Commercial Aircraft Cabin Trash Compactors Market 2024-2028

The commercial aircraft cabin trash compactors market size is estimated to grow at a CAGR of 5.62% between 2023 and 2028. The market size is forecast to increase by USD 33.19 million. The growth of the market depends on several factors such as the growing demand for new commercial aircraft, the increasing air connectivity on regional routes, and the increasing need to recycle cabin waste.

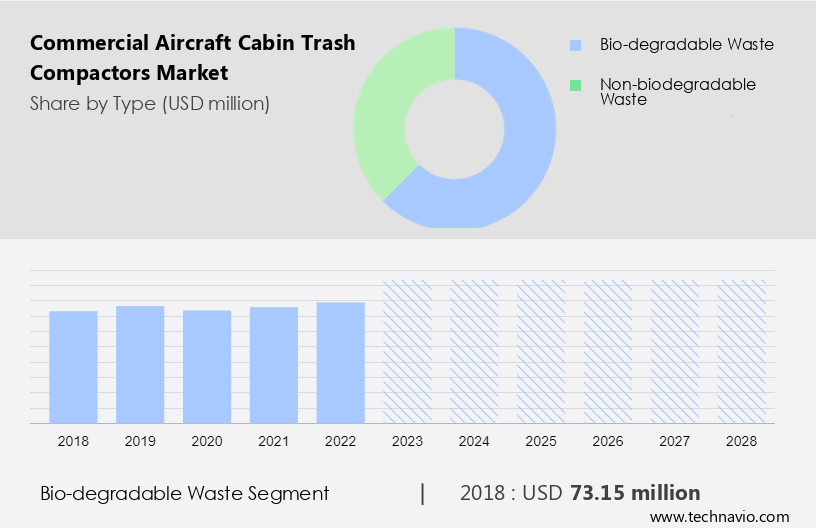

The report includes a comprehensive outlook on the Commercial Aircraft Cabin Trash Compactors Market, offering forecasts for the industry segmented by Type, which comprises bio-degradable waste and non-biodegradable waste. Additionally, it categorizes Application into narrow body aircraft, wide body aircraft, and regional aircraft, and covers Geography regions, including APAC, North America, Europe, South America, and Middle East and Africa. The report provides market size, historical data spanning from 2018 to 2022, and future projections, all presented in terms of value in USD million for each of the mentioned segments.

What will be the size of the Commercial Aircraft Cabin Trash Compactors Market During the Forecast Period?

Commercial Aircraft Cabin Trash Compactors Market Forecast 2024-2028

To learn more about this report, Request Free Sample

Commercial Aircraft Cabin Trash Compactors Market Dynamic

Driver- Growing demand for new commercial aircraft

Integration of various national economies as a result of globalization, the growing frequency of air travel as a result of the growing middle-class population across the world owing to consistent economic development, and rapidly improving civil aviation infrastructure are driving the demand for commercial jets. As a result, global civil aviation traffic has increased along with a high average occupancy rate per aircraft, which, in turn, has increased the need for new commercial aircraft.

Moreover, civil passenger traffic is expected to double in the next 15 years across the globe, and APAC is expected to account for the majority of the incremental growth. Thus, the growing demand for new commercial aircraft is expected to drive the growth of global commercial aircraft cabin trash compactors market during the forecast period.

Trends- Leading aircraft equipment manufacturers engaging in merger and acquisition

Aircraft component manufacturers are acquiring peer companies to grow significantly. This is expected to increase the concentration ratio of the market and increase the bargaining power of manufacturers. For instance, in April 2020, Raytheon Technologies Corporation and United Technologies Corporation announced that their all-stock merger of equals deal had been completed successfully.

Furthermore, several other M&As are expected to take place in the next five years. In December 2021, for example, Safran SA entered into exclusive discussions to acquire Orolia, a global leader in resilient positioning, navigation, and timing. Such developments are likely to propel the growth of the global commercial aircraft cabin trash compactors market during the forecast period.

Challenge- Stringent regulations preventing sorting of cabin waste

Various countries have differing national catering waste guidelines. These guidelines, formed to control the handling of catering waste, restrict the recycling of catering waste from international flights. As per these regulations, the disposal of food and beverages from foreign countries is associated with the risk of spreading infection and contamination and may negatively impact the agriculture and livestock industry. Thus, these regulations compel airlines to incinerate their cabin waste.

For example, countries such as Australia, Canada, and New Zealand, which have a very advanced agricultural sector, witness strict controls on the disposal, reuse, and recycling of cabin waste. Several governments across the world have adopted the International Catering Waste (ICW) legislation, which restricts several airlines from cabin waste recycling, thereby limiting the growth of the market during the forecast period.

Commercial Aircraft Cabin Trash Compactors Market Segmentation by Type, Application, Geography

Type Segment Analysis:

The bio-degradable waste segment will account for a major share of the market's growth during the forecast period.? Bio-degradable waste in the market includes of catering waste like inflight meals, snacks, and beverages served to passengers and can consist of leftover food, drinks, newspapers, paper towels, and food dropped on the floor, among others. The bio-degradable waste segment is expected to grow due to an increase in air passenger traffic globally, a rising trend of airline meal ordering, and growing expectations among air passengers. Factors such as people's growing disposable income and their increasing preference for air travel have significantly increased the total passenger density at airports.

Customised Report as per your requirements!

The bio-degradable waste segment was valued at USD 73.15 million in 2018. Moreover, in many developing countries, air transport has become a major mode of transport, which has led to rapid growth in global air travel. As the total air passenger density continues to increase, bio-degradable waste is expected to grow. furthermore, cabin waste audits undertaken by IATA and the number of airlines indicate that 20-25% of cabin waste is untouched food and beverages, meaning the sector is incinerating or landfilling USD2-3 billion worth of resources. Thus, such factors are expected to drive the market's growth through the bio-degradable waste segment during the forecast period.

Application Segment Analysis

Based on application, the market has been segmented into narrow body aircraft, wide body aircraft, and regional aircraft. The narrow body aircraft?segment will account for the largest share of this segment.? A single-aisle aircraft that can seat more than 100 passengers in two axial groups is termed a narrow-body aircraft. Most narrow-body commercial aircraft serve short to medium-haul routes. On these routes, most airlines are focused on minimizing the amount of cabin waste generated by reducing the quantity and variety of food and beverages served on board. This also helps airlines reduce their operational expenditure and increase profitability. Thus, such factors are expected to drive the demand for cabin trash compactors for narrow-body aircraft during the forecast period.

has context menu

Regional Analysis

For more insights on the market share of various regions Download Sample PDF now!

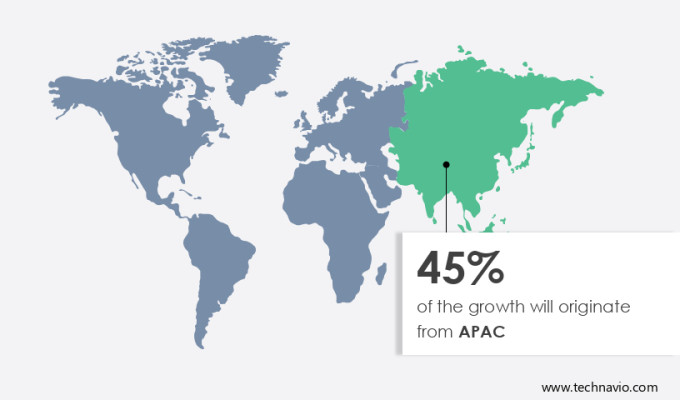

APAC is estimated to contribute 45% to the growth by 2027. Technavio’s analysts have elaborately explained the regional trends, drivers, and challenges that are expected to shape the market during the forecast period. Airlines in APAC have placed some of the largest commercial aircraft orders in the history of the global commercial aircraft market. For instance, Airbus and China Aviation Supplies Holding Company signed a General Terms Agreement (GTA) in May 2022 that covers the acquisition of 300 Airbus aircraft by Chinese airlines. Other leading countries in APAC, such as Japan and Indonesia, have placed large orders to aircraft manufacturers.

Furthermore, countries in APAC, such as China and Japan, are developing commercial aircraft to compete with global rivals such as Airbus and Boeing. For instance, The Commercial Aircraft Corporation of China Ltd. has developed the ARJ21 regional twin-engine jet. Thus, such developments are expected to increase the demand for cabin trash compactors in APAC during the forecast period.

Who are the Major Commercial Aircraft Cabin Trash Compactors Market Companies?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

- Airbus SE: The company offers commercial aircraft cabin trash compactor innovative solutions for waste management on airliners.

We also have detailed analyses of the market’s competitive landscape and offer information on 8 market companies, including:

C. Melchers GmbH and Co. KG, Iacobucci HF Aerospace S p A, John Swire and Sons Ltd., Raytheon Technologies Corp., Safran SA, The Boeing Co., and The MEL Group

Technavio report provides an in-depth analysis of the market and its players through combined qualitative and quantitative data. The analysis classifies companies into categories based on their business approaches, including pure-play, category-focused, industry-focused, and diversified. Companies are specially categorized into dominant, leading, strong, tentative, and weak, based on their quantitative data analysis.

Segment Overview

The commercial aircraft cabin trash compactors market report forecasts market growth by revenue at global, regional & country levels and provides an analysis of the latest trends and growth opportunities from 2018 to 2028.

- Type Outlook

- Bio-degradable waste

- Non-biodegradable waste

- Application Outlook

- Narrow body aircraft

- Wide body aircraft

- Regional aircraft

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- The U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- South America

- Chile

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

|

Commercial Aircraft Cabin Trash Compactors Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

153 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.62% |

|

Market Growth 2024-2028 |

USD 33.19 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

4.97 |

|

Regional analysis |

APAC, North America, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 45% |

|

Key countries |

US, China, India, Ireland, and Russia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Airbus SE, C. Melchers GmbH and Co. KG, Iacobucci HF Aerospace S p A, John Swire and Sons Ltd., Raytheon Technologies Corp., Safran SA, The Boeing Co., and The MEL Group |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the forecast period. |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Commercial Aircraft Cabin Trash Compactors Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the growth of the commercial aircraft cabin trash compactors market between 2024 and 2028

- Precise estimation of the commercial aircraft cabin trash compactors market size and its contribution to the market in focus on the parent market

- Accurate predictions about upcoming trends and changes in consumer behavior

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- A thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of commercial aircraft cabin trash compactors market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch