Drone Data Link System Market Size 2025-2029

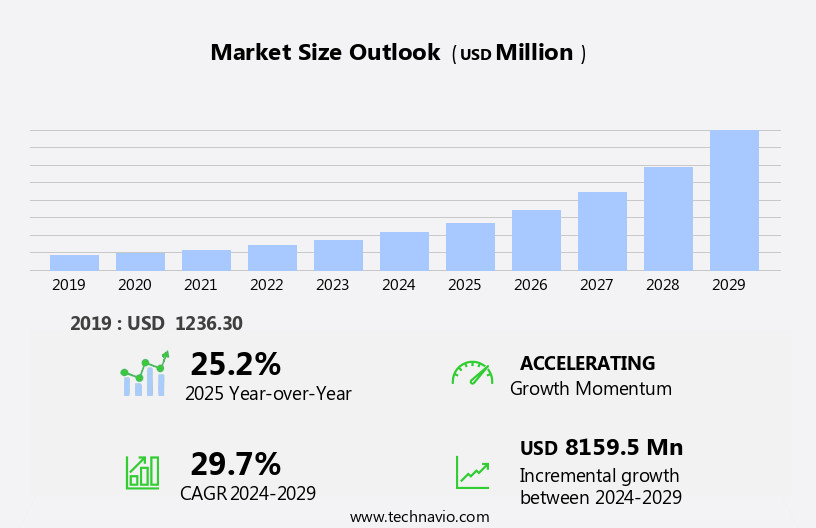

The drone data link system market size is forecast to increase by USD 8.16 billion at a CAGR of 29.7% between 2024 and 2029.

- The market is experiencing notable growth, driven by technological advancements, especially in the fields of network-centric warfare (NCW) and electronic warfare. NCW facilitates smooth communication and data exchange between military units, improving the efficiency of drone operations. However, this heightened connectivity also exposes drone data link systems to potential cybersecurity risks. With drones being increasingly utilized for surveillance and data gathering, securing the connection between the drone and the ground control station is becoming increasingly vital. Additionally, the integration of artificial intelligence and machine learning algorithms in drone systems is expected to further drive market growth. Despite these opportunities, the market faces challenges such as stringent regulatory frameworks and high implementation costs. Overall, the market is poised for strong growth, driven by technological advancements and the increasing demand for secure and efficient data transmission.

What will be the Drone Data Link System Market Size During the Forecast Period?

- The market encompasses technologies that enable real-time communication between unmanned aerial vehicles (UAVs) and ground control stations. These systems are integral to the functionality of drones in various sectors, including military applications. Drone data link systems consist of transceivers, ground stations, and communication protocols that facilitate live video, audio, sensor data transmission, and telemetry exchange. UAV autonomy is enhanced through these systems, allowing for greater payload capabilities and real-time situational awareness.

- Additionally, advancements in drone technology include the integration of encrypted communication, anti-jamming capabilities, and 5G connectivity to ensure secure and reliable data transmission. Electronic warfare developments and artificial intelligence are also driving innovation in this market. Different drone types, such as fixed wing, rotary wing, and hybrid, require tailored data link systems to optimize their performance. Ground control stations serve as the nerve center for drone operations, providing operators with critical information for effective surveillance and mission execution.

How is this Drone Data Link System Industry segmented and which is the largest segment?

The drone data link system industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Military

- Civil and commercial drones

- Application

- Fixed wing

- Rotary wing

- Hybrid

- Geography

- North America

- Canada

- US

- APAC

- China

- India

- Japan

- South Korea

- Europe

- Germany

- France

- Italy

- Middle East and Africa

- South America

- North America

By End-user Insights

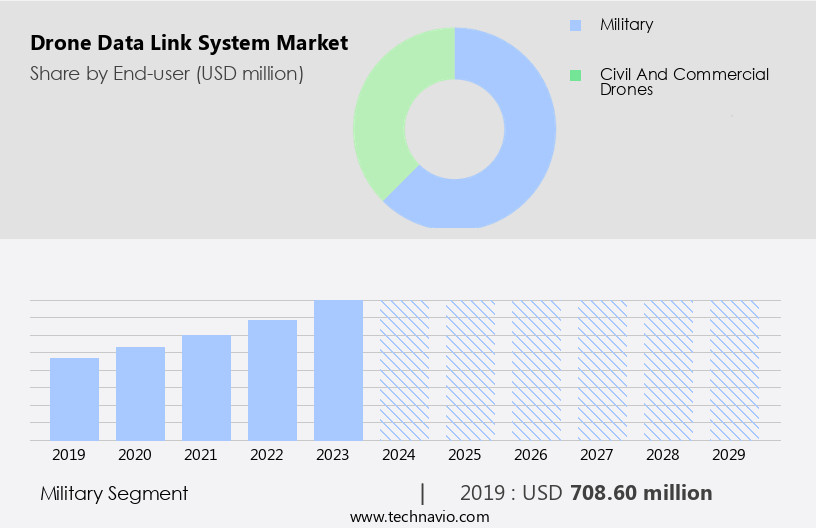

- The military segment is estimated to witness significant growth during the forecast period.

UAVs are increasingly utilized by military forces for operational and tactical purposes due to rising security concerns and modernization initiatives. The military sector's demand for UAVs is driven by geopolitical tensions, border disputes, and the need for real-time intelligence. To enhance UAV capabilities in modern warfare, companies invest in advanced technologies, including these systems. These systems enable high-speed, encrypted data transmission for military applications, ensuring mission success through uninterrupted data flow. Data link systems consist of transceivers, ground stations, and communication protocols, offering features such as live video, audio, remote operator control, surveillance, tracking, monitoring, enemy movements mapping, and surveying.

Additionally, the integration of drones in various sectors, including agriculture, law enforcement, and industry, also necessitates secure data transmission. Despite the high cost and regulatory restrictions, the demand for advanced data link systems continues to grow, driven by the need for enhanced situational awareness, mission planning, data analytics, and secure communication channels. Companies focus on developing data link systems for fixed-wing, rotary-wing, multi-rotor, and hybrid UAVs, utilizing satellite communication, cellular communication, and Wi-Fi communication. Security threats, privacy risks, and cybersecurity challenges necessitate the implementation of encryption protocols, anti-jamming capabilities, and 5G connectivity.

Get a glance at the Drone Data Link System Industry report of share of various segments Request Free Sample

The military segment was valued at USD 708.60 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 39% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American market holds a significant share in the global UAV industry, with the US being a major operator of military-grade drones. The US Department of Defense and NASA are investing in advanced electronics and sensors for military UAVs, including data link systems. These systems, such as BADDC routers, act as payload data multiplexers, increasing the data transmission capacity of UAVs within network limitations. Military applications, including surveillance, tracking, monitoring enemy movements, and mapping, are primary drivers for the use of drones in the defense sector. Advanced features like real-time data transmission, telemetry exchange, and UAV autonomy are essential for these applications.

Additionally, global military expenditure, cloud-based services, and the integration of satellite communication systems, cellular communication, and Wi-Fi communication further boost the demand for data link systems. However, regulatory restrictions, skilled personnel requirements, security threats, and privacy risks pose challenges to the market's growth. Companies like AeroVironment Inc focus on organic and inorganic growth strategies, including acquisitions, to expand their offerings and cater to various drone types and applications, including military, commercial, agriculture, and law enforcement.

Market Dynamics

Our drone data link system market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Drone Data Link System Industry?

Advancements in electronic warfare are the key driver of the market.

- The market has witnessed significant growth in recent years due to the increasing adoption of drones in various sectors, particularly in the military and defense industry. Data link systems enable real-time communication between drones and ground stations, allowing for live video, audio, and telemetry exchange. These systems are essential for military applications such as surveillance, tracking, monitoring enemy movements, mapping, and surveying. Advanced features, including encrypted communication, anti-jamming capabilities, and 5G connectivity, enhance situational awareness and mission planning. Both high-cost and low-cost drones, including fixed-wing UAVs, rotary-wing UAVs, multi-rotor UAVs, and hybrid UAVs, utilize these systems. The market is driven by global military expenditure, cloud-based services, and the need for real-time data transmission.

- However, regulatory restrictions, skilled personnel requirements, and security and privacy risks pose challenges. Satellite communication systems, cellular communication, and Wi-Fi communication are common communication protocols used in these systems. Civil and commercial applications, such as agriculture, law enforcement, and industrial inspections, also utilize drones systems. Organic and inorganic growth strategies, including acquisitions, are being employed by key players to expand their market presence.

- Thus, the market is expected to continue growing due to the increasing demand for enhanced situational awareness, data analytics, and UAV autonomy. However, cybersecurity threats, hacking attempts, signal interference, and data breaches pose significant challenges to the market's growth. The system providers must prioritize encryption protocols, secure communication channels, and anti-jamming capabilities to mitigate these risks.

What are the market trends shaping the Drone Data Link System Industry?

Network-centric warfare (NCW) is the upcoming market trend.

- The market encompasses the technologies and systems enabling real-time communication between drones and their ground stations. In the military sector, these systems are essential for live video, audio, surveillance, tracking, monitoring of enemy movements, mapping, surveying, and inspection. Advanced features, such as encrypted communication, anti-jamming capabilities, and 5G connectivity, enhance situational awareness and mission planning. Military applications dominate the market, with the defense sector and law enforcement agencies being significant users. However, commercial and industrial applications, including agriculture, are experiencing organic growth. Low-cost drones are gaining popularity due to their accessibility, while high-end models offer advanced features. Global military expenditure drives demand for advanced data link systems, with cloud-based services offering real-time data and data analytics.

- Additionally, regulatory restrictions and security threats, including privacy risks and cybersecurity threats, pose challenges. Satellite communication systems, cellular communication, and Wi-Fi communication are common communication protocols. Manufacturers, such as AeroVironment Inc, offer fixed-wing UAVs, rotary-wing UAVs, multi-rotor UAVs, and hybrid UAVs, catering to various military and commercial applications. The market's future growth may be influenced by electronic warfare developments, artificial intelligence, and UAV autonomy.

- Thus, effective communication systems are crucial for drone operations, ensuring payload capabilities, telemetry exchange, and UAV autonomy. Enhanced communication protocols, such as encrypted communication and secure communication channels, protect against hacking attempts, signal interference, and data breaches.

What challenges does the Drone Data Link System Industry face during its growth?

Vulnerability to cybersecurity threats is a key challenge affecting the industry's growth.

- Drone data link systems play a crucial role in enabling real-time communication between unmanned aerial vehicles (UAVs) and their ground control stations. In the military sector, these systems are essential for surveillance, tracking, monitoring enemy movements, and mission planning. Military applications of drone data link systems include fixed-wing UAVs, rotary-wing UAVs, multi-rotor UAVs, and hybrid UAVs. These systems use transceivers to transmit live video, audio, and telemetry data to the ground station, allowing remote operators to make informed decisions. However, data link systems for drones come with challenges such as regulatory restrictions, security threats, and privacy risks. For instance, unencrypted communication channels like Wi-Fi can leave drones vulnerable to hacking attempts and signal interference.

- Moreover, high-cost drones with advanced features require skilled personnel to operate and maintain the systems. The global military expenditure on drone technology continues to grow, driving demand for cloud-based services that offer real-time data and enhanced situational awareness. Advanced communication protocols, encrypted communication, and anti-jamming capabilities are essential features for secure data transmission. The integration of 5G connectivity and artificial intelligence is expected to further enhance the capabilities of drone data link systems. Civil and industrial applications of drones, such as agriculture, law enforcement, and inspection, also require effective data link systems. The use of low-cost drones with limited communication capabilities poses unique challenges, necessitating organic and inorganic growth strategies such as acquisitions and partnerships.

- In summary, drone data link systems are a critical component of UAV operations, enabling real-time communication and data exchange between the platform and the ground control station. The market is driven by military applications, but civil and industrial uses are also growing. Security, privacy, and regulatory concerns necessitate advanced communication protocols, encryption, and anti-jamming capabilities. The integration of 5G and AI is expected to further enhance the capabilities of these systems.

Exclusive Customer Landscape

The drone data link system market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the drone data link system market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, drone data link system market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AeroVironment Inc. - The company primarily offers the design, development, production, delivery, and support of a technologically advanced portfolio of intelligent, multi-domain robotic and drone systems and related services for government agencies, and businesses.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 911Security

- AeroVironment Inc.

- Airbus SE

- BERTEN DSP SL

- Censys Technologies Crop.

- Commtact Ltd.

- CP Technologies LLC

- Cubic Corp.

- Edge Autonomy

- Elbit Systems Ltd.

- IMC Microwave Industries Ltd.

- Inmarsat Global Ltd.

- Meteksan Defence Industry Inc.

- Silvus Technologies Inc.

- Space and Defence Technologies Inc.

- SZ DJI Technology Co. Ltd.

- Thales Group

- UAV Navigation SL

- UAVOS Inc.

- UAVRADIO

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses the technologies and infrastructure that enable real-time communication between unmanned aerial vehicles (UAVs) and their ground control stations. These systems play a crucial role in various sectors, including military and civil applications, by facilitating the transmission of live video, audio, telemetry, and other critical data. Data link systems are integral components of UAVs, enabling operators to maintain situational awareness and control over their aircraft in real-time. These systems utilize various communication technologies, such as satellite communication, cellular communication, and Wi-Fi, to ensure reliable and secure data transmission. Ground control stations serve as the central hub for managing UAV operations. They receive data from the drones and provide operators with real-time information, enabling them to make informed decisions and adjust flight paths as needed. Advanced features, such as mission planning, data analytics, and airspace management, further enhance the functionality of these systems.

Additionally, the military sector has been a significant driver of the market due to the need for real-time intelligence, surveillance, and reconnaissance capabilities. Military applications include tracking enemy movements, monitoring territory, and mapping and surveying areas. In recent years, there has been a growing trend towards the use of advanced features, such as encrypted communication, anti-jamming capabilities, and 5G connectivity, to enhance situational awareness and ensure secure communication channels. Civil applications of drone data link systems are also on the rise, with commercial and industrial users increasingly adopting UAVs for various purposes. Agriculture applications, such as crop monitoring and precision farming, have gained significant traction, while law enforcement agencies use drones for surveillance and search and rescue missions. The market faces several challenges, including regulatory restrictions, the need for skilled personnel, and security threats. Regulators are implementing strict guidelines to ensure the safe and secure operation of UAVs, while the need for cybersecurity measures to protect against hacking attempts, signal interference, and data breaches is becoming increasingly important.

Thus, despite these challenges, the market for drone data link systems is expected to grow significantly in the coming years. Organic growth strategies, such as product innovation and expansion into new markets, as well as inorganic growth strategies, such as acquisitions and partnerships, are driving market growth. In summary, the market plays a vital role in enabling real-time communication between UAVs and their ground control stations. These systems are essential for various sectors, including military and civil applications, and are driving innovation and growth in the UAV industry. However, regulatory restrictions, security threats, and the need for skilled personnel pose challenges that must be addressed to ensure the continued growth and success of the market.

|

Drone Data Link System Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

200 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 29.7% |

|

Market growth 2025-2029 |

USD 8.16 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

25.2 |

|

Key countries |

US, China, Canada, South Korea, Japan, Russia, India, France, Germany, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Drone Data Link System Market Research and Growth Report?

- CAGR of the Drone Data Link System industry during the forecast period

- Detailed information on factors that will drive the Drone Data Link System growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the drone data link system market growth of industry companies

We can help! Our analysts can customize this drone data link system market research report to meet your requirements.