Crypto Wallet Market Size 2025-2029

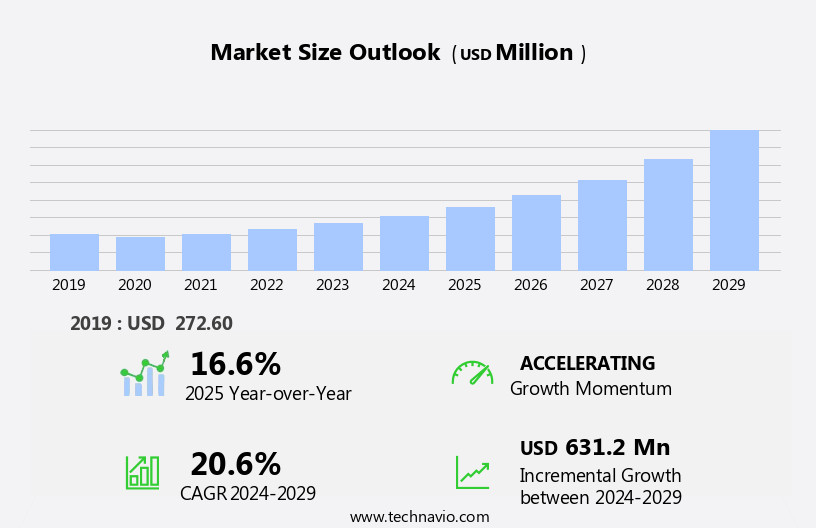

The crypto wallet market size is forecast to increase by USD 631.2 million, at a CAGR of 20.6% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing popularity of digital currencies and the expanding availability of crypto wallets. The inclination towards digital currencies, offering benefits such as decentralization, anonymity, and faster transactions, is fueling market expansion. However, challenges persist, with misuse and security attacks posing significant obstacles to widespread adoption. As the crypto market continues to evolve, it presents both opportunities and risks for businesses. Companies seeking to capitalize on this market can focus on enhancing security measures, ensuring user-friendly interfaces, and expanding their offerings to cater to diverse user needs. Navigating the challenges requires continuous innovation and a commitment to addressing security concerns, ensuring trust and confidence among users.

- In summary, the market is characterized by robust growth, driven by the shift towards digital currencies, while grappling with challenges related to security and misuse. Companies must seize opportunities to provide secure, user-friendly solutions to capitalize on this dynamic market.

What will be the Size of the Crypto Wallet Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with various types of wallets catering to diverse user needs. Hardware wallets provide offline storage for private keys, enhancing security. Non-fungible tokens (NFTs) integration enables users to store and manage unique digital assets. Multi-currency wallets support various cryptocurrencies, while decentralized applications (dApps) integration offers seamless access to decentralized finance (DeFi) services. Transaction history and asset management are essential features for effective portfolio tracking. Wallet providers offer biometric authentication for enhanced security, while open-source wallets ensure transparency and community-driven development. Development kits (SDKs) enable customizable wallet solutions, catering to specific business requirements. Regulatory compliance is crucial, with Anti-Money Laundering (AML) and Know Your Customer (KYC) integrations becoming standard.

Network fees, transaction fees, and gas fees are ongoing considerations for users, necessitating efficient wallet management. Security audits, import/export functions, and backup and restore capabilities are essential for maintaining wallet security. Cross-chain compatibility, seed phrases, staking rewards, and smart contract integrations are emerging trends, offering users more flexibility and opportunities. User experience (UX) and privacy coins prioritize user privacy and convenience. Payment gateways, merchant services, and wallet integrations facilitate seamless transactions. Key management and wallet recovery solutions ensure users maintain control over their assets. Threshold signatures and multi-signature wallets offer enhanced security through collective approval mechanisms. Blockchain integration, cryptocurrency exchange integration, and API integrations streamline user experience.

The market's continuous dynamism underscores the importance of staying informed and adaptable to evolving trends and user needs.

How is this Crypto Wallet Industry segmented?

The crypto wallet industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Software-based

- Hardware-based

- OS

- Android

- iOS

- Others

- Application

- Trading

- Peer-to-peer payments

- Remittance

- Others

- End-user

- Individual

- Commercial

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- The Netherlands

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Product Insights

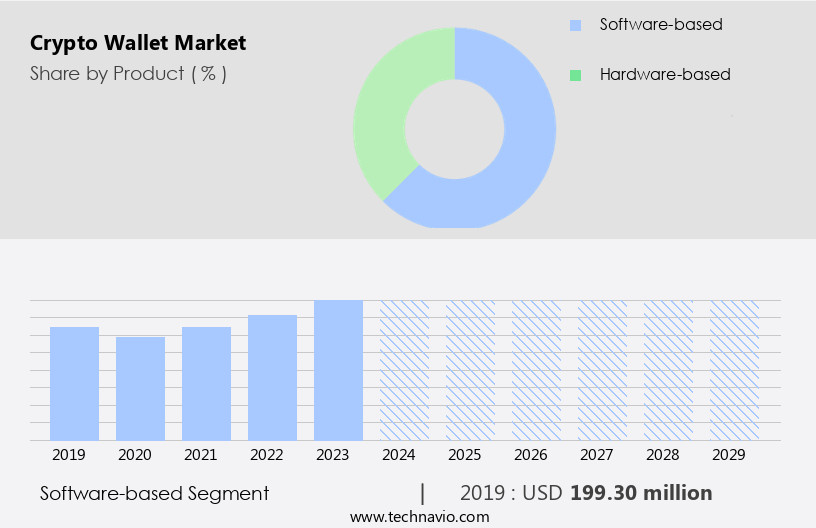

The software-based segment is estimated to witness significant growth during the forecast period.

Crypto wallets serve as essential digital vaults for managing various cryptocurrencies and non-fungible tokens (NFTs). These wallets offer users the ability to purchase, swap, lend, and earn digital assets, contributing to the growing recognition of cryptocurrencies as a liquid and broadly held asset class. Software-based wallets, including desktop applications and browser extensions, facilitate transactions online, making them known as hot wallets. Multi-currency wallets support multiple cryptocurrencies and tokens, while decentralized applications (dApps) enable users to access various DeFi services. Wallet providers offer additional features like transaction history, biometric authentication, and user interfaces tailored to individual preferences. Asset management tools help users track their portfolio, while development kits and APIs enable customization and integration with various platforms.

Wallets also prioritize security through measures like multi-signature authentication, cold storage, and seed phrases. Regulatory compliance is ensured through anti-money laundering (AML) measures and security audits. Wallets can be integrated with exchanges, payment gateways, and merchant services, providing seamless transaction experiences. Additionally, wallets support various blockchain networks, enabling cross-chain compatibility. Users can backup and restore their wallets, ensuring data security. Wallets also offer features like transaction fees, gas fees, and staking rewards, providing users with more control over their digital assets.

The Software-based segment was valued at USD 199.30 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

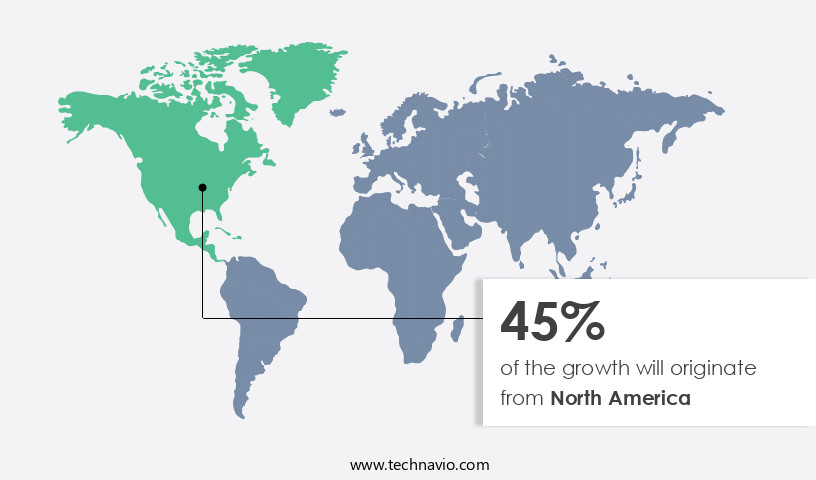

North America is estimated to contribute 45% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the dynamic the market, North America leads with a significant share due to the presence of numerous innovative companies and the increasing acceptance of digital currencies in the region. The US, as a developed nation, is at the forefront of this technological advancement, with a growing user base reaching 66 million people in 2024, up from 15% in 2021. This region's dominance can be attributed to the rising demand for multi-currency wallets, hardware wallets, desktop wallets, and mobile wallets that cater to various user needs. Decentralized applications (dapps) and decentralized finance (defi) are also gaining traction, driving the market's growth.

Wallet providers offer features such as transaction history, biometric authentication, user interface (ui), asset management, and security audits to enhance the user experience (ux). Cross-chain compatibility, seed phrases, and staking rewards are essential elements that cater to the evolving market trends. The integration of smart contracts, threshold signatures, and api integrations further strengthens the functionality of these wallets. Additionally, regulatory compliance through anti-money laundering (aml) measures and privacy coins adds another layer of security. The market also includes proprietary wallets, wallet recovery, backup and restore, and cryptocurrency trading, with wallet security and network fees being crucial factors. The emergence of layer-2 scaling solutions, customizable wallets, and merchant services further broadens the market's scope.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic and evolving digital economy, the market occupies a pivotal role, enabling users to securely store, manage, and transact with various cryptocurrencies. This marketplace caters to diverse needs, offering solutions like hot wallets for frequent transactions and cold wallets for long-term storage. Blockchain technology underpins these wallets, ensuring secure and decentralized transactions. Users can easily buy, sell, and exchange cryptocurrencies within their wallets, leveraging features like multi-currency support and real-time market data. Security is paramount, with features like two-factor authentication, biometric login, and private keys to protect assets. The market continues to evolve, integrating with various platforms and offering advanced features like staking and yield farming, making digital asset management more accessible and convenient.

What are the key market drivers leading to the rise in the adoption of Crypto Wallet Industry?

- The significant inclination of people towards digital currencies serves as the primary driver for the dynamic market growth in this sector.

- Crypto wallets have gained significant traction in the digital currency market, providing users with secure methods to store, manage, and transact various cryptocurrencies. Two popular wallet types include cold storage wallets and non-custodial wallets, which prioritize security by allowing users to maintain full control over their private keys. Zero-knowledge proofs add an extra layer of privacy, ensuring wallet addresses remain anonymous. Privacy coins and staking rewards are additional features attracting users to crypto wallets. Integrations with payment gateways and merchant services enable seamless transactions, while key management solutions ensure easy access to funds. Cross-chain compatibility is another essential factor, allowing users to manage multiple digital currencies from a single wallet.

- Seed phrases serve as a backup for wallet access, while user experience (UX) remains a top priority for wallet developers. Wallets offer web-based solutions for convenience and mobile applications for on-the-go access. Staking rewards incentivize users to hold their cryptocurrencies in their wallets, contributing to the network's security and decentralization. In summary, crypto wallets cater to the growing demand for secure, private, and user-friendly solutions for managing digital currencies. With features such as cold storage, zero-knowledge proofs, cross-chain compatibility, and staking rewards, wallets are an essential tool for investors, traders, and businesses in the digital currency ecosystem.

What are the market trends shaping the Crypto Wallet Industry?

- The growing prevalence of cryptocurrency wallets represents a significant market trend. This increasing accessibility allows for greater convenience and adoption of digital currencies.

- Crypto wallets have emerged as a popular choice for individuals seeking to invest in digital currencies. These wallets enable users to manage their cryptocurrencies with ease, facilitating transactions through blockchain technology for enhanced security. Crypto wallets come in various forms, including physical media, gadgets, software, or facilities, where private and public keys for cryptocurrency transactions are stored. The finest crypto wallets offer several benefits, making them an attractive option for investors. They provide simplicity and ease of use, allowing users to manage their digital assets with minimal effort. Moreover, they offer long-term investment opportunities, enabling users to hold their cryptocurrencies securely.

- Additionally, crypto wallets ensure account and transaction confidentiality, providing investors with peace of mind. Crypto wallets also offer portfolio management capabilities, enabling users to keep track of their holdings across multiple currencies. Furthermore, they provide access to various cryptocurrency exchanges for trading purposes, along with risk management features and integration with layer-2 scaling solutions. Threshold signatures, smart contracts, API integrations, and wallet recovery, backup, and restore options further enhance the functionality of these wallets. In summary, crypto wallets offer a secure and convenient way for investors to manage their digital currencies, providing them with the flexibility and freedom to buy, sell, and hold their investments with ease.

- With features such as account confidentiality, portfolio management, and access to various exchanges, crypto wallets have become an essential tool for those looking to invest in the cryptocurrency market.

What challenges does the Crypto Wallet Industry face during its growth?

- The adoption of cryptocurrencies is hindered by the prevalence of misuse and security attacks, posing a significant challenge to the industry's growth.

- Digital currencies, such as cryptocurrencies, have gained significant attention due to their decentralized and unregulated nature. However, this lack of regulation and control poses concerns for businesses and governments, as digital currencies are increasingly used for illicit activities. Criminals utilize digital currencies for tax evasion, money laundering, and terrorism financing due to their pseudonymous and untraceable transfers. Furthermore, the absence of financial intermediaries like banks and the lack of anti-money laundering reporting and compliance rules make digital currencies an attractive option for these illicit transactions. Additionally, the increasing number of cyberattacks and security issues have led to significant losses for investors, further limiting the adoption of digital currencies.

- While digital currencies offer potential benefits, such as faster and cheaper transactions, the risks associated with their use cannot be ignored. It is crucial for businesses and governments to address these concerns and establish regulations and security measures to mitigate the risks associated with digital currencies. Two-factor authentication and other security measures can help protect digital wallets and prevent unauthorized access. By taking a proactive approach, businesses and governments can ensure the safe and ethical use of digital currencies.

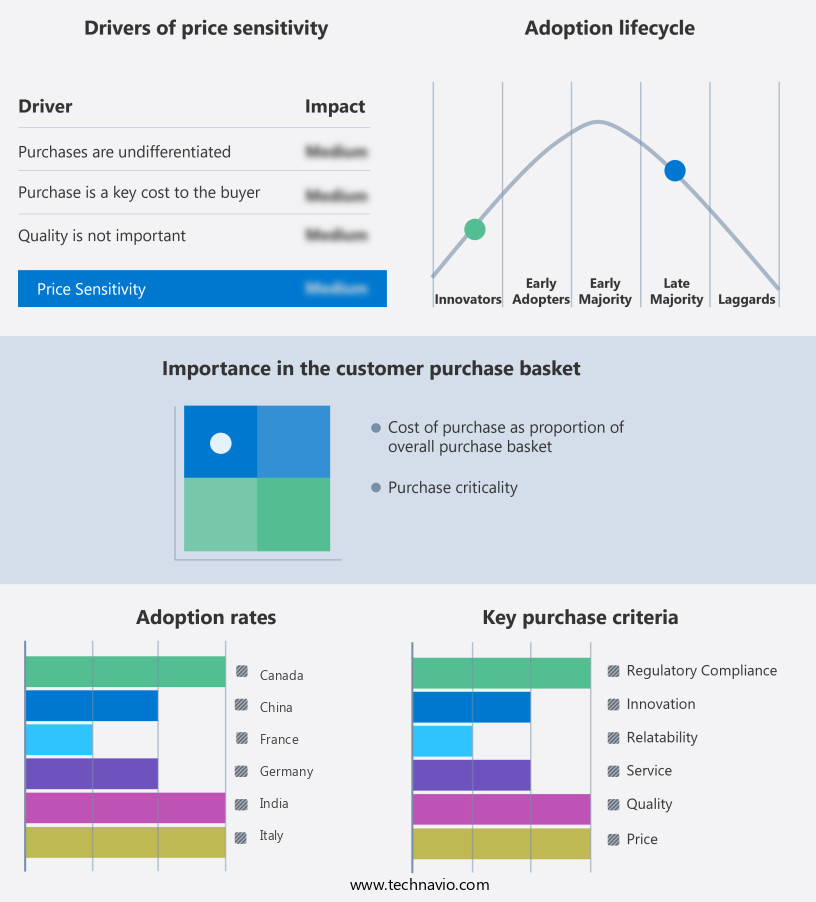

Exclusive Customer Landscape

The crypto wallet market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the crypto wallet market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, crypto wallet market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ARCHOS SA - This company specializes in providing secure crypto wallet solutions, including the Archos Safe T mini and SafeT touch models. Our offerings prioritize user experience and advanced security features, enhancing digital asset management for individuals and businesses. By utilizing state-of-the-art encryption and multi-factor authentication, we ensure the protection of valuable digital assets. Our commitment to innovation and customer satisfaction sets us apart in the ever-evolving crypto market.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ARCHOS SA

- Binance Holdings Ltd.

- BitGo Inc.

- BitLox Ltd.

- BitPay Inc.

- Bittrex Global GmbH

- Breadwinner AG

- Coinkite Inc.

- CoolBitX Ltd.

- ELLIPAL Ltd.

- Exodus Movement Inc.

- Gemini Trust Co. LLC

- iFinex Inc.

- Ledger SAS

- OPOLO SARL

- SecuX Technology Inc.

- ShapeShift AG

- Shift Crypto AG

- Sofitto NV

- Trezor Co. sro

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Crypto Wallet Market

- In January 2024, leading crypto wallet provider, Blockchain Inc., announced the launch of their new decentralized finance (DeFi) wallet, Exodus Dapp, at the Consensus: Austin conference (Blockchain.Com, 2024). This wallet supports over 150 cryptocurrencies and integrates with popular DeFi platforms, marking a significant expansion of Blockchain Inc.'s product offerings.

- In March 2024, global technology giant, Microsoft, announced a strategic partnership with MetaMask, a popular crypto wallet and browser extension, to integrate Ethereum wallet functionality into Microsoft Edge, their web browser (Microsoft, 2024). This collaboration aims to make crypto transactions more accessible to Microsoft's user base of over 1 billion people.

- In May 2024, major crypto exchange Binance, in collaboration with Visa, secured a strategic investment of USD200 million in the crypto payment processing firm, Bakkt (Binance, 2024). This investment will accelerate Bakkt's mission to bring cryptocurrencies to mainstream consumers through partnerships with leading financial institutions and merchants.

- In April 2025, the European Union's Markets in Crypto-Assets (MiCA) regulatory framework received a final approval from the European Parliament and Council (European Parliament, 2025). This landmark regulatory development will establish a comprehensive regulatory framework for crypto assets and wallets, ensuring investor protection and market integrity.

Research Analyst Overview

- In the dynamic the market, digital asset management is a priority for businesses and individuals alike. Wallet operating systems continue to evolve, integrating metaverse environments and blockchain gaming experiences. Yield farming and crypto borrowing have emerged as popular use cases, requiring robust security measures. Technical support is crucial for users navigating complex onboarding flows and understanding security best practices. Bug bounty programs and community forums offer valuable resources for addressing issues and implementing security improvements. Fraud prevention and malware protection are essential, with phishing protection a top concern for wallet developers and manufacturers. Decentralized identity solutions and social recovery mechanisms enhance user experience and security.

- Cryptographic algorithms and token standards underpin the decentralized finance (DeFi) landscape, enabling yield farming, crypto lending, and decentralized exchanges (DEXs). Hardware wallet manufacturers focus on security chips and user-friendly designs, while software wallet developers prioritize wallet firmware updates and customer support. NFT marketplaces and blockchain gaming platforms expand the use cases for crypto wallets, necessitating robust security and user-friendly features. Security best practices, including recovery phrases and multi-factor authentication, remain essential for safeguarding digital assets. Overall, the market continues to evolve, driven by innovation and the need for secure, user-friendly digital asset management solutions.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Crypto Wallet Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

214 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 20.6% |

|

Market growth 2025-2029 |

USD 631.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

16.6 |

|

Key countries |

US, Canada, China, Germany, UK, The Netherlands, India, France, Italy, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Crypto Wallet Market Research and Growth Report?

- CAGR of the Crypto Wallet industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the crypto wallet market growth of industry companies

We can help! Our analysts can customize this crypto wallet market research report to meet your requirements.