Commercial Water Heaters Market Size 2024-2028

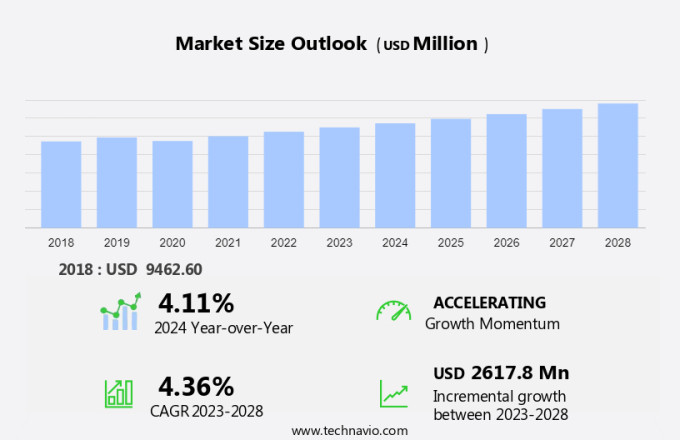

The commercial water heaters market size is forecast to increase by USD 2.62 billion at a CAGR of 4.36% between 2023 and 2028.

- The commercial water heater market is experiencing significant growth, driven by increasing demand from the hospitality sector, particularly in regions with a high tourist population. Additionally, there is a rising trend towards energy efficiency in commercial buildings, leading to increased initiatives for the installation of energy-efficient water heating systems.

- However, the high installation and maintenance costs associated with commercial water heaters can be a challenge for market growth. To mitigate this, manufacturers are focusing on developing cost-effective and energy-efficient solutions, such as tankless water heaters and heat pump water heaters. Furthermore, government regulations and incentives are also driving the adoption of energy-efficient water heating systems in commercial buildings. Overall, the commercial water heater market is expected to continue growing, driven by these trends and the increasing demand for hot water in various industries.

What will be the Commercial Water Heaters Market Size During the Forecast Period?

- The market is driven by the increasing demand for hot water in various industries, including healthcare, hotels, restaurants, and manufacturing facilities. The market is segmented based on energy sources, with oil, electricity, solar, and renewable sources being the major categories. Corporate places are increasingly adopting energy-efficient and sustainable solutions to reduce their carbon footprint and mitigate the impact of energy crises. Renewable water sources, such as solar and heat pumps, are gaining popularity due to their ability to reduce CO2 emissions.

- Additionally, technologically advanced solutions, such as heat recovery systems and smart water heaters, are also gaining traction due to their energy efficiency and cost savings. Incentives from governments and regulatory bodies are further boosting the market growth. The market is expected to grow at a significant rate, with Massachusetts being a key market due to its stringent energy efficiency regulations. The market is expected to remain competitive, with key players focusing on product innovation and energy efficiency to gain a competitive edge.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Electric water heater

- Gas water heater

- Solar water heater

- Distribution Channel

- Offline

- Online

- Geography

- APAC

- China

- India

- Japan

- Europe

- Germany

- North America

- US

- South America

- Middle East and Africa

- APAC

By Type Insights

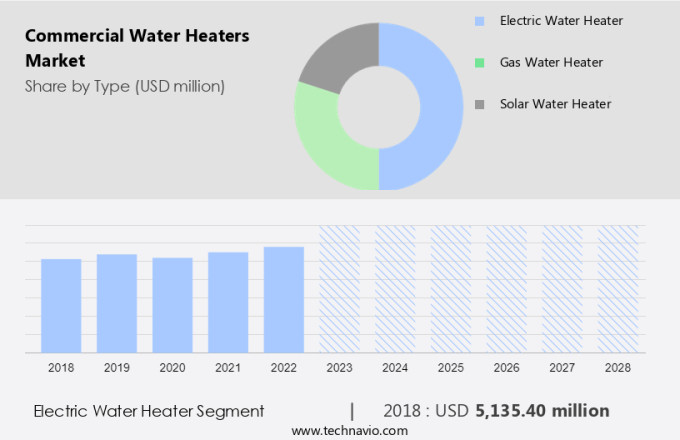

- The electric water heater segment is estimated to witness significant growth during the forecast period.

Commercial water heating systems play a crucial role in various industries, including healthcare, hotels, restaurants, and corporate places. The energy source for these systems has been traditionally derived from oil and electricity. However, there is a growing trend towards the adoption of renewable sources such as solar, heat pumps, and biofuels to reduce reliance on fossil fuels and mitigate the energy crisis. Rinnai Corporation, among others, offers dual fuel heaters that use both electricity and gas, providing flexibility in fuel type and enhancing energy efficiency. Moreover, energy-efficient heaters, such as condensing and heat pump heaters, have gained popularity due to their high heat recovery factor and low CO2 emission.

Additionally, institutes, offices, salons, SPAs, cafes, schools, and colleges are increasingly investing in energy-efficient water heating solutions to improve building energy performance and reduce energy consumption. The Massachusetts legislature, for instance, mandates that all new commercial buildings must meet certain energy efficiency standards. Heat pumps, a type of renewable energy technology, are gaining traction as an alternative to traditional water heating systems. These systems use electricity to transfer heat from the ambient air or water to the water in the tank, making them an eco-friendly and cost-effective option for commercial establishments. The energy performance of these systems is influenced by factors such as insulation, power capacity, and storage capacity.

In conclusion, the commercial water heater market is witnessing significant growth due to the increasing demand for energy-efficient and renewable energy-based heating solutions. companies are focusing on developing innovative products that cater to the diverse needs of various industries while adhering to stringent energy efficiency regulations. The adoption of these advanced technologies not only helps in reducing greenhouse gas emissions but also offers cost savings in the long run.

Get a glance at the market report of share of various segments Request Free Sample

The electric water heater segment was valued at USD 5.14 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

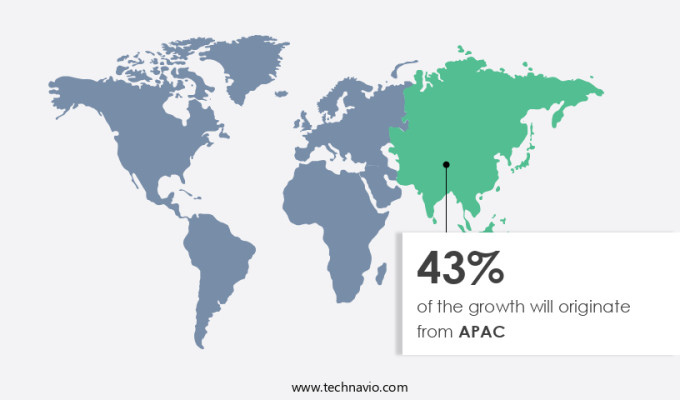

- APAC is estimated to contribute 43% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Commercial water heaters play a crucial role in supplying hot water to hospitals, office buildings, and manufacturing facilities. Energy efficiency and sustainability are key considerations in the selection of these systems. Technologically advanced, energy-efficient models are preferred, including those with condensing heat, smart controls, and better insulation. Renewable water sources and hybrid systems are increasingly being adopted to reduce carbon footprints and comply with environmental regulations.

Additionally, incentives for energy efficiency and the integration of Internet of Things (IoT) technology are driving the market. Scheduled maintenance and advanced control systems, such as remote monitoring and internet connectivity, enhance operational efficiency. The market for commercial water heaters includes electric and instant segments, with offices being a significant end-user segment. Facility managers prioritize capacity and energy efficiency standards when deploying new systems. Smart water heaters, with their advanced features, are becoming increasingly popular in this market.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Commercial Water Heaters Market ?

Increasing demand from the hospitality sector is the key driver of the market.

- In the commercial sector, water heaters play a crucial role in ensuring the smooth operation of various establishments, including healthcare facilities, hotels, restaurants, and educational institutions. The energy consumption of these commercial spaces is significantly higher than residential buildings due to the high frequency of hot water usage. As a result, the energy savings from water heating systems in commercial spaces can be substantial. Companies are increasingly focusing on energy-efficient solutions to reduce their carbon footprint and mitigate the impact of energy crises. Renewable energy sources, such as solar and biofuel heaters, are gaining popularity in commercial applications. However, traditional energy sources like oil and electricity continue to dominate the market.

- Additionally, electric water heaters, such as heat pump heaters and tankless models, are popular choices for commercial spaces due to their energy efficiency and consistent hot water availability. These heaters are particularly suitable for establishments with high hot water demand, such as hotels, hospitals, and restaurants. Heat recovery systems and insulation are essential factors in improving the energy performance of commercial water heating systems. Rinnai Corporation, a leading manufacturer of commercial water heaters, offers a range of energy-efficient models, including dual-fuel and condensing heaters, with varying storage and power capacities. The fuel type of water heaters can also impact their energy efficiency.

- In conclusion, gas heaters, including hybrid and condensing models, offer cost-effective solutions for commercial applications. However, they emit CO2 and other greenhouse gases, which can contribute to environmental concerns. In conclusion, the selection of water heating systems for commercial spaces depends on various factors, including energy source, fuel type, building energy requirements, and energy performance. Companies must consider these factors to make an informed decision and select the most energy-efficient and cost-effective solution for their specific needs.

What are the market trends shaping the Commercial Water Heaters Market?

Rising initiatives for energy-efficient commercial buildings is the upcoming trend in the market.

- The market encompasses various energy sources, including oil, electricity, solar, and renewable sources, for heating water in corporate places such as offices, institutes, salons, SPAs, cafes, schools, colleges, nursing homes, and healthcare facilities, including hotels and restaurants. The energy crisis has led to the increased adoption of energy-efficient heaters, such as heat pump heaters and condensing heaters, which offer improved energy performance and efficiency. Rinnai Corporation, among others, is a leading manufacturer of energy-efficient water heaters, offering dual fuel, electric, gas, hybrid, and biofuel heaters with high storage and power capacity. The shift towards renewable sources, such as solar and biofuel heaters, is gaining momentum due to their reduced carbon footprint and CO2 emission.

- Additionally, building energy consumption is a significant contributor to greenhouse gas emissions, and the adoption of energy-efficient heaters plays a crucial role in reducing these emissions. The focus on improving occupant health and operational efficiency has led the commercial sector to consider whole-lifecycle building standards, such as LEED and Estidama, which emphasize insulation, heat recovery factor, and energy consumption reduction. Heat pumps, which offer both heating and cooling capabilities, are increasingly being adopted for their energy-saving potential.

What challenges does Commercial Water Heaters Market face during the growth?

High installation and maintenance costs are key challenges affecting the market growth.

- Commercial establishments, such as corporate places, healthcare facilities, hotels, restaurants, and educational institutions, rely on water heating systems for their daily operations. Tankless water heaters, which differ from conventional tank water heaters, offer several advantages, including energy efficiency and the ability to provide a continuous supply of hot water. However, the energy source used, such as oil or electricity, can impact the overall cost and environmental impact. Renewable sources, like solar and biofuel heaters, are gaining popularity due to their reduced carbon footprint and energy savings. Energy-efficient heaters, such as heat pumps and condensing heaters, can help mitigate energy consumption and improve building energy performance.

- However, companies like Rinnai Corporation offer a range of fuel types, including electric, gas, hybrid, and dual fuel, to cater to various commercial needs. Despite their benefits, tankless water heaters require regular maintenance to ensure optimal performance and prevent potential issues, such as CO2 emission and heat loss. Factors like insulation, heat recovery, and heat pump heaters can significantly impact the energy efficiency and performance of these systems. The energy crisis and increasing awareness of greenhouse gas emissions have further emphasized the importance of energy-efficient water heating solutions. Institutes, offices, salons, SPAs, cafes, schools, and colleges are increasingly adopting these advanced water heating systems to reduce energy consumption and improve overall efficiency.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- A. O. Smith Corp.

- Ariston Holding NV

- Bradford White Corp.

- Daikin Industries Ltd.

- Electric Heater Co.

- Electrolux group

- Ferroli Spa

- Guangdong Vanward New Electric Co. Ltd.

- Hangzhou Kangquan Water Heater Co. Ltd.

- Jaquar India

- MIDEA Group Co. Ltd.

- Noritz Corp.

- Rheem Manufacturing Co.

- Rinnai Corp.

- Robert Bosch GmbH

- Solahart Industries Pty Ltd.

- STIEBEL ELTRON GmbH and Co. KG

- Vaillant GmbH

- Viessmann Climate Solutions SE

- Watts Water Technologies Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is driven by the demand for hot water in various industries, including corporate places, healthcare, hotels, restaurants, and educational institutions. The energy source for commercial water heaters varies, with oil, electricity, solar, and renewable sources being the most common. The energy crisis and the need for energy-efficient solutions have led to the popularity of energy-efficient heaters, such as heat pumps and condensing heaters. Renewable sources, such as solar and biofuel heaters, are gaining traction due to their environmental benefits and decreasing costs. In Massachusetts, there is a growing emphasis on reducing CO2 emission, leading to the adoption of energy-efficient and low-emission heaters.

In summary, the market for commercial water heaters is segmented based on fuel type, with electric, gas, hybrid, and biofuel heaters being the major types. The market is further segmented based on power capacity, storage capacity, and heat recovery factor. Key players in the market include Rinnai Corporation, manufacturers of gas-fired commercial water heaters, and companies specializing in heat pump heaters, such as Daikin and Mitsubishi Electric. Energy consumption and building energy performance are crucial factors in the selection of commercial water heaters. Insulation and efficiency are also important considerations for reducing energy costs and minimizing greenhouse gas emissions.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

168 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.36% |

|

Market growth 2024-2028 |

USD 2.62 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.11 |

|

Key countries |

China, US, India, Germany, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch