Satellite Market Size 2024-2028

The satellite market size is forecast to increase by USD 14.53 billion at a CAGR of 3.31% between 2023 and 2028. The market is experiencing significant growth, driven by the increasing demand for DTH services and satellite-based telemetry applications. The number of DTH subscribers continues to rise, fueled by the availability of affordable satellite receivers. High-throughput satellites (HTS) are gaining popularity due to their ability to provide faster data transmission rates, making them ideal for IoT devices and other bandwidth-intensive applications. The high cost of satellite hardware and components remains a challenge, but innovations such as 3D-printed satellite parts are helping to reduce costs. OneWeb, among others, is leading the charge in this area, with plans to launch a constellation of low Earth orbit satellites to provide global connectivity. Overall, the market is poised for continued growth, driven by advancements in technology and increasing demand for reliable, high-speed connectivity.

The market is witnessing significant growth due to the increasing demand for artificial satellites in various applications such as communication, earth observation, navigation, scientific research, and space exploration. These satellites are launched into different orbits, including Low Earth Orbit (LEO), Medium Earth Orbit (MEO), and Geostationary Earth Orbit (GEO), depending on their function. Communication is a major application segment in the market, driving the demand for satellite services, including satellite-based internet services and voice communications. Earth observation is another significant application area, with satellite imaging playing a crucial role in areas like agriculture, forestry, and disaster management. High-throughput satellites and mega constellations, such as Starlink satellites, are emerging trends in the market, aiming to bridge the digital divide by providing internet access to remote and underserved areas.

Furthermore, space exploration missions and satellite-based warfare are other key applications driving the growth of the market. Small satellites are gaining popularity due to their cost-effectiveness and ease of deployment. Satellite data transmission is another crucial aspect of the market, with space data being used for various applications, including television and video distribution, digital television, and internet access. The market is witnessing significant investments from satellite enterprises, communication service providers, and space-focused firms.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Civil

- Defense

- Type

- Large

- medium satellite

- Small satellite

- Geography

- North America

- US

- Europe

- France

- APAC

- China

- Japan

- Middle East and Africa

- South America

- North America

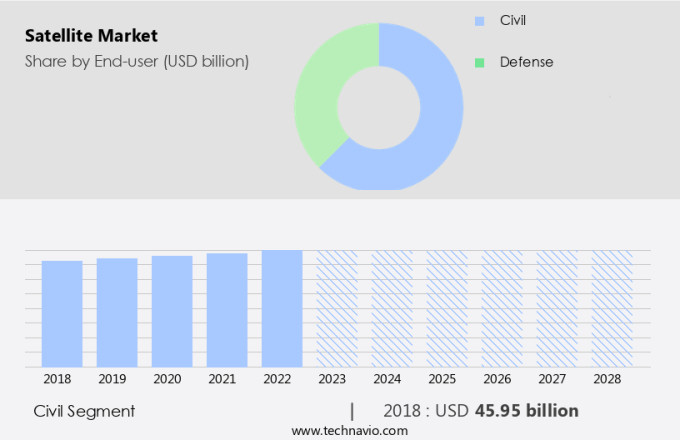

By End-user Insights

The civil segment is estimated to witness significant growth during the forecast period. Satellites play a crucial role in driving economic growth for various sectors, including commercial enterprises, government agencies, and the telecommunications and space industries. These technological marvels come in different forms, determined by their frequency, orbit, and mission objectives. With the escalating demand for Internet services and the growing number of mobile users, satellites have found extensive applications in civilian domains, such as voice communications, satellite-based internet services, and meteorology. Manufacturers of GPS receivers cater to the needs of civilians, particularly scientists and surveyors, who rely on these devices for precise time and position measurements for research and surveying purposes. Additionally, satellites contribute significantly to civil aviation, ensuring optimal navigational services and flight information region (FIR) coverage.

Get a glance at the market share of various segments Request Free Sample

The civil segment was valued at USD 45.95 billion in 2018 and showed a gradual increase during the forecast period.

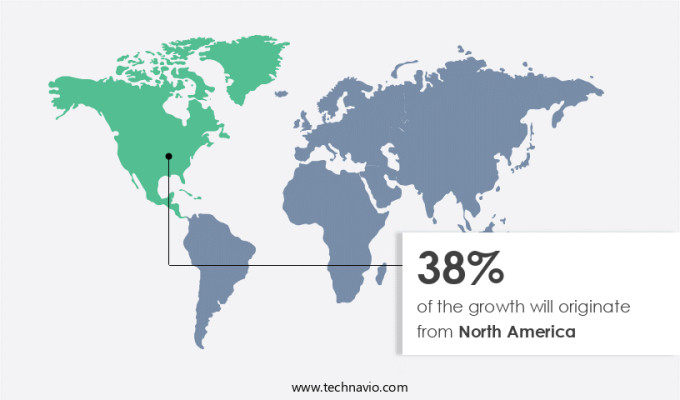

Regional Insights

North America is estimated to contribute 38% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Satellite services play a crucial role in various applications, including satellite imaging, internet connectivity, and voice communications. North America is a significant market for these services, with the US, Canada, and Mexico being the primary consumers. The US, in particular, has a strong civil space sector, led by NASA, which focuses on maintaining four main activities: aeronautical research, exploration systems, science, and space operations. The demand for satellites in the US civil sector has risen, especially for navigation, communications, and location-based services (LBS). High-throughput satellites are increasingly being used to bridge the digital divide and provide satellite-based internet services to remote areas. Furthermore, space exploration missions also contribute significantly to the market in North America.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The accelerating demand for satellite navigation equipment is the key driver of the market. Artificial satellites play a pivotal role in various applications, including communication, Earth observation, navigation, and scientific research. Orbiting the Earth at different altitudes, these satellites offer continuous coverage and early detection capabilities. For instance, they are utilized for strategic and tactical operations, such as monitoring enemy weapon development and pre-positioning military assets in strategic locations during potential conflicts. Communication satellites facilitate global connectivity, enabling voice and data transmission between distant regions.

Furthermore, Earth observation satellites provide valuable data for agriculture, environmental monitoring, and disaster management. Navigation satellites, such as GPS, enable precise location determination. Furthermore, LEO (Low Earth Orbit) satellites are increasingly being used for space exploration and scientific research. With advancements in technology, miniaturization, and collaboration, countries and organizations can access these capabilities through their own networks or partnerships.

Market Trends

The growing satellite-based telemetry applications is the upcoming trend in the market. Artificial satellites play a crucial role in various applications, including communication, Earth observation, navigation, and scientific research. Orbiting satellites enable the transmission of signals over vast distances, making them indispensable for global connectivity. In the realm of Earth observation, satellites provide valuable data for monitoring environmental changes, natural disasters, and urban development. Navigation systems, such as GPS, rely on satellites to determine precise locations.

Moreover, satellites facilitate scientific research in numerous domains. For instance, they are used to track the movements of animals and birds on Earth through radio signals transmitted from transmitters attached to the targets. The satellites calculate the distance between the transmitter and the satellite, enabling researchers to determine the transmitter's location on the ground. This technology has significant applications in fields like ecology, conservation, and wildlife management. Overall, the demand for satellite technology continues to grow, driven by the need for efficient communication, accurate navigation, and advanced scientific research.

Market Challenge

The high cost of satellite hardware and components is a key challenge affecting the market growth. Artificial satellites play a crucial role in various applications such as communication, Earth observation, navigation, scientific research, and space exploration. These satellites orbit the Earth at different altitudes, including Low Earth Orbit (LEO), Medium Earth Orbit (MEO), and Geostationary Earth Orbit (GEO). The development and manufacture of satellites entail significant challenges due to the extreme space environment and stringent security and certification requirements. Satellites have evolved to become larger, more complex, and costlier machines. Building a satellite involves extensive resources and financial support for design, construction, launch, and monitoring. Equipment and materials used in satellite manufacturing contribute significantly to the overall cost.

Transponders, which are essential components for communication, cost hundreds of thousands of dollars annually to maintain. The minimum cost of bandwidth per MHz is priced at approximately USD3,500 per month. Despite these challenges, the market continues to grow, driven by the increasing demand for advanced satellite technologies and applications.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Airbus SE - The company offers satellites such as Optical Earth observation satellites, and Radar Earth observation satellites.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AAC Clyde Space AB

- Airbus SE

- Ball Corp.

- EnduroSat

- Eutelsat SA

- Gilat Satellite Networks Ltd.

- Intelsat US LLC

- Kongsberg Gruppen ASA

- L3Harris Technologies Inc.

- Leidos Holdings Inc.

- Lockheed Martin Corp.

- Maxar Technologies Inc.

- Mitsubishi Electric Corp.

- Northrop Grumman Corp.

- OHB SE

- Raytheon Technologies Corp.

- Safran SA

- Sierra Nevada Corp.

- Space Exploration Technologies Corp.

- Terran Orbital Corp.

- Thales Group

- The Boeing Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing demand for artificial satellites in various applications such as communication, earth observation, navigation, and scientific research. The market is segmented based on orbit type and function. Low Earth Orbit (LEO) satellites dominate the market due to their ability to provide real-time data and services. Satellite services include communication, satellite-based internet services, digital television, and Direct-to-Home (DTH) services. High-throughput satellites (HTS) are gaining popularity due to their ability to provide high-speed internet connectivity, bridging the digital divide in remote areas. Space exploration missions, satellite-based warfare, and space data are other applications driving market growth.

Furthermore, mega constellations, such as Starlink satellites, OneWeb, and Amazon's Project Kuiper, are transforming the satellite industry with their large numbers of satellites in LEO. Satellite enterprises, communication service providers, and space-focused firms are investing in the development of small satellites, including nanosatellites, microsatellites, and minisatellites, for cost-effective solutions. Satellite data transmission is crucial for various applications, including IoT devices, weather forecasting, mapping and navigation, and surveillance and security. The market trends include the use of 3D-printed satellite parts, the integration of HTS in DTH services, and the growth of satellite receiver technology. Cable infrastructure and DTH subscribers are expected to decline due to the increasing popularity of satellite-based internet services and digital television.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

172 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.31% |

|

Market growth 2024-2028 |

USD 14.53 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

2.94 |

|

Regional analysis |

North America, Europe, APAC, Middle East and Africa, and South America |

|

Performing market contribution |

North America at 38% |

|

Key countries |

US, China, Japan, Russia, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AAC Clyde Space AB, Airbus SE, Ball Corp., EnduroSat, Eutelsat SA, Gilat Satellite Networks Ltd., Intelsat US LLC, Kongsberg Gruppen ASA, L3Harris Technologies Inc., Leidos Holdings Inc., Lockheed Martin Corp., Maxar Technologies Inc., Mitsubishi Electric Corp., Northrop Grumman Corp., OHB SE, Raytheon Technologies Corp., Safran SA, Sierra Nevada Corp., Space Exploration Technologies Corp., Terran Orbital Corp., Thales Group, and The Boeing Co. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch