Commercial Vehicle Fleet Management System Market Size 2025-2029

The commercial vehicle fleet management system market size is forecast to increase by USD 8.7 billion, at a CAGR of 7.7% between 2024 and 2029.

- The market is experiencing significant dynamics, driven by the high-cost pressure on fleet operators. This pressure stems from the need to optimize operational expenses and enhance efficiency. In response, there is a growing trend towards the adoption of 360-degree fleet management Systems (FMS). These advanced systems offer comprehensive solutions, integrating functions such as vehicle tracking, maintenance scheduling, and driver behavior monitoring. However, the implementation of FMS comes with a high cost. This challenge poses a significant barrier for smaller fleet operators with limited budgets. Despite this hurdle, the benefits of FMS, including improved productivity, reduced fuel consumption, and enhanced safety, make it a strategic investment for larger fleet operators.

- To navigate this challenge, potential adopters can explore financing options, consider partial implementation, or opt for cloud-based solutions with lower upfront costs. Overall, the market presents a compelling opportunity for companies offering cost-effective FMS solutions, enabling fleet operators to optimize their operations and stay competitive in the market.

What will be the Size of the Commercial Vehicle Fleet Management System Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market is characterized by its continuous evolution and dynamic nature, with various entities integrating advanced technologies to optimize operations and enhance efficiency across multiple sectors. These systems encompass a range of applications, from satellite connectivity and dispatch management to GPS tracking, environmental monitoring, and driver scorecards. Predictive modeling and driver behavior monitoring leverage artificial intelligence and machine learning to identify trends and improve safety. Cloud-based platforms facilitate real-time data access, enabling fleet managers to optimize routes, manage inventory, and monitor engine hours and performance metrics. Mobile applications offer driver communication, compliance management, and incident management, ensuring seamless integration of hardware and software components.

Data privacy and security systems are essential, with data encryption, API integrations, and IoT devices ensuring the protection of sensitive information. Big Data analytics and business intelligence provide valuable insights, enabling cost reduction, improved operational efficiency, and enhanced fleet telematics. Fleet management systems also focus on vehicle security, fuel efficiency, and maintenance scheduling. Real-time location tracking, temperature monitoring, and cargo monitoring ensure optimal supply chain management and parts management. Harsh braking detection, harsh acceleration detection, and driver fatigue detection contribute to safety management and regulatory compliance. The integration of sensor technology and vehicle diagnostics enables remote diagnostics and odometer readings, while fuel consumption monitoring and idle time analysis contribute to cost reduction and improved fleet performance. Insurance telematics and vehicle security systems further enhance the value proposition of these advanced fleet management systems.

How is this Commercial Vehicle Fleet Management System Industry segmented?

The commercial vehicle fleet management system industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Third party

- OEM

- Component

- Software

- Hardware

- Services

- Application

- Tracking

- Telematics

- Fuel Management

- Vehicle Type

- Trucks

- Buses

- Vans

- Geography

- North America

- US

- Mexico

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

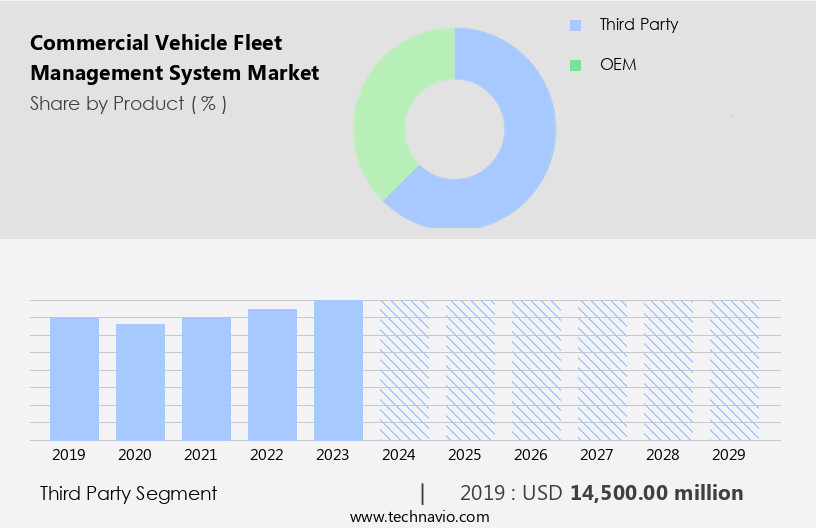

The third party segment is estimated to witness significant growth during the forecast period.

The market is witnessing significant growth as fleet operators seek to optimize operations and enhance vehicle performance. Third party fleet management systems, which offer features such as satellite connectivity, dispatch management, GPS tracking, environmental monitoring, driver scorecards, predictive modeling, driver behavior monitoring, artificial intelligence, compliance management, and cloud-based platforms, are gaining popularity. These systems enable real-time vehicle monitoring, route optimization, inventory management, ELD compliance, temperature monitoring, repair management, driver communication, and more. The integration of technologies like machine learning, sensor technology, and IoT devices facilitates advanced analytics and reporting, fuel efficiency, vehicle diagnostics, and safety management. The adoption of usage-based insurance (UBI) and subscription models further drives market growth.

The need for cost reduction, regulatory compliance, asset tracking, and risk management are key factors fueling the demand for fleet telematics. The industry's focus on operational efficiency, data analytics, and business intelligence (BI) is also contributing to the market's expansion. The integration of APIs, speed monitoring, cargo monitoring, and vehicle diagnostics further enhances the capabilities of fleet management systems. The market is expected to continue its growth trajectory as fleet operators increasingly adopt these advanced technologies to manage their commercial vehicle fleets more effectively.

The Third party segment was valued at USD 14.5 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 42% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the US market, commercial vehicle fleet management systems have gained significant traction in North America due to the increasing adoption of advanced telematics in commercial vehicles. The demand for these systems is driven by various factors, including the need for real-time vehicle monitoring, optimization of fleet operating expenses, and the growing international trades. Advanced applications, such as dispatch management, GPS tracking, environmental monitoring, driver scorecards, predictive modeling, driver behavior monitoring, and artificial intelligence, are increasingly being adopted to enhance operational efficiency and safety. Cloud-based platforms, cellular connectivity, ELD compliance, temperature monitoring, repair management, driver communication, route optimization, and subscription models are essential components of these systems.

Usage-based insurance, harsh braking detection, incident management, safety management, mobile applications, supply chain management, parts management, harsh cornering detection, engine hours, performance metrics, data privacy, hardware integration, machine learning, sensor technology, driver safety training, big data analytics, and fuel efficiency are also integral to the market. Additionally, fleet telematics, vehicle security, cost reduction, data analytics, reporting & analytics, data mining, accident reporting, harsh acceleration detection, data encryption, IoT devices, and regulatory compliance are key features that are transforming the commercial vehicle fleet management system landscape. The market is expected to continue growing due to the increasing focus on risk management, real-time location tracking, API integrations, speed monitoring, cargo monitoring, vehicle diagnostics, business intelligence, maintenance scheduling, fuel consumption monitoring, vehicle maintenance, data visualization, odometer readings, remote diagnostics, idle time, insurance telematics, driver fatigue detection, and asset tracking.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic and competitive the market, businesses seek advanced solutions to optimize their operations and enhance productivity. Integrating telematics, real-time tracking, and predictive analytics, fleet management systems streamline vehicle maintenance, improve driver behavior, and ensure regulatory compliance. These systems facilitate efficient route planning and optimization, reducing fuel consumption and operational costs. Additionally, they offer fleet performance reporting and analytics, enabling data-driven decision-making. Furthermore, fleet management systems integrate with other business applications, providing a centralized platform for managing various aspects of fleet operations. By leveraging the power of IoT, GPS, and cloud technology, fleet management systems contribute significantly to the growth and success of businesses in diverse industries.

What are the key market drivers leading to the rise in the adoption of Commercial Vehicle Fleet Management System Industry?

- The high-cost pressure experienced by fleet operators serves as the primary market driver.

- Commercial vehicle fleet management systems have gained significant traction in the logistics and transportation industry due to the increasing need for cost optimization and regulatory compliance. These systems leverage advanced technologies such as satellite connectivity, GPS tracking, and cellular connectivity to offer features like dispatch management, driver scorecards, predictive modeling, driver behavior monitoring, environmental monitoring, temperature monitoring, inventory management, ELD compliance, repair management, driver communication, and route optimization. Fuel cost pressure is a major challenge for fleet operators, leading them to adopt fleet management systems to optimize fuel consumption and enhance fleet efficiency. Advanced features like real-time vehicle monitoring, predictive maintenance, and route optimization help reduce fuel consumption and improve overall fleet performance.

- Additionally, innovations in vehicle engines, such as reducing cylinder numbers and using turbochargers, contribute to better mileage and fuel efficiency. Moreover, fleet management systems enable remote monitoring of vehicle components, generating valuable data for improving component design parameters. Artificial intelligence and machine learning algorithms are being integrated into these systems to provide insights into driver behavior and predictive maintenance, further enhancing fleet efficiency and reducing downtime. In conclusion, the adoption of commercial vehicle fleet management systems is on the rise as fleet operators seek to optimize costs, improve efficiency, and ensure regulatory compliance.

- These systems offer a range of advanced features, from real-time vehicle monitoring to predictive maintenance and driver behavior analysis, making them an indispensable tool for fleet managers.

What are the market trends shaping the Commercial Vehicle Fleet Management System Industry?

- The 360-degree fleet management system (FMS) is gaining significant traction in the market, representing an emerging trend. This advanced system offers comprehensive monitoring and optimization capabilities for fleet operations.

- Commercial Vehicle Fleet Management Systems (FMS) have advanced significantly beyond basic vehicle tracking, transforming into comprehensive driving performance solutions. The integration of camera technology into FMS enables more effective interpretation of safety-related issues. For instance, SmartDrive's SmartDrive 360 system activates up to four cameras based on safety risks, such as harsh braking or collisions. The footage from these cameras is analyzed by expert driving analysts and collisions are confirmed within an hour, allowing fleet managers to promptly respond to incidents. Subscription models, Usage-Based Insurance (UBI), and real-time data analytics are key trends shaping the FMS market.

- These innovations provide fleet managers with valuable performance metrics, including engine hours, harsh braking detection, harsh cornering detection, and incident management. Mobile applications and hardware integration enable real-time monitoring and data access, while machine learning and sensor technology optimize fleet operations. Safety management is a critical aspect of FMS, with driver safety training and big data analytics contributing to improved fleet safety. Supply chain management and parts management are also essential features, ensuring efficient fleet maintenance and reducing downtime. Data privacy remains a significant concern, with robust security measures and transparent privacy policies essential to maintain trust with customers.

What challenges does the Commercial Vehicle Fleet Management System Industry face during its growth?

- The high cost of Fleet Management Systems (FMS) poses a significant challenge and hinders the growth of the industry.

- Commercial Vehicle Fleet Management Systems (FMS) are essential tools for businesses seeking operational efficiency, cost reduction, and risk management. FMS utilizes fleet telematics, IoT devices, and real-time location tracking to optimize fleet performance. Key features include data analytics, reporting & analytics, data mining, accident reporting, harsh acceleration detection, speed monitoring, fuel efficiency, and data warehousing. The initial investment for implementing FMS includes license, setup, installation, customization, and integration fees. These costs can vary depending on the chosen solution's complexity and the number of vehicles in the fleet. For instance, Verizon offers FMS with a hardware cost ranging from USD3500 to USD6500 per year for a fleet of ten vehicles, along with a monthly subscription fee of USD35 to USD60.

- FMS offers numerous benefits, such as improved vehicle security, enhanced driver behavior, and real-time vehicle maintenance alerts. Data encryption ensures the security of the transmitted data, while API integrations facilitate seamless integration with existing systems. By leveraging FMS, businesses can make data-driven decisions, optimize fleet utilization, and minimize operational costs.

Exclusive Customer Landscape

The commercial vehicle fleet management system market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the commercial vehicle fleet management system market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, commercial vehicle fleet management system market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AT&T Inc. - This company specializes in fleet management services, providing advanced optimization of routes to enhance operational efficiency. Compliance tools are integrated to minimize regulatory infringements, thereby reducing potential fines and penalties. By leveraging these solutions, businesses can significantly decrease fuel consumption and maintenance expenses. Our offerings ensure regulatory compliance while maximizing fleet productivity and cost savings.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AT&T Inc.

- Ctrack (Inseego Corp.)

- Donlen Corporation

- Element Fleet Management Corp.

- Fleet Complete

- Geotab Inc.

- GPS Insight

- KeepTruckin Inc. (Motive)

- Masternaut Limited

- MiX Telematics Ltd.

- Omnitracs LLC

- ORBCOMM Inc.

- Samsara Networks Inc.

- Teletrac Navman

- TomTom International BV

- Trimble Inc.

- Verizon Connect

- Webfleet Solutions (Bridgestone)

- Wheels Inc.

- Zonar Systems Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Commercial Vehicle Fleet Management System Market

- In January 2024, Volvo Group, a leading commercial vehicle manufacturer, announced the launch of its new Fleet Services platform, integrating telematics, maintenance, and financing services for fleet operators (Volvo Group Press Release, 2024). This comprehensive solution aimed to improve fleet efficiency and productivity.

- In March 2024, Daimler Trucks and Mercedes-Benz Trucks signed a strategic partnership with Microsoft to develop cloud-based fleet management services, leveraging Microsoft's Azure platform and AI capabilities (Daimler Trucks & Buses AG Press Release, 2024). This collaboration aimed to enhance fleet management, predictive maintenance, and connectivity.

- In May 2024, Trimble, a technology provider, acquired PeopleNet, a leading provider of fleet management solutions, for approximately USD1.1 billion (Trimble Press Release, 2024). This acquisition expanded Trimble's fleet management offerings and strengthened its position in the market.

- In April 2025, the European Union passed the Alternative Fuels Infrastructure Regulation, mandating the installation of alternative fuel infrastructure for commercial vehicles at rest areas and truck stops by 2030 (European Parliament Press Release, 2025). This regulation is expected to drive demand for fleet management systems that support alternative fuel vehicles.

Research Analyst Overview

- The market is witnessing significant advancements, driven by the integration of various technologies and services. Sensor data and telematics hardware are revolutionizing workforce management and logistics management, providing real-time insights for fleet optimization and delivery optimization. Advanced driver-assistance systems and autonomous driving technologies are shaping the future of fleet operations, enhancing safety and efficiency. Algorithm development and consulting services are crucial for revenue management and carbon footprint reduction, while payment processing and invoicing systems streamline financial transactions. Hybrid vehicle integration and electric vehicle integration are key sustainability initiatives, aligning with business objectives and regulatory requirements.

- Driver recruitment, support & maintenance, and software upgrades ensure a well-maintained and productive workforce. Supply chain visibility and integration services enable seamless collaboration between stakeholders, fostering a more connected and efficient fleet management ecosystem. Invoicing systems and billing systems further strengthen the financial management aspect of fleet operations. Overall, the market is evolving to meet the demands of modern business requirements, offering a comprehensive solution for managing and optimizing fleet operations.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Commercial Vehicle Fleet Management System Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

204 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.7% |

|

Market growth 2025-2029 |

USD 8700 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.2 |

|

Key countries |

US, China, Germany, Japan, UK, Australia, India, France, Brazil, UAE, Rest of World (ROW), Saudi Arabia, France, South Korea, Mexico, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Commercial Vehicle Fleet Management System Market Research and Growth Report?

- CAGR of the Commercial Vehicle Fleet Management System industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the commercial vehicle fleet management system market growth of industry companies

We can help! Our analysts can customize this commercial vehicle fleet management system market research report to meet your requirements.