Dermatological Drugs Market Size 2024-2028

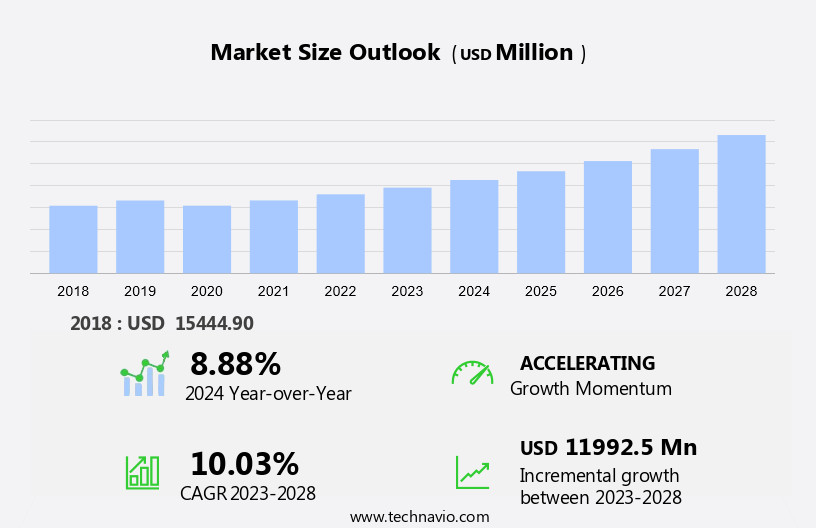

The dermatological drugs market size is forecast to increase by USD 11.99 billion at a CAGR of 10.03% between 2023 and 2028.

- The demand for safe and stable medications that require minimal monitoring is a key factor driving the market. Additionally, the rising costs of dermatological drugs have become a significant trend in the healthcare industry. The market is witnessing significant growth due to the increasing use of hyaluronic acid in skincare treatments for its hydrating and anti-aging properties. At the same time, the introduction of new biologics and biosimilars faces considerable obstacles due to access barriers, making it harder for these therapies to reach patients. These barriers could include regulatory hurdles, pricing issues, and distribution challenges that slow the adoption of novel treatments. Together, these factors highlight the growing need for affordable, effective drugs with fewer side effects, as well as the importance of addressing obstacles in the availability and accessibility of advanced therapies.

- Companies seeking to capitalize on these opportunities should focus on innovation, cost-effective solutions, and strategic partnerships to navigate the competitive landscape and meet the evolving needs of consumers and industries.

What will be the Size of the Dermatological Drugs Market during the forecast period?

- The market encompasses a wide range of pharmaceutical treatments addressing various skin conditions, including acne, eczema, rosacea, and others such as keratosis, xerosis, corns, callous, nail problems, ingrown nails, and wounds. Customer preferences for effective and safe solutions continue to drive market growth. Environmental conditions and personal care expenditure are significant factors influencing the market dynamics. Investments by companies in research and development of innovative formulations utilizing ingredients like emollients, keratolytic agents, and moisturizers, such as petrolatum, lanolin, mineral oil, dimethicone, lactic acid, salicylic acid, urea, and water, cater to diverse skin types and conditions.

- The market landscape is marked by the introduction of advanced technologies and the integration of natural and organic ingredients into dermatological products.

How is the Dermatological Drugs Industry segmented?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Biologics

- Small molecules

- Geography

- North America

- US

- Canada

- Europe

- Finland

- Asia

- Rest of World (ROW)

- North America

By Product Insights

The biologics segment is estimated to witness significant growth during the forecast period. The market is witnessing significant growth due to the increasing prevalence of various skin conditions such as acne, eczema, and rosacea. Customer preferences for effective topical treatments and the rising aging population are key drivers for market expansion. Environmental conditions and personal care expenditure also contribute to the market's growth. Companies are investing in research and development to introduce innovative products, including emollients, keratolytics, and treatments for dry skin, keratosis, xerosis, corns, callous, nail problems, ingrown nails, wounds, and dermatological products for the eyes, lips, mouth, nose, vaginal area, groin area, face, bathing, showering, and shampooing.

Biologics, including adalimumab, etanercept, and infliximab, are increasingly being used for dermatologic conditions, accounting for approximately 18% of the global pharmaceutical drugs market. The market is expected to continue growing due to the rising disposable income and healthcare expenditure, as well as the expiring patents of several dermatological drugs. Trade associations play a crucial role in promoting industry growth and collaboration. The market is global, with varying manufacturer price levels and VAT regulations, and companies employ various modeling approaches to forecast demand.

Get a glance at the market report of share of various segments Request Free Sample

The Biologics segment was valued at USD 10.07 billion in 2018 and showed a gradual increase during the forecast period.

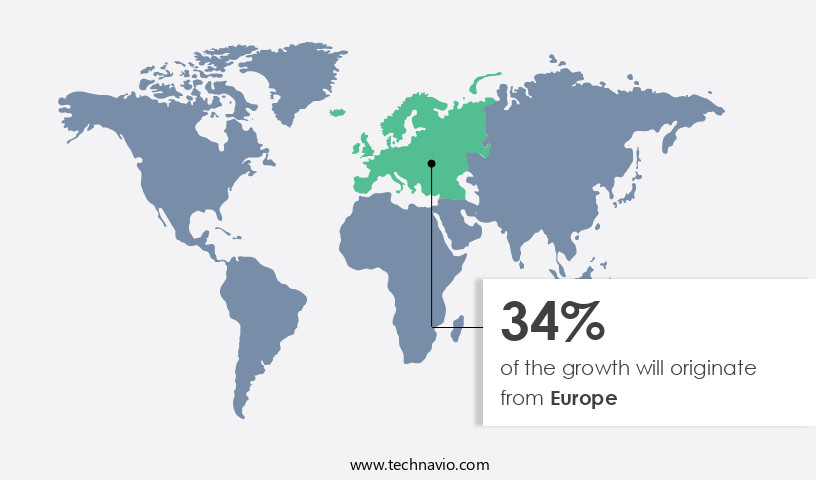

Regional Analysis

Europe is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The North American market is experiencing notable expansion due to the increasing geriatric population and high prevalence of skin diseases. In the US, the growing awareness of diagnostic dermatology tests among the elderly population is driving sales of dermatological drugs, particularly those used for treating various types of skin cancer, which are more common among the elderly. Customer preferences for effective treatments, environmental conditions, and personal care expenditure are additional factors fueling market growth. Companies are investing in research and development to introduce innovative products and cater to the evolving needs of consumers.

The market is also influenced by healthcare expenditure, expiring patents, and trade associations. Topical products for conditions such as acne, eczema, rosacea, dry skin, keratosis, xerosis, and nail problems are in high demand. Ingredients like emollients, keratolytic agents, and moisturizers are commonly used in these products. Water, petrolatum, lanolin, mineral oil, dimethicone, lactic acid, salicylic acid, urea, and corn and callous treatments are among the popular ingredients. Dermatological products for the eyes, lips, mouth, nose, vaginal area, groin area, and face are also gaining popularity. The market is segmented into doctor-prescribed and over-the-counter (OTC) products. Consumers often consult doctors or pharmacists for doctor-prescribed products, while OTC products can be purchased without a prescription.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the Dermatological Drugs Industry?

- The need for safe and stable drugs that require minimal monitoring is the key driver of the market. The market caters to the demand for safe and reliable medications for treating various skin conditions affecting the lips, mouth, nose, vaginal area, groin area, face, and other parts of the body. With an increasing number of people suffering from severe dermatologic conditions, there is a growing need for effective and safe drugs with minimal adverse effects. Rational drug use is essential in dermatology to ensure the use of appropriate, effective, and safe therapies in the recommended dosage and formulation for the correct indications and duration.

- Moreover, dermatologists play a crucial role in defining the illness, setting therapy objectives, using personalized treatment, initiating treatment, providing necessary information to patients, and monitoring their progress. Bathing, showering, and shampooing are common practices that require the use of various dermatological products such as moisturizers, shampoos, and cleansers. Ensuring the safety and efficacy of these products is essential to prevent adverse reactions and maintain patient compliance. Thus, such factors are driving the growth of the market during the forecast period

What are the market trends shaping the Dermatological Drugs Industry?

- An increase in prices of dermatological drugs is the upcoming market trend. The market is witnessing an upward trend due to the rising consumer demand and expedited approvals of new medications. Topical treatments remain the most affordable dermatological therapy, while small molecules follow. Biologics, on the other hand, are high-priced. To mitigate the high costs, manufacturers employ pricing strategies such as negotiated discounts with buyers and copay coupon cards. The introduction of biosimilars is anticipated to impact innovator drug prices and decrease the costs for subsequent follow-on biologics.

- In response, manufacturers of newer biologics focus on catering to specialized niche markets to justify their product pricing. The anticipated availability of effective and affordable biosimilars may temper the high prices of biologics in the dermatological drugs market. This includes treatments for various areas such as the lips, mouth, nose, vaginal area, groin area, face, and during bathing, showering, and shampooing, as well as the use of moisturizers.

What challenges does the Dermatological Drugs Industry face during its growth?

- The presence of access barriers for novel biologics and biosimilars is a key challenge affecting the industry's growth. The dermatological drugs market encompasses a range of pharmaceutical products designed for the treatment of various skin conditions affecting the lips, mouth, nose, vaginal area, groin area, face, and other parts of the body. The use of these drugs includes bathing, showering, and shampooing, as well as the application of moisturizers and specialized topical treatments. One significant segment of the market is dominated by TNF-alpha inhibitor biologics, which are primarily used for chronic inflammatory conditions.

- However, the high cost of these biologics, which are protected by clustered patents for another five years, limits their adoption. Regulatory bodies, such as the FDA and EMA, have responded by promoting the adoption of biosimilars, which are lower-priced alternatives. Yet, originator companies have implemented various legal and regulatory barriers to hinder the entry of biosimilars, extending their monopoly profits. Additionally, insurers' mandatory step therapy requirements further complicate the market landscape.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AbbVie

- Amgen Inc.

- Bausch Health Companies Inc.

- Botanix Pharmaceutical

- Bristol Myers Squibb Co.

- Cipla Inc.

- Dr Reddys Laboratories Ltd.

- F. Hoffmann La Roche Ltd.

- Galderma SA

- GlaxoSmithKline Plc

- Johnson and Johnson Services Inc.

- LEO Pharma AS

- Lupin Ltd.

- Novartis AG

- Pfizer Inc.

- Sanofi SA

- Sol Gel Technologies Ltd.

- Sun Pharmaceutical Industries Ltd.

- UCB SA

- Vibcare Pharma Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a wide range of pharmaceutical products designed to address various skin conditions and disorders. These conditions include but are not limited to, acne, eczema, rosacea, and a host of others, such as customer preferences influenced by environmental conditions. The global population's aging process and the subsequent increase in personal care expenditure have led to significant investments by companies in this sector. The rising disposable income in several regions has further fueled the growth of the market. A global comparison of healthcare expenditure reveals that a substantial portion is allocated towards the treatment of skin conditions, making it an attractive area for pharmaceutical companies.

Moreover, manufacturers employ various modeling approaches to develop effective dermatological drugs. These approaches include extensive research and development efforts to create topical products that cater to various skin types and conditions. The expiring patents of certain blockbuster drugs have opened up opportunities for new entrants in the market. The market dynamics for dermatological drugs are influenced by several factors. These include the prevalence of skin conditions, customer preferences, and the availability of effective treatments. Environmental conditions also play a crucial role in the demand for specific dermatological products. The market for dermatological drugs is diverse and expansive, with products targeting various body parts and conditions.

Furthermore, these include conditions affecting the eyes, lips, mouth, nose, vaginal area, groin area, face, and various other parts of the body. The use of these products extends to various activities such as bathing, showering, and shampooing. The market for dermatological drugs includes a wide range of products, from emollients and keratolytics for dry skin conditions to keratosis and xerosis treatments. These products employ various active ingredients such as water, petrolatum, lanolin, mineral oil, dimethicone, lactic acid, salicylic acid, urea, and others. The use of dermatological products is not limited to medical settings. Pharmacists and doctors play a crucial role in recommending these products to patients, while consumers increasingly rely on over-the-counter options for self-treatment.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

139 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.03% |

|

Market growth 2024-2028 |

USD 11.99 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.88 |

|

Key countries |

US, Finland, China, Canada, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Dermatological Drugs Market Research and Growth Report?

- CAGR of the Dermatological Drugs industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the dermatological drugs market growth of industry companies

We can help! Our analysts can customize this dermatological drugs market research report to meet your requirements.