Application Security Market Size 2025-2029

The application security market size is valued to increase USD 21.9 billion, at a CAGR of 21.8% from 2024 to 2029. Growing number of data leaks will drive the application security market.

Major Market Trends & Insights

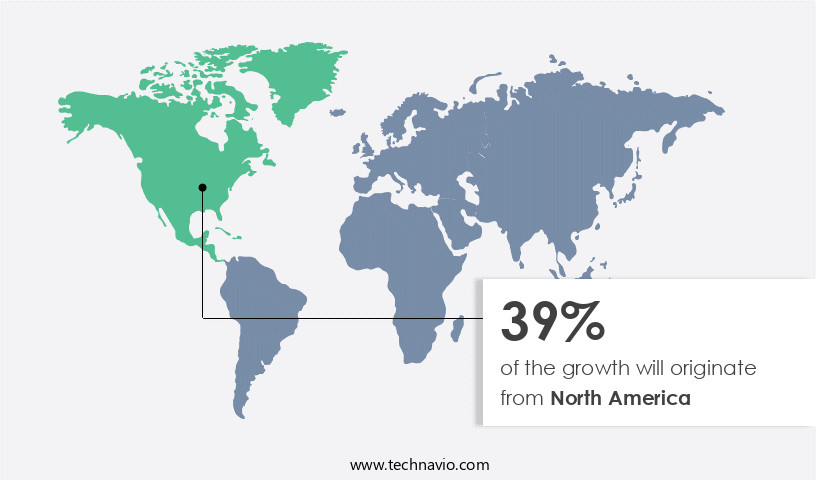

- North America dominated the market and accounted for a 39% growth during the forecast period.

- By Deployment - On-premises segment was valued at USD 3.94 billion in 2023

- By End-user - Web application security segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 408.74 million

- Market Future Opportunities: USD 21901.30 million

- CAGR from 2024 to 2029 : 21.8%

Market Summary

- The market is experiencing significant expansion, fueled by the increasing number of data breaches and the prevalence of shadow IT in organizations. According to recent estimates, the market value is projected to surpass USD24.9 billion by 2026, reflecting a robust demand for advanced security solutions. The threat landscape is evolving rapidly, with open-source application security solutions emerging as a notable challenge. These solutions, while cost-effective, may lack the necessary security features and updates, leaving organizations vulnerable to attacks. To mitigate these risks, businesses are investing in comprehensive application security solutions that provide real-time threat detection, vulnerability management, and continuous monitoring.

- These solutions enable organizations to secure their applications, protect sensitive data, and maintain regulatory compliance. Moreover, the integration of artificial intelligence and machine learning technologies enhances the effectiveness of these solutions, allowing for automated threat identification and response. The market's future direction is shaped by several trends, including the shift towards DevSecOps practices, the increasing adoption of cloud-based security solutions, and the growing importance of container security. As organizations continue to digitalize their operations and adopt new technologies, the need for robust application security solutions will only become more critical. The market's growth is expected to remain strong, driven by the increasing awareness of cybersecurity risks and the evolving threat landscape.

What will be the Size of the Application Security Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Application Security Market Segmented ?

The application security industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Deployment

- On-premises

- Cloud

- End-user

- Web application security

- Mobile application security

- Web application security

- Component

- Solution

- Service

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Deployment Insights

The on-premises segment is estimated to witness significant growth during the forecast period.

On-premises application security continues to be a significant focus in the evolving the market, with organizations seeking to maintain direct control over their security systems and data. According to a recent report, the on-premises the market is projected to reach a value of USD15.4 billion by 2025, growing at a compound annual growth rate of 13.5%. This market caters to various solutions and services, ensuring the protection of web and mobile applications throughout their secure development lifecycle. Key features of on-premises application security solutions include Web Application Firewalls (WAFs), which act as a protective shield against external threats, such as malicious attacks and unauthorized access attempts.

Other essential components include authentication protocols, secure coding practices, authorization mechanisms, and vulnerability management. Container security, threat modeling techniques, and behavioral analytics are also crucial elements, as is the integration of encryption algorithms, security audits, and multi-factor authentication. Additionally, on-premises application security encompasses serverless security, intrusion prevention systems, and data loss prevention. Compliance frameworks, risk assessment frameworks, and security awareness training further bolster these solutions. Privileged access management, zero trust architecture, and security incident response are essential for maintaining a robust security posture. Vulnerability scanning tools, software composition analysis, and penetration testing methods are employed to identify and address potential vulnerabilities.

Patch management systems and data encryption standards ensure that applications remain up-to-date and secure. Overall, on-premises application security offers organizations the flexibility, control, and customization needed to protect their critical applications and data.

The On-premises segment was valued at USD 3.94 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 39% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Application Security Market Demand is Rising in North America Request Free Sample

The market is experiencing notable expansion, with North America leading the global landscape in 2024. Fueled by the widespread use of mobile devices and the increasing adoption of cloud-based networking, this region is expected to witness substantial growth during the forecast period. Key players, including IBM, Cisco, Contrast Security, and Synopsis, contribute significantly to the market's growth in North America. As technologically advanced countries, such as the US, continue to pioneer technology adoption, the market is poised for continued expansion in this region.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses a range of solutions and services designed to safeguard web and software applications from cyber threats. Businesses are increasingly recognizing the importance of secure coding practices for web applications, implementing effective access control mechanisms, and embracing best practices for vulnerability management. These efforts are driven by the need to use penetration testing for secure software development, detect and respond to security incidents, and manage application security posture. Application security posture management tools play a crucial role in this landscape, enabling organizations to design a secure API gateway architecture, enhance cloud security with zero trust, deploy robust multi-factor authentication, and leverage security information and event management.

Effective data loss prevention strategies are also essential, as are measures to mitigate common web application vulnerabilities. Building a secure software development lifecycle is a priority for many organizations, with an increasing focus on implementing robust identity and access management, managing security risks in cloud environments, and employing advanced threat detection and response measures. Strengthening application security with encryption and compliance with industry security regulations is also key. Interestingly, a recent survey revealed that over 80% of organizations are investing in proactive security measures against cyberattacks, with a significant portion of these investments directed towards securing serverless applications.

This underscores the growing recognition that a comprehensive application security strategy must address the unique challenges posed by modern software development and deployment models. In comparison to traditional security approaches, the shift towards proactive, data-driven security measures has led to a marked increase in the number of security solutions being adopted. This trend is expected to continue, as businesses seek to stay ahead of evolving cyber threats and protect their digital assets.

What are the key market drivers leading to the rise in the adoption of Application Security Industry?

- The increasing prevalence of data leaks serves as the primary catalyst for market growth.

- Cyber threats continue to pose significant risks to businesses and organizations across various sectors, with data breaches and cyber-attacks on the rise. In the year 2024, numerous high-profile attacks targeted industries such as telecommunications, healthcare, and education, compromising sensitive information and affecting millions. The healthcare sector, in particular, faced unprecedented security challenges, with over 13 major data breaches exposing records for more than 1 million individuals each.

- This equated to approximately 42% of the US population being impacted. These incidents underscored the importance of robust application security measures in safeguarding valuable data. Consequently, investments in comprehensive security solutions have surged to address vulnerabilities and protect sensitive information.

What are the market trends shaping the Application Security Industry?

- Shadow IT's prevalence represents the latest market trend. The increasing usage of unsanctioned IT solutions warrants heightened attention in today's business landscape.

- Shadow IT refers to the use of digital solutions within organizations without explicit approval from management. Tools such as Slack, Google Docs, and Evernote are common examples. The rise of Internet of Things (IoT) devices connecting to company networks, which often lack usage policies, is one factor fueling the adoption of shadow IT. Another driving force is the proliferation of cloud-based services, which enable businesses to bypass lengthy IT procurement processes and quickly access technology services. The ongoing trend toward remote work and the need for flexible communication and collaboration solutions further boosts the usage of shadow IT tools.

- According to recent studies, the shadow IT market is witnessing significant growth, with an increasing number of businesses acknowledging the benefits of these solutions. The adoption of shadow IT is a continuous process, shaped by evolving business needs and technological advancements.

What challenges does the Application Security Industry face during its growth?

- Open-source application security solutions pose a significant challenge to the industry's growth due to their increasing prevalence and the complexities they introduce in ensuring robust security.

- Open-source application security solutions are gaining significant traction in the market, particularly in developing economies like India and China. These solutions offer an affordable alternative to expensive on-premises and cloud-based application security offerings, making them attractive to small-scale enterprises with limited resources and expertise. The adoption of open-source application security solutions is on the rise due to their lower capital investment requirements. This trend poses a challenge to The market, as the increasing popularity of these solutions is expected to decrease overall revenue during the forecast period. The open-source application security landscape is continuously evolving, with new solutions and updates being released frequently.

- These solutions offer a range of functionalities, including vulnerability scanning, intrusion detection, and web application firewalls. Despite their cost-effectiveness, open-source application security solutions require a dedicated team for maintenance and updates, which can be a significant investment for resource-constrained organizations. However, the benefits of improved security and cost savings are driving their widespread adoption. The open-source the market is expected to remain dynamic, with ongoing developments and innovations shaping its future applications across various sectors.

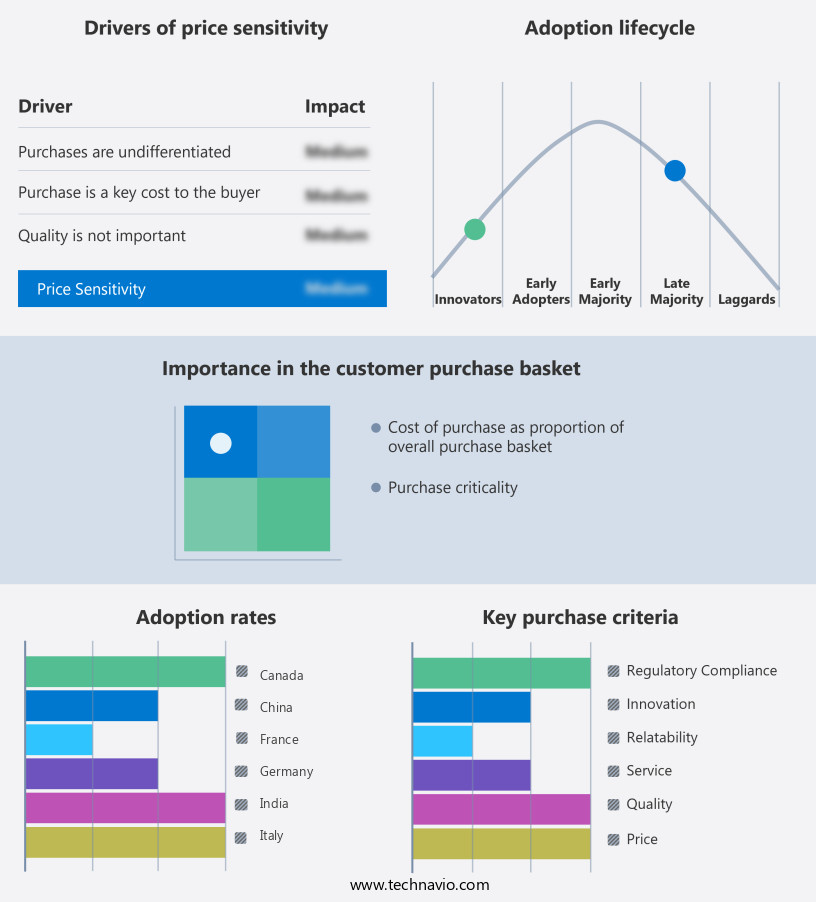

Exclusive Technavio Analysis on Customer Landscape

The application security market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the application security market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Application Security Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, application security market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Broadcom Inc. - The company specializes in advanced application security solutions, including Gen 8.6 technology, ensuring robust protection against cyber threats for businesses worldwide. This cutting-edge security approach enhances digital trust and safeguards critical data assets.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Broadcom Inc.

- Capgemini Services SAS

- Checkmarx Ltd.

- Contrast Security Inc.

- Dynatrace Inc.

- F5 Inc.

- Fasoo

- Fortinet Inc.

- Hewlett Packard Enterprise Co.

- ImmuniWeb SA

- International Business Machines Corp.

- Invicti Security Ltd.

- Nippon Telegraph and Telephone Corp.

- PRADEO Security Systems SAS

- Qualys Inc.

- Rapid7 Inc.

- Singapore Telecommunications Ltd.

- Sitelock LLC

- Synopsys Inc.

- Trend Micro Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Application Security Market

- In January 2024, CyberArk, a leading cybersecurity company, announced the launch of its new Application Security Solution, "Application Defender," designed to protect against application-layer attacks. This solution uses machine learning and behavioral analytics to detect and prevent attacks in real-time (CyberArk Press Release, 2024).

- In March 2024, Check Point Software Technologies and Microsoft entered into a strategic partnership to integrate Check Point's application security solutions with Microsoft Azure. This collaboration aimed to provide enhanced security for cloud-based applications (Microsoft News Center, 2024).

- In May 2024, Rapid7, a cybersecurity provider, raised USD150 million in a funding round, led by Blackstone Growth, to expand its application security offerings and accelerate research and development (Rapid7 Press Release, 2024).

- In April 2025, IBM Security acquired Reason Software, a machine learning startup specializing in application security. This acquisition was intended to enhance IBM's application security capabilities and provide clients with advanced threat detection and response (IBM Press Release, 2025).

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Application Security Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

213 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 21.8% |

|

Market growth 2025-2029 |

USD 21901.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

19.7 |

|

Key countries |

US, Germany, Canada, China, Japan, France, India, UK, Italy, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- Amidst the ever-evolving digital landscape, application security continues to be a critical concern for businesses worldwide. The market encompasses a diverse range of solutions designed to safeguard applications from increasingly sophisticated threats. API Security Gateways form a cornerstone, ensuring secure access to application programming interfaces (APIs) by implementing access control policies and encrypting data in transit. Meanwhile, the Secure Development Lifecycle (SDLC) integrates security into the software development process, preventing vulnerabilities at their source. Container Security focuses on securing containerized applications, while Authentication Protocols and Authorization Mechanisms manage access to applications and data. Vulnerability Management and Penetration Testing Methods identify and remediate weaknesses, and Web Application Firewalls and Incident Management Systems protect against attacks and mitigate their impact.

- Risk Assessment Frameworks, Security Awareness Training, and Compliance Frameworks ensure a proactive approach to security. Threat Modeling Techniques, Data Loss Prevention, Intrusion Prevention Systems, Privileged Access Management, Zero Trust Architecture, and Security Incident Response further fortify defense strategies. Encryption Algorithms, Security Audits, Multi-Factor Authentication, Serverless Security, Behavioral Analytics, Software Composition Analysis, Vulnerability Scanning Tools, Intrusion Detection Systems, and Data Encryption Standards are essential components, each contributing to a robust application security ecosystem. According to recent research, the market is projected to grow at an impressive rate, with Container Security and API Security Gateways experiencing significant growth due to the increasing adoption of cloud-native applications and APIs.

- This underscores the importance of staying informed and implementing the most effective security measures to protect your business.

What are the Key Data Covered in this Application Security Market Research and Growth Report?

-

What is the expected growth of the Application Security Market between 2025 and 2029?

-

USD 21.9 billion, at a CAGR of 21.8%

-

-

What segmentation does the market report cover?

-

The report is segmented by Deployment (On-premises and Cloud), End-user (Web application security , Mobile application security, and Web application security), Component (Solution and Service), and Geography (North America, Europe, APAC, Middle East and Africa, and South America)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Growing number of data leaks, Threat from open-source application security solutions

-

-

Who are the major players in the Application Security Market?

-

Broadcom Inc., Capgemini Services SAS, Checkmarx Ltd., Contrast Security Inc., Dynatrace Inc., F5 Inc., Fasoo, Fortinet Inc., Hewlett Packard Enterprise Co., ImmuniWeb SA, International Business Machines Corp., Invicti Security Ltd., Nippon Telegraph and Telephone Corp., PRADEO Security Systems SAS, Qualys Inc., Rapid7 Inc., Singapore Telecommunications Ltd., Sitelock LLC, Synopsys Inc., and Trend Micro Inc.

-

Market Research Insights

- The market encompasses a range of solutions designed to safeguard software applications from various threats. Two significant areas of focus within this market are network security monitoring and security orchestration. According to industry estimates, the global network security monitoring market is projected to reach USD32.6 billion by 2025, growing at a compound annual growth rate of 11.5% during the forecast period. In contrast, the security orchestration market is anticipated to expand at a CAGR of 13.2% between 2020 and 2027, reaching USD5.3 billion by 2027. These figures underscore the importance of both network security monitoring and security orchestration in the application security landscape.

- Network security monitoring solutions enable organizations to identify and respond to threats in real-time, while security orchestration streamlines security operations by automating and integrating various security tools. Key technologies within the market include phishing detection, cross-site scripting prevention, static and dynamic code analysis, SQL injection prevention, and key management systems. Additionally, other critical components include data breach response, secure remote access, security monitoring tools, log management systems, threat intelligence feeds, role-based access control, automation and response, data masking techniques, malware analysis techniques, digital rights management, access control lists, social engineering attacks, and data exfiltration prevention. These technologies are continually evolving to address emerging threats and vulnerabilities, ensuring the ongoing relevance and importance of the market.

We can help! Our analysts can customize this application security market research report to meet your requirements.