Downhole Tools Market Size 2024-2028

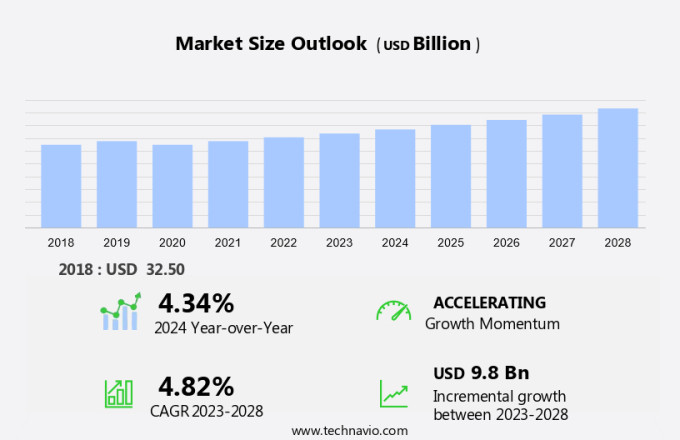

The downhole tools market size is forecast to increase by USD 9.8 billion at a CAGR of 4.82% between 2023 and 2028. The market is experiencing significant growth due to several key drivers. One major factor is the increasing production capacity in the energy sector, particularly in the exploration and extraction of unconventional oil and gas resources. Another trend is the adoption of new-generation automated drilling rigs, which improve efficiency and reduce operational costs. Additionally, volatility in crude oil prices continues to influence market growth. However, the industry is also facing challenges, such as the shift towards renewable energy and the need to reduce carbon emissions. Industry executives are focusing on developing heat transfer models and other advanced technologies to optimize downhole operations and improve overall performance. This market analysis report provides a comprehensive assessment of these trends and challenges, offering valuable insights for stakeholders in the downhole tools industry.

Market Analysis

The market plays a pivotal role in the hydrocarbon industry, particularly in the context of drilling processes and well intervention. These tools are essential components of the bottom hole assembly (BHA) used in oil well drilling, both onshore and offshore. They facilitate efficient drilling operations, improve formation evaluation, and ensure a reliable supply of crude oil and natural gas. Drilling techniques have evolved significantly over the years, with the advent of horizontal drilling and hydraulic fracturing revolutionizing the exploration and production of unconventional hydrocarbons such as shale gas and tight gas.

Moreover, downhole tools have been instrumental in enabling these advanced drilling methods, providing precise control and monitoring capabilities. The hydrocarbon industry's focus on energy security and supply reliability necessitates the continuous improvement of drilling operations. Downhole tools contribute to this goal by enhancing the performance of drilling activities, optimizing well completion, and facilitating effective well intervention. Formation evaluation is a critical aspect of drilling processes, and downhole tools play a significant role in this area. They enable accurate measurement of various geological parameters, providing valuable data for reservoir characterization and production forecasting. Trade activity in the hydrocarbon industry remains strong, with ongoing onshore projects and offshore ventures driving the demand for advanced downhole tools. Furthermore, the market for these tools is expected to grow, fueled by the increasing complexity of drilling operations and the need for improved efficiency and productivity.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Drilling

- Well intervention

- Completion

- Geography

- North America

- US

- Middle East and Africa

- Europe

- APAC

- China

- South America

- Brazil

- North America

By Application Insights

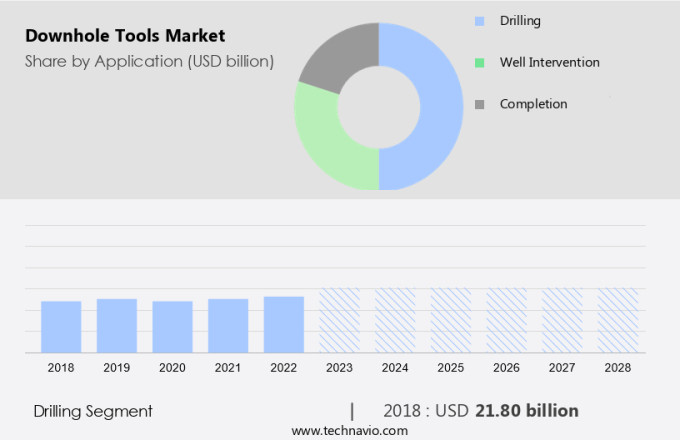

The drilling segment is estimated to witness significant growth during the forecast period. The energy sector, particularly oil companies, continues to face the challenge of extracting hydrocarbons from increasingly complex formations, with an average well depth surpassing 8,000 feet. To drill at these depths, specialized downhole tools are essential. These tools provide the necessary weight and pressure to maintain the drill string's cutting efficiency without significantly impacting the Rate of Penetration (ROP). The drilling segment dominates The market due to its extensive application. Furthermore, advanced well logging services, such as logging while drilling (LWD) and measurement while drilling (MWD), rely on downhole drilling tools for accurate data acquisition.

Furthermore, the market's growth is driven by the energy sector's need to maximize production capacity and improve operational efficiency. As the industry transitions towards renewable energy sources and reduces carbon emissions, the demand for downhole tools will remain significant.

Get a glance at the market share of various segments Request Free Sample

The drilling segment accounted for USD 21.80 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

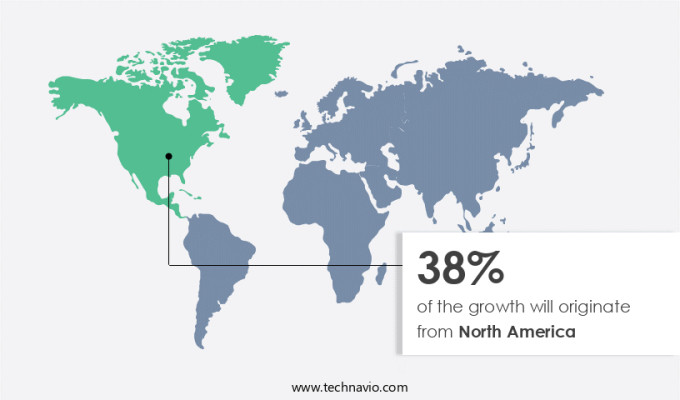

North America is estimated to contribute 38% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In the Americas, the demand for downhole tools is anticipated to expand significantly in 2023 due to the rising number of drilling rigs and the rise in hydrocarbon exploration and production activities. This trend is particularly noticeable in the context of the resurgence of shale drilling, including horizontal drilling and hydraulic fracturing, which are key techniques in extracting crude oil and natural gas from shale formations. The uptick in onshore projects in the US is expected to fuel the need for reliable downhole tools in the region. Furthermore, the revival of oil and gas companies' investments in the US, driven by the recovery of crude oil prices, will likely boost the demand for these essential tools.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The rise in unconventional oil and gas resources is the key driver of the market. Unconventional hydrocarbon resources, including shale gas and tight oil, have gained significant attention in the Hydrocarbon industry in recent years due to the depletion of conventional reserves. These resources are primarily found in low-permeability formations such as shale and tight sand, making their extraction more complex and costly compared to conventional sources. Offshore ventures have also turned to unconventional resources to supplement their production.

Formation and evaluation techniques have advanced to enable the exploration and production of these resources. Downhole control tools and drilling tools have been developed to effectively extract hydrocarbons from these formations. The use of unconventional hydrocarbons, such as shale gas and tight oil, is essential for meeting the increasing energy demands and globally. Despite the challenges, the benefits of unconventional resources outweigh the costs. The Hydrocarbon industry continues to invest in research and development to improve the efficiency and cost-effectiveness of unconventional resource production.

Market Trends

New-generation automated drilling rigs is the upcoming trend in the market. In the oil and gas industry, ensuring safety and operational efficiency is of paramount importance. Accidents can result in significant consequences, making it essential to minimize human error. The drilling process in this sector involves various techniques and activities, all of which require a high level of precision and attention. A

Automation has emerged as a viable solution to address these challenges. Widely adopted in industries such as automobile manufacturing, aeronautics, power generation, and utilities, automation offers several advantages. It enables the continuous repetition of tasks without the distractions or inconsistencies that humans may encounter. This, in turn, enhances operational efficiency and accuracy. As the energy sector focuses on energy security and supply reliability, the integration of automation in drilling processes can lead to significant cost savings and improved safety standards.

Market Challenge

Volatility in crude oil prices is a key challenge affecting the market growth. The oil and gas industry faces significant challenges due to the unpredictability of crude oil prices, which can significantly impact new drilling investments, refinery expansions, and contract terms. The oil price trend has shown inconsistency, with prices dropping from over USD 100/bbl in 2014 to under USD 35/bbl by May 2020.

This volatility affects the market for downhole tools, as the price of crude oil influences the cost of various derivative products, such as gasoline and lubricants. The oil market's instability necessitates careful planning and adaptability for companies operating in the oil well drilling, well intervention, and well completion sectors, both onshore and offshore.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Archer Ltd. - The company offers downhole tools for the entire well lifecycle, from well construction to decommissioning supported by laboratory and technical support.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aker Solutions ASA

- AKITA Drilling Ltd

- American Oilfield Tools Inc.

- Archer Ltd.

- Baker Hughes Co.

- Dril Quip Inc.

- General Electric Co.

- Halliburton Co.

- Hunting Plc

- Innovex

- NexTier Oilfield Solutions Inc.

- Nine Energy Service Inc

- NOV Inc.

- Schlumberger Ltd.

- Schoeller Bleckmann Oilfield Equipment AG

- Superior Energy Services Inc.

- Tasman Oil Tools Ltd.

- The Weir Group Plc

- Tryton Tool Services

- Weatherford International Plc

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market plays a crucial role in the energy sector, particularly in oil and gas exploration and production. These tools are essential for various drilling processes, including horizontal drilling and hydraulic fracturing, used in both onshore and offshore projects. The market caters to the needs of oil companies and industry executives, providing reliable tools for drilling operations, well intervention, and well completion. Downhole tools are integral to ensuring energy security and supply reliability by increasing production capacity. They are used in formation and evaluation, enabling accurate assessment of hydrocarbon reservoirs. Additionally, they are employed in impurity control, logging, and handling tools, ensuring the efficient extraction of crude oil and natural gas.

Furthermore, the market also serves the geothermal industries, utilizing heat transfer models and heat extraction systems for effective energy production. As the industry evolves, there is a growing focus on reducing carbon emissions, with downhole tools playing a vital role in optimizing drilling activities and improving overall efficiency. Domestic manufacturing of these tools is becoming increasingly important, ensuring the availability of reliable tools for drilling operations.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

155 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.82% |

|

Market growth 2024-2028 |

USD 9.8 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.34 |

|

Regional analysis |

North America, Middle East and Africa, Europe, APAC, and South America |

|

Performing market contribution |

North America at 38% |

|

Key countries |

US, Saudi Arabia, Russia, China, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Aker Solutions ASA, AKITA Drilling Ltd, American Oilfield Tools Inc., Archer Ltd., Baker Hughes Co., Dril Quip Inc., General Electric Co., Halliburton Co., Hunting Plc, Innovex, NexTier Oilfield Solutions Inc., Nine Energy Service Inc, NOV Inc., Schlumberger Ltd., Schoeller Bleckmann Oilfield Equipment AG, Superior Energy Services Inc., Tasman Oil Tools Ltd., The Weir Group Plc, Tryton Tool Services, and Weatherford International Plc |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Middle East and Africa, Europe, APAC, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch