Construction Toys Market Size 2025-2029

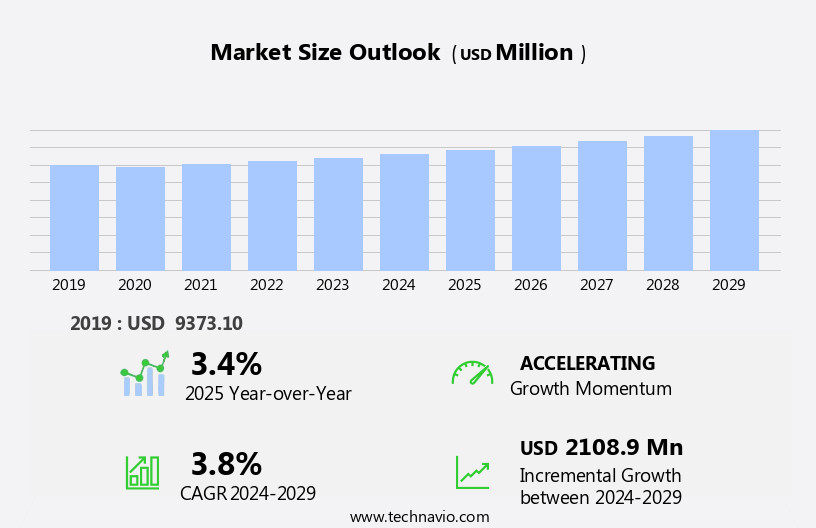

The construction toys market size is forecast to increase by USD 2.11 billion at a CAGR of 3.8% between 2024 and 2029.

- The market is witnessing significant growth due to the increasing focus on children's educational development. Parents are increasingly seeking toys that offer more than just entertainment value, leading to an increase in demand for construction toys that promote creativity, problem-solving skills, and fine motor development. Furthermore, the integration of robotics and digital technology in construction toys is adding a new dimension to the market. E-commerce platforms are making it easier for consumers to access a wide range of construction toys, from plastic building blocks to computer-controlled models. However, the market is also facing challenges such as the presence of counterfeit products and the need for medical device cleaning and safety regulations. As eco-friendly toys gain popularity, manufacturers are responding by introducing more sustainable options made from recycled materials. Overall, the market is poised for continued growth as it caters to the evolving needs of modern parents and children.

What will be the Size of the Construction Toys Market During the Forecast Period?

- The market encompasses a wide range of products designed to stimulate cognitive development and holistic growth in children. These toys, often made of plastic or PVC, foster spatial reasoning and imagination through city-building and mechanical projects. Educational institutions and child psychology experts recognize the value of construction toys in enhancing motor skills, social competence, and problem-solving abilities. Market dynamics reflect a growing emphasis on sustainable toys made from recyclable materials, as regulatory authorities increasingly scrutinize the use of bisphenol A and other potentially harmful substances in children's toys. E-commerce platforms have emerged as popular sales channels, particularly among working-class parents, enabling easy access to a diverse range of construction toys catering to various age groups and interests.

- Product categories span from traditional building blocks to more complex mechanical toys, incorporating principles of levers, gearing, and problem-solving skills. The market's continued growth is driven by the intellectual, physical, and social development benefits these toys provide, making them an essential component of children's play and learning experiences.

How is this Construction Toys Industry segmented and which is the largest segment?

The construction toys industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Type

- Bricks and blocks

- Tinker toys

- Others

- Material

- Polymer

- Wood

- Metal

- Age Group

- School age

- Preschool

- Toddlers

- Teenagers

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- South America

- Middle East and Africa

- APAC

By Distribution Channel Insights

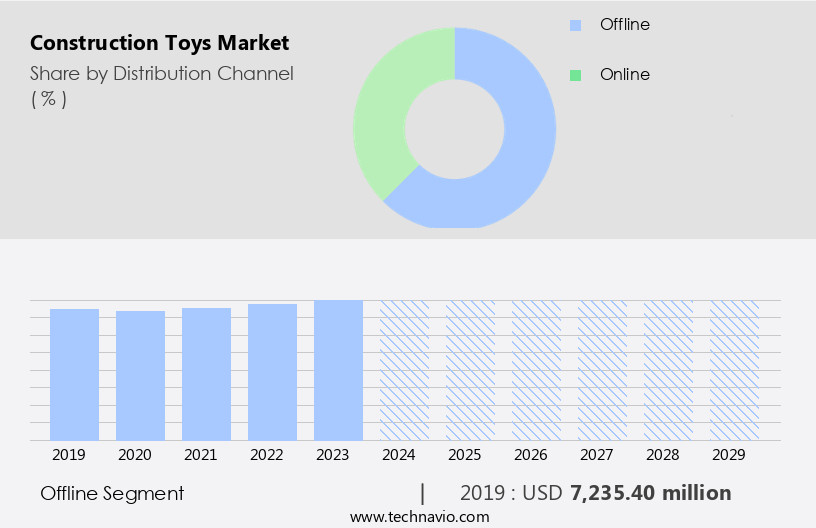

- The offline segment is estimated to witness significant growth during the forecast period. The market encompasses various segments, including cognitive development, spatial reasoning, education systems, holistic development, imagination, plastic toys, PVC, Bisphenol A, regulatory authorities, child psychology, motor skills, social competence, sustainable toys, recyclable materials, and safety. Construction toys are essential for mental and physical development, fostering problem-solving skills, productive skills, and creativity in children. These toys, which include building blocks, bricks, tinker toys, and city-building toys, are available in various materials, such as plastic, water resistance, and eco-friendly raw materials. Market leaders and followers in this industry include established players, toy makers, and e-commerce platforms. Working-class parents and educators prefer these toys for their children due to their educational value, focusing on mechanical principles, such as levers, gearing, and problem-solving skills.

Get a glance at the market report of share of various segments Request Free Sample

The offline segment was valued at USD 7.24 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

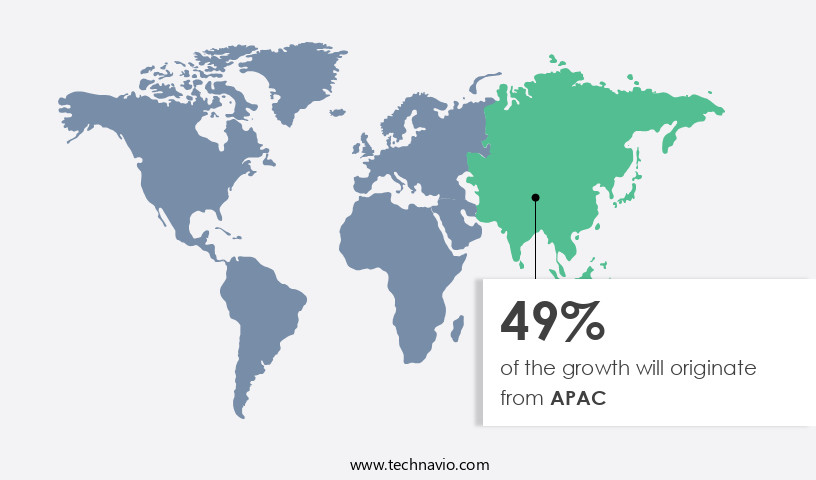

- APAC is estimated to contribute 49% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The market in APAC is projected to lead the global industry due to the increasing demand for premium and branded products. China, Japan, and India are key contributing countries, with China being a significant toy manufacturing hub. Consumers in China are investing in high-quality construction toys as disposable income rises. Cognitive development, spatial reasoning, and educational benefits are significant factors driving the market. Construction toys made from sustainable and recyclable materials are gaining popularity. Holistic development, imagination, and motor skills are essential aspects of these toys. Brands like LEGO, Tinker toys, and others dominate the market. E-commerce platforms cater to working-class parents and both boy's and girl's categories.

For more insights on the market size of various regions, Request Free Sample

Safety concerns and regulatory authorities play a crucial role in the industry. Market leaders include established players focusing on mechanical principles, problem-solving skills, and productive skills. The market is influenced by micro-economic factors, including price and financial position. Sustainable toys made from eco-friendly raw materials are increasingly preferred.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Construction Toys Industry?

- Increased focus of parents on holistic development of children is the key driver of the market. The market is experiencing significant growth due to the increasing emphasis on holistic development among parents. With children increasingly engrossed in digital devices, there is a rising demand for toys that foster physical and mental activities. Construction toys cater to this need by encouraging children to build and create, thereby enhancing their cognitive development, spatial reasoning, and motor skills. These toys also aid in the development of problem-solving skills, productive skills, and social competence. Manufacturers are innovating in this space, introducing a range of construction toys such as building blocks, model vehicle toys, and city-building toys. Sustainable toys made from recyclable materials are gaining popularity among parents and educators, as they align with the growing concern for the environment.

- Regulatory authorities continue to prioritize child safety, ensuring that raw materials used in construction toys are free from harmful substances like Bisphenol A, phthalates, and other toxic plasticizers. Major players in the market are introducing eco-friendly raw materials, such as PVC and adipates, to cater to this demand. The educational value of construction toys, which teach mechanical principles like levers and gearing, makes them an essential component of many education systems. These toys are popular among both boys and girls, and are available on various e-commerce platforms for easy access to working-class parents.

What are the market trends shaping the Construction Toys Industry?

- Introduction of eco-friendly toys is the upcoming market trend. The market experiences significant growth due to the emphasis on cognitive development and holistic development in education systems. Spatial reasoning and problem-solving skills are crucial for intellectual development, making construction toys an essential learning tool. These toys also aid in the development of motor skills, social competence, and creativity. However, concerns regarding the safety and health implications of plastic toys, such as those containing Bisphenol A, phthalates, and other toxic plasticizers, have led parents and educators to seek alternatives. Sustainable toys made from recyclable materials, like PVC-free and biodegradable plastics, have gained popularity. Notable companies, including LEGO and Tinker Toys segment, have responded to this trend by introducing eco-friendly products.

- E-commerce platforms have made it easier for working-class parents to access these toys. The demand for educational, mechanical, and city-building toys is driven by the need to foster mental, physical, and intellectual development. Building blocks and tinker toys continue to be popular choices for both boys and girls. As decision-makers consider price, financial position, and the safety of raw materials, established players in the market face increasing competition from eco-conscious toy makers. Safety concerns have also led to a preference for toys made from eco-friendly raw materials, such as green toys. These toys are free from harmful additives like BPA and phthalates.

What challenges does the Construction Toys Industry face during its growth?

- Presence of counterfeit products is a key challenge affecting the industry growth. Construction toys play a significant role in children's cognitive and physical development. These toys, including building blocks, city-building sets, and tinker toys, enhance spatial reasoning, problem-solving skills, motor skills, and social competence. Education systems recognize their value in holistic development, focusing on imagination, creativity, and intellectual growth. Plastic toys, such as PVC and those containing Bisphenol A, have faced regulatory scrutiny due to health concerns. Child psychology experts recommend sustainable toys made from recyclable materials as safer alternatives. Established players like LEGO dominate the market, offering a wide range of educational, mechanical, and creative toys based on mechanical principles like levers and gearing.

- E-commerce platforms have expanded the reach of construction toys, catering to working-class parents and both boy's and girl's categories. Safety concerns and the increasing demand for eco-friendly raw materials have led to the emergence of green toys made from eco-friendly raw materials. Counterfeit products, often made of low-quality raw materials, pose a challenge to the market. These products can negatively impact the sales and pricing strategies of genuine companies, leading to market fragmentation, lack of price standardization, and uneven competition. Despite the risks, the construction toy market continues to grow, driven by the demand for toys that foster mental, physical, and intellectual development.

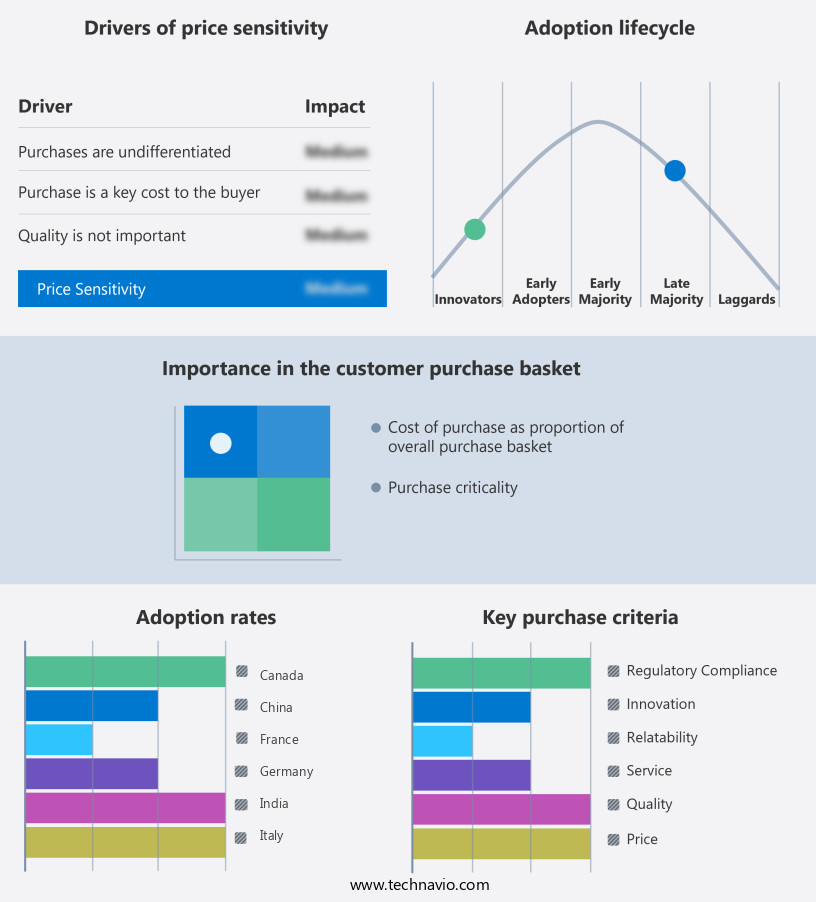

Exclusive Customer Landscape

The construction toys market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the construction toys market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, construction toys market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

All Star Learning Inc. - The company offers construction toys such as Magfarmers carnival set, Hape Quadrilla marble run ârace to the finishâ and Hape Quadrilla âcastle escapeâ. They also offer kid toys for building blocks.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 4M Industrial Development Ltd.

- Bandai Namco Holdings Inc.

- BASIC FUN Inc.

- Elenco Electronics Inc.

- Evertoys

- Gsmserver

- Hasbro Inc.

- Learning Resources Ltd.

- LEGO System AS

- Magformers LLC

- Mattel Inc.

- PlayMonster LLC

- Ravensburger AG

- Simba Dickie Group

- Smartivity Labs Pvt. Ltd.

- Spin Master Corp.

- Takara Tomy Co. Ltd.

- VTech Holdings Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The construction toy market encompasses a wide range of products designed to foster cognitive development and holistic growth in children. These toys, primarily made of plastic materials such as PVC, play a significant role in enhancing spatial reasoning and imagination. Education systems worldwide recognize the value of these toys in promoting mental, physical, and intellectual development. Construction toys cater to various age groups and skill levels, from enhancing motor skills and social competence in younger children to developing problem-solving skills and mechanical principles in older kids. The market segment for tinker toys has gained popularity due to their open-ended nature, allowing children to explore their creativity and build structures based on their imagination.

In addition, the construction toy industry has seen a shift towards sustainable and eco-friendly options, with an increasing focus on recyclable materials and reducing the use of harmful substances like bisphenol A. Regulatory authorities play a crucial role in ensuring the safety of these toys, particularly in regards to the health implications of raw materials and plasticizers such as phthalates and adipates. The market dynamics of the construction toy industry are influenced by several micro-economic factors. Established players in the market, including Lego and Tinker Toys, continue to dominate the sector, while followers capitalize on emerging trends and consumer preferences.

Furthermore, e-commerce platforms have revolutionized the sales process, making construction toys more accessible to working-class parents and educators. Boys and girls alike benefit from construction toys, with the former often favoring boy's categories due to their focus on mechanical principles and problem-solving skills. City-building toys and building blocks are popular choices for both genders, offering opportunities to learn about various structures and architectural designs. Safety remains a top priority in the construction toy market, with manufacturers ensuring their products adhere to stringent safety standards. Parents and educators seek out brands that offer sustainable and eco-friendly raw materials, such as green toys made from eco-friendly raw materials.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

237 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.8% |

|

Market growth 2025-2029 |

USD 2.11 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.4 |

|

Key countries |

US, China, Japan, India, South Korea, Germany, Canada, UK, France, and Italy |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Construction Toys Market Research and Growth Report?

- CAGR of the Construction Toys industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the construction toys market growth of industry companies

We can help! Our analysts can customize this construction toys market research report to meet your requirements.