Electric Kick Scooter Market Size 2024-2028

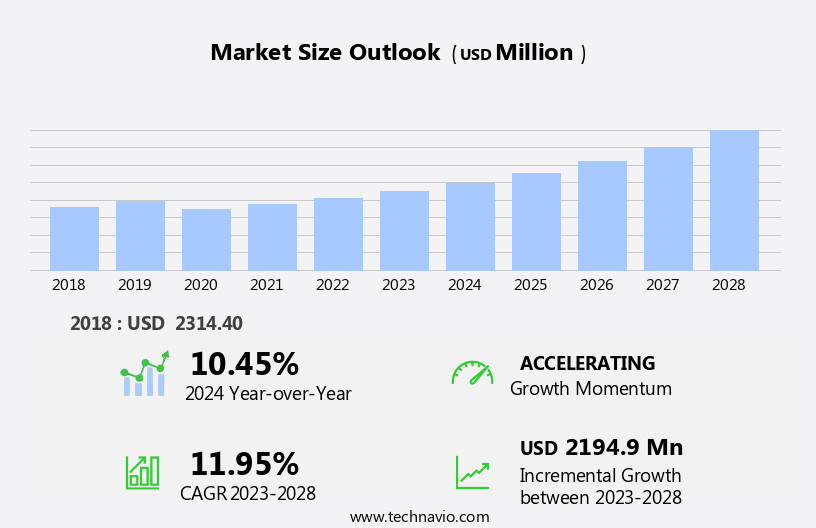

The electric kick scooter market size is forecast to increase by USD 2.19 billion at a CAGR of 11.95% between 2023 and 2028.

What will be the Size of the Electric Kick Scooter Market During the Forecast Period?

How is this Electric Kick Scooter Industry segmented and which is the largest segment?

The electric kick scooter industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Variant

- 25v to 50v

- Less than 25v

- More than 50v

- Geography

- Europe

- Germany

- UK

- France

- North America

- US

- APAC

- China

- South America

- Middle East and Africa

- Europe

By Variant Insights

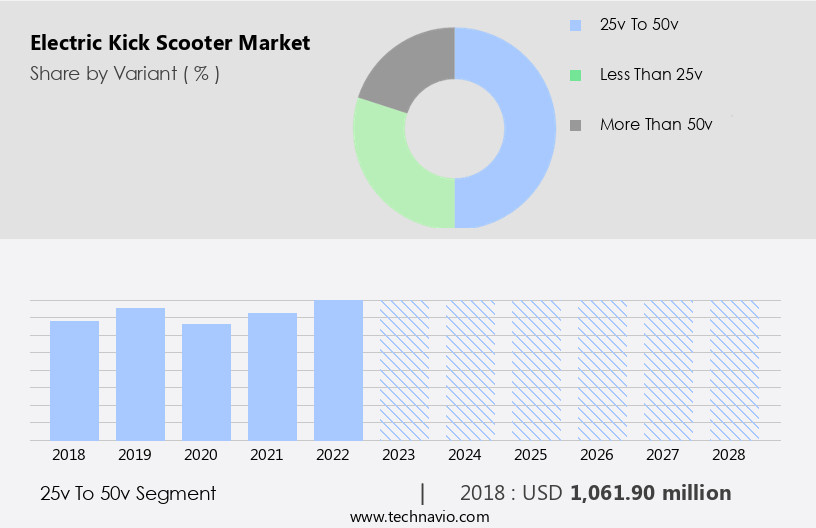

- The 25v to 50v segment is estimated to witness significant growth during the forecast period.

The market, encompassing electric motorized scooters and standing scooters, experienced notable growth in 2023, with the 25v to 50v segment leading the charge. Factors fueling this expansion include declining battery prices, low maintenance costs, government incentives, and heightened environmental consciousness. As more consumers opt for electric scooters as an environmentally friendly alternative to traditional transportation methods, competition intensifies among manufacturers. To remain competitive, companies are innovating to deliver electric scooters with advanced features at cost-effective prices. In developed regions, electric scooters are gaining traction for short-distance commuting, especially in emerging economies where parking space requirements are minimal. The post-pandemic market is witnessing a surge in demand, with electric scooters offering a quick, cost-effective, and eco-friendly solution to fluctuating fuel prices and carbon emissions concerns.

Government authorities worldwide are encouraging the adoption of electric vehicles, including electric two-wheelers, through favorable policies. The battery segment, which includes lead-acid and lithium-ion (Li-Ion) technologies, plays a crucial role In the market's growth, with Li-Ion technology gaining popularity due to its higher energy density and longer lifespan. The drive segment consists of below-belt drive, chain drive, hub drive, and belt drive, each offering unique advantages in terms of performance and cost. The end-use segment includes personal vehicles, commercial vehicles, and those for kids and adults, with ride-sharing platforms further expanding the market's reach.

Get a glance at the Electric Kick Scooter Industry report of share of various segments Request Free Sample

The 25v to 50v segment was valued at USD 1.06 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

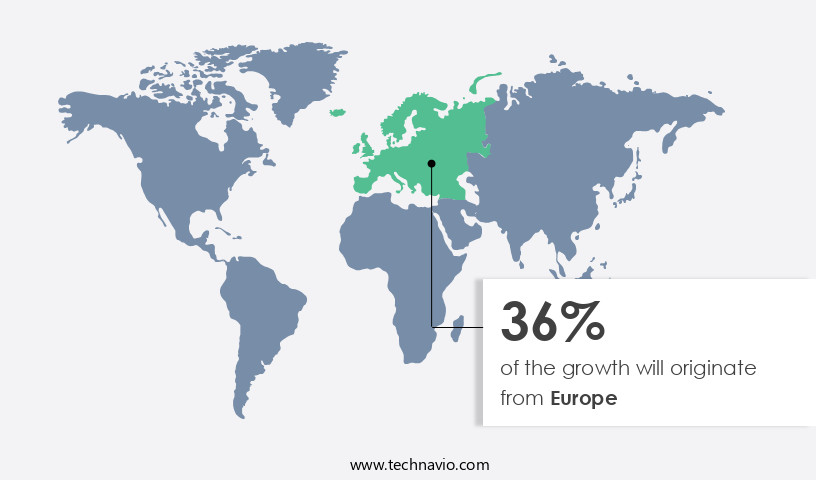

- Europe is estimated to contribute 36% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in Europe is experiencing significant growth due to various factors. One key driver is the increasing adoption of electric kick scooters for shared services in response to traffic congestion and rising pollution in major European cities, such as London, Berlin, and Paris. The compact size and suitable speed of electric kick scooters make them an ideal solution for short-distance commuting. Additionally, government initiatives and stringent emission laws are boosting the market's growth. Europe's the market is dominated by micro-mobility companies offering electric kick scooters and other two-wheelers. The market's growth is also influenced by the shift towards environmentally friendly transportation solutions and the fluctuating fuel prices.

The electric kick scooter's lightweight design, quick charging capabilities, and cost-effectiveness further contribute to its rising demand. Government authorities are encouraging the use of electric vehicles, including electric two-wheelers, to reduce carbon emissions. The battery segment, which includes lead-acid and lithium-ion (Li-Ion) batteries, plays a crucial role In the market's growth, with Li-Ion technology gaining popularity due to its longer battery life and faster charging capabilities. The market's drive segment includes below-belt drive, chain drive, hub drive, and belt drive systems, with each segment catering to specific market requirements. The end-use segment includes personal vehicles, commercial vehicles, and kids and adults.

Ride-sharing platforms are also contributing to the market's growth, offering a convenient and cost-effective transportation solution.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Electric Kick Scooter Industry?

Increasing incentives and subsidies by governments is the key driver of the market.

What are the market trends shaping the Electric Kick Scooter Industry?

Increasing popularity of electric kick scooter-sharing services is the upcoming market trend.

What challenges does the Electric Kick Scooter Industry face during its growth?

Demand for batteries with long range, fast charging, and long lifespan is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The electric kick scooter market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the electric kick scooter market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, electric kick scooter market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

ABB Ltd. - The company specializes in robotics and automation solutions, including the production of electric kick scooters, at its state-of-the-art manufacturing facility. This innovative transportation alternative joins the firm's diverse product offerings, catering to the growing demand for eco-friendly and efficient mobility solutions. Electric kick scooters represent a burgeoning sector In the transportation industry, characterized by their compact design, affordability, and convenience. As the market continues to expand, the company's commitment to cutting-edge technology and manufacturing excellence positions it as a key player in this dynamic and evolving field.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- Ather Energy Pvt. Ltd.

- Bolzzen

- CaliRides LLC

- Evolve Skateboards Aus Pty Ltd.

- Maytech

- Mellow Boards GmbH

- NSK Ltd.

- QS MOTORS Ltd.

- Schneider Electric SE

- Segway Inc.

- STEL LLC

- UBOARD INDIA

- Xiaomi Communications Co. Ltd.

- Yuneec International Co. Ltd.

- Zero Motorcycles Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Electric kick scooters, also known as e-kick scooters or electric motorized standing scooters, have gained significant traction in recent years as an environmentally friendly and cost-effective transportation solution. These sleekly designed devices offer ease of use and are particularly well-suited for short distance commuting and intra-city travel. The emergence of electric kick scooters can be attributed to several market dynamics. Fluctuating fuel prices and increasing environmental concerns have led consumers to seek alternative modes of transportation. Additionally, the post-pandemic market has witnessed a surge in demand for personal mobility solutions that prioritize social distancing and convenience. Favorable government policies have further bolstered the growth of the market.

In many developed regions, authorities have implemented incentives to encourage the adoption of electric vehicles, including electric two wheelers, to reduce carbon emissions and promote sustainable transportation. The battery segment plays a crucial role In the market. Both lead acid and lithium-ion (li-ion) batteries are used In these devices. Li-ion technology, with its higher energy density and longer lifespan, has gained popularity due to its ability to provide longer ride times and quicker charging capabilities. The drive segment In the market includes below-belt drive, chain drive, hub drive, and belt drive systems. Hub drive systems, which integrate the motor into the wheel hub, have gained traction due to their simplicity and efficiency.

The end-use segment of the market can be divided into personal vehicle and commercial vehicle applications. Personal vehicles are primarily used for short distance commuting and recreational purposes, while commercial vehicles are employed for ride sharing platforms and last-mile delivery services. Electric kick scooters are also gaining popularity among kids and adults in emerging economies as a fun and affordable mode of transportation. The lightweight design and quick charging capabilities make these devices an attractive option for those seeking a cost-effective alternative to cars and motorbikes. Despite their numerous benefits, electric kick scooters face challenges, such as parking space requirements and potential safety concerns.

Government authorities are addressing these issues by implementing regulations and infrastructure developments to accommodate the growing number of electric kick scooters on the roads. In conclusion, the market is experiencing robust growth due to a combination of factors, including environmental concerns, fluctuating fuel prices, and favorable government policies. The market is expected to continue expanding as consumers seek convenient, cost-effective, and eco-friendly transportation solutions.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

134 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.95% |

|

Market growth 2024-2028 |

USD 2194.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

10.45 |

|

Key countries |

US, Germany, France, UK, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Electric Kick Scooter Market Research and Growth Report?

- CAGR of the Electric Kick Scooter industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the electric kick scooter market growth of industry companies

We can help! Our analysts can customize this electric kick scooter market research report to meet your requirements.