Cryptocurrency Mining Hardware Market Size 2025-2029

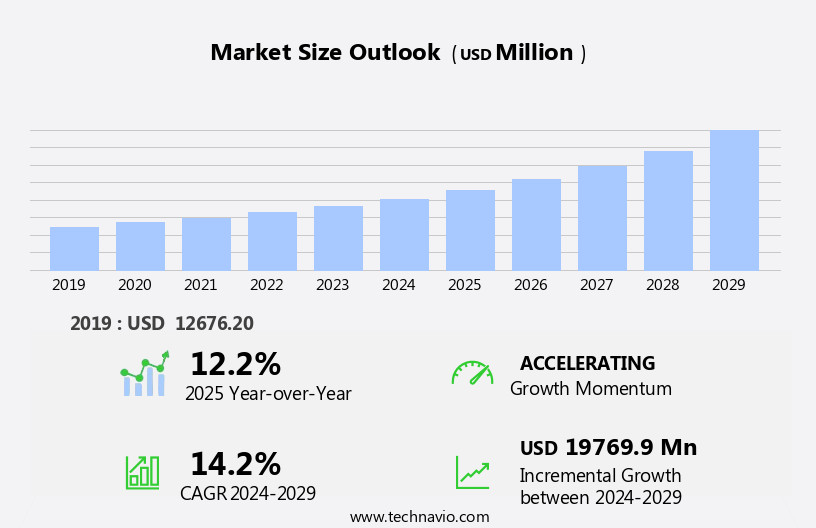

The cryptocurrency mining hardware market size is forecast to increase by USD 19.77 billion, at a CAGR of 14.2% between 2024 and 2029.

- The market is driven by the profitability of cryptocurrency mining ventures and the increasing acceptance of cryptocurrency by retailers. Mining cryptocurrencies, such as Bitcoin and Ethereum, can yield significant financial returns, making it an attractive investment for individuals and businesses. Furthermore, as more retailers embrace digital currencies as a form of payment, the demand for cryptocurrency mining hardware is expected to grow. The increasing adoption of crypto wallets, driven by factors like blockchain technology, peer-to-peer networks, and digital payments, has led to a growing demand for advanced mining hardware. However, the market faces challenges, including the volatility in the value of cryptocurrencies. Sudden price fluctuations can impact the profitability of mining operations and introduce financial risk.

- As such, companies must closely monitor market trends and adapt their strategies accordingly to mitigate risk and capitalize on opportunities. To succeed in this dynamic market, businesses must remain agile and responsive, focusing on innovation and operational efficiency to stay ahead of the competition.

What will be the Size of the Cryptocurrency Mining Hardware Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market dynamics shaping its applications across various sectors. Mining software developers are consistently releasing updates to optimize performance and improve efficiency. Ethereum mining, a significant segment of the market, requires continuous adjustments due to the complexity of its proof-of-work algorithm and the need for difficulty adjustment to maintain network security. Legal compliance and mining regulations are increasingly influencing market activities. Mining farms, large-scale mining operations, are investing in infrastructure to enhance hash rate and power efficiency. Fan speed, power supply, and thermal management are crucial considerations for mining rig maintenance and cooling systems.

Mining hardware manufacturers, including GPU and ASIC producers, are focusing on energy efficiency and noise reduction to address environmental concerns and minimize disruptions. FPGA manufacturers are also gaining traction due to their flexibility and adaptability. Mining profitability, a critical factor in market decisions, is influenced by mining pool fees, block rewards, and power consumption. Mining risk management and network security are essential for mining firms and pool operators to mitigate potential losses and ensure data security. Cloud mining providers offer an alternative to traditional mining rig setup, allowing investors to participate in the market without the need for physical hardware.

However, they come with their own set of challenges, including mining fees and contract terms. The ongoing unfolding of market activities underscores the importance of staying informed about the latest trends and developments in the market.

How is this Cryptocurrency Mining Hardware Industry segmented?

The cryptocurrency mining hardware industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- ASIC

- GPU

- Others

- Application

- Bitcoin mining

- Ethereum mining

- Others

- End-user

- Personal

- Enterprise

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- The Netherlands

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

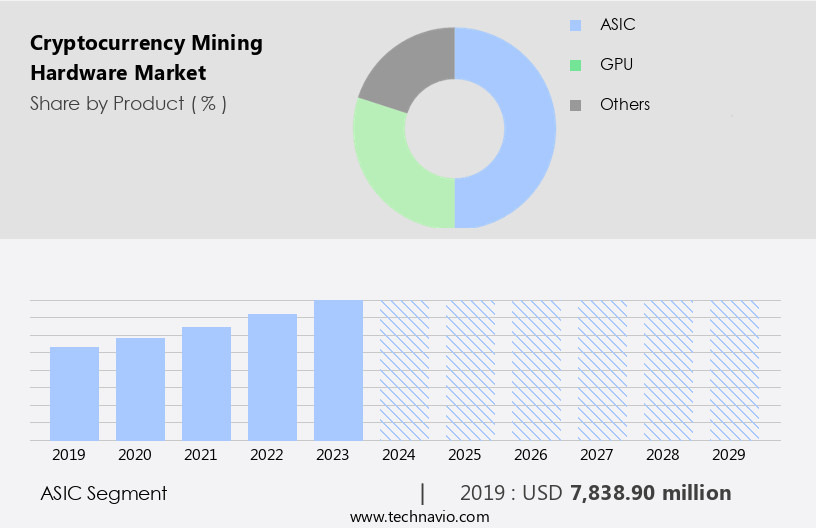

By Product Insights

The asic segment is estimated to witness significant growth during the forecast period.

Cryptocurrency mining involves specialized hardware to process and record transactions efficiently. Application-specific integrated circuit (ASIC) hardware, designed for specific algorithms, offers faster mining processes for cryptocurrencies like Bitcoin. ASIC solutions, manufactured predominantly in China by companies such as Bitmain, process hashes much faster than high-end general-purpose processors or customized GPU miners. However, their customization limits their use to specific cryptocurrencies. Mining software updates, rig setup, and tax implications are crucial considerations for miners. Mining pool stability, security, and regulatory compliance are essential for mining pools and farms. Mining profitability calculators help determine feasibility, while fees, noise levels, carbon footprint, and hardware lifespan are significant factors.

Thermal management, mining investment, and risk management are vital aspects of mining rig maintenance. Mining pool operators ensure network security, while cooling systems and data security maintain mining farm infrastructure. ASIC chip manufacturers like Bitmain, ASIC miners, FPGA manufacturers, power supply, and energy efficiency are essential components of the mining ecosystem. Ethereum mining, altcoin mining, and cloud mining are alternative mining options. Mining contracts, mining firmware, and mining regulations are shaping the mining landscape. Despite the environmental impact and proof-of-work (PoW) concerns, the market continues to evolve, with mining rigs, hardware upgrades, and mining farm management remaining key areas of focus.

The ASIC segment was valued at USD 7.84 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 40% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth, primarily driven by the US, Canada, and Mexico. The early adoption of blockchain technology and cryptocurrency in these countries has resulted in a thriving ecosystem for cryptocurrency mining. Mining operations range from large-scale ventures to individual hobbyists, all requiring advanced mining hardware. GPU-based mining hardware solutions are particularly popular due to their widespread availability and relatively lower power consumption compared to ASIC miners. Mining software updates are crucial for maintaining the efficiency and profitability of mining rigs, while mining rig setup and maintenance require careful consideration of factors such as thermal management, noise levels, and energy consumption.

Tax implications, mining pool stability, and mining security are essential concerns for mining operators. Mining hardware manufacturers, including ASIC chip manufacturers and FPGA manufacturers, continuously innovate to improve mining hardware efficiency and profitability. Mining profitability calculators help miners assess the feasibility of new mining projects, taking into account mining pool fees, mining fees, and block rewards. Environmental impact, proof-of-work (PoW), and legal compliance are increasingly important considerations for the cryptocurrency mining industry. Cloud mining providers offer a flexible alternative to traditional mining rigs, while mining farm infrastructure, including cooling systems and mining pool operators, play a crucial role in ensuring the smooth operation of large-scale mining operations.

Mining risk management is a growing concern for investors, with mining firms implementing robust security measures to protect against network attacks and data breaches. Mining hardware retailers offer a range of mining rigs and hardware upgrades, while mining firmware and mining software developers optimize their offerings for various cryptocurrencies, including Ethereum and Bitcoin. Altcoin mining and mining contracts also contribute to the market's dynamics, with miners seeking to maximize their returns through careful management of mining rigs and mining farm infrastructure. The cryptocurrency mining landscape is constantly evolving, with new challenges and opportunities emerging as the technology continues to mature.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Cryptocurrency Mining Hardware Industry?

- The profitability of cryptocurrency mining ventures serves as the primary catalyst for market growth and momentum.

- The market is driven by the profitability of mining ventures between 2025 and 2029. Miners earn rewards in cryptocurrency for every successful transaction based on their computational power contribution. While small-scale operations face challenges due to high energy costs and competition, large-scale mining ventures benefit from advanced hardware and economies of scale. For instance, in January 2025, Bitmain Technologies Ltd. Launched the Antminer S21 series, offering improved energy efficiency and hash rates. Canaan Creative's AvalonMiner A1366, introduced in November 2023, provides a balance of performance and energy efficiency, catering to both enterprise and individual miners.

- Mining profitability is a crucial factor as miners must cover the costs of mining hardware, electricity, and mining pool fees. Mining pools enable miners to pool their resources and share rewards, increasing their chances of earning cryptocurrency. Thermal management is essential for mining rig maintenance, ensuring optimal performance and longevity. Network security is another concern, as mining rigs are vulnerable to hacking and malware attacks. Mining fees, which are paid to process transactions on the blockchain, also impact profitability. Power consumption and energy consumption are significant environmental concerns in cryptocurrency mining. ASIC chip manufacturers, such as Bitmain and Canaan Creative, are addressing these concerns by developing more energy-efficient chips.

- GPU manufacturers, like Nvidia and AMD, also cater to the mining market with high-performance graphics cards. Mining risk management is crucial, as market volatility and regulatory changes can impact profitability. Overall, the market is dynamic, with constant innovation and competition driving advancements in mining technology.

What are the market trends shaping the Cryptocurrency Mining Hardware Industry?

- The acceptance of cryptocurrencies as a form of payment by retailers is an emerging market trend. This growing trend signifies a shift towards digital currencies as a legitimate and viable means of transaction.

- The market has experienced notable growth due to the increasing acceptance of digital currencies like Bitcoin and Ethereum by retailers. This trend is driven by the benefits of faster transactions and lower fees compared to traditional payment methods. For instance, a major e-commerce platform in the US announced the acceptance of Bitcoin as a payment option in January 2025, partnering with a third-party exchange for cryptocurrency-to-cash conversions. Mining software developers continue to optimize their software for Ethereum mining, focusing on difficulty adjustment and legal compliance to ensure mining regulations are met. Mining farms are investing in infrastructure, including high-performance GPUs, ASIC miners, and FPGA manufacturers, to improve hash rate and power efficiency.

- Factors such as fan speed and power supply are crucial considerations for mining farm operations. The market dynamics are expected to remain favorable as more businesses adopt cryptocurrencies, leading to increased demand for advanced mining hardware.

What challenges does the Cryptocurrency Mining Hardware Industry face during its growth?

- The volatility in the value of cryptocurrencies poses a significant challenge to the growth of the industry, as price fluctuations can negatively impact investor confidence and hinder the adoption of digital currencies as a stable and reliable form of payment or store of value.

- The market faces challenges from the volatile nature of cryptocurrency prices between 2025 and 2029. The unpredictability of Bitcoin and Ethereum values, for instance, impacts mining operations' profitability. In January 2025, Bitcoin experienced a 15% price drop within a week, demonstrating the market's volatility. This uncertainty discourages low-risk investors from entering, limiting demand for mining hardware. Moreover, the concentration of cryptocurrency holdings among a few large investors, or "whales," intensifies price swings. These entities can manipulate values through large-scale trades, as evidenced by the 10% price drop triggered by a single Bitcoin whale selling USD100 million in BTC in 2024.

- Mining hardware upgrades, mining firmware, and mining software are essential components of the market. Mining rigs, cooling systems, and heat dissipation are crucial for energy efficiency. Mining farm management, mining pool operators, and data security are other significant factors. Cloud mining offers an alternative to traditional mining, allowing users to rent mining power from remote data centers. Despite these developments, the market's growth remains uncertain due to the volatility of cryptocurrency prices.

Exclusive Customer Landscape

The cryptocurrency mining hardware market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the cryptocurrency mining hardware market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, cryptocurrency mining hardware market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Argo Blockchain Plc - This company specializes in producing application-specific integrated circuits (ASICs) designed for the energy-intensive process of bitcoin mining.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Argo Blockchain Plc

- BIT Digital Inc.

- Bitfarms Ltd.

- BitMain Group

- Canaan Inc.

- Ebang International Holdings Inc.

- Elite Mining Inc.

- ePIC Blockchain Technologies Inc.

- Genesis Mining Ltd.

- GMO Internet Group Inc

- Helium Systems Inc.

- HIVE Blockchain Technologies Ltd.

- Hut 8 Corp.

- INNOSILICON Technology Ltd.

- Intelion Mine LLC

- Marathon Digital Holdings Inc.

- NiceHash Ltd.

- Riot Blockchain Inc.

- Shenzhen Jingang Zhuoyue Co. Ltd

- Shenzhen MicroBT Electronics Technology Co. Ltd

- Spacemesh

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Cryptocurrency Mining Hardware Market

- In January 2024, Bitmain, a leading cryptocurrency mining hardware manufacturer, unveiled its latest innovation, the Antminer S19 Pro, boasting a hash rate of 110 terahashes per second (TH/s), making it the most powerful Bitcoin miner at the time (Bitmain press release).

- In March 2024, NVIDIA, a leading graphics processing unit (GPU) manufacturer, announced a strategic partnership with Bitmain to optimize its GPUs for cryptocurrency mining, enhancing their efficiency and profitability for miners (NVIDIA press release).

- In May 2024, MicroBT, another significant cryptocurrency mining hardware provider, raised USD50 million in a Series B funding round led by IDG Capital and Sequoia China, further strengthening its position in the competitive market (Crunchbase).

- In April 2025, the European Union passed the Markets in Crypto-Assets (MiCA) regulation, which aims to provide a regulatory framework for cryptocurrencies and related services, including cryptocurrency mining, potentially attracting more investments and legitimizing the industry in Europe (European Parliament).

Research Analyst Overview

- The cryptocurrency mining market is characterized by the constant evolution of mining hardware and software. Mining profitability is a significant factor driving market dynamics, with Ethereum and Bitcoin being the most popular cryptocurrencies for mining. Cloud mining providers offer an alternative to setting up mining rigs, but they come with their own risks, including mining pool stability and legal compliance. Mining regulations are increasingly becoming a concern for mining operators, with some countries implementing strict energy efficiency regulations. Mining risk management is crucial, as power supply and cooling systems are essential components of mining farm infrastructure.

- Mining rig maintenance, fan speed, and noise levels are critical factors affecting mining profitability. Mining pool fees, mining pool operators, and mining software updates are essential for optimizing mining performance. Energy consumption and carbon footprint are significant concerns, with mining farms investing in power efficiency and heat dissipation technologies. Mining hardware retailers offer a range of mining rigs and power supplies, while mining software developers continuously update mining software to improve mining profitability calculators and network security. Mining farm management involves optimizing hash rate, power consumption, and hardware lifespan, while mining rig setup requires careful consideration of mining pool fees, mining fees, and hardware upgrades.

- Mining pool stability and network security are crucial for maintaining mining operations, with mining rig maintenance a constant requirement to ensure mining profitability.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Cryptocurrency Mining Hardware Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

214 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14.2% |

|

Market growth 2025-2029 |

USD 19769.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

12.2 |

|

Key countries |

US, China, Germany, Canada, UK, Japan, Brazil, India, France, and The Netherlands |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Cryptocurrency Mining Hardware Market Research and Growth Report?

- CAGR of the Cryptocurrency Mining Hardware industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the cryptocurrency mining hardware market growth of industry companies

We can help! Our analysts can customize this cryptocurrency mining hardware market research report to meet your requirements.