Federal Aviation Administration (FAA) and other aviation authorities. MRO providers play a crucial role in maintaining and upgrading avionics systems in widebody jets, narrowbody aircraft, freighters, regional and business jets. Key sub-systems include flight management, flight control, navigation & surveillance systems, electrical & emergency, communication, and systems electronics. Engine controls and aircraft operations computer are also integral components. In-flight entertainment systems and real-time data transmission are becoming increasingly important for passenger comfort and network capacities.

- Addition, emerging economies and the expanding middle-class population are driving demand for low-cost carriers, leading to an increase in narrow body aircraft deliveries. However, the aviation industry faces challenges such as vulnerability to cyber-attacks and the need to comply with the regulatory framework. Next-generation aircraft and commercial aviation networks are expected to revolutionize the market with advanced avionics systems. System expenditure is projected to grow as freight volume and airline passengers continue to increase. Thus, such trends will shape the growth of the market during the forecast period

What challenges does the Commercial Aircraft Avionic Systems Industry face during its growth?

Complications associated with malfunctioning is a key challenge affecting the industry growth.

- The market is experiencing significant growth due to increasing passenger traffic and aircraft demand. Aircraft Original Equipment Manufacturers (OEMs) are continually innovating to meet the needs of fleet expansion and modernization. The Federal Aviation Administration (FAA) and other regulatory bodies are driving the adoption of advanced avionics systems, including flight management, flight control, navigation & surveillance, electrical & emergency, communication, systems electronics, and engine controls. Widebody jets and narrowbody segments, particularly in low-cost carriers, are major consumers of these systems. In-flight entertainment and real-time data are becoming essential for enhancing passenger experience and network capacities.

- Moreover, the vulnerability to cyber-attacks is a concern, and regulatory frameworks are being established to mitigate risks. Next-generation aircraft, such as those with advanced communication systems and Nextgen aircraft technologies, are driving system expenditure. Emerging economies with growing middle-class populations and increasing airline passengers are significant markets for avionics systems. Freight volume is also a factor, with freighter aircraft requiring specialized avionics systems. MRO providers play a crucial role in maintaining and upgrading these systems for various aircraft types, including regional & business jets, narrow body, wide body, and freighters. Hence, the above factors will impede the growth of the market during the forecast period

Exclusive Customer Landscape

The commercial aircraft avionic systems market forecasting report includes the adoption lifecycle of the market, market growth and forecasting, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the commercial aircraft avionic systems market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, commercial aircraft avionic systems market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Airbus SE

- Avidyne Corp.

- Avilution, LLC

- BAE Systems Plc

- Curtiss Wright Corp.

- Field Aerospace

- Garmin Ltd.

- General Electric Co.

- Honeywell International Inc.

- L3Harris Technologies Inc.

- Meggitt Plc

- Northrop Grumman Corp.

- Panasonic Avionics Corporation.

- Safran SA

- Sagetech Avionics Inc.

- Samtel Avionics.

- Teledyne Technologies Inc.

- Thales Group

- The Boeing Co.

- Universal Avionics Systems Corporation

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The commercial aviation industry continues to experience significant growth, driven by increasing passenger traffic and expanding fleet sizes. Avionic systems play a crucial role in ensuring the safety, efficiency, and connectivity of modern aircraft. These systems encompass various sub-systems, including flight management, flight control, navigation & surveillance, electrical & emergency, communication, and engine controls. Flight management systems are essential for optimizing flight routes, monitoring fuel consumption, and managing aircraft performance. Flight control systems enable pilots to maneuver the aircraft effectively and maintain stability. Navigation & surveillance systems provide real-time data on aircraft position, altitude, and air traffic, enhancing situational awareness and safety.

Communication systems enable seamless communication between aircraft and ground personnel, ensuring efficient coordination and safety. Systems electronics, including engine controls and aircraft operations computers, are integral to the overall functioning of the aircraft. The aviation industry is subject to stringent regulations aimed at ensuring safety, security, and environmental sustainability. Regulatory frameworks dictate the design, installation, and maintenance of avionic systems. These regulations apply to all aircraft, from narrow-body jets to wide-body and freighter aircraft, as well as regional and business jets. Advanced technologies continue to shape the aviation industry, with initiatives focused on next-generation aircraft, unmanned aerial vehicles (UAVs), and digital cockpits.

These innovations offer enhanced situational awareness, improved fuel efficiency, and increased connectivity. The avionics market is characterized by a diverse range of stakeholders, including airlines, defense organizations, and avionics manufacturers. These entities collaborate to develop and implement avionic systems that meet the evolving needs of the industry. The market for avionic systems is subject to various challenges, including economic downturns, regulatory requirements, and cyber threats. Compatibility issues between different systems and components can also pose significant challenges. Additionally, the industry must address concerns related to emissions and fuel consumption, as well as the vulnerability of avionic systems to cyber-attacks.

Despite these challenges, the future of the avionic systems market looks promising, with significant growth expected due to increasing passenger traffic, expanding fleet sizes, and the adoption of innovative technologies. The market is also being driven by emerging economies, where the middle-class population is growing and low-cost airlines are expanding their networks. Thus, the avionic systems market plays a vital role In the commercial aviation industry, enabling safer, more efficient, and more connected aircraft. The market is subject to various challenges, including regulatory requirements, cyber threats, and economic downturns, but also offers significant growth opportunities due to increasing passenger traffic and the adoption of innovative technologies.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

190 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 1.68% |

|

Market growth 2024-2028 |

USD 3.62 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

1.64 |

|

Key countries |

US, France, China, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Commercial Aircraft Avionic Systems Market Research and Growth Report?

- CAGR of the Commercial Aircraft Avionic Systems industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the commercial aircraft avionic systems market growth of industry companies

We can help! Our analysts can customize this commercial aircraft avionic systems market research report to meet your requirements.