Drone Package Delivery Market Size 2024-2028

The drone package delivery market size is forecast to increase by USD 33.81 billion at a CAGR of 64.16% between 2023 and 2028.

- The market is witnessing significant growth due to the increasing adoption of drones by e-commerce companies for expedited delivery services. This trend is driven by the growing consumer demand for faster and more convenient delivery options, particularly in light of the COVID-19 pandemic's impact on traditional supply chain networks. Additionally, the integration of blockchain technology in drone package delivery is expected to enhance security and transparency, providing an extra layer of trust for both customers and businesses. However, the market faces challenges due to the complex regulatory landscape governing the use of Unmanned Aerial Vehicles (UAVs) in various regions.

- Restrictive laws and regulations, such as those related to airspace restrictions, privacy concerns, and safety requirements, can hinder market growth and require companies to navigate these complexities carefully. To capitalize on market opportunities and navigate challenges effectively, companies must stay informed of regulatory developments and invest in technology solutions that address safety, security, and efficiency concerns. By doing so, they can position themselves as leaders in the rapidly evolving the market.

What will be the Size of the Drone Package Delivery Market during the forecast period?

-

The Drone Package Delivery Market is soaring with delivery drones and autonomous delivery drones revolutionizing logistics. Medical delivery drones enable rapid medical supply drone delivery, dental clinic supply delivery, pharmaceutical drone delivery, diagnostic imaging equipment delivery, and orthodontic aligner delivery. AI-powered drone delivery enhances efficiency, while eco-friendly drone delivery and solar-powered delivery drones align with sustainability. Drone package delivery market trends 2025 highlight last-mile drone delivery and drone delivery for emergency supplies. Secure drone package delivery, real-time drone delivery tracking, drone logistics for dental clinics, and drone delivery for orthodontic practices ensure precision. Autonomous drone fleets and the drone package delivery market forecast 2030 signal robust growth for innovative delivery solutions.

- Environmental impact, delivery routes, and predictive maintenance are essential aspects of drone delivery, with companies exploring ways to minimize carbon emissions and optimize delivery logistics. Delivery transparency, customer experience, and emergency response capabilities are also critical components, as the industry continues to adapt and innovate. Delivery networks and delivery optimization are at the forefront of drone technology, with flight planning and certifications playing a vital role in ensuring delivery efficiency and safety. As the market continues to unfold, the focus on delivery automation, drone integration, and regulatory compliance will remain paramount. Applications in medical supplies, food delivery, disaster relief, and other sectors are expanding, offering new opportunities for growth and innovation.

How is this Drone Package Delivery Industry segmented?

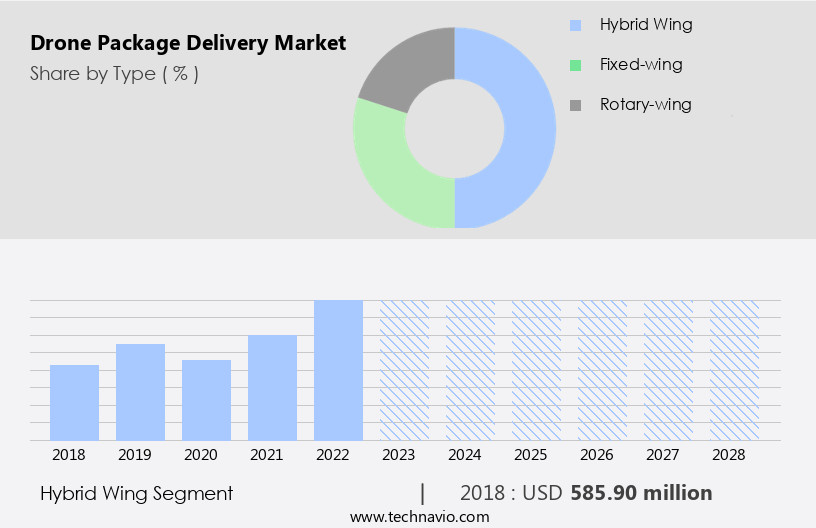

The drone package delivery industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Hybrid wing

- Fixed-wing

- Rotary-wing

- Application

- E-commerce

- Medical Supplies

- Food Delivery

- Range

- Short-Range

- Medium-Range

- Long-Range

- End-User

- Retail

- Logistics

- Healthcare

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The hybrid wing segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant advancements, with the hybrid wing segment poised for substantial growth. This segment's expansion is attributed to the introduction of innovative drone designs, enhancing delivery capabilities within urban areas. Manufacturers focus on developing drones for city-limit package delivery and integrating features such as vertical landing and AI-based collision avoidance systems. These advancements propel the demand for hybrid drones, driving the growth of the global market. Moreover, the market is witnessing progress in drone infrastructure, including delivery platforms, air traffic management, and regulatory frameworks. Autonomous delivery systems and predictive maintenance are improving delivery reliability and efficiency.

Delivery networks are expanding to cater to various industries, including medical supplies, food delivery, and disaster relief, while addressing environmental concerns and carbon emissions. Data analytics, sensors, and cybersecurity are crucial components of drone technology, ensuring secure and transparent delivery services. Regulations, safety, and liability are key considerations for drone operations, with insurance and charging stations addressing potential challenges. Delivery optimization and automation are essential for efficient last-mile delivery, while emergency response applications are gaining traction. The market's evolution encompasses the integration of drones into delivery logistics, enhancing customer experience and streamlining operations. As drone technology continues to advance, it will revolutionize delivery networks, enabling faster, more reliable, and sustainable package delivery solutions.

The Hybrid wing segment was valued at USD 585.90 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 52% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth due to the increasing adoption of commercial drones by transportation and logistics companies. Drones offer several advantages over traditional delivery methods, including faster delivery speeds, extended drone range, and improved reliability. The infrastructure for drone delivery is also expanding, with delivery platforms and drone charging stations becoming more common. Autonomous delivery using drones is becoming increasingly viable, reducing the need for manual labor and improving efficiency. However, challenges such as drone traffic management, battery life, and liability remain. Regulations surrounding drone use are also evolving, with a focus on safety, airspace management, and cybersecurity.

The market is expected to see continued growth in sectors such as medical supplies, food delivery, and disaster relief, particularly in rural and remote locations. Companies are also investing in predictive maintenance and delivery optimization technologies to enhance efficiency and customer experience. Despite concerns around environmental impact, carbon emissions from drones are expected to be lower than those from traditional delivery vehicles. Overall, the market is poised for continued growth, driven by the integration of drone technology into various industries and the need for efficient, reliable, and cost-effective delivery solutions.

Market Dynamics

The market continues to evolve, with dynamic market dynamics shaping its development across various sectors. Drone range and delivery speed are key considerations, as companies strive to optimize their offerings for efficient last-mile delivery. Drone infrastructure and battery life are also crucial elements, with ongoing advancements in autonomous delivery systems and traffic management systems aimed at enhancing delivery reliability. Drone liability, maintenance, and cybersecurity are significant concerns, as the industry navigates the complexities of drone insurance, compliance, and data security. Delivery platforms and air traffic management systems are being integrated to ensure safe and efficient drone operations in urban areas and rural communities.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Drone Package Delivery Industry?

- The significant expansion in the deployment of drones by e-commerce firms serves as the primary catalyst for market growth.

- Drone delivery is an emerging automated logistics solution in the global e-commerce industry, gaining traction due to rising costs of fuel, fleet service and maintenance, and labor. This trend is driving logistics players to invest in drone operations in partnership with e-commerce companies to remain competitive. For instance, EHang's collaboration with Aerotree Flight Services Sdn. Bhd. In March 2022 for urban air mobility (UAM) business development in Malaysia includes MRO and training. Drones offer several advantages, including quick delivery in rural communities, reduced carbon emissions, and disaster relief operations.

- However, challenges such as drone safety, noise pollution, and delivery cost, along with the need for drone charging stations and predictive maintenance, require careful consideration. Delivery logistics and payload capacity are also crucial factors. Despite these challenges, the benefits of drone delivery are compelling, making it a promising solution for the future of logistics.

What are the market trends shaping the Drone Package Delivery Industry?

- The use of blockchain technology in drone package delivery is an emerging market trend. This innovative approach combines the security and transparency of blockchain with the efficiency and convenience of drone delivery, offering a new level of trust and accountability in the logistics industry.

- Drone package delivery is revolutionizing the logistics industry with the integration of advanced drone technology and blockchain. Blockchain, a digital platform with distributed transaction ledgers, ensures data consistency and security for all stakeholders. In drone delivery, cloud infrastructure and virtualization are employed to provide flexibility and scalability in the supply chain solution. During the forecast period, drones are mandated to carry cryptographical material for secure communication and data protection. A blockchain-based repository is utilized to store operational information, including time, resources, location, package route, and delivery date, for data authentication. This data is accessible only to authorized drones, enhancing delivery transparency and efficiency.

- Drone software plays a crucial role in delivery optimization and automation, enabling flight planning, drone airspace management, and delivery tracking. Customer experience is prioritized through real-time package location updates and emergency response capabilities. Overall, the integration of drone technology and blockchain is transforming the delivery landscape, offering a secure, efficient, and immersive experience for customers.

What challenges does the Drone Package Delivery Industry face during its growth?

- The strict regulations and limitations imposed on the use of Unmanned Aerial Vehicles (UAVs) represent a significant challenge to the industry's growth trajectory.

- The market is gaining traction due to the unique advantages offered by drones over traditional delivery methods. Drones have extended operational ranges compared to crewed aircraft, enabling faster delivery speeds. However, the growth of this market is influenced by various regulations and infrastructural challenges. Governments and commercial entities utilize unmanned aerial vehicles (UAVs) and drones for diverse applications. However, the scope of their usage is subject to numerous laws and regulations enacted by different governments worldwide. For instance, the Federal Aviation Administration (FAA) in the US has imposed several regulations that limit the expansion of the market.

- One of the significant challenges in drone delivery is ensuring sufficient drone battery life for long-distance deliveries. Autonomous delivery systems require robust drone infrastructure, including drone traffic management and maintenance. Additionally, air traffic management and environmental impact are essential considerations for drone delivery platforms. Data analytics and drone sensors play a crucial role in optimizing delivery routes and enhancing the overall efficiency of drone delivery operations. However, drone liability remains a significant concern for businesses and consumers alike. Addressing these challenges and ensuring regulatory compliance are essential for the growth and success of the market.

Exclusive Customer Landscape

The drone package delivery market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the drone package delivery market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, drone package delivery market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aerodyne Group - This company specializes in innovative drone delivery solutions, including Skyways drone technology for efficient shore-to-ship transportation.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aerodyne Group

- Airbus SE

- Amazon.com Inc.

- DJI

- Drone Delivery Canada Corp.

- DHL International GmbH

- Elroy Air

- FedEx Corp.

- Flirtey

- Flytrex

- Matternet Inc.

- Manna Drone Delivery

- Rakuten Group Inc.

- Skycart Inc.

- Skyports Ltd.

- United Parcel Service Inc.

- Wing Aviation LLC

- Workhorse Group Inc.

- Zipline International Inc.

- Zomato Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Drone Package Delivery Market

- In February 2024, Amazon announced the successful completion of over 1,800 drone deliveries in the United States through its Prime Air service, marking a significant milestone in the market (Amazon Press Release). This demonstrates the growing commercial viability of drone delivery services.

- In May 2025, Alphabet's Wing Aviation, a drone delivery company, partnered with FedEx to expand its delivery network in the United States. This collaboration aimed to increase the reach and efficiency of both companies' delivery services, highlighting the strategic importance of partnerships in the drone delivery market (FedEx Press Release).

- In August 2024, Zipline, a California-based drone delivery company, raised a USD200 million Series C funding round, bringing its total funding to over USD300 million. This investment will support the expansion of its drone delivery network and the development of new technologies (TechCrunch).

- In December 2024, the European Union Aviation Safety Agency (EASA) granted regulatory approval for commercial drone deliveries in Europe, opening the market for companies like Wing, Zipline, and others to expand their operations. This approval represents a significant policy shift, paving the way for the growth of the market in Europe (EASA Press Release).

Research Analyst Overview

In the dynamic drone delivery market, operational efficiency and logistics optimization are key drivers for success. Delivery data analysis helps companies optimize delivery radius and flight time, while drone integration policies and delivery hubs facilitate seamless supply chain management. Multi-rotor and fixed-wing drones, each with distinct advantages, expand payload capacity and enable autonomous flight. Sense and avoid technology, collision avoidance systems, and noise mitigation measures address safety concerns. Drone landing pads, battery management, and drone swarms enhance delivery efficiency. Social acceptance and public perception are crucial for market growth, with drone safety standards and environmental sustainability initiatives playing essential roles.

Flight control systems and drone infrastructure development are vital for scaling drone delivery networks, reducing costs, and enhancing customer engagement.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Drone Package Delivery Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

135 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 64.16% |

|

Market growth 2024-2028 |

USD 33810.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

42.94 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Drone Package Delivery Market Research and Growth Report?

- CAGR of the Drone Package Delivery industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the drone package delivery market growth of industry companies

We can help! Our analysts can customize this drone package delivery market research report to meet your requirements.