Cook-In Bag Market Size 2024-2028

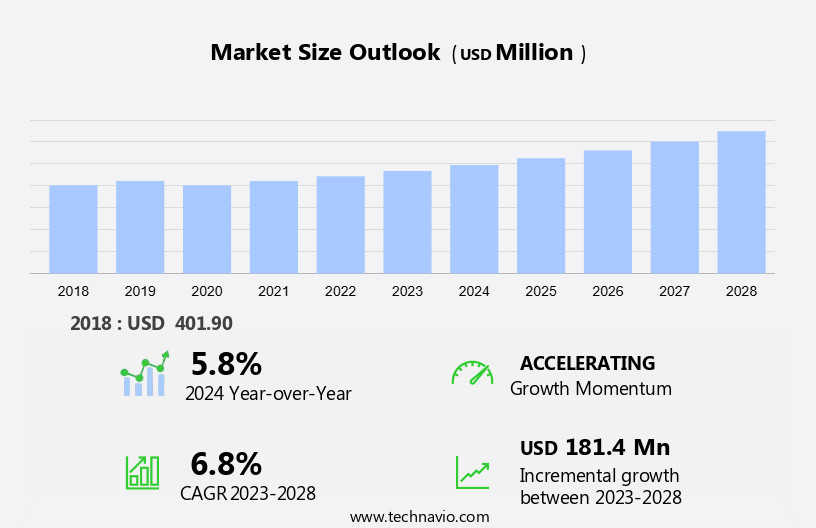

The cook-in bag market size is forecast to increase by USD 181.4 million at a CAGR of 6.8% between 2023 and 2028.

What will be the Size of the Cook-In Bag Market During the Forecast Period?

How is this Cook-In Bag Industry segmented and which is the largest segment?

The cook-in bag industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Material

- Plastic

- Aluminum foil

- Others

- End-user

- Institutional

- Retail

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Spain

- APAC

- China

- India

- Japan

- South Korea

- South America

- Middle East and Africa

- North America

By Material Insights

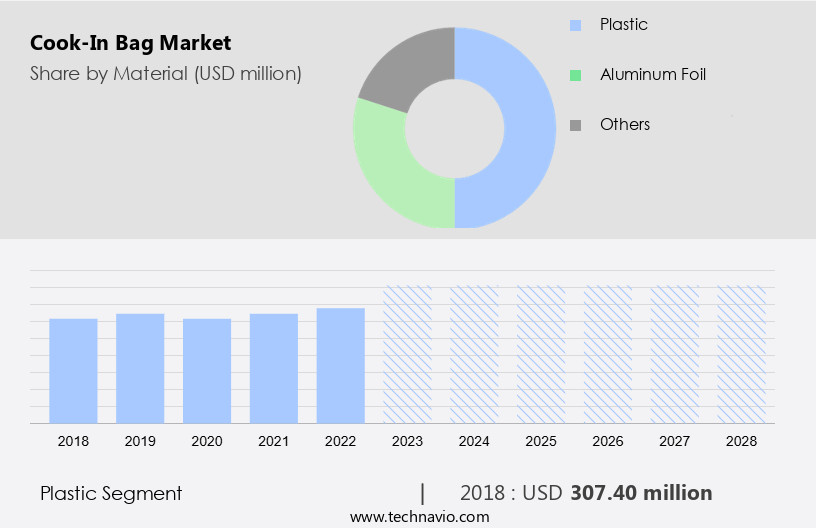

The plastic segment is estimated to witness significant growth during the forecast period. Cook-in bags, a type of packaging solution for frozen foods, have gained popularity due to their convenience and versatility. These bags are made from durable plastics that are lightweight, resistant to chemicals, and non-porous, making them ideal for food handling and safe handling practices. The bags are suitable for various culinary applications, including chicken, rice & cereals, bakery & confectionary, and ready-to-eat-foods. Manufacturers prioritize quality and food safety, ensuring BPA and dioxin-free cook-in bags. BPA, a chemical used in some plastics, can leach into food during heating and pose health risks, such as heart disease and liver problems. Dioxins, toxic substances formed during the manufacturing process of certain plastics, can cause cancer and damage the immune system.

By eliminating these chemicals, cook-in bag manufacturers address consumer safety concerns. Cook-in bags are suitable for various cooking procedures, including baking in traditional ovens, melting in microwaves, and heating in water or on the stove. They maintaIn the food's texture and moisture during cooking, extending the shelf-life and ensuring food consumption solutions remain fresh. The transparent cook-in bags enable consumers to easily monitor food preparation and presentation. Key drivers for the market include the convenience of meal preparation, extended shelf-life, and reduced food waste. Cook-in bags cater to various consumption patterns, including online and offline sales, and are used for a range of food and beverage products.

Cook-in bags are available in various packaging materials, including printed and aluminum foil, to cater to diverse consumer preferences.

Get a glance at the market report of various segments Request Free Sample

The Plastic segment was valued at USD 307.40 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 38% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in North America is currently the largest In the global market, driven by the high consumption of frozen foods and convenience in meal preparation. The market is fragmented with numerous regional and global companies, including COOKINA inc., DuPont de Nemours Inc., and Elkay Plastics Co. Cook-in bags are increasingly popular due to their ability to maintain food texture and quality during frozen food storage and safe handling practices. These bags are suitable for various culinary applications, including chicken, rice & cereals, bakery & confectionary, and ready-to-eat food. Cook-in bags are used in various cooking procedures, such as baking in traditional ovens and heating in microwaves, and are made of heat-resistant materials and durable plastics.

The bags' transparency allows for easy food monitoring during cooking, ensuring even heating and preventing food spoilage. Cook-in bags offer consumption solutions for various food consumption patterns and are widely used for meal preparation purposes. The market's growth is influenced by factors such as the increasing demand for ready-to-eat food and the convenience they offer in food handling. Cook-in bags' shelf-life is extended due to their ability to maintain moisture and prevent foodborne diseases.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Cook-In Bag Industry?

- Growing preference for ready-to-eat meals is the key driver of the market.The market has experienced significant growth due to the increasing demand for convenient consumption solutions In the food industry. With consumers leading busy lifestyles and seeking time-saving meal preparation options, cook-in bags have become a popular choice for ready-to-eat meals, particularly In the frozen food sector. These bags allow for cooking directly In the packaging, eliminating the need for additional dishes and reducing food handling, ensuring safe and hygienic meal preparation. Major suppliers have recognized the importance of preserving the texture, flavor, and shelf-life of food products packed in cook-in bags. Innovative packaging technologies, such as heat-resistant materials, microwave-safe plastics, and transparent bags, have been introduced to maintain food quality during the cooking procedure.

Cook-in bags are suitable for various culinary applications, including chicken, rice & cereals, bakery & confectionary, and frozen food products. They can be used in traditional ovens, ovens, and even microwaves, making them versatile for different cooking purposes. The market growth is driven by factors such as the need to prevent food spoilage, minimize foodborne diseases, and cater to changing food consumption patterns. Cook-in bags are available in various sizes, shapes, and materials, including durable plastics and aluminum foil. These packaging solutions offer a range of benefits, including extended shelf-life, easy-to-use designs, and convenient meal preparation. The market is expected to continue growing as consumers increasingly seek out convenient and safe meal options.

What are the market trends shaping the Cook-In Bag market?

- Clean labeling is the upcoming market trend.The market In the food industry has gained significant traction due to the advancements in packaging technologies. These bags are increasingly being used for frozen food products, including chicken, rice & cereals, and bakery & confectionary, as they preserve texture and maintain food quality during food handling and safe handling practices. Cook-in bags offer convenience for various culinary applications, such as baking, melting, and cooking purposes, in traditional ovens, microwaves, and even oven bags. The use of durable plastics and heat-resistant materials ensures a longer shelf-life for the packaged food. Consumption solutions, such as ready-to-eat-food in cook-in bags, have become popular due to changing food consumption patterns.

Transparent cook-in-bags allow consumers to easily view the food before cooking, adding to the appeal. Key drivers for the market include the convenience they offer in meal preparation and the reduction in food spoilage during storage. The market also caters to various industries, including bakery, meat, and food and beverages. Cook-in bags are available in various forms, such as printed and aluminum foil, to cater to diverse consumer preferences.

What challenges does the Cook-In Bag Industry face during its growth?

- Factors restraining use of plastic in manufacturing cook-in bags is a key challenge affecting the industry growth.The market encompasses packaging solutions for various food categories, including frozen food, rice and cereals, bakery and confectionery, and ready-to-eat food. These bags employ heat-resistant materials, such as durable plastics and aluminum foil, enabling consumers to cook food directly inside the packaging using various methods like ovens, microwaves, and baking. This convenience aligns with evolving food consumption patterns, as more individuals opt for meal preparation simplification. However, market growth faces challenges. While plastic's cost-effectiveness and ease of processing technologies are key drivers, environmental concerns and regulatory restrictions on boiling times pose hurdles. For instance, plastic use raises environmental concerns due to its non-biodegradability, and some governments limit boiling times to ensure food safety and prevent food spoilage.

These factors may hinder market expansion during the forecast period. Despite these challenges, cook-in bags offer several advantages. They maintain food texture and quality through safe handling practices, reducing foodborne diseases risks. Transparent cook-in bags allow consumers to monitor the cooking procedure, ensuring the food's melting and heating progress. Cook-in bags cater to various culinary applications, including chicken, meat, and food and beverages, extending their shelf-life and enhancing convenience.

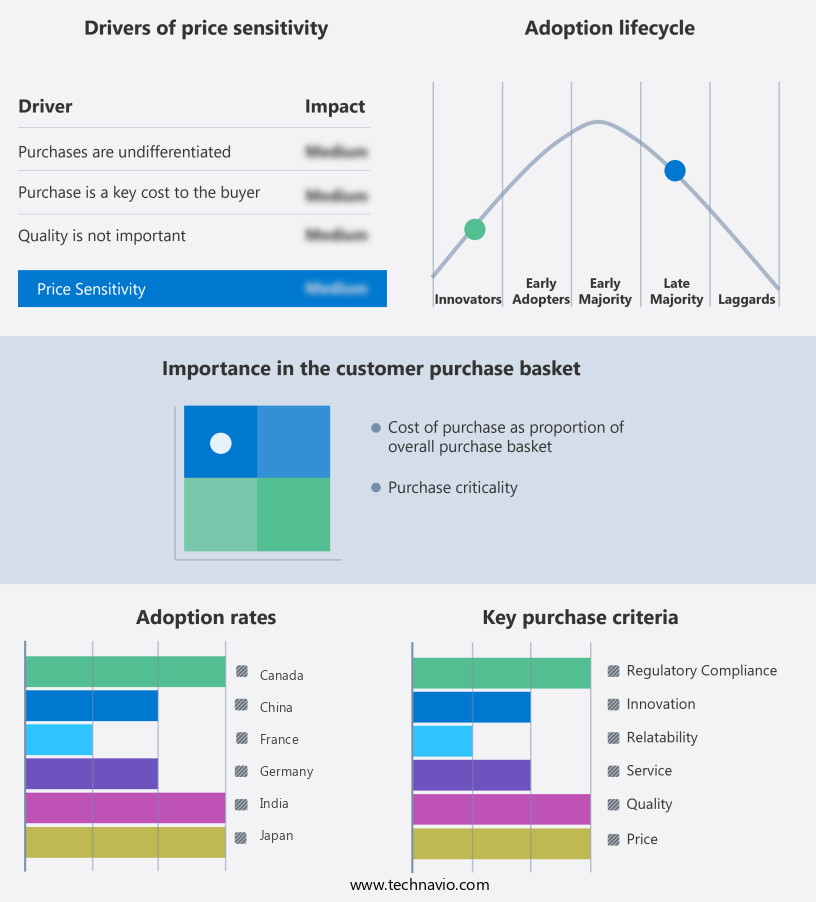

Exclusive Customer Landscape

The cook-in bag market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the cook-in bag market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, cook-in bag market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

COOKINA inc. - The company specializes in cook-in bag solutions, providing a range of products such as GARD Mat, Parchminum Mat, Cuisine Mat, and PAKS Parchminum. These offerings enable consumers to cook and serve meals directly withIn the bags, eliminating the need for additional dishes and reducing cleanup time. The cook-in bags are designed with functionality and convenience in mind, ensuring a hassle-free cooking experience. Each product offers unique benefits, with GARD Mat providing superior heat distribution, Parchminum Mat offering easy-to-clean properties, Cuisine Mat delivering even browning, and PAKS Parchminum offering a combination of convenience and durability.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- COOKINA inc.

- DuPont de Nemours Inc.

- Elkay Plastics Co. Inc.

- Extra Packaging Corp.

- FFP Packaging Ltd.

- Flexipol Packaging Ltd.

- GRANITOL

- Greencore Group Plc

- M and Q Packaging LLC

- Nandos Group

- Packit Gourmet

- Plascon Group

- ProAmpac Holdings Inc.

- S.C. Johnson and Son Inc.

- Schur Flexibles Holding GesmbH

- Sealed Air Corp.

- Sirane Ltd.

- TCL Packaging Ltd.

- UltraSource LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a range of packaging technologies specifically designed for frozen food products. These innovative solutions offer consumers convenient and efficient ways to prepare meals, while maintaining the desired texture and quality of the food. The consumption solutions provided by cook-in bags cater to various food handling needs, ensuring safe and effective heat transfer during the cooking procedure. Frozen food consumption patterns have significantly evolved, with cook-in bags gaining popularity due to their ability to minimize food spoilage and simplify meal preparation. The melting of frozen food withIn these bags is facilitated through various heating methods, including microwaves and traditional ovens.

The use of durable plastics and heat-resistant materials in cook-in bags ensures an extended shelf-life for the contained food items. Cook-in bags have become indispensable for various culinary applications, including chicken, rice & cereals, frozen food products, and bakery & confectionary. Their versatility extends to ready-to-eat-foods, making them a preferred choice for consumers seeking quick and easy meal solutions. Transparent cook-in-bags offer added convenience by allowing users to monitor the cooking progress without having to open the bag. Key drivers of the market include the growing demand for ready-to-cook and ready-to-eat food products, the convenience they offer in food handling, and the enhanced food safety they provide by eliminating the need for cross-contamination during cooking.

The market for cook-in bags is not limited to online sales channels; offline sales through supermarkets and retail outlets also contribute significantly to its growth. Printed cook-in-bags and aluminum foil cook-in-bags are popular alternatives withIn the market, each offering unique advantages. Printed cook-in-bags provide branding opportunities and added information for consumers, while aluminum foil cook-in-bags offer superior heat conductivity and a traditional cooking experience. The food and beverages industry, including meat and bakery products, heavily utilizes cook-in bags due to their ability to maintain product quality and ensure safe handling practices during cooking. In conclusion, the market represents a dynamic and growing sector withIn the food packaging industry.

Its ability to cater to various food handling needs, maintain food quality, and simplify meal preparation makes it an essential component of modern food consumption patterns. The market's continued growth is driven by factors such as convenience, food safety, and the evolving preferences of consumers In the food and beverages industry.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

183 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.8% |

|

Market growth 2024-2028 |

USD 181.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.8 |

|

Key countries |

US, China, Germany, UK, Japan, Canada, India, France, South Korea, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Cook-In Bag Market Research and Growth Report?

- CAGR of the Cook-In Bag industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the cook-in bag market growth of industry companies

We can help! Our analysts can customize this cook-in bag market research report to meet your requirements.