Devsecops Market Size 2024-2028

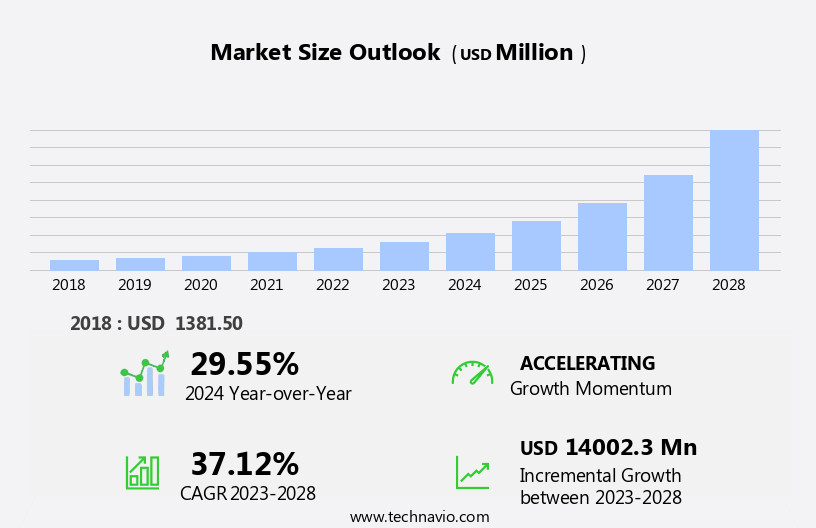

The devsecops market size is forecast to increase by USD 14 billion at a CAGR of 37.12% between 2023 and 2028.

What will be the Size of the Devsecops Market During the Forecast Period?

How is this Devsecops Industry segmented and which is the largest segment?

The devsecops industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Component

- Software

- Service

- Deployment

- On-premise

- Cloud

- Geography

- North America

- US

- APAC

- China

- India

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- North America

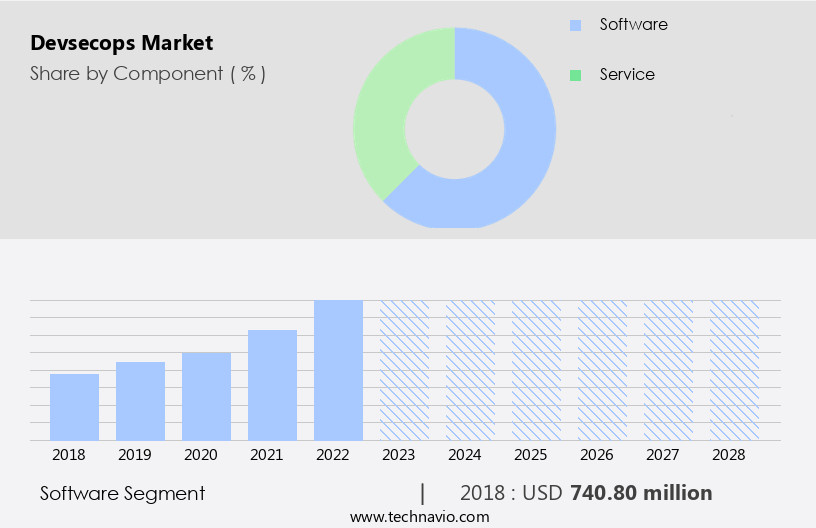

By Component Insights

The software segment is estimated to witness significant growth during the forecast period. The market, which encompasses the software segment, is experiencing substantial growth due to the integration of security in every phase of the software development lifecycle. DevSecOps, a combination of development, security, and operations, automates security processes in software design, integration, testing, deployment, and delivery. This approach enhances productivity and accelerates the systems development lifecycle in various industries, including retail, finance, telecommunications, and healthcare. IT modernization efforts, team collaboration, automation adoption, and cybersecurity concerns are driving the demand for DevSecOps solutions. Key industries, such as banking and insurance, are increasingly investing in DevSecOps to address data volumes, lockdowns, cloud services, and cyberattacks.

DevSecOps also supports IT security In the telecommunications segment, ensuring product quality, customer experience, delivery time, and release timelines. With the rise of 5G, Artificial Intelligence, Machine Learning, and Cloud Computing, the need for continuous monitoring, attacks, and defects resolution is more critical than ever. DevSecOps solutions offer scalability, speed, and 24/7 services, making them essential for small, medium, and large enterprises.

Get a glance at the market report of various segments Request Free Sample

The Software segment was valued at USD 740.80 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

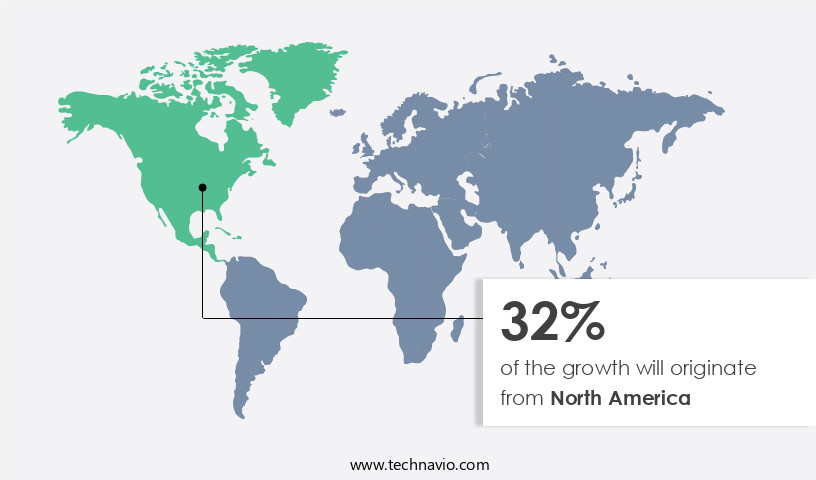

North America is estimated to contribute 32% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The North American region dominates the market due to its early adoption of advanced technologies in industries such as telecommunication, IT, and retail. With a highly developed industrial sector and a technologically mature economy, North America is an attractive market for DevSecOps solutions. The US, in particular, is a significant contributor to the regional market, being the industrial hub of the world and an early adopter of technology. In 2023, the prevalence and penetration of major companies In the region further propelled market growth. The market in North America is driven by IT modernization efforts, team collaboration, automation adoption, and security and compliance needs.

Key verticals, including healthcare, banking, insurance, and retail, are investing heavily in cloud computing, microservices, and service virtualization to enhance product quality, customer experience, and delivery time. The region's focus on 5G, Artificial Intelligence, and Machine Learning also creates opportunities for DevSecOps solutions to address increasing data volumes, cloud services, and cyberattacks. The market is further boosted by the shift to remote working and cloud deployment models, as well as the growing use of devices such as tablets and social media, which require speed, scalability, and 24/7 services. The market in North America is expected to continue its growth trajectory due to the increasing importance of IT security in telecommunications and other sectors.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Devsecops Industry?

- Increasing incidence of cyberattacks is the key driver of the market.The market experiences significant growth due to escalating cybercrimes and data breaches. With the proliferation of Internet of Things (IoT), IT, telecommunication, banking, insurance, and other industries' digital transformation, the attack surface expands, increasing the risk of cyberattacks. Advanced threats, including 5G, Artificial Intelligence (AI), and Machine Learning (ML), target networks and devices, leading to potential data loss and business disruption. Small and Medium Enterprises (SMEs) and Large Enterprises invest heavily in IT modernization efforts, focusing on team collaboration, automation adoption, software development, and security compliance. Microservices, service virtualization, and cloud computing are integral to these initiatives. The shift to remote working and cloud deployment models necessitates robust security measures.

Cyberattacks on telecommunications, retail, consumer goods, healthcare, and other sectors can lead to significant financial losses, reputational damage, and regulatory fines. The DevSecOps framework's continuous monitoring and integration of security into the development process help mitigate these risks. The market dynamics include the increasing data volumes, the need for 24/7 services, and the growing importance of IT security. The telecommunication segment's emphasis on product quality, customer experience, delivery time, and release timelines drives the demand for DevSecOps solutions. Cloud services, devices like tablets and social media, and the speed and scalability of applications further contribute to the market's growth.

What are the market trends shaping the Devsecops market?

- Increasing penetration of IoT and distributed denial-of-service (DDoS) attacks is the upcoming market trend.The market is experiencing significant growth due to the increasing number of cyberattacks on Internet of Things (IoT) devices and networks. With the proliferation of connected devices in IT, telecommunication, banking, insurance, healthcare, retail, and consumer goods sectors, the risk of cybercrimes, such as data breaches and security breaches, has escalated. According to recent estimates, there were approximately 14.4 billion IoT device breaches worldwide between January 2022 and December 2022, a significant increase from the 1.51 billion attacks reported in 2021. Hackers are primarily targeting networks with weak security, employing techniques like Denial-of-service (DoS) attacks to overwhelm user web servers and network resources, increasing network vulnerability.

As IT modernization efforts continue, team collaboration and automation adoption in software development have become essential for maintaining product quality, enhancing customer experience, and reducing delivery time and release timelines. Cloud computing, microservices, and service virtualization have also driven enterprise investments to ensure continuous monitoring and security compliance. With the advent of 5G and the integration of Artificial Intelligence (AI) and Machine Learning (ML) into IT infrastructure, the need for robust cybersecurity solutions has become more critical than ever. The DevSecOps framework, which emphasizes continuous monitoring and integration of security into the development process, is increasingly being adopted to mitigate the risks of cyberattacks and ensure the security of IT systems and data volumes.

Remote working and cloud deployment models have further accelerated the need for DevSecOps, as organizations grapple with securing devices, tablets, and social media platforms while ensuring speed, scalability, and 24/7 services. In conclusion, the market is poised for continued growth as organizations prioritize IT security, especially In the telecommunications segment, to protect against cyberattacks and maintain product quality and customer experience.

What challenges does the Devsecops Industry face during its growth?

- High costs of deploying enterprise DevSecOps is a key challenge affecting the industry growth.The market is witnessing significant growth due to the increasing need for advanced data security solutions among businesses and organizations. IT modernization efforts, telecommunications, banking, insurance, healthcare, retail, and consumer goods sectors are investing heavily in IT security to mitigate cybercrimes, data breaches, and cyberattacks. The adoption of cloud computing, microservices, and service virtualization is driving the demand for DevSecOps frameworks that support continuous monitoring, automation, and team collaboration. Key technologies such as Artificial Intelligence, Machine Learning, 5G, and Internet of Things are transforming the IT landscape, creating new challenges for security and compliance. Small and medium enterprises (SMEs) and large enterprises are adopting DevSecOps to address these challenges and ensure product quality, customer experience, delivery time, and release timelines.

However, implementing advanced data security solutions comes with its own set of challenges. These include high costs, complexity, data breakup, underused servers, resource-related challenges, and managing portability. Cloud deployment models, remote working, and the increasing use of devices like tablets and social media add to the complexity of IT security. Despite these challenges, businesses recognize the importance of investing in IT security to protect their data volumes and maintain 24/7 services. The market is expected to continue growing as businesses seek solutions to address their security needs while minimizing the impact on network infrastructure and maximizing speed and scalability.

Exclusive Customer Landscape

The devsecops market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the devsecops market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, devsecops market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Alphabet Inc. - The company specializes in devsecops solutions, encompassing offerings such as Google Cloud DevOps. By integrating security practices into the continuous delivery pipeline, this approach enables organizations to produce software more efficiently and effectively, while minimizing vulnerabilities. Devsecops combines the benefits of development and IT operations teams working collaboratively, resulting in faster release cycles and improved security posture. This methodology is gaining traction as businesses increasingly prioritize agility and security In their software development processes.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alphabet Inc.

- Aqua Security Software Ltd.

- Broadcom Inc.

- Check Point Software Technologies Ltd.

- Cloudflare Inc.

- Contrast Security Inc.

- Copado Inc.

- CyberArk Software Ltd.

- Entersoft Australia Pty Ltd.

- Fastly Inc.

- International Business Machines Corp.

- Microsoft Corp.

- Okta Inc.

- Palo Alto Networks Inc.

- Progress Software Corp.

- Qualys Inc.

- Riverbed Technology Inc.

- Synopsys Inc.

- ThreatModeler Software Inc.

- VMware Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is experiencing significant growth as businesses across various industries recognize the importance of integrating security into their IT operations. This market encompasses a range of solutions designed to help organizations secure their applications, infrastructure, and data In the context of continuous integration and delivery. IT and telecommunication industries are major contributors to the market due to their reliance on technology and the large volumes of data they handle. In sectors such as banking and insurance, where data security is paramount, DevSecOps practices enable faster and more secure IT modernization efforts. The adoption of 5G networks and the increasing use of artificial intelligence (AI) and machine learning (ML) technologies in business processes are driving the need for DevSecOps.

Small, medium, and large enterprises are investing in DevSecOps frameworks to enhance their security posture and improve their ability to respond to cybercrimes and data breaches. Cloud computing plays a significant role In the market, with many organizations moving towards cloud deployment models to take advantage of the speed, scalability, and 24/7 services that these platforms offer. However, this shift also presents new security challenges, as cloud services become increasingly targeted by cyberattacks. The telecommunications segment is another key area of focus for DevSecOps, as the industry undergoes a digital transformation and adopts new technologies such as microservices and service virtualization.

DevSecOps solutions are helping telecommunications providers to improve product quality, customer experience, and delivery time while ensuring compliance with regulatory requirements. The retail and consumer goods sectors are also investing in DevSecOps to enhance their IT security and protect against cyberattacks. With the rise of remote working and the increasing use of devices such as tablets and social media, the need for robust security measures is greater than ever. DevSecOps solutions are helping organizations to address the challenges of continuous monitoring and responding to attacks and defects in real-time. Team collaboration and automation adoption are also key benefits of DevSecOps, enabling faster software development and release timelines.

Enterprises are investing heavily in DevSecOps solutions to address the growing threat landscape and ensure the security and compliance of their IT infrastructure. As data volumes continue to grow and the use of cloud services becomes more prevalent, the importance of DevSecOps will only continue to increase. In conclusion, the market is experiencing significant growth as businesses across various industries adopt DevSecOps practices to enhance their IT security and improve their ability to respond to cybercrimes and data breaches. The market is driven by the increasing use of technology in business processes, the shift towards cloud computing, and the need for faster and more secure IT modernization efforts.

DevSecOps solutions are helping organizations to address the challenges of continuous monitoring, automation adoption, and team collaboration while ensuring compliance with regulatory requirements.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

165 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 37.12% |

|

Market growth 2024-2028 |

USD 14002.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

29.55 |

|

Key countries |

US, China, Germany, India, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Devsecops Market Research and Growth Report?

- CAGR of the Devsecops industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the devsecops market growth of industry companies

We can help! Our analysts can customize this devsecops market research report to meet your requirements.