Construction Scaffolding Rental Market Size 2025-2029

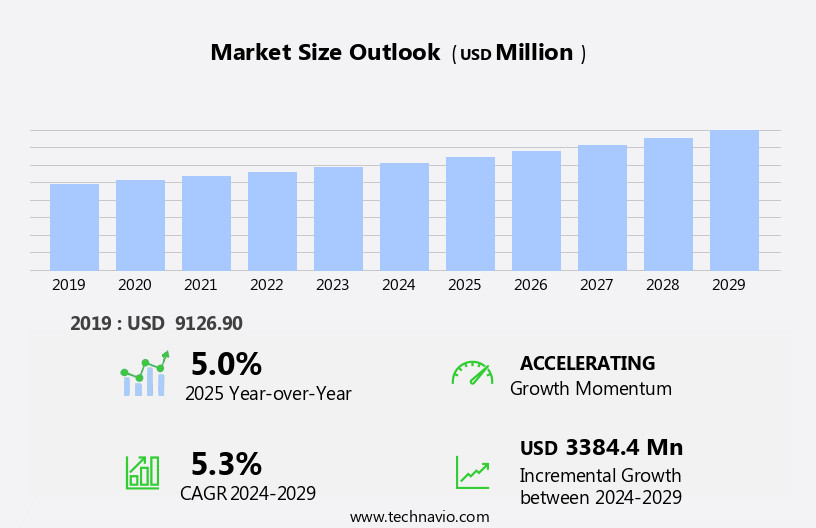

The construction scaffolding rental market size is forecast to increase by USD 3.38 billion at a CAGR of 5.3% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increase in global construction activities. This trend is expected to continue as infrastructure development and real estate sectors remain key priorities for governments and businesses worldwide. The market is also witnessing the incorporation of advanced technologies, such as modular and automated scaffolding systems, which offer increased efficiency, safety, and cost savings. However, the shortage of skilled labor poses a significant challenge to market growth. As the construction industry continues to expand, there is a pressing need for companies to invest in training and development programs to address this issue. Moreover, this trend is driven by the growth of end-user industries such as real estate and infrastructure development.

- Additionally, the adoption of innovative business models, such as rental and leasing, is gaining traction as a cost-effective solution for construction projects. Companies seeking to capitalize on market opportunities and navigate challenges effectively should focus on offering flexible rental solutions, investing in technology, and addressing the labor shortage through training and recruitment initiatives. The construction sector's expansion in these countries is resulting in an increased requirement for extension and platform ladders to ensure safe and efficient workmanship and fall protection.

What will be the Size of the Construction Scaffolding Rental Market during the forecast period?

- The market in the United States is a dynamic and sizeable industry, driven by the continuous need for temporary structures to support building projects. Market activity remains, with key growth factors including the outsourcing of scaffolding services, a focus on sustainability, and the pursuit of productivity enhancements through innovation. Scaffolding rental companies prioritize efficiency in areas such as inventory management, delivery, and assembly, while also addressing safety compliance and repair needs. The industry hosts numerous events and conferences to showcase the latest trends, including automation, fleet management, and cost-effectiveness. Innovation is a significant driver in the market, with advancements in scaffolding design, materials, and technology continually shaping the landscape. Smart Transportation methods, ladder innovation trends, and sustainability practices are shaping the industry.

How is this Construction Scaffolding Rental Industry segmented?

The construction scaffolding rental industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Supported

- Mobile

- Suspended

- Application

- New construction

- Refurbishment

- Demolition

- End-user

- Non-residential

- Residential

- Type

- Frame scaffolding

- Tube and clamp scaffolding

- Others

- Geography

- APAC

- Australia

- China

- India

- Japan

- South Korea

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- Middle East and Africa

- South America

- APAC

By Product Insights

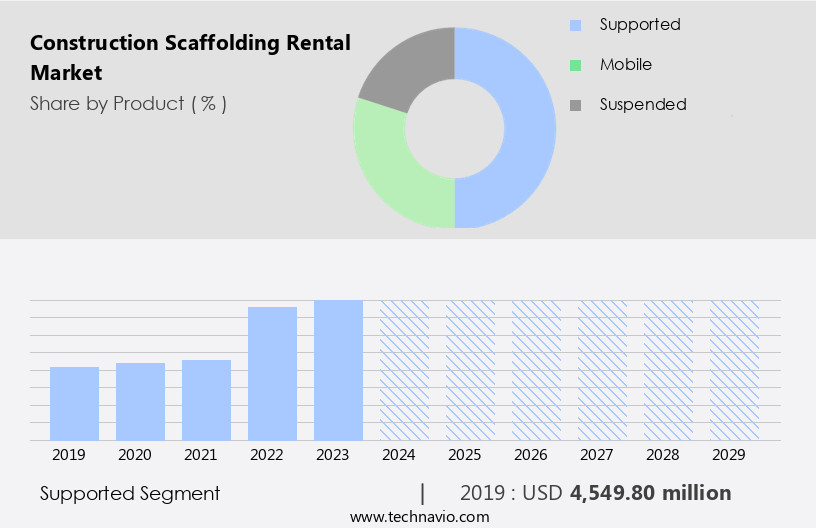

The supported segment is estimated to witness significant growth during the forecast period. The market is marked by the widespread usage of scaffolding safety solutions in various projects, including heavy industrial and infrastructure. Scaffolding plays a crucial role in ensuring safety through risk assessment, accident prevention, and compliance with regulations. Adjustable and mobile scaffolding towers, such as system and steel scaffolding, cater to diverse project requirements. Scaffolding training programs equip workers with the necessary skills for installation, maintenance, and inspection. Safety audits, certification, and software facilitate scaffolding compliance and optimization. Ladder designs continue to innovate with features like handrails, automation, fiberglass, and aluminum materials, catering to diverse applications. Suspended platforms, fall protection systems, and scaffolding components like safety harnesses and fall arrest systems ensure height safety.

Get a glance at the market report of share of various segments Request Free Sample

The Supported segment was valued at USD 4.55 billion in 2019 and showed a gradual increase during the forecast period. The energy industry, aerospace manufacturing, and bridge construction are just a few sectors that heavily rely on scaffolding rental services for their projects. Scaffolding rental companies offer various services, including installation, maintenance, design, and leasing. These companies provide access equipment, such as work platforms, and scaffolding components, like aluminum and steel options. They also offer training programs to ensure that clients' workforces are competent in handling and using the scaffolding safely. The market is continuously evolving, with advancements in technology leading to innovations like automated scaffolding, scaffolding software, and optimization solutions.

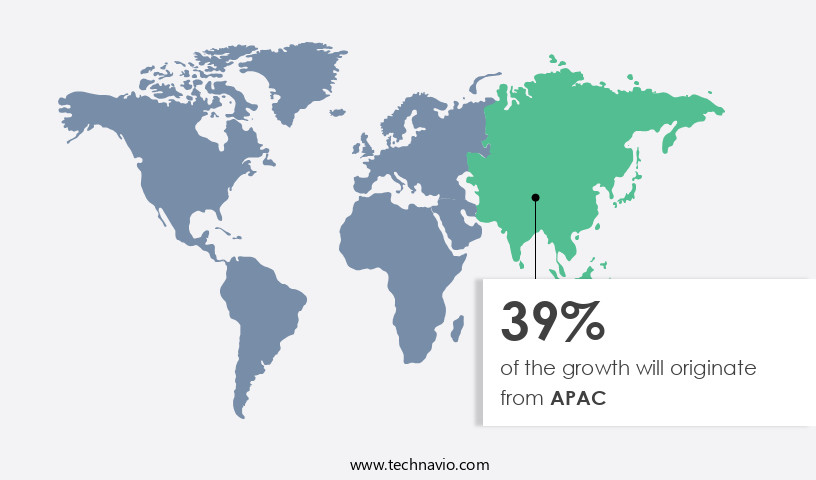

Regional Analysis

APAC is estimated to contribute 39% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market is driven by the increasing demand for scaffolding safety solutions in heavy industrial projects and infrastructure developments. Scaffolding risk assessment and accident prevention are crucial aspects of the industry, leading to a growing focus on scaffolding training programs and certification. Steel scaffolding and system scaffolding are popular choices due to their durability and adaptability to various project requirements. Scaffolding maintenance and inspection are essential for ensuring compliance with safety regulations and industry standards. Leasing services offer flexibility and cost savings for construction contractors, particularly for large-scale projects in the energy industry, industrial maintenance, and power plant construction.

Scaffolding design, adjustable scaffolding, and mobile scaffolding towers cater to the diverse needs of renovation projects, commercial construction, and high-rise construction. Scoffolding designs include platform ladders, rung ladders, step ladders, extension ladders, warehouse ladders, and folding ladders. Fall protection systems, such as safety harnesses and fall arrest systems, are integral to scaffolding safety audits and inspections. Scaffolding software and optimization technologies enhance scaffolding management and planning, enabling automated scaffolding and efficient logistics. Scaffolding components, including aluminum scaffolding and scaffolding accessories, complete the temporary structures for various construction projects.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Construction Scaffolding Rental Industry?

- Rise in global construction activities is the key driver of the market. The market is experiencing substantial growth due to the increasing number of construction activities worldwide. The increase in infrastructure investments, particularly in developing economies, is driving the demand for scaffolding solutions across various industries. Strict safety regulations mandating the use of dependable scaffolding to ensure worker safety and adherence to construction standards further fuel this growth. Moreover, the ongoing urbanization trend and the expansion of residential, commercial, and industrial projects contribute significantly to the escalating demand for scaffolding rentals. The cost-effective nature of renting scaffolding instead of purchasing is an attractive proposition for construction firms aiming to optimize their budgets while maintaining operational flexibility.

- Scaffolding is indispensable in general contracting, power plant construction, aerospace manufacturing, and bridge construction. Modular and automated scaffolding, along with leasing services, offer flexibility and efficiency. The market's growth is fueled by the need for temporary structures in renovation and building restoration projects, as well as in commercial and high-rise construction. Scaffolding technology continues to evolve, providing innovative solutions for industrial maintenance, energy industry, and construction logistics. By prioritizing safety, efficiency, and compliance, scaffolding rental companies offer valuable services to construction projects of all scales.

What are the market trends shaping the Construction Scaffolding Rental Industry?

- Incorporation of advanced technologies is the upcoming market trend. The market has experienced significant technological advancements, revolutionizing the scaffolding rental process. In the construction industry, prompt delivery of scaffolding to project sites is crucial to adhere to project deadlines. To address this need for efficiency, scaffolding rental providers are integrating enterprise resource planning (ERP) software solutions. ERP software streamlines various processes, including inventory management, scaffold location tracking, availability checking, delivery monitoring, and automatic billing. Additionally, it facilitates maintenance and repair tracking, ensuring a well-maintained fleet of scaffolding. These advanced technologies enable rental providers to reduce lead times, simplify payments, and maintain a high level of service quality.

- Rental duration, rental rates, and contract terms are critical considerations for both renters and providers, with the market responding to evolving customer demands and economic conditions. Sustainability and safety remain top priorities, with industry certifications and refurbishment programs playing essential roles in ensuring the highest standards. The scaffolding rental market is poised for continued growth, offering opportunities for both established players and new entrants.

What challenges does the Construction Scaffolding Rental Industry face during its growth?

- Shortage of skilled labor is a key challenge affecting the industry growth. Scaffoldings are essential in the construction industry, serving as a supportive structure for workers to carry out tasks at varying heights. They facilitate the transportation of workers and construction materials to desired locations, ensuring safety from falls. Compliance with proper scaffolding erection regulations, as mandated by various governments, is crucial for creating a secure working environment. However, the construction industry faces a significant challenge with the shortage of skilled labor. The design of scaffolds can vary significantly based on construction sites, necessitating the need for professionals with a relevant degree or experience in scaffold erection, as per OSHA standards.

- The market experiences continuous growth due to the increasing demand for safe and efficient construction methods. The market dynamics are influenced by factors such as the increasing number of large-scale infrastructure projects, the growing emphasis on safety regulations, and the availability of advanced scaffolding technologies. The market caters to a wide array of clients, including general contractors, power plant constructors, and construction companies involved in high-rise, commercial, and industrial projects.

Exclusive Customer Landscape

The construction scaffolding rental market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the construction scaffolding rental market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, construction scaffolding rental market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Altrad Group - The company provides rental solutions for versatile scaffold systems, catering to various industries such as construction and manufacturing.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Altrad Group

- American Scaffolding

- Apollo Scaffold Services Ltd.

- Approved Access Ltd.

- ASA SCAFFOLDING SERVICES Ltd.

- Ashtead Group Plc

- Associates Scaffolding Co. Inc.

- ASW Scaffolding Ltd.

- Atlantic Pacific Equipment LLC

- Brand Industrial Services Inc.

- CALLMAC Scaffolding UK Ltd.

- Coles Groundworks Ltd.

- Condor S.p.A.

- Modern China Scaffolding Manufacturing Ltd.

- Pee Kay Scaffolding and Shuttering Ltd.

- Southwest Scaffolding and Supply Co.

- The Brock Group

- United Rentals Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a diverse range of temporary structures and access solutions utilized in various industries to facilitate infrastructure development and maintenance projects. These structures, which include adjustable, system, suspended, mobile towers, and modular options, serve as essential components in heavy industrial projects, infrastructure developments, and even residential construction. Safety is a paramount concern in the scaffolding rental market, with an emphasis on risk assessment, training programs, and adherence to regulations. Scaffolding safety audits and inspections are integral parts of the rental process, ensuring that all structures meet stringent safety standards. These standards cover various aspects, such as fall protection, height safety, and compliance with industry regulations. Vacant land and undeveloped property present opportunities for investors, while the construction and development of new housing and commercial projects contribute to the market's overall growth.

The Construction Scaffolding Rental Market thrives with dynamic scaffolding rental rates and flexible scaffolding rental duration options. Clear scaffolding rental contracts ensure transparency. Reliable scaffolding delivery and smooth scaffolding pickup enhance client convenience. Efficient scaffolding assembly and swift scaffolding disassembly save time. Services like scaffolding repair and scaffolding refurbishment maintain quality. Advanced scaffolding inventory management and scaffolding fleet management optimize operations. Strategic scaffolding outsourcing boosts productivity. Cutting-edge scaffolding innovation and scaffolding automation elevate industry standards. Focus on scaffolding sustainability aligns with eco-conscious goals. Enhanced scaffolding efficiency, improved scaffolding productivity, and scaffolding cost effectiveness drive market appeal. Ensuring scaffolding safety compliance and achieving scaffolding industry certifications build credibility. Participation in scaffolding industry events and scaffolding conferences keeps stakeholders informed and connected.

These developments aim to streamline the scaffolding rental process, improve safety, and enhance efficiency. In the realm of infrastructure projects, scaffolding plays a crucial role in providing access to hard-to-reach areas, enabling maintenance, renovation, and construction activities. Industrial maintenance, particularly in sectors like power generation and manufacturing, relies on scaffolding for routine inspections, repairs, and upgrades. The scaffolding rental market is a vital contributor to the construction industry, providing essential solutions for various projects while ensuring safety, compliance, and efficiency. With a focus on continuous improvement and innovation, the market is poised to meet the evolving needs of clients in various industries.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

229 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.3% |

|

Market growth 2025-2029 |

USD 3.38 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.0 |

|

Key countries |

US, China, India, Canada, Japan, Germany, UK, South Korea, France, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Construction Scaffolding Rental Market Research and Growth Report?

- CAGR of the Construction Scaffolding Rental industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the construction scaffolding rental market growth of industry companies

We can help! Our analysts can customize this construction scaffolding rental market research report to meet your requirements.