Healthcare Information Software Market Size 2024-2028

The healthcare information software market size is forecast to increase by USD 8.75 billion at a CAGR of 5.65% between 2023 and 2028.

- In the dynamic healthcare landscape, smaller healthcare organizations and outpatient care facilities are increasingly adopting advanced information management systems to streamline operations and enhance patient care. The information-intensive nature of healthcare necessitates the use of efficient and integrated solutions for effective data exchange and decision-making. The clinical solutions segment, including revenue cycle management (RCM) solutions, is witnessing significant growth due to the need for cost reduction and improved patient care. The healthcare industry in the US is undergoing a digital transformation, with a significant focus on implementing advanced software solutions to enhance patient care, improve healthcare quality, and reduce costs.

- Moreover, key trends include the adoption of AI in healthcare for improved diagnostics and patient outcomes, as well as the integration of consumer technology companies' offerings for better patient engagement. However, challenges persist, such as ensuring usability, interoperability, and data security in the face of growing cyberattacks. Health systems are focusing on IT architecture and data communication standards to address these concerns and provide comprehensive healthcare provider solutions. The cost of care and the need for efficient data exchange remain critical factors driving market growth.

What will be the Size of the Market During the Forecast Period?

- The market is witnessing notable growth due to various factors. Patient Safety and Quality: The need for enhanced patient safety and improved healthcare quality is a major driver for the adoption of healthcare information software. These solutions enable healthcare providers to access centralized medical records, ensuring accurate and timely diagnosis and treatment. Additionally, healthcare IT infrastructure, including telehealth and e-prescribing systems, facilitates remote patient monitoring and teleconsultation, enabling better care for patients with chronic diseases.

- Moreover, the integration of healthcare systems is another key trend in the market. Healthcare organizations are investing in software solutions that enable seamless data exchange between different healthcare providers and departments. This not only enhances patient care but also reduces administrative costs and improves overall efficiency. The widespread use of smartphones and improved internet coverage in the US is fueling the growth of the market. Remote patient monitoring and teleconsultation are becoming increasingly popular, enabling patients to access healthcare services from the comfort of their homes. Furthermore, smartphones and mobile applications are being used to facilitate e-prescribing and other clinical solutions.

- However, the rising healthcare costs in the US are also driving the adoption of healthcare information software. These solutions enable healthcare providers to streamline their operations, reduce administrative costs, and improve patient outcomes, leading to cost savings in the long run. The use of big data analytics and artificial intelligence (AI) in healthcare is a growing trend. These technologies enable healthcare providers to analyze patient data and identify patterns and trends, leading to better diagnosis and treatment. Additionally, AI-powered chatbots and virtual assistants are being used to provide patients with personalized healthcare advice and support.

- In conclusion, the market is witnessing significant growth due to factors such as the need for enhanced patient safety and quality, the integration of healthcare systems, the widespread use of smartphones and internet coverage, and rising healthcare costs. The use of big data analytics and AI is also a growing trend, enabling healthcare providers to provide more personalized and effective care to their patients.

How is this market segmented and which is the largest segment?

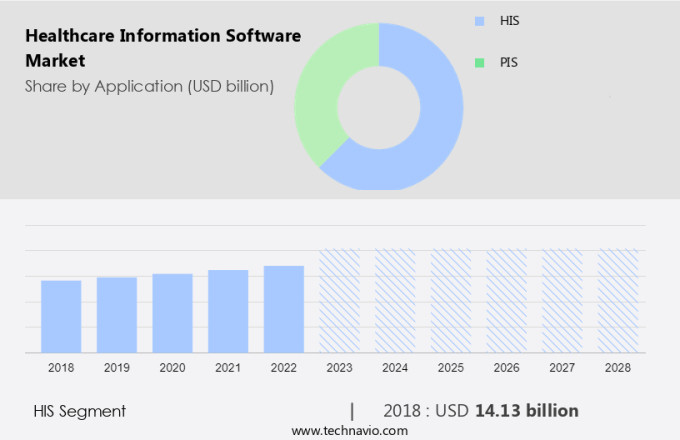

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- HIS

- PIS

- Deployment

- On premises

- Cloud based

- Geography

- North America

- US

- Europe

- Germany

- UK

- Asia

- China

- Japan

- Rest of World (ROW)

- North America

By Application Insights

- The HIS segment is estimated to witness significant growth during the forecast period.

Healthcare Information Software (HIS) is a vital solution for managing the intricate requirements of healthcare systems globally. A significant component of HIS is Electronic Health Records (EHR), which offers digital solutions for patient data management, clinical documentation, and interoperability. Notable companies in the EHR sector include Epic Systems Corporation, GE Healthcare, and UnitedHealth Group Inc. Some of the applications within HIS include medical billing and revenue cycle management, Clinical Decision Support Systems (CDSS), Picture Archiving and Communication Systems, and more. Medical Billing and Revenue Cycle Management (RCM) software optimizes financial processes, encompassing billing, claims processing, and revenue enhancement. CDSS empowers healthcare providers with evidence-based recommendations, alerts, and decision-making tools to enhance patient care outcomes.

Moreover, teleconsultation and telehealth are increasingly integrated into healthcare systems, enabling remote patient monitoring and consultations for chronic diseases. Telehealth solutions facilitate seamless communication between healthcare providers and patients, improving access to care and reducing hospital bed occupancy. Healthcare organizations grapple with interoperability issues and security concerns when implementing HIS. Capacity management solutions, such as Surescripts, serve as interoperability tools, ensuring seamless data exchange between various systems. Security measures, including encryption and access control, are essential to protect sensitive patient information. Clinical devices, such as medical equipment and e-prescribing systems, are integrated into HIS to streamline workflows and improve patient care. As healthcare systems continue to evolve, HIS will remain a crucial component, enabling efficient, data-driven decision-making and enhancing overall patient safety.

Get a glance at the market report of share of various segments Request Free Sample

The HIS segment was valued at USD 14.13 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 38% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American market is experiencing notable expansion, fueled by several factors. Advanced healthcare infrastructure, substantial healthcare expenditures, and a high adoption rate of healthcare IT solutions are key drivers in this region. In the United States, the presence of favorable reimbursement policies, including Medicare, Medicaid, and the Children's Health Insurance Program (CHIP), and the establishment of health insurance exchange subsidies under the Affordable Care Act, significantly contribute to the market's growth. The increasing investment in healthcare and the implementation of various government policies are boosting the adoption of digital health technologies, such as healthcare information software. Moreover, the rise in smartphone penetration and internet coverage has facilitated the growth of telehealth, tele-care, and remote patient monitoring.

Solutions like Change Healthcare, eClinical Solutions, and Independenta are increasingly popular, enabling healthcare providers to offer more efficient and accessible services. The integration of artificial intelligence, big data analytics, clinical alarm management, laboratory informatics, clinical information systems, and electronic prescribing systems is revolutionizing the healthcare industry. Radiology information systems and monitoring analysis software are also gaining traction, enhancing diagnostic accuracy and streamlining workflows. The North American market for healthcare information software is poised for continued growth, with significant opportunities in the areas of healthcare analytics and telehealth.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Healthcare Information Software Market?

Increasing adoption of electronic health records is the key driver of the market.

- The market in the United States is witnessing significant growth due to the increasing adoption of electronic health records (EHR) by various stakeholders. The shift from traditional paper-based records to digital EHR systems is gaining momentum as governments, healthcare organizations, and patients recognize the advantages of enhanced accessibility and efficiency in managing patient data. EHR systems allow healthcare professionals to access patient records instantly, enabling faster decision-making, reducing errors, and ultimately improving patient care. This trend is further supported by regulatory initiatives such as the Health Information Technology for Economic and Clinical Health (HITECH) Act of 2009, which offers incentives for healthcare providers to implement EHR systems.

- Furthermore, the integration of mHealth solutions, e-prescribing, and interoperability among various healthcare IT systems is contributing to the market's expansion. Despite concerns over security and interoperability issues, the market is expected to continue its growth trajectory due to the increasing demand for coordinated healthcare environments and capacity management solutions. According to Worldometer, there were approximately 3.5 million hospital beds in the United States as of 2020, underscoring the need for efficient healthcare information management systems to support the industry's growing capacity.

What are the market trends shaping the Healthcare Information Software Market?

Increasing adoption of advanced technologies like AI in healthcare is the upcoming trend in the market.

- In the rapidly evolving information-intensive healthcare industry, smaller healthcare organizations and outpatient care facilities are recognizing the importance of upgrading their IT infrastructure to enhance patient care and reduce costs. Health systems are investing in advanced healthcare provider solutions, such as RCM solutions and clinical information management systems, to streamline operations and improve decision-making. The integration of these systems enables seamless data exchange and better interoperability, allowing for more effective patient care. Consumer technology companies are also entering the healthcare sector, bringing innovative solutions to the table.

- Moreover, usability, integration, and data communication standards are key considerations for healthcare organizations when selecting new IT architecture. The cost of care continues to rise, making the need for efficient information management systems increasingly crucial. The clinical solutions segment is experiencing significant growth as healthcare providers seek to improve patient outcomes and reduce readmissions. AI is gaining acceptance in the healthcare industry, with applications in diagnosis, treatment planning, and population health management. These technologies enable healthcare professionals to access patient information quickly and make informed decisions, ultimately improving patient care.

What challenges does Healthcare Information Software Market face during the growth?

Concerns about the security of patient data and cyberattacks are key challenges affecting the market growth.

- The healthcare sector handles vast amounts of sensitive patient information, making it a prime target for data breaches and cybersecurity threats. Electronic storage of patient health records and clinical data, facilitated by automated healthcare systems, increases the risks of data piracy and unauthorized access. Common security vulnerabilities include data theft, unsecured disposal of information, data loss, and hacking. The implementation of bring-your-own-device (BYOD) policies in hospitals further complicates security, as these devices may not adhere to the same security protocols as institutional systems. Cybersecurity poses a significant challenge to the healthcare industry, with the increasing adoption of advanced technologies amplifying the risk of cyberattacks.

- To mitigate these risks, healthcare organizations must invest in strong IT infrastructure, employ skilled IT personnel, and prioritize cost-effective security solutions. The benefits of Healthcare Information Technology (HCIT) include price transparency, improved healthcare management, ePrescriptions, electronic prior authorizations, and virtual healthcare. However, the implementation of HCIT comes with costs, including software costs, maintenance, and software upgrades. Organizational impacts and user requirements should also be considered during implementation. Core technologies such as interoperability tools, controlled substances tracking, and benefit responses are essential components of HCIT. Ensuring compliance with regulatory requirements and addressing IT infrastructure constraints are critical considerations for successful HCIT implementation.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- ALLSCRIPTS HEALTHCARE SOLUTIONS INC.

- Asteres Inc.

- athenahealth Inc.

- Azalea Health Innovations Inc.

- Change Healthcare

- Cognizant Technology Solutions Corp.

- Dedalus Group

- ec2 Software Solutions

- Epic Systems Corp.

- Fusion

- GE Healthcare Technologies Inc.

- Happiest Minds Technologies Ltd.

- Huawei Technologies Co. Ltd.

- Koch Industries Inc.

- Koninklijke Philips N.V.

- McKesson Corp.

- Microsoft Corp.

- NextGen Healthcare Inc.

- Oracle Corp.

- Siemens AG

- UnitedHealth Group Inc.

- Veradigm LLC

- Wipro Ltd.

- WRS Health

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is experiencing significant growth momentum due to the increasing adoption of advanced technologies such as remote patient monitoring, tele-healthcare, artificial intelligence, and big data analytics. The change in healthcare delivery models, driven by smartphone penetration and internet coverage, is fueling the demand for centralized medical records and clinical information systems. The clinical devices segment, including laboratory informatics and radiology information systems, is also witnessing substantial growth. The healthcare IT industry is an information-intensive sector that requires high financial strength and profitability. R&D investments are crucial for staying competitive in this rapidly evolving market. Tele-healthcare, tele-care, e-prescribing, and mHealth solutions are becoming increasingly popular, addressing the needs of healthcare organizations and providers in outpatient care facilities and smaller healthcare organizations.

Moreover, despite the benefits of healthcare IT, there are challenges such as interoperability issues, security concerns, and cost issues. Skilled IT personnel are required for deployment, maintenance, and software upgrades. The implementation cost, infrastructure, and recurring expenditure are significant factors influencing the adoption of healthcare IT tools and systems. The integration of healthcare IT tools and systems into healthcare organizations is essential for improving patient safety, care delivery, and healthcare quality. Patient information must be usable, integrated properly, and exchanged seamlessly between different systems and healthcare providers. The proliferation of medical apps and consumer technology companies is contributing to the growth of healthcare IT, with teleconsultation, chronic disease management, and virtual healthcare becoming increasingly important. Price transparency, specialty medications, electronic prior authorizations, and controlled substances are other areas where healthcare IT is making a significant impact. The implementation of electronic prescribing systems, monitoring analysis software, and clinical alarm management solutions is improving patient care and reducing the cost of care. The use of IT infrastructure constraints, such as capacity management solutions and data communication standards, is essential for addressing the needs of hospitals and advanced healthcare solutions.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

168 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.65% |

|

Market growth 2024-2028 |

USD 8.75 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.21 |

|

Key countries |

US, Germany, UK, China, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch