Commercial Large Format Display Signage Market Size 2024-2028

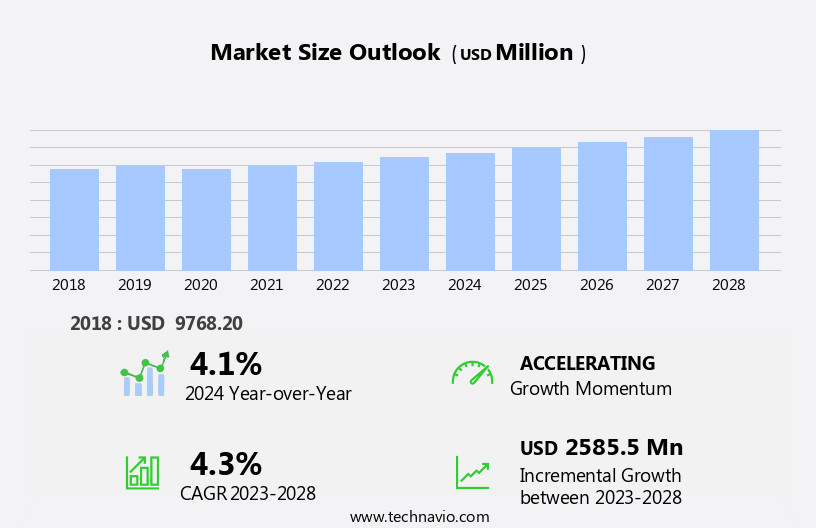

The commercial large format display signage market size is forecast to increase by USD 2.59 billion at a CAGR of 4.3% between 2023 and 2028.

- The market is experiencing significant growth, driven by several key trends. One of the primary factors fueling market expansion is the advent of direct-view LED displays, which offer superior image quality and energy efficiency compared to traditional display technologies. Additionally, the increasing popularity of virtual reality (VR) and 360-degree video content is driving demand for large format displays that can effectively showcase immersive visual experiences.

- Furthermore, the growing importance of digital marketing in today's business landscape is leading companies to invest in large format displays as a cost-effective and impactful way to reach their audiences. These trends are expected to continue shaping the market In the coming years.

What will be the Size of the Commercial Large Format Display Signage Market During the Forecast Period?

- The market encompasses digital signage utilizing wide-screen displays and vertical monitors for business promotion visibility. These optimal screens, featuring advanced technologies such as Android OS, 24/7 displays, and 4k UHD resolution, offer clear image quality and are future-proof, reliable, and durable. The market's growth is driven by the increasing demand for eye-catching, high-definition displays in various sectors, including schools and businesses.

- LCD flat-screen technology dominates the landscape, with a focus on display management systems ensuring seamless content delivery. Patented anti-burn-in technology is a key differentiator, ensuring long-term vibrancy and reducing maintenance costs. The market's direction is towards larger, more dynamic displays, offering enhanced visual experiences for audiences.

How is this Commercial Large Format Display Signage Industry segmented and which is the largest segment?

The commercial large format display signage industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Indoor

- Outdoor

- Geography

- North America

- US

- APAC

- China

- Japan

- Europe

- Germany

- UK

- Middle East and Africa

- South America

- North America

By Application Insights

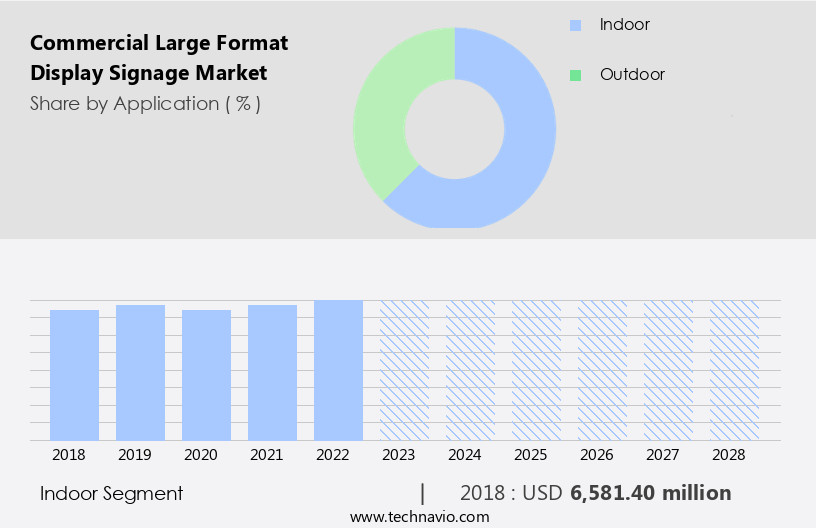

The indoor segment is estimated to witness significant growth during the forecast period. Indoor large-format display signage is the dominant segment In the signage market, characterized by its size, format, and versatility. These displays serve various purposes, including wayfinding, directional, and informational functions. By delivering pertinent and timely information, they enhance visitor experience and facilitate navigation. Commercial entities utilize digital signage for business promotion, leveraging its higher perceived value over traditional signage. The emergence of direct-view large-format displays and organic light-emitting diode (OLED) offers businesses the opportunity to captivate customers with visually appealing graphics and persuasive messaging. Future-proof, reliable, and durable digital signage solutions cater to diverse industries such as schools, businesses, restaurants, bars, and venues.

Featuring 24/7 operation, 4K UHD resolution, clear image quality, and patented anti-burn-in technology, these displays ensure optimal performance. Display management software enables customized content, local ads, special promotions, image sensors, gestures, and touchscreen. LCD flat-screen technology, with its long usage life and brightness, is ideal for commercial purposes.

Get a glance at the Commercial Large Format Display Signage Industry report of share of various segments. Request Free Sample

The Indoor segment was valued at USD 6.58 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

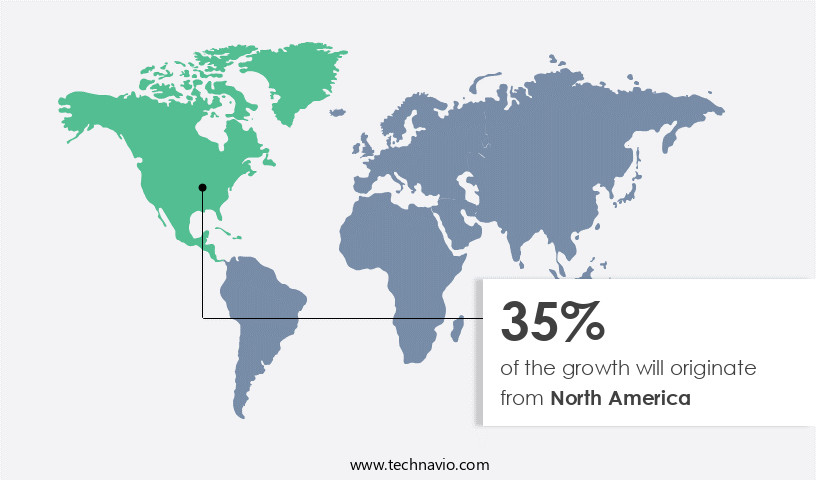

North America is estimated to contribute 35% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in North America is experiencing growth due to significant investments in research and development by leading industry players and a well-established regulatory framework. The US and Canada dominate this market, with Mexico exhibiting promising growth. Digital signage is a crucial tool for businesses focusing on digital advertising and marketing, leading to increased spending in this area and driving market expansion. Large-format LCD screens, offering wide-screen displays, vertical monitors, and 24/7 operation, are essential for business promotion visibility. Future-proof, reliable, and durable digital signage solutions with Android OS, 4K UHD resolution, clear image quality, and patented anti-burn-in technology are in high demand.

Display management, LCD flat-screen, and customized software cater to various commercial purposes, including schools, businesses, restaurants, bars, venues, and longer use operations. Brightness and backlights ensure optimal viewing in various environments, while intense images and customized software support local ads, special promotions, image sensors, gestures, and touch screen technology.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Commercial Large Format Display Signage Industry?

- Advent of direct-view LED displays is the key driver of the market. The market is experiencing technological innovations, particularly with the emergence of narrow bezel LCDs and direct-view fine-pixel LED displays. Direct-view LED displays utilize light-emitting diodes (LEDs) to generate light energy and form images directly on the screen. Each LED consists of a semiconductor that converts electrical energy into light energy and a specific chemical compound defining the color. In contrast to LCDs, direct-view LED displays create images using the LEDs themselves, resulting in improved brightness, longer lifespan, and optimal screens for business promotion visibility.

- Digital signage applications, such as wide-screen displays and vertical monitors, have become essential for businesses, schools, restaurants, bars, and venues to enhance consumer engagement. These future-proof, reliable, and durable displays offer 24/7 operations, 4K UHD resolution, and clear image quality. Patented anti-burn-in technology ensures image sensors, gestures, movement, and touch screen technology function optimally. Display management systems enable customized software for local ads, special promotions, and longer use operations. Business operators require installation and usage expertise for these large-format LCD screens, which may undergo wear and tear and overuse. Digital displays are increasingly replacing traditional signage methods for commercial purposes, making audio-visual solutions a crucial investment. With the advancement of technology, consumers and businesses alike benefit from the enhanced viewing distance and the ability to display intense images, even in corporate lobbies and sports stadiums.

What are the market trends shaping the Commercial Large Format Display Signage Industry?

- Growing popularity of virtual reality (VR) and 360 degree video content is the upcoming market trend. The market is experiencing significant growth due to the increasing adoption of digital signage applications, particularly wide-screen displays and vertical monitors. Businesses, schools, restaurants, bars, and venues are utilizing these displays for optimal visibility and promotion. Digital signage solutions are becoming increasingly future-proof, reliable, and durable, with features such as Android OS, 24/7 displays, and 4K UHD resolution ensuring clear image quality.

- Patented anti-burn-in technology and display management systems ensure longevity, even with intensive usage. LCD flat-screen technology, longer use operations, and customized software enable local ads, special promotions, and real-time image sensors for gesture, movement, and touch screen technology. VR and 360-degree video content are the latest advances in this market, offering immersive experiences for consumers and businesses alike. With the increasing popularity of these technologies, spending on digital displays for commercial purposes is expected to continue growing.

What challenges does the Commercial Large Format Display Signage Industry face during its growth?

- Growing popularity of digital marketing is a key challenge affecting the industry growth. Commercial large format display signage is a significant investment for businesses seeking optimal visibility and engagement with their audiences. Digital signage applications, such as wide-screen displays and vertical monitors, offer versatility and customization for business promotion. These future-proof solutions are reliable and durable, with features like Android OS, 24/7 displays, and 4K UHD resolution ensuring clear image quality. Patented anti-burn-in technology preserves content longevity, while display management software simplifies installation and usage. Large-format LCD screens are ideal for various commercial purposes, including schools, businesses, restaurants, bars, and venues. Customized software enables local ads, special promotions, and interactive features like image sensors, gestures, and movement.

- Touch screen technology adds an additional layer of consumer engagement. Digital displays are increasingly popular for their ability to withstand wear and tear and longer use operations. Advanced features like brighter backlights and intense images cater to various viewing distances and environments. Customized software and audio-visual solutions further enhance the user experience. Business operators benefit from the flexibility and cost-effectiveness of digital signage solutions, making them an essential tool for corporate lobbies, sports stadiums, and other high-traffic locations.

Exclusive Customer Landscape

The commercial large format display signage market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the commercial large format display signage market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, commercial large format display signage market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AUO Corp.

- Barco NV

- Dahua Technology Co. Ltd.

- Daktronics Inc.

- Deepsky Corp. Ltd.

- Delta Electronics Inc.

- Hyundai IT Co. Ltd.

- LG Electronics Inc.

- Mitsubishi Electric Corp.

- Panasonic Holdings Corp.

- Planar Systems Inc.

- Qisda Corp.

- Retop LED Display Co. Ltd.

- Samsung Electronics Co. Ltd.

- Sharp Corp.

- Shenzhen AOTO Electronics Co. Ltd.

- Sony Group Corp.

- YFY Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a range of digital solutions designed for business promotion visibility. These displays, which include wide-screen monitors and vertical models, are optimized for commercial purposes and prioritize features such as reliability, durability, and future-proof technology. One key consideration for businesses considering digital signage solutions is the importance of clear image quality. Advanced technologies like 4k UHD resolution and patented anti-burn-in technology ensure that the displays maintain optimal screens for extended periods, even during 24/7 operations. Another important factor for businesses is the ability to effectively manage their digital signage displays. This includes features like display management software, which allows for easy content scheduling, remote monitoring, and real-time updates.

LCD flat-screen technology is a popular choice for commercial large format displays due to its brightness and ability to handle intense images. Android OS is also a common operating system for these displays, offering flexibility and compatibility with various customized software options. Business operators in various industries, including schools, restaurants, bars, venues, and corporations, have embraced digital signage solutions for their ability to increase visibility and engage customers. These displays can be used for local ads, special promotions, and even interactive features like image sensors, gestures, and touch screen technology. Longer use operations, such as those in corporate lobbies and sports stadiums, require displays that can withstand wear and tear and overuse.

Commercial-grade large format displays are designed with these demands in mind, offering robust backlights and durable materials to ensure reliable performance. Audio visual solutions, including large-format LCD screens, are also an essential component of many digital signage applications. Proper consideration of viewing distance and brightness is crucial for maximizing the impact of these displays. In conclusion, the market offers businesses a range of solutions designed to increase visibility, engage customers, and provide reliable, future-proof technology. Features like clear image quality, customized software, and durable materials make these displays a valuable investment for businesses in various industries.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

151 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.3% |

|

Market growth 2024-2028 |

USD 2.59 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.1 |

|

Key countries |

US, Japan, China, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Commercial Large Format Display Signage Market Research and Growth Report?

- CAGR of the Commercial Large Format Display Signage industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the commercial large format display signage market growth of industry companies

We can help! Our analysts can customize this commercial large format display signage market research report to meet your requirements.