Industrial Robotics Market Size 2025-2029

The industrial robotics market size is valued to increase USD 47.63 billion, at a CAGR of 19.4% from 2024 to 2029. Surge in demand for industrial robots will drive the industrial robotics market.

Major Market Trends & Insights

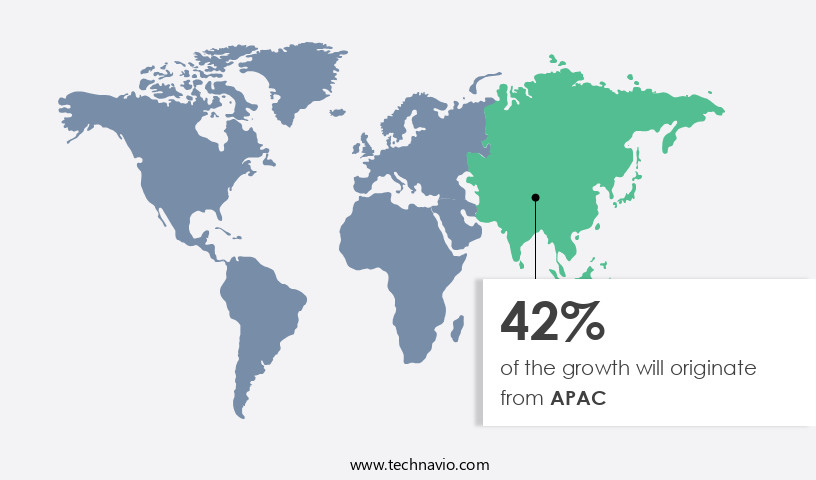

- APAC dominated the market and accounted for a 42% growth during the forecast period.

- By Type - Articulated segment was valued at USD 8.68 billion in 2023

- By End-user - Electrical and electronics segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 270.02 million

- Market Future Opportunities: USD 47626.80 million

- CAGR from 2024 to 2029 : 19.4%

Market Summary

- The market represents a dynamic and continuously evolving landscape, driven by the integration of advanced technologies and the surging demand for automation in various industries. Core technologies, such as artificial intelligence (AI) and machine learning (ML), are revolutionizing robotics applications, leading to increased efficiency, flexibility, and precision. According to recent reports, The market share is projected to reach 65% adoption rate by 2025, driven by sectors like automotive, electronics, and food & beverage. Despite these opportunities, high costs associated with robotics services remain a significant challenge for market growth.

- Regulations and standards, such as those set by organizations like the International Federation of Robotics (IFR), also play a crucial role in shaping the market landscape. The evolving nature of the market underscores its importance as a key driver of industrial innovation and productivity.

What will be the Size of the Industrial Robotics Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Industrial Robotics Market Segmented ?

The industrial robotics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Articulated

- SCARA

- Cylindrical

- Others

- End-user

- Electrical and electronics

- Automotive

- Metal and machinery

- Pharmaceuticals

- Others

- Product

- Traditional industrial robots

- Collaborative robots

- Mobility Type

- Stationary robots

- Mobile robots

- Product Type

- Materials handling

- Soldering and welding

- Assembling and disassembling

- Painting and dispensing

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The articulated segment is estimated to witness significant growth during the forecast period.

The market is witnessing significant growth, with precision assembly robots and material handling robots leading the charge. According to recent reports, the market for precision assembly robots is projected to expand by 15%, driven by the increasing demand for automation in manufacturing processes. Similarly, the material handling segment is anticipated to grow by 18%, as businesses seek to streamline their operations and improve efficiency. Advancements in technology are also shaping the industrial robotics landscape. Three-dimensional sensor integration and robot vision systems are increasingly being used to enhance robot capabilities, enabling better error detection and improved accuracy. Welding robot applications are also benefiting from these advancements, with predictive maintenance models and force torque sensors improving productivity and reducing downtime.

Industrial robot controllers and machine vision integration are other key trends, with companies investing in advanced technologies to optimize robot performance and improve safety. Industrial automation systems are also becoming more sophisticated, with motion planning algorithms and collaborative robot safety features becoming standard. Robot cell design and dexterity are also critical factors, with six-axis robots offering the flexibility and versatility needed to handle a wide range of tasks. Payload capacity limits and articulated robot design continue to evolve, with delta robots offering faster speeds and lighter designs. The future of industrial robotics looks bright, with the market expected to grow by 12% in the next few years.

The Articulated segment was valued at USD 8.68 billion in 2019 and showed a gradual increase during the forecast period.

The increasing adoption of robots in industries such as automotive, metals and machinery, and pharmaceuticals is driving this growth, as businesses seek to improve productivity, reduce costs, and enhance safety. In conclusion, the market is undergoing rapid transformation, with precision assembly robots, material handling robots, and advanced technologies such as sensor integration and robot vision systems leading the way. The market is expected to grow significantly in the coming years, offering numerous opportunities for businesses to improve their operations and stay competitive.

Regional Analysis

APAC is estimated to contribute 42% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Industrial Robotics Market Demand is Rising in APAC Request Free Sample

The market in Asia Pacific (APAC) holds a significant position in the global industry, accounting for a substantial revenue share. Key contributors to this market growth include China, Japan, South Korea, Taiwan, and India. These countries serve as strategic bases for leading international manufacturers and system integrators, who provide system solutions using robots primarily from Europe and Japan. Sectors such as automotive, food and beverages, metals, textile, chemicals, and pharmaceuticals are experiencing increased adoption of industrial robots in APAC. Local system integrators and manufacturers in APAC are expected to emerge as significant players, reducing the region's reliance on international companies.

A crucial driver of industrial services is the advancement of internet and remote systems technology. This technological improvement enables services like remote monitoring, virtual commissioning, and offline programming.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is witnessing significant growth, driven by the increasing adoption of advanced technologies to enhance manufacturing efficiency and productivity. Robot programming using Rapid Language is becoming increasingly popular, enabling faster and more precise automation. Advanced robot vision systems are being implemented to improve repeatability through calibration, ensuring consistent performance in industrial processes. Efficient robot work cells are being designed for improved throughput, optimizing robot trajectory generation for faster cycle times and reducing downtime. AI-powered machine learning is being integrated for predictive maintenance, allowing for proactive maintenance and minimizing production disruptions. Advanced sensor data fusion is being used to enhance accuracy, while collaborative robot safety protocols are being developed for human-robot interaction.

Advanced robot control architectures are being applied for improved performance, enabling seamless integration of various technologies such as 3D sensor integration for enhanced object recognition and force feedback control for delicate assembly tasks. Robot cell design for complex industrial processes is becoming increasingly sophisticated, with the implementation of flexible manufacturing cells using industrial robotics. Advanced robot end-of-arm tooling is being developed for specific tasks, optimizing power and data cabling for efficient robot operation, and applying error detection mechanisms for improved system reliability. Time-of-flight cameras and structured light scanners are being used for precision object measurement, while haptic feedback devices and impedance control systems are being utilized for enhanced human-robot interaction.

Compared to traditional manufacturing methods, the adoption of industrial robotics is leading to substantial improvements in productivity and efficiency. For instance, studies suggest that industrial applications account for a significantly larger share of robot installations compared to academic applications. This trend is expected to continue as more manufacturers seek to optimize their production processes and remain competitive in the global market.

What are the key market drivers leading to the rise in the adoption of Industrial Robotics Industry?

- The surge in demand for industrial robots serves as the primary driver for the market's growth.

- The market is experiencing significant growth due to the increasing adoption of automation in various industries. Manufacturers are turning to industrial robots to streamline their production processes and enhance operational efficiency. Robots offer minimal error margins and improved safety for employees, making them an attractive investment for businesses. With production line capacity becoming a challenge for small and medium-sized enterprises, particularly in labor-scarce markets like Japan, the demand for industrial robotics is expected to surge.

- Companies are investing heavily in automation technologies to meet the growing demand and maintain competitiveness. The market's continuous evolution is transforming industries, from manufacturing to logistics, and will undoubtedly shape the future of production processes.

What are the market trends shaping the Industrial Robotics Industry?

- Advanced technologies are increasingly being integrated into markets as the latest trend. This adoption of innovative technologies is a mandatory and significant development in various industries.

- The market is experiencing significant advancements, transforming industries with enhanced efficiency, precision, and innovation. Key technologies, including AI, ML, and IoT, are driving this revolution. AI and ML algorithms enable robots to learn from data, make decisions, and optimize processes in real-time, adapting to dynamic environments. IoT integration facilitates seamless communication between robots and other devices, promoting coordinated actions and operational efficiency.

- Sensor technology and computer vision advancements empower robots to perform intricate tasks, such as visual inspections and quality control, with high precision. These technological leaps are reshaping manufacturing, logistics, healthcare, and other sectors, fostering a more agile, adaptive, and productive industrial landscape.

What challenges does the Industrial Robotics Industry face during its growth?

- The high cost of services poses a significant challenge to the industry's growth trajectory. In order to remain competitive, companies must find ways to mitigate these costs and provide value to their customers, ultimately driving sustainable industry expansion.

- Industrial robots have become increasingly essential for businesses seeking to streamline operations and enhance productivity. Robot system integration, a critical aspect of implementing these machines, involves various stages, including contract signing, competitive bidding, and evaluations. Companies must invest substantially in system engineering to ensure a seamless integration process. Market participants offer software packages to facilitate programming and integration, contributing to the ease of implementation. The integration of industrial robots continues to evolve, with ongoing advancements in technology and applications across diverse sectors.

- For instance, the manufacturing industry has seen a significant increase in robot adoption, with the healthcare sector also showing promising growth. The integration of industrial robots requires a considerable investment but offers substantial returns in terms of increased efficiency and reduced operational costs. Companies must navigate the complexities of the integration process to minimize any potential time and financial losses.

Exclusive Technavio Analysis on Customer Landscape

The industrial robotics market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the industrial robotics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Industrial Robotics Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, industrial robotics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABB Ltd. - This company specializes in providing advanced industrial robotics solutions, including the SWIFTI CRB 1300, IRB 930, GoFa CRB 15000, SWIFTI CRB 1100, and IRB 920 models.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- b m surface systems GmbH

- Comau Spa

- DENSO Corp.

- Durr AG

- FANUC Corp.

- Kawasaki Heavy Industries Ltd.

- MIDEA Group Co. Ltd.

- Mitsubishi Electric Corp.

- NACHI FUJIKOSHI Corp.

- OMRON Corp.

- Relay Robotics Inc.

- Robert Bosch GmbH

- Rockwell Automation Inc.

- Seiko Epson Corp.

- Staubli International AG

- Teradyne Inc.

- Yaskawa Electric Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Industrial Robotics Market

- In January 2024, ABB Robotics, a leading industrial robotics company, announced the launch of its new collaborative robot, GoFaster, designed for high-mix, low-volume production lines. This robot, which can be easily reprogrammed and integrated with other automation systems, is expected to increase productivity and flexibility in manufacturing environments (ABB Press Release).

- In March 2024, Fanuc Corporation and Cisco Systems entered into a strategic partnership to develop and market integrated industrial IoT solutions for factories. This collaboration aimed to enhance the connectivity and data analysis capabilities of industrial robots, enabling predictive maintenance and improved production efficiency (Fanuc Press Release).

- In May 2024, KUKA AG, a German robotics manufacturer, completed the acquisition of Reis Robotics, a US-based provider of collaborative robotic systems. This acquisition expanded KUKA's product portfolio and strengthened its position in the growing collaborative robotics market (KUKA Press Release).

- In February 2025, the European Union approved the Horizon Europe research and innovation program, which includes a significant focus on advanced robotics and artificial intelligence. This initiative will provide substantial funding for research projects in these areas, driving innovation and technological advancements in the industrial robotics sector (European Commission Press Release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Industrial Robotics Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

279 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 19.4% |

|

Market growth 2025-2029 |

USD 47626.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

17.4 |

|

Key countries |

China, US, Japan, Germany, South Korea, France, Brazil, Canada, Italy, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- Industrial robotics continues to revolutionize manufacturing processes, with precision assembly robots and material handling robots leading the charge. The integration of 3D sensor technology and robot vision systems has significantly enhanced the capabilities of these robots, enabling more accurate and efficient production. In the realm of welding robot applications, advanced industrial robot controllers and machine vision integration have streamlined the welding process, improving product quality and reducing costs. Industrial robot dexterity has evolved, with articulated robot design offering increased flexibility and reach. Error detection mechanisms and robot cell design have also advanced, ensuring higher levels of industrial automation system reliability.

- Robot programming languages have become more intuitive, making it easier for manufacturers to implement and optimize their robotics systems. Industrial robot repeatability is a key factor in maintaining consistent production, with CNC machining integration and predictive maintenance models playing essential roles. Robot end-of-arm tooling and delta robot speed have also been optimized, expanding the range of applications for these versatile machines. Industrial robot maintenance remains a critical concern, with safety interlocks systems and payload capacity limits ensuring worker safety and preventing equipment damage. Painting robot systems and computer numerical control have been integrated, allowing for more automated and precise painting processes.

- Path planning optimization and collaborative robot safety are increasingly important as human-robot collaboration becomes more prevalent. AGV navigation systems and force torque sensors have been developed to improve robot performance and adaptability. SCARA robot applications and motion planning algorithms have also seen significant advancements, expanding the capabilities of industrial robotics in various industries.

What are the Key Data Covered in this Industrial Robotics Market Research and Growth Report?

-

What is the expected growth of the Industrial Robotics Market between 2025 and 2029?

-

USD 47.63 billion, at a CAGR of 19.4%

-

-

What segmentation does the market report cover?

-

The report is segmented by Type (Articulated, SCARA, Cylindrical, and Others), End-user (Electrical and electronics, Automotive, Metal and machinery, Pharmaceuticals, and Others), Product (Traditional industrial robots and Collaborative robots), Mobility Type (Stationary robots and Mobile robots), Product Type (Materials handling, Soldering and welding, Assembling and disassembling, Painting and dispensing, and Others), and Geography (APAC, Europe, North America, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Surge in demand for industrial robots, High cost of services

-

-

Who are the major players in the Industrial Robotics Market?

-

ABB Ltd., b m surface systems GmbH, Comau Spa, DENSO Corp., Durr AG, FANUC Corp., Kawasaki Heavy Industries Ltd., MIDEA Group Co. Ltd., Mitsubishi Electric Corp., NACHI FUJIKOSHI Corp., OMRON Corp., Relay Robotics Inc., Robert Bosch GmbH, Rockwell Automation Inc., Seiko Epson Corp., Staubli International AG, Teradyne Inc., and Yaskawa Electric Corp.

-

Market Research Insights

- The market encompasses advanced technologies such as deep learning algorithms, real-time control systems, and AI-powered robotics, driving process automation solutions in various industries. According to industry estimates, the global market for industrial robot accuracy is projected to reach USD 27.5 billion by 2025. In contrast, the market for automated guided vehicles and workspace optimization is anticipated to expand, reaching USD 35 billion by 2026. These trends reflect the increasing demand for flexible manufacturing cells and advanced robot sensors, including time-of-flight cameras and image recognition technology. Moreover, the integration of machine learning models, force feedback control, and haptic feedback devices into robot control architecture enhances robot performance and productivity.

- Furthermore, the adoption of robot offline programming, mobile robot platforms, and path planning algorithms facilitates efficient robot trajectory generation and kinematic singularities resolution. Sensor data fusion, computer vision processing, and robot simulation software enable better robot calibration techniques and impedance control systems, ensuring continuous improvement and innovation in the market.

We can help! Our analysts can customize this industrial robotics market research report to meet your requirements.