Dual Fuel Generator Market Size 2024-2028

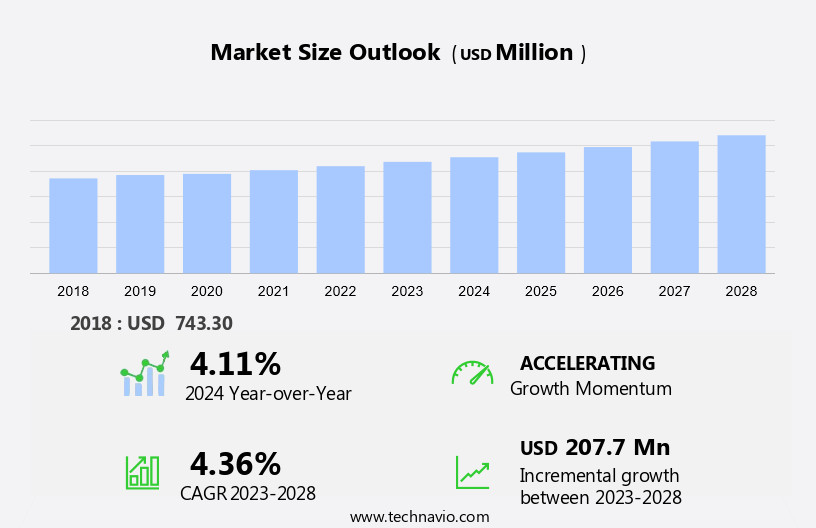

The dual fuel generator market size is forecast to increase by USD 207.7 million at a CAGR of 4.36% between 2023 and 2028.

- The market is experiencing significant growth due to several key factors. One of the primary drivers is the high benefits offered by dual fuel generators, which include improved fuel efficiency, reduced emissions, and increased reliability. Another trend influencing the market is the growth of microgrid networks, which require flexible and efficient power generation solutions like dual fuel generators. Furthermore, the increasing number of activities associated with renewable energy sources is also boosting the demand for dual fuel generators, as they can seamlessly integrate with renewable energy systems to provide backup power and ensure grid stability. Overall, these factors are expected to drive the growth of the market In the coming years.

What will be the Size of the Dual Fuel Generator Market During the Forecast Period?

- The market represents a vital niche In the power generation industry, characterized by its competitive nature and constant innovation. With the increasing demand for reliable backup power solutions and the growing popularity of hybrid fuel generators, this market has experienced significant accumulation and amalgamation in recent years. Dual fuel generators, capable of running on propane, gasoline, natural gas, and even diesel, offer versatility and flexibility to consumers. Power output and noise restrictions are essential factors driving market trends. Noiseless gas generators, for instance, cater to residential applications, while high-power output models are favored for industrial use. The market's fragmentation is evident In the variety of applications, including grills, residential heating systems, ovens, ranges, and watts-ranging from a few hundred to several thousand.

- Natural disasters and the increasing importance of business continuity plans further fuel market growth. As the demand for dual fuel generators continues to rise, the forefront of technology sees the development of advanced features, such as electrical starters and improved fuel efficiency. The market is poised to remain a significant player In the power generation landscape.

How is this Dual Fuel Generator Industry segmented and which is the largest segment?

The dual fuel generator industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Fuel Type

- Gasoline and liquid propane

- Natural gas and liquid propane

- End-user

- Industrial

- Commercial

- Residential

- Geography

- APAC

- China

- Japan

- North America

- US

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- APAC

By Fuel Type Insights

- The gasoline and liquid propane segment is estimated to witness significant growth during the forecast period.

The market is experiencing growth due to the increasing preference for environmentally friendly power solutions. With the US Environmental Protection Agency (EPA) imposing Tier 4 emission regulations on diesel generators, gasoline and liquid propane generators have gained popularity. These generators offer several advantages over diesel generators, including zero or minimal emissions and the elimination of the need for storage. The consistent supply of gasoline and liquid propane through pipeline infrastructure further bolsters market growth. The compatibility of generators with these fuel sources, which are readily available and reasonably priced, is a significant market driver. Dual Fuel Generators are widely used in construction sites, residential areas, hospitals, and various industries such as oil and healthcare.

Companies like Fuelflip Energy, Control Infotech, and Impact-technology start-ups are leading the market with innovative solutions. For investors, companies like DuroMax Power Equipment, Sportsman Generator, Champion Power Equipment, Briggs & Stratton, Cummins, and Generac Power Systems are recommended due to their reliability and continuous power provision. The market is competitive, with companies offering various power output levels and noise restrictions to cater to diverse customer needs. The fragmented market landscape is expected to witness dominance and amalgamation as companies focus on expanding their product offerings and market presence.

Get a glance at the Dual Fuel Generator Industry report of share of various segments Request Free Sample

The Gasoline and liquid propane segment was valued at USD 521.20 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 35% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The Asia Pacific region, marked by rapid industrialization and urbanization, is witnessing a significant increase in population, accounting for 63% of the global urban population in 2023. This growth is driven by major countries in East Asia and the Pacific. The demand for electricity In the region is escalating due to population growth and inadequate power infrastructure, leading to power outages. Consequently, the market for dual fuel generators is expanding in response to the increasing demand from residential, commercial, and small-scale industries In the region. These generators offer the advantage of running on both propane and gasoline or natural gas, providing reliable, continuous power.

The market is competitive, with key players such as Fuelflip Energy, Control Infotech, Impact-technology start-up, DuroMax Power Equipment, Sportsman Generator, Champion Power Equipment, Briggs & Stratton, Cummins, and Generac Power Systems offering a range of dual fuel generators with varying power outputs. The market is also eco-friendly, with a focus on reducing carbon emissions, making it an attractive investment opportunity for those seeking sustainable energy solutions.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Dual Fuel Generator Industry?

High benefits of dual fuel generators is the key driver of the market.

- The market is experiencing significant growth due to the increasing demand for flexible and cost-effective power solutions. Dual fuel generators offer the advantage of running on both propane and gasoline or natural gas and diesel, providing businesses with the ability to switch fuels based on availability and cost. This flexibility is vital In the competitive nature of various industries, including construction sites, residential areas, hospitals, and oil and healthcare industries. The volatile fuel prices have made the cost of fuel a substantial operating expense for end-users. Dual fuel generators address this challenge by allowing users to switch between fuels, ensuring continuous power supply and cost savings.

- The market is fragmented, with several players offering dual fuel generators, such as Fuelflip Energy, Control Infotech, Impact-technology start-up, DuroMax Power Equipment, Sportsman Generator, Champion Power Equipment, Briggs & Stratton, Cummins, Generac Power Systems, and Perkins Engines. Eco-conscious businesses and consumers are increasingly preferring dual fuel generators due to their lower carbon emissions compared to diesel-run generators. Additionally, the growing demand for noiseless gas generators and dual-fuel conversion kits further expands the market's potential. Investors looking for recommendations in this sector can consider companies that prioritize product satisfaction, innovation, and customer service.

What are the market trends shaping the Dual Fuel Generator Industry?

Growth of microgrid networks is the upcoming market trend.

- The market is experiencing vital growth due to the increasing demand for continuous power solutions in various sectors, including construction sites, residential areas, hospitals, and oil and healthcare industries. This market's competitive nature is driven by the availability of diverse fuel options, such as propane, gasoline, natural gas, and hybrid fuel generators. Product satisfaction is a key business strategy for market players, as reliable and noiseless gas generators gain popularity due to noise restrictions in residential areas. Moreover, the fragmented market landscape is witnessing amalgamation and dominance by leading players like Fuelflip Energy, Control Infotech, Impact-technology start-up, DuroMax Power Equipment, Sportsman Generator, Champion Power Equipment, Briggs & Stratton, Cummins, Generac Power Systems, and Perkins Engines.

- These companies offer a wide range of dual fuel generators with varying power output levels, catering to different consumer needs. Eco-conscious consumers are increasingly preferring dual fuel generators due to their ability to reduce carbon emissions, making them an attractive investment option for businesses and individuals alike. Natural disasters and power outages further emphasize the importance of having a reliable power source, leading to a growing demand for these generators. Investors seeking recommendations are advised to consider the market's dynamics, including the competitive nature, accumulation of market players, and the vital role dual fuel generators play in ensuring uninterrupted power supply.

What challenges does the Dual Fuel Generator Industry face during its growth?

Growing number of activities associated with renewable sources is a key challenge affecting the industry growth.

- In the power generation market, dual fuel generators have gained significant traction due to their ability to operate on both propane and gasoline or natural gas. Businesses are increasingly adopting these generators as part of their strategic initiatives to ensure continuous power supply and product satisfaction. The forefront of this trend includes pathfinders in the niche industries, such as construction sites, residential areas, hospitals, and oil and healthcare industries. The competitive nature of this market is driving the accumulation of innovative technologies, with companies like Fuelflip Energy, Control Infotech, and Impact-technology start-ups introducing eco-friendly hybrid fuel generators. These generators offer vital advantages, such as higher power output, noise restrictions, and reliability, making them a vital investment for businesses.

- However, the fragmentation of the market, with players like DuroMax Power Equipment, Sportsman Generator, Champion Power Equipment, Briggs & Stratton, Cummins, Generac Power Systems, Perkins Engines, and others, presents a challenge for businesses in terms of dominance and amalgamation. As the world moves towards reducing carbon emissions, businesses are increasingly looking for eco-friendly alternatives to diesel-run generators. Noiseless gas generators, electrical starters, and dual-fuel conversion kits are becoming increasingly popular. Companies are investing in research and development to produce more efficient and cleaner generators, catering to the growing demand for sustainable power solutions. Investors are recommended to closely monitor the market dynamics and keep abreast of the latest trends and technologies.

- The market is expected to grow significantly In the coming years, driven by the increasing demand for reliable, continuous power and the need to reduce carbon emissions.

Exclusive Customer Landscape

The dual fuel generator market forecasting report includes the adoption lifecycle of the market, market growth and forecasting, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the dual fuel generator market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, dual fuel generator market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- All Power America

- Briggs and Stratton LLC

- Brookfield Business Partners LP

- Caterpillar Inc.

- Champion Power Equipment Inc.

- Cummins Inc.

- DuroMax Power Equipment

- Electrogene Ltd.

- Generac Holdings Inc.

- Island Generator Co.

- Jiangsu SUMEC Group Co. Ltd.

- Kohler Co.

- MAN Energy Solutions SE

- North tool and Equipment

- Pulsar Products Inc.

- Qianjiang Group

- Shandong Heavy Industry Group Co. Ltd.

- Sportsman Series

- Tillotson Ltd.

- WEN Products

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market represents a significant and growing sector within the power generation industry. These generators, capable of running on both propane and gasoline or natural gas, offer businesses and individuals a versatile and efficient solution for their power needs. The business strategy of companies operating in this market is centered around product satisfaction and staying at the forefront of technological advancements. As a pathfinder in this niche, these companies understand the vital role competitive nature plays In the market's accumulation and fragmentation. Dominance is sought after, with amalgamation and collaboration being common strategies to expand market share. The market is driven by the demand for reliable, continuous power in various industries. Construction sites, residential areas, hospitals, and oil and healthcare industries are just a few sectors that benefit from the power output these generators provide. The ability to run on multiple fuel types offers flexibility and cost savings, making these generators a vital asset in regions where fuel availability or prices vary. Eco-friendliness is another factor influencing the market's growth. Dual fuel generators that run on propane or natural gas emit fewer carbon emissions compared to diesel-run generators. This makes them an attractive option for businesses and individuals looking to reduce their carbon footprint.

Noise restrictions and the need for quieter generators have also emerged as important considerations. Noiseless gas generators have gained popularity in residential areas due to their minimal noise output, making them a preferred choice for homeowners. Hybrid fuel generators, which combine the benefits of multiple fuel types, are expected to gain traction In the market. These generators offer the versatility of dual fuel generators with the added advantage of improved fuel efficiency and reduced emissions. Power output remains a crucial factor In the market, with businesses and individuals requiring varying wattage levels depending on their specific power needs. Manufacturers cater to this demand by offering generators with a wide range of power output options.

Thus, the competitive nature of the market also leads to the development of innovative technologies. For instance, electrical starters have replaced traditional pull-start mechanisms, making it easier to start the generators. Dual-fuel conversion kits are also becoming increasingly popular, allowing existing generators to be converted to dual fuel models. Investors looking to enter the market may consider companies that specialize in dual fuel generators, such as Fuelflip Energy, Control Infotech, or Impact-Technology Start-Up. Duromax Power Equipment, Sportsman Generator, Champion Power Equipment, Briggs & Stratton, Cummins, and Generac Power Systems have established players In the market with a strong presence. In summary, the market is a dynamic and growing sector within the power generation industry. Its versatility, efficiency, and eco-friendliness make it an attractive option for various industries and applications. Companies operating in this market are focused on innovation, product satisfaction, and expanding their market share.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

166 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.36% |

|

Market growth 2024-2028 |

USD 207.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.11 |

|

Key countries |

US, China, Germany, Japan, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Dual Fuel Generator Market Research and Growth Report?

- CAGR of the Dual Fuel Generator industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the dual fuel generator market growth of industry companies

We can help! Our analysts can customize this dual fuel generator market research report to meet your requirements.