Concrete And Cement Market Size 2025-2029

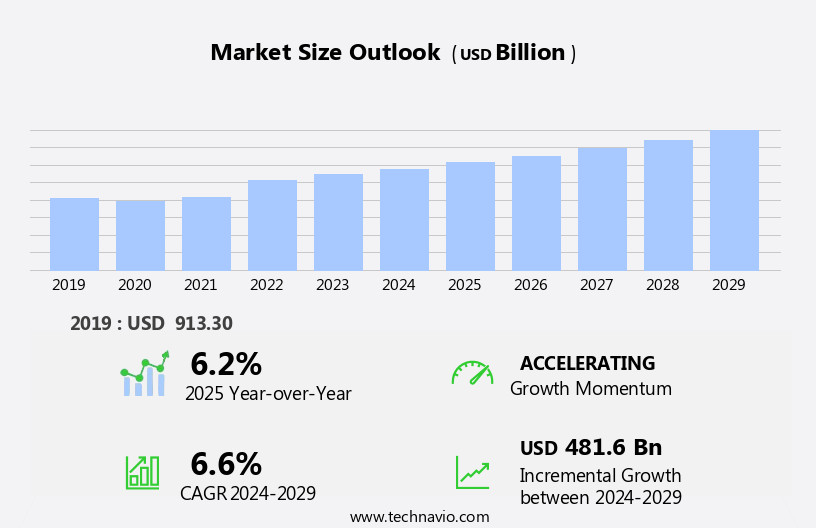

The concrete and cement market size is forecast to increase by USD 481.6 billion at a CAGR of 6.6% between 2024 and 2029.

- The market is experiencing significant growth, driven by the expanding global construction industry, fueled by rapid urbanization and increasing disposable income in various regions. This trend is expected to continue as the demand for infrastructure development and residential and commercial construction projects remains . However, it is essential to note that the overall cost of construction is on the rise, making it crucial for market participants to optimize their operations and explore cost-effective solutions. Key trends in the market include the increasing adoption of advanced technologies such as BIM (Building Information Modeling) and the growing popularity of ready-mix concrete and precast concrete products.

- Companies in the market must stay abreast of these trends and adapt to changing market conditions to capitalize on opportunities and navigate challenges effectively. Additionally, sustainability and environmental concerns are becoming increasingly important, with a growing focus on the use of eco-friendly cement and concrete products. Overall, the market presents significant opportunities for growth, particularly in emerging economies, and companies that can innovate and adapt to market trends and challenges will be best positioned for success.

What will be the Size of the Concrete And Cement Market during the forecast period?

- The market in the United States is a dynamic and significant sector, driven by construction activity in both commercial and residential sectors. The market's size is substantial, with demand coming from various applications, including the production of concrete paving blocks, commercial buildings, residential structures, and infrastructure projects. Key growth factors include the construction boom in urban areas, the increasing adoption of sustainable construction practices, and economic advancements. Drivers for the market include the need for infrastructure investments, regulatory standards, and the demand for high-performance concrete in high-rise buildings. Market trends include the use of eco-friendly materials, energy efficiency, and material innovation, such as low heat cement, hydrophobic cement, and smart concrete.

- Threats and opportunities include the need for carbon capture and infrastructure resilience, as well as the digitalization of construction processes. The market is also witnessing the development of new products, such as rapid hardening cement and white cement, which offer enhanced strength and improved aesthetics. Urban development and urbanization are also key factors driving market growth, with a focus on sustainability and infrastructure resilience. Overall, the market is poised for continued growth, driven by these trends and factors.

How is this Concrete And Cement Industry segmented?

The concrete and cement industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Cement

- Concrete

- End-user

- Residential

- Non-residential

- Geography

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Europe

- France

- Germany

- UK

- North America

- US

- Canada

- South America

- Middle East and Africa

- APAC

By Product Insights

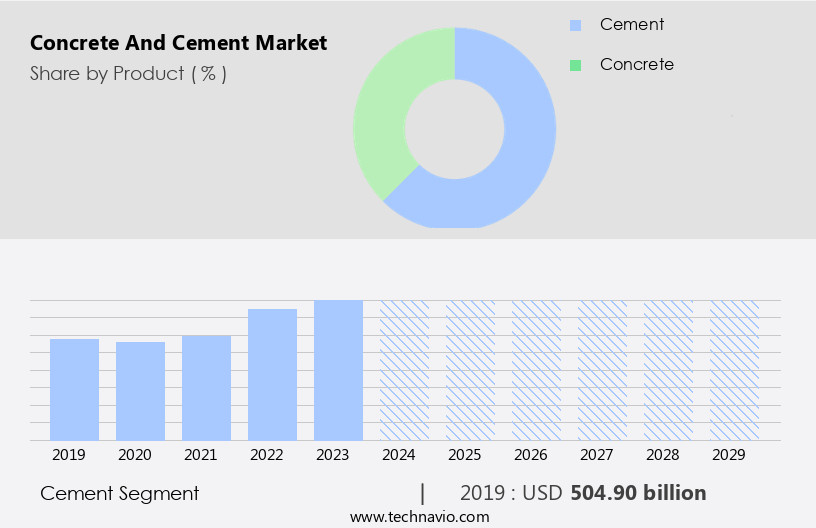

The cement segment is estimated to witness significant growth during the forecast period.

Cement plays a crucial role in construction activities as it binds various materials together to form building blocks. The cement market encompasses various types, with Portland cement being the most widely used due to its versatility in all general constructions. Cement manufacturing is an intricate, energy-intensive process that utilizes raw materials such as limestone, shells, chalk, or marl, combined with shale, clay, blast furnace slag, silica sand, and iron ore. In the non-residential sector, cement is extensively used in the production of structural components like bridge girders, wall panels, and column covers. Colored cement and white cement are popular choices for aesthetic reasons, while rapid-hardening cement is preferred for time-sensitive projects.

Hydrophobic cement is another specialty cement that offers water-repellent properties, making it suitable for paving blocks and concrete slabs. The construction industry is undergoing digitalization, with smart construction practices and operational efficiencies gaining traction. Advanced concrete mixtures, such as Portland pozzolana cement and low-heat cement, are being adopted for their improved properties and sustainability. Ready-mix concrete and concrete pipes are also increasingly being used for infrastructure investments. Cement and concrete are essential components in urban areas, where planned skyscrapers and high-rise buildings are being constructed. These structures demand high load-bearing capacity and infrastructure resilience. Predictive maintenance and regulatory standards ensure the longevity and safety of these structures.

Drivers and opportunities in the cement and concrete market include infrastructure investments, energy-efficient practices, and the increasing demand for sustainable construction practices. Threats and challenges include the energy-intensive process of cement manufacturing, coal supply, and regulatory compliance. Despite these challenges, the cement and concrete market continues to grow, driven by the construction boom in urban centers and developing markets.

Get a glance at the market report of share of various segments Request Free Sample

The Cement segment was valued at USD 504.90 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 58% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in the APAC region is experiencing significant growth due to the increasing number of construction projects. Countries such as India, Vietnam, Indonesia, and Thailand are anticipated to expand at a rate of 4%-5% during the forecast period, surpassing the average growth rate of the regional construction industry. The expansion of the construction sector in nations like India, China, Japan, Thailand, Indonesia, and the Philippines is propelling the growth of the APAC market. In 2024, the APAC region accounted for approximately 60% of global economic growth, with construction activities remaining stable despite global economic instability. Non-residential construction, including commercial buildings and infrastructure projects, is a significant contributor to the market's growth.

Innovations in construction, such as digitalization, smart construction, and advanced concrete technologies, including Colored cement, White cement, Portland pozzolana cement, Rapid hardening cement, and Hydrophobic cement, are gaining popularity. Bridge girders, Concrete slabs, Wall panels, and Structural components are in high demand for infrastructure investments. The cement manufacturing process is energy-intensive, with burning coal being a significant contributor to the industry's carbon footprint. However, there is a growing focus on sustainable construction practices and regulatory standards to reduce the environmental impact. Operational efficiencies, such as predictive maintenance, load-bearing capacity, and remote monitoring, are also essential for the industry's growth.

The market's growth is driven by the increasing demand for construction in urban centers and developing markets. Urban areas require infrastructure resilience, and the demand for Concrete pipes, Concrete raised structures, and Steel beams is increasing. The market faces challenges such as regulatory standards, coal supply, and competition from alternative building materials. Despite these challenges, the market presents opportunities for growth in infrastructure investments, advanced concrete technologies, and operational efficiencies.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Concrete And Cement Industry?

- Growing global construction industry is the key driver of the market.

- The global construction industry's expansion is driving the demand for concrete and cement due to their desirable properties, such as superior compressive strength, durability, water reduction, and resistance to chemicals and extreme weather conditions. Notable contributors to the industry's growth include India, China, the US, Brazil, Malaysia, Russia, Hungary, and Vietnam. By 2024, the Asia-Pacific region is expected to dominate the market, with emerging economies like India, Indonesia, Malaysia, Vietnam, and the Philippines investing heavily in infrastructure development to fuel economic growth.

- Concrete and cement's essential role in construction makes them indispensable in this context.

What are the market trends shaping the Concrete And Cement Industry?

- Rapid urbanization and rising disposable income is the upcoming market trend.

- The economic advancements in countries such as India, Vietnam, Malaysia, China, and Qatar have led to substantial income growth and accelerated urbanization. These economic developments have significantly enhanced consumers' disposable incomes, thereby increasing their purchasing power. For instance, China's GDP per capita rose from approximately USD10,260 in 2019 to around USD13,900 in 2024. Similarly, India's GDP per capita increased from USD2,099.6 in 2019 to about USD2,698 in 2024. This in purchasing power is anticipated to fuel consumer spending on residential and non-residential infrastructure projects, thereby bolstering the expansion of the global construction sector.

- Consequently, The market is poised to experience growth during the forecast period, driven by the increasing demand for construction materials in the aforementioned countries.

What challenges does the Concrete And Cement Industry face during its growth?

- Increase in overall construction cost is a key challenge affecting the industry growth.

- Building materials, including cement and concrete, account for a significant portion of construction costs. Cement's share is approximately 10%, while steel comprises around 9%. The remaining 27% is attributed to other materials. The pricing of these materials can fluctuate, causing an increase in the total construction cost. European countries like the UK, France, and Germany, with economies, can manage price hikes in ongoing projects.

- The availability of these materials influences the construction industry's dynamics, necessitating additional investments when prices rise. Building materials' cost variations impact the total investment required for a construction project.

Exclusive Customer Landscape

The concrete and cement market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the concrete and cement market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, concrete and cement market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ACC Ltd. - The company specializes in the production and supply of cement and concrete solutions, encompassing a range of specialized cement types and value-added concrete offerings. Our product portfolio caters to diverse industries and applications, ensuring optimal performance and sustainability. By leveraging advanced technologies and industry expertise, we deliver innovative solutions that meet evolving market demands and customer expectations.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ACC Ltd.

- Adbri Ltd.

- BGC Australia PTY Ltd.

- Buzzi SpA

- Cementir Holding NV

- CEMEX SAB de CV

- China National Building Material Co. Ltd.

- FCC SA

- Fletcher Building Group

- Heidelberg Materials AG

- Holcim Ltd.

- JK Cement Ltd

- Mitsubishi Cement Corp.

- NIPPON STEEL CEMENT Co Ltd.

- Oldcastle APG Inc.

- PPC Ltd.

- Sumitomo Osaka Cement Co. Ltd.

- Taiheiyo Cement Corp.

- Titan Cement Group

- UltraTech Cement Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a broad range of products and applications, with non-residential construction being a significant end-use sector. One of the trends shaping this market is the increasing use of colored cement and white cement in various applications, from bridge girders to wall panels and paving blocks. Digitalization is transforming the construction industry, with concrete manufacturing and production processes becoming more efficient and intelligent. The implementation of smart construction technologies, such as remote monitoring and predictive maintenance, is enabling operational efficiencies and improving the load-bearing capacity of structures. The production of cement and concrete is an energy-intensive process, with burning coal being a primary source of energy in many developed markets.

International standards and regulatory bodies are increasingly focusing on reducing the carbon footprint of the industry, driving the adoption of advanced cement technologies, such as low-heat cement and hydrophobic cement. The construction boom in urban centers is leading to a in demand for structural components, including concrete slabs, bridge girders, and steel beams. Infrastructure investments in developing markets are also driving growth in the market, with a focus on infrastructure resilience and sustainability. The market for concrete and cement is diverse and complex, with various drivers and restraints shaping its growth. Factors such as operational efficiencies, regulatory standards, and infrastructure investments are key drivers, while threats and opportunities include coal supply and the availability of low-interest loans.

The production of cement involves various stages, from cement manufacturing in batch plants to the grinding of clinker in mills. The use of advanced technologies and sustainable practices is becoming increasingly important in the industry, with a focus on reducing energy consumption and improving product quality. The concrete market is also witnessing the emergence of new applications, such as acoustically improved concrete and concrete raised for insulation purposes. The construction of planned skyscrapers and high-rise buildings is driving demand for rapid-hardening cement and other advanced concrete technologies. In , the market is a dynamic and evolving industry, with various trends and factors shaping its growth.

The use of digital technologies, advanced cement technologies, and sustainable practices are key drivers of innovation and growth in the market. The industry is also facing challenges, such as energy consumption and regulatory compliance, which require continuous improvement and adaptation.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

198 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.6% |

|

Market growth 2025-2029 |

USD 481.6 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.2 |

|

Key countries |

China, US, Japan, India, South Korea, UK, Australia, Canada, Germany, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Concrete And Cement Market Research and Growth Report?

- CAGR of the Concrete And Cement industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the concrete and cement market growth of industry companies

We can help! Our analysts can customize this concrete and cement market research report to meet your requirements.