Printing Inks Market Size 2025-2029

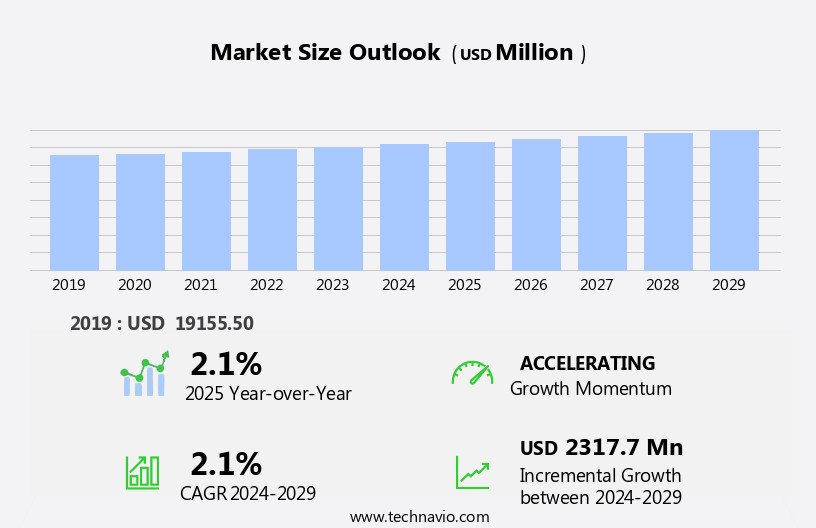

The printing inks market size is forecast to increase by USD 2.32 billion, at a CAGR of 2.1% between 2024 and 2029.

- The market is driven by the robust demand from the packaging industry, which continues to expand due to the increasing consumer preference for branded and attractive packaging. This trend is expected to fuel the growth of the market. Additionally, new product development remains a key strategy for market participants to cater to the evolving needs of various end-use industries and maintain their competitive edge. However, the market faces challenges from the volatility of crude oil prices, which significantly impact the production costs of printing inks.

- This uncertainty can hinder the growth prospects of the market players. To capitalize on the opportunities presented by the packaging industry and mitigate the challenges arising from crude oil price fluctuations, market participants must focus on innovation, cost optimization, and strategic partnerships.

What will be the Size of the Printing Inks Market during the forecast period?

The market continues to evolve, with dynamic market activities unfolding across various sectors. Inkjet application finds extensive use in digital printing, textiles, and packaging, while water-based inks gain popularity for their eco-friendliness in commercial printing. Flexographic printing maintains its dominance in the packaging industry due to its high printing speed and quality. UV curable inks and gravure inks are key players in industrial printing, offering superior durability and high-quality results. Digital printing technology advances with automation and higher resolution, challenging traditional offset printing in certain applications. Printing processes, such as screen printing and gravure printing, undergo continuous improvements in technology and automation.

Gravure printing's ability to produce high-quality images and consistent colors makes it a preferred choice for label and packaging applications. Flexographic printing technology's flexibility in printing on various substrates, including plastic films, and its fast production speed contribute to its growth in the market. Inkjet technology's ability to automate and produce high-resolution images makes it a viable option for digital presses and industrial applications. The market for inkjet cartridges and gravure printing presses continues to expand, driven by advancements in inkjet technology and gravure printing automation. Industrial inks, such as solvent-based and low voc inks, cater to specific industries and applications.

Publication inks and printing plates play a crucial role in the printing industry, ensuring color accuracy and consistency across various printing processes. Bio-based inks and recyclable inks are emerging trends, addressing environmental concerns and sustainability. The printing market's continuous evolution is driven by technological advancements, automation, and the evolving needs of various industries. The integration of inkjet, flexographic, and gravure printing technologies ensures a diverse range of applications and solutions.

How is this Printing Inks Industry segmented?

The printing inks industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

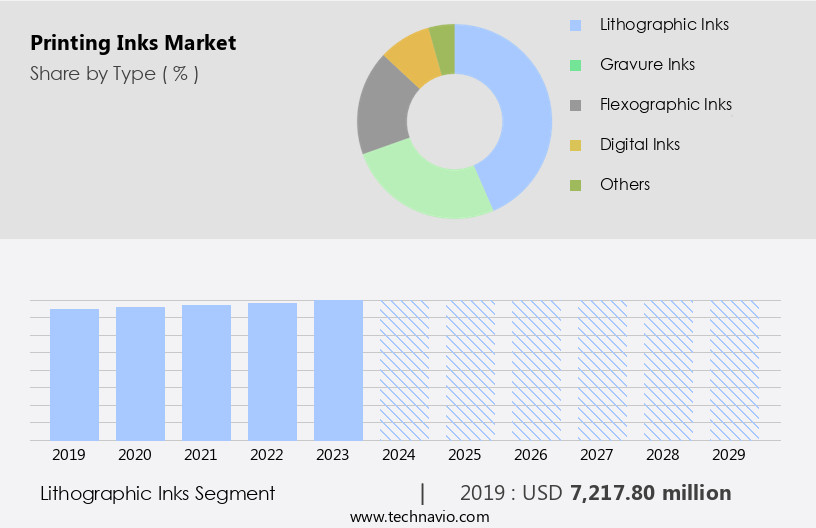

- Type

- Lithographic inks

- Gravure inks

- Flexographic inks

- Digital inks

- Others

- End-user

- Packaging and labeling

- Publication and commercial printing

- Corrugated cardboards

- Others

- Resin Type

- Polyurethane

- Modified resin

- Modified cellulose

- Acrylic

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The lithographic inks segment is estimated to witness significant growth during the forecast period.

The market encompasses a significant segment dedicated to lithographic inks. Lithography printing, a technique renowned for producing high-quality prints, is extensively used in various applications such as packaging, commercial printing, and publication printing. Lithographic inks, essential for this process, are formulated using pigments, resins, solvents, and additives to ensure proper adhesion to the printing surface. These inks are distinguished by their vibrant color strength, brightness, and superior print quality. Depending on the printing process requirements, lithographic inks are available in both oil-based and water-based versions. Offset printing automation, a crucial aspect of the printing industry, is integrated into the production of lithographic inks.

Inkjet printers, a key component of digital printing, employ advanced color management systems to ensure accurate color matching. Offset printing speed is optimized through the use of commercial printing inks, while uv curable inks facilitate faster drying times. Flexographic printing applications benefit from the versatility of lithographic inks, and automation enhances the process through flexographic printing technology. Textile inks and packaging inks are other significant sectors within the market. Flexographic printing automation and color matching are essential for these applications, which often involve printing on various substrates. Gravure printing, a technique for producing high-quality prints on large surfaces, utilizes gravure inks and presses.

Digital printing technology, with its inkjet heads and automation, offers increased speed and resolution. Water-based inks and bio-based inks are gaining popularity due to their eco-friendly properties. Recyclable inks and solvent-free inks contribute to the sustainability of the printing industry. Industrial inks, such as screen printing inks and label inks, are integral to various manufacturing processes. Digital printing applications, including screen printing machines and digital presses, continue to evolve with advancements in inkjet technology. The market is characterized by continuous innovation and the integration of various technologies, including offset printing, inkjet printing, flexographic printing, and gravure printing.

These printing processes are employed across a wide range of applications, from packaging and publication printing to textile printing and industrial manufacturing. The market's dynamic nature is driven by the ongoing pursuit of improved print quality, increased efficiency, and the development of more sustainable ink solutions.

The Lithographic inks segment was valued at USD 7.22 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 46% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing significant growth, particularly in the North American region, due to the increasing demand for packaging, driven by the rise in retail e-commerce sales. In 2024, North America is expected to dominate the market, with the US and Canada being the leading contributors to retail e-commerce sales. The packaging sector, which includes food and beverages and personal care products, is the primary consumer of printing inks in North America. The region's retail e-commerce sales for the fourth quarter of 2023 were approximately USD285 billion. Advancements in printing technologies, such as offset printing automation, inkjet printers, and color management, are driving the market's evolution.

Offset printing speed and quality have improved significantly, making it a popular choice for commercial applications. UV curable inks and water-based inks are gaining popularity due to their environmental benefits and versatility. Flexographic printing technology is increasingly being used for applications such as packaging and labeling due to its speed and cost-effectiveness. Digital printing technology, including inkjet and screen printing, is also gaining traction due to its flexibility and customization capabilities. Digital printing speed and resolution have improved, making it a viable alternative to traditional printing methods for certain applications. Gravure printing, another traditional printing method, is still used for high-volume applications where consistency and high image quality are required.

The market is also witnessing the development of new technologies, such as bio-based inks and recyclable inks, which are expected to gain popularity due to their environmental benefits. The use of printing automation, including screen printing machines and digital presses, is increasing to improve efficiency and reduce production costs. Printing substrates, such as plastic films, are also evolving to meet the changing demands of the market. Inkjet durability and gravure inks' color gamut are critical factors in the selection of printing substrates. The market is also witnessing the development of new applications, such as textile printing, which is expected to drive growth in the future.

In conclusion, The market is witnessing significant growth due to the increasing demand for packaging and the evolution of printing technologies. Offset printing, digital printing, and flexographic printing are the primary printing methods used in the market, each with its unique advantages and applications. The market is also witnessing the development of new technologies, such as bio-based inks and recyclable inks, and the emergence of new applications, such as textile printing. The market is expected to continue its growth trajectory in the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Printing Inks Industry?

- The packaging industry's substantial demand for printing inks serves as the primary market driver.

- The market is experiencing steady growth, driven primarily by the expansion of the packaging industry. With the consumer goods sector thriving, there is a rising demand for packaged foods, beverages, and frozen foods. This trend is expected to significantly impact the development and growth of the market, particularly in the water-borne segment, during the forecast period. The packaging industry is the largest consumer of printing inks, making it a key market driver. Printing technologies such as offset presses, gravure presses, flexographic presses, inkjet printing, and screen printing are used in the production of packaging.

- Offset printing technology offers high color gamut and print quality, making it suitable for producing high-quality packaging. Gravure printing applications, including labels and flexible packaging, benefit from the high gravure printing speed, while flexographic printing is known for its automation capabilities and cost-effectiveness. Inkjet printing, on the other hand, offers the advantage of digital printing automation and customization. Bio-based inks are gaining popularity due to their eco-friendly nature and reduced environmental impact. These inks are used in various applications, including packaging, labels, and commercial printing. The market for bio-based inks is expected to grow at a significant rate due to increasing consumer awareness and government regulations promoting sustainable practices.

- In conclusion, The market is poised for growth, driven by the expanding packaging industry and technological advancements in printing technologies. The market offers opportunities for innovation and growth, particularly in the area of sustainable and eco-friendly printing inks.

What are the market trends shaping the Printing Inks Industry?

- New product development is currently a significant market trend. It involves the creation of new goods or services to meet evolving consumer demands and stay competitive in the industry.

- The global printing ink market is witnessing significant innovation with manufacturers focusing on new product development to cater to evolving customer requirements. Two key trends in this area are the production of eco-friendly and high-performance inks. Eco-friendly inks are gaining popularity due to their minimal environmental impact. These inks are derived from renewable resources, emit low Volatile Organic Compounds (VOCs), and are easily recyclable. This trend aligns with the growing demand for sustainable business practices across industries. High-performance inks, on the other hand, offer superior print quality and durability. Manufacturers are developing inks that are resistant to fading, scratching, and other damage.

- This is particularly important for applications in industries such as packaging, where product longevity is crucial. Inkjet technology, including inkjet cartridges and digital presses, is a significant area of growth in the printing ink market. Water-based inkjet inks, for instance, are widely used in inkjet application areas like digital printing for publications and industrial printing for plastic films. Inkjet automation is another trend driving the growth of inkjet technology. Flexographic printing, which uses gravure inks, remains a popular choice for its high printing quality. However, flexographic printing speed is a challenge that manufacturers are addressing through technological advancements.

- Gravure inks continue to be used extensively in applications like label printing and packaging due to their excellent print quality and consistency. In summary, the global printing ink market is witnessing a focus on eco-friendly and high-performance inks, driven by changing customer needs and technological advancements. Inkjet technology, including inkjet cartridges and digital presses, is a significant growth area, while flexographic printing continues to be a popular choice for its high print quality.

What challenges does the Printing Inks Industry face during its growth?

- The volatility of crude oil prices poses a significant challenge to the growth of the industry.

- The market is significantly influenced by the price fluctuations of crude oil, a key raw material in ink production. The volatility of crude oil prices directly impacts the cost of printing ink production, which can ultimately affect affordability for both consumers and businesses. As crude oil prices rise, production costs increase, leading to higher ink prices and potentially lower profit margins for producers and distributors. Conversely, when crude oil prices decrease, production costs decline, potentially leading to price wars and increased competition within the industry. It is essential for market participants to closely monitor and manage crude oil price trends to maintain profitability and competitiveness.

- In addition, advancements in printing technologies, such as offset printing automation, inkjet printers, and color management systems, continue to shape the market landscape, driving demand for commercial printing inks, UV curable inks, flexographic printing applications, and digital printing technologies. Printing substrates, textile inks, label inks, and screen printing machines also represent significant opportunities for growth within the market.

Exclusive Customer Landscape

The printing inks market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the printing inks market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, printing inks market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Altana AG - This company specializes in low-viscosity cubic ink, ideal for commercial and industrial printing applications. With its advanced formulation, this ink delivers superior print quality and consistency, enhancing brand image and customer satisfaction. The ink's low viscosity enables efficient ink flow, reducing downtime and minimizing waste. Its versatility caters to a wide range of printing technologies, ensuring versatility and adaptability for diverse projects. This innovative ink solution empowers businesses to produce high-quality prints, meeting stringent industry standards and exceeding customer expectations.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Altana AG

- Bordeaux Digital PrintInk Ltd.

- Dainichiseika Color and Chemicals Mfg. Co. Ltd.

- DEERS i Co. Ltd.

- DIC Corp.

- Encres DUBUIT

- Epple Druckfarben AG

- Flint Group

- FUJIFILM Holdings Corp.

- MHM Holding GmbH

- Sakata Inx India Pvt Ltd.

- SICPA HOLDING SA

- Siegwerk Druckfarben AG and Co. KGaA

- Sun Chemical Corp.

- T and K TOKA Corp.

- The Dow Chemical Co.

- Tokyo Printing Ink Mfg Co. Ltd.

- Toyo Ink

- Vibrantz

- Zeller and Gmelin GmbH and Co. KG.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Printing Inks Market

- In February 2023, Sun Chemical, a leading global producer of printing inks and pigments, announced the launch of its new line of sustainable UV inks, named SunVisto EcoSolvent Inks, designed to reduce the carbon footprint in the printing industry (Sun Chemical press release, 2023). This innovative product line is expected to cater to the growing demand for eco-friendly solutions in the printing sector.

- In July 2022, INX International Ink Co. Entered into a strategic partnership with Koch Industries' subsidiary, Invista, to develop and commercialize inks based on Invista's proprietary StainGuard technology. This collaboration aims to provide improved stain resistance and durability to the printed materials, targeting the food packaging and labeling markets (INX International Ink Co. Press release, 2022).

- In March 2021, BASF SE, the German chemical giant, completed the acquisition of the printing ink business of ALTANA AG, expanding its portfolio in the market. The acquisition strengthened BASF's position in the industry and provided it with a broader product range and enhanced customer base (BASF SE press release, 2021).

- In October 2019, Flint Group, a leading global supplier of printing and ink solutions, received regulatory approval from the European Chemicals Agency (ECHA) for its new UV-curable offset inks. The approval marked a significant milestone in the company's efforts to offer more sustainable and compliant solutions to its customers in the European market (Flint Group press release, 2019).

Research Analyst Overview

- The market encompasses a diverse range of products, including inkjet and offset inks, each with unique formulations and requirements. Stability and durability are paramount in both applications, with inkjet ink formulation influencing drop size and viscosity for optimal nozzle performance. Substrate compatibility is crucial, as printing inks must adhere effectively to various materials. Inkjet ink delivery systems require precise rheology for consistent flow, while screen printing relies on stencil and ink chemistry for optimal image quality. Performance benchmarks, such as printing ink testing, ensure consistent results in both digital and offset printing workflows.

- Lithography and digital printing technologies continue to evolve, driving advancements in ink chemistry and delivery systems. Printing quality control remains a top priority, with ongoing research focusing on enhancing inkjet ink formulation and optimizing printing processes.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Printing Inks Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

234 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.1% |

|

Market growth 2025-2029 |

USD 2317.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

2.1 |

|

Key countries |

US, China, UK, Germany, Japan, Canada, France, India, Italy, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Printing Inks Market Research and Growth Report?

- CAGR of the Printing Inks industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the printing inks market growth of industry companies

We can help! Our analysts can customize this printing inks market research report to meet your requirements.