Dental Imaging Market Size 2025-2029

The dental imaging market size is forecast to increase by USD 1.76 billion at a CAGR of 7.6% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing prevalence of dental-related issues among the edentulous and geriatric population. This demographic shift presents a substantial opportunity for market participants, as the demand for advanced diagnostic tools and solutions continues to rise. The integration of intraoral scanners and open architecture solutions into dental practices is another key trend driving market expansion. However, the high cost of advanced dental imaging equipment and procedures poses a significant challenge for both patients and providers.

- Additionally, collaboration with insurance providers and government initiatives to increase dental coverage for underserved populations could help expand market reach and accessibility. Overall, the market offers promising opportunities for growth, particularly for companies that can effectively address affordability concerns and meet the evolving diagnostic needs of an aging population. These advanced diagnostic tools play a crucial role in various dental specialties, including cosmetic dentistry, implantology, endodontics, orthodontics, and dental diagnostic centers.

What will be the Size of the Dental Imaging Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market encompasses a range of technologies and solutions, including dental imaging hardware, such as multislice CT scanners, and digital imaging workflow systems. These advancements facilitate high-resolution imaging, contrast enhancement methods, and virtual surgical planning. Data management systems enable efficient handling of patient data, ensuring privacy and security. Treatment outcome assessment and clinical decision support are enhanced through image analysis software and diagnostic accuracy metrics. Radiation safety protocols and low-dose imaging techniques minimize radiation exposure, while noise reduction techniques optimize image quality. Image viewing software and archiving systems streamline workflow and facilitate easy access to historical data.

Advanced image registration algorithms and 3D model reconstruction enable precise diagnosis and treatment planning. Image guided orthodontic and biopsy offer minimally invasive procedures, while software user interfaces ensure ease of use. Security protocols and artifact correction algorithms maintain image integrity. Overall, these innovations contribute to the evolution of dental imaging, improving diagnostic accuracy and patient care. Dental imaging companies must navigate this obstacle by offering affordable financing options, leasing programs, or alternative imaging technologies to remain competitive.

How is this Dental Imaging Industry segmented?

The dental imaging industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Dental clinics

- Hospitals and diagnostic centers

- Dental research institutes

- Others

- Application

- Diagnostic

- Cosmetic

- Forensic

- Type

- Intraoral imaging

- Extraoral imaging

- Cone beam computed tomography

- 3D dental imaging

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

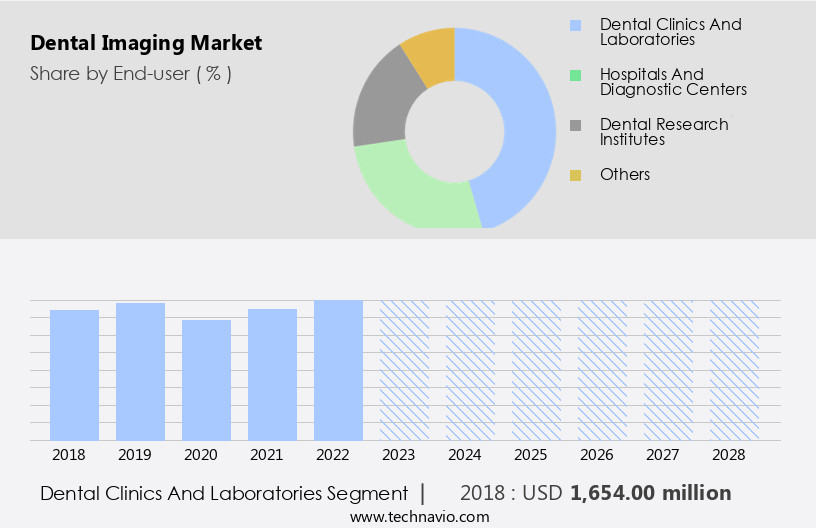

By End-user Insights

The Dental clinics segment is estimated to witness significant growth during the forecast period. The market encompasses various technologies and applications, including software image enhancement, CBCT imaging, impacted tooth identification, and orthodontic treatment planning. The dental clinics segment includes dental clinics and laboratories. Dental clinics have been providing independent dental services to patients. In most countries, dental clinics have entered a collaboration with insurance companies in order to provide dental coverage. In the UK and some APAC countries, such as India, the British United Provident Association is engaged in providing insurance coverage to individuals. The high procedure cost and inadequate reimbursement policies have been a constraint in the dental imaging market. The number of private dental clinics has increased due to foreign and domestic investments.

Dental clinics and laboratories constitute a significant segment of the market. While dental clinics have traditionally offered independent dental services, many have entered into collaborations with insurance companies to provide coverage. In countries like the UK and India, entities such as the British United Provident Association offer insurance coverage. However, high procedure costs and inadequate reimbursement policies have posed challenges. The rise in private dental clinics due to foreign and domestic investments is expected to fuel demand for dental imaging, as it plays a crucial role in accurate diagnosis and treatment planning. Technological advancements in imaging techniques, such as 3D dental imaging and tooth decay detection, are further driving market growth. These advanced diagnostic tools play a crucial role in various dental specialties, including cosmetic dentistry, implantology, endodontics, orthodontics, and dental diagnostic centers.

The Dental clinics segment was valued at USD 1.74 billion in 2019 and showed a gradual increase during the forecast period.

The Dental Imaging Market is advancing rapidly with innovations enhancing diagnostic accuracy and patient care. High X-ray Image Quality is crucial for detecting dental abnormalities and guiding treatments. To assess imaging precision, clinics rely on Image Resolution Metrics that measure sharpness and clarity. Efficient Dental Imaging Workflow solutions streamline image capture, review, and reporting processes, improving clinical productivity. Secure Image Archiving Systems ensure organized storage and retrieval, while robust Image Security Protocols safeguard sensitive visuals. An intuitive Software User Interface enhances usability for dental professionals, enabling seamless operation. Protecting Patient Data Privacy remains a priority, with strict compliance measures in place. Additionally, advanced Image Guided Biopsy techniques are transforming oral pathology diagnostics through precise, minimally invasive procedures. However, the high cost of digital X-Ray systems remains a challenge for small and medium-sized dental clinics, limiting their adoption.

Regional Analysis

Asia is estimated to contribute 48% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American market is experiencing significant growth, driven by the convergence of advanced healthcare infrastructure, increased patient awareness, and a sophisticated reimbursement system in the United States and Canada. This market is driven forward by the adoption of advanced technologies that improve diagnostic accuracy and streamline clinical workflows. An illustrative example of this trend emerged in January 2024, when the FDA granted expanded clearance to Pearl Second Opinion's artificial intelligence (AI) software. This clearance expanded the software's capabilities to detect a broader range of pathologies in bitewing and periapical radiographs, including calculus, root canal filling discrepancies, and crowns. Ceramics, metals, and technical plastics are commonly used materials in dental imaging equipment due to their stiffness, resistance to heat, and other desirable properties.

Advanced technologies, such as CBCT imaging, image guided surgery, dental implant planning, image fusion techniques, image processing algorithms, remote diagnostic services, PACS systems integration, intraoral cameras, dental materials analysis, radiation dose reduction, facial analysis software, 3D dental imaging, tooth decay detection, and orthodontic treatment planning, are revolutionizing the dental industry. Technological innovations, such as digital radiography and 3D imaging, offer enhanced diagnostic accuracy, improved patient comfort, and reduced radiation exposure, making them increasingly popular in dental practices.

These technologies enable dentists to make more accurate diagnoses, plan complex procedures, and provide more personalized treatments, ultimately improving patient outcomes and satisfaction.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Dental Imaging market drivers leading to the rise in the adoption of Industry?

- The edentulous and geriatric population segment experiences a significant increase in dental issues, serving as the primary driver for the growth of the market focused on dental solutions. The market is experiencing significant growth due to the rising prevalence of dental problems among the edentulous population. Dental issues, such as poor oral hygiene, dental cavities, gum disease, gum decay, injury, cancer, smoking, and tooth wear, contribute to tooth loss, particularly among aged and vulnerable populations. The geriatric population is growing rapidly due to increased life expectancy, further fueling market expansion. Additionally, the prevalence of dental diseases is increasing due to the proliferation of risk factors like diabetes, poor oral hygiene, stress, and tobacco and alcohol use. Advancements in dental imaging technology are also driving market growth.

- Remote diagnostic services, PACS systems integration, intraoral cameras, dental materials analysis, radiation dose reduction, cephalometric analysis software, CAD/CAM technology, and 3D printing models are transforming the dental industry. These technologies enable accurate diagnoses, efficient workflows, and improved patient outcomes. Moreover, the integration of CAD/CAM technology and 3D printing models in dental procedures is revolutionizing the industry by enabling the production of customized dental restorations and implants. These innovations are enhancing patient comfort, reducing treatment times, and improving overall patient satisfaction.

What are the Dental Imaging market trends shaping the Industry?

- The use of intraoral scanners and open architecture solutions is gaining significant traction in the market. These advanced technologies are becoming increasingly mandatory for dental professionals to stay competitive and provide superior patient care. Dental imaging technology has witnessed significant advancements, with TMJ imaging and restorative dentistry imaging becoming increasingly essential. Cone beam CT scans are popular for their ability to provide three-dimensional images, enabling accurate diagnosis and treatment planning in aesthetic dentistry. Treatment simulation software allows dentists to visualize the outcome of various procedures, enhancing the overall patient experience.

- Open-architecture software is gaining popularity in the market due to its compatibility with various milling units. This flexibility allows dentists to choose their preferred milling center, enhancing the functionality of the dental imaging system. The open architecture enables seamless communication and integration between different components of the system, leading to improved efficiency and better patient care. Radiographic image interpretation is a crucial aspect of dental imaging, and cloud-based image storage facilitates easy access to these images from anywhere. Jawbone density assessment is another application of dental imaging, which is vital in determining the suitability of dental implants.

How does Dental Imaging market face challenges during its growth?

- The high cost of acquiring and maintaining advanced dental imaging equipment, as well as the associated procedural expenses, poses a significant challenge to the growth of the dental industry. Dental imaging technology has seen significant advancements in recent years, with various techniques and equipment revolutionizing the diagnostic process in dentistry. Surgical guides fabrication using 3D dental imaging and image segmentation techniques have become essential tools for accurate and precise dental procedures. Dental panoramic x-rays and digital radiography sensors offer superior image quality and root canal visualization, enhancing the diagnostic capabilities of dental professionals.

- The average cost of CBCT equipment ranges from USD 150,000 to USD 300,000, while the imaging or diagnosis cost for each procedure can be between USD 300 and USD 600. Despite these challenges, the benefits of using advanced dental imaging technologies, such as improved accuracy, efficiency, and patient satisfaction, make them indispensable tools in modern dental practices. Facial analysis software is another innovative application of dental imaging, enabling early detection of various dental conditions, including tooth decay. The adoption of these advanced imaging technologies, however, is influenced by their high cost and limited reimbursement in developed countries.

Exclusive Customer Landscape

The dental imaging market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the dental imaging market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, dental imaging market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3Shape AS - The company specializes in dental imaging technology, providing innovative solutions like the 3Shape Dental System.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3Shape AS

- Align Technology Inc.

- Asahi Roentgen Ind. Co. Ltd

- BIOLASE Inc.

- Carestream Health Inc.

- ClaroNav

- Danaher Corp.

- Dentsply Sirona Inc.

- Ewoosoft Co. Ltd.

- Finapoline SAS

- Freedom Technologies Group LLC

- J. Morita Corp.

- Midmark Corp.

- Ningbo Runyes Medical Instrument Co. Ltd.

- Owandy Radiology

- Planet DDS

- Planmeca Oy

- Planmed Oy

- The Yoshida Dental Mfg. Co. Ltd.

- Vatech Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Dental Imaging Market

- In January 2024, Siemens Healthineers, a leading medical technology company, launched its new Dental.All-in-One X-ray system, which combines panoramic, cephalometric, and bitewing imaging in a single unit. This innovation aims to streamline dental imaging processes and improve diagnostic accuracy (Siemens Healthineers Press Release).

- In March 2024, GE Healthcare and Planmeca, a Finnish dental equipment manufacturer, announced a strategic partnership to integrate Planmeca's dental imaging solutions with GE Healthcare's Edison platform. This collaboration aims to enhance dental imaging workflows and data analysis capabilities (GE Healthcare Press Release).

- In May 2024, Dentsply Sirona, a leading dental products and technologies company, completed the acquisition of KaVo Kerr, a dental equipment and technology provider, for approximately USD 3.4 billion. This deal strengthens Dentsply Sirona's position in the market and expands its product portfolio (Dentsply Sirona Press Release).

- In January 2025, the U.S. Food and Drug Administration (FDA) cleared Dexis, a subsidiary of Varian Medical Systems, to market its Dexis CariVu portable caries detection device. This non-radiographic imaging system uses transillumination technology to detect caries lesions, offering a radiation-free alternative to traditional X-rays (Dexis Press Release).

Research Analyst Overview

The market continues to evolve, driven by advancements in technology and growing applications across various sectors. Surgical guides fabrication relies on image segmentation techniques and dental panoramic x-rays, while digital radiography sensors enable real-time image processing and radiation dose reduction. Root canal visualization and tooth decay detection are enhanced through the use of CAD/CAM technology and 3D dental imaging. Facial analysis software and cone beam CT offer improved diagnostic capabilities, enabling dentists to assess jawbone density and identify impacted teeth with greater accuracy. DICOM image formats facilitate seamless integration with PACS systems and remote diagnostic services. Image fusion techniques and treatment simulation software enable more precise dental implant planning and restoration dentistry.

Moreover, the ongoing development of image processing algorithms and radiographic image interpretation software allows for more efficient and accurate diagnosis. Cloud-based image storage solutions offer convenience and accessibility, while intraoral cameras and dental materials analysis provide valuable information for aesthetic dentistry planning. TMJ imaging and cephalometric analysis software offer insights into complex dental conditions. The market dynamics of dental imaging are continually unfolding, with new technologies and applications emerging to enhance diagnostic capabilities and improve patient outcomes. The integration of AI and machine learning algorithms is expected to further revolutionize the field, enabling more accurate and efficient diagnosis and treatment planning.

Overall, the market is a dynamic and evolving landscape, driven by the ongoing pursuit of improved diagnostic capabilities and patient care. The market is experiencing robust growth due to the rising prevalence of dental problems and the aging population, coupled with advancements in dental imaging technology. Remote diagnostic services, PACS systems integration, intraoral cameras, dental materials analysis, radiation dose reduction, cephalometric analysis software, CAD/CAM technology, and 3D printing models are transforming the dental industry by enabling accurate diagnoses, efficient workflows, and improved patient outcomes. Medical tourism influences the market dynamics, offering cost-effective solutions for patients seeking advanced dental care.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Dental Imaging Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

216 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.6% |

|

Market growth 2025-2029 |

USD 1.76 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.6 |

|

Key countries |

US, Germany, UK, France, Canada, Italy, China, Japan, India, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Dental Imaging Market Research and Growth Report?

- CAGR of the Dental Imaging industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the dental imaging market growth of industry companies

We can help! Our analysts can customize this dental imaging market research report to meet your requirements.