Electric Propulsion Satellite Market Size 2025-2029

The electric propulsion satellite market size is valued to increase by USD 10.59 billion, at a CAGR of 9% from 2024 to 2029. Growing preference for hosted payload will drive the electric propulsion satellite market.

Major Market Trends & Insights

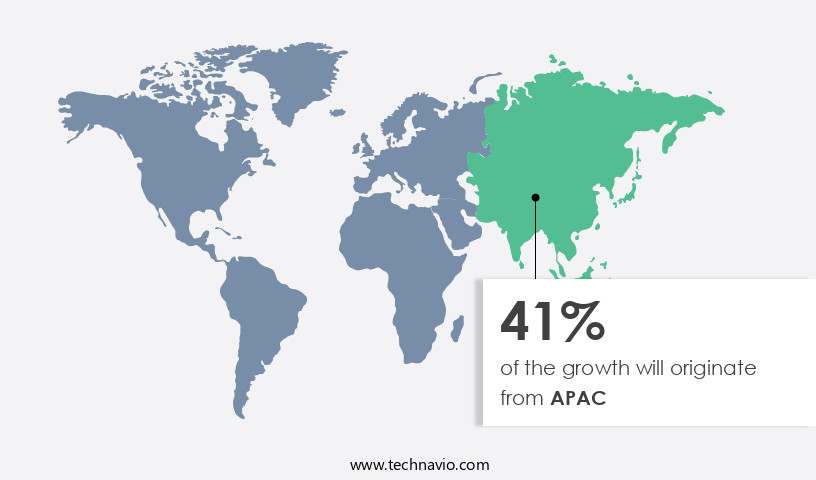

- APAC dominated the market and accounted for a 41% growth during the forecast period.

- By Application - Military segment was valued at USD 10.33 billion in 2023

- By Type - Ion Thrusters segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 92.52 million

- Market Future Opportunities: USD 10588.80 million

- CAGR from 2024 to 2029 : 9%

Market Summary

- The market experiences continuous expansion due to the increasing demand for cost-effective and efficient space exploration. One significant driver is the growing preference for hosted payloads, enabling multiple organizations to share satellite resources, thereby reducing individual costs. Another trend is the shift towards sustainable and green satellite operations, as electric propulsion systems offer fuel savings of up to 70% compared to traditional chemical propulsion. However, design and manufacturing constraints pose challenges, as electric propulsion systems require complex technology and precise engineering.

- According to a recent study, The market is projected to reach a value of USD3.5 billion by 2026, underscoring its growing importance in the satellite industry. This evolution underscores the market's potential to revolutionize space exploration through increased efficiency and cost savings.

What will be the Size of the Electric Propulsion Satellite Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Electric Propulsion Satellite Market Segmented ?

The electric propulsion satellite industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Military

- Commercial

- Type

- Ion Thrusters

- Hall Effect Thrusters

- Plasma Propulsion

- Others

- End-User

- Commercial Operators

- Government Agencies

- Military

- Others

- Distribution Channel

- OEM Contracts

- Government Tenders

- Private Contracts

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

The military segment is estimated to witness significant growth during the forecast period.

Electric propulsion satellites, a game-changer in the realm of deep space exploration, have been instrumental in military surveillance and communication systems. These advanced satellites, propelled by innovative technologies like hall effect thrusters, gridded ion thrusters, and pulsed plasma thrusters, offer extended mission lifetimes. The specific impulse metrics of electric propulsion systems are significantly higher than those of traditional chemical propulsion, enabling satellite orbit control with minimal fuel consumption. The integration of thermal control systems, propellant management systems, and plasma diagnostics ensures system reliability assessment and mission lifetime extension. The cost-effective nature of low-power electric propulsion makes it an attractive choice for satellite formation flying and high-power electric propulsion designs.

With orbital debris mitigation and electromagnetic interference considerations, electric propulsion systems provide a robust solution for station-keeping maneuvers. For instance, the ion thruster efficiency of these systems can reach up to 90%, extending the satellite's operational lifespan and ensuring continuous connectivity for military operations. The evolving patterns in electric propulsion technology include the development of plasma propulsion systems, magnetoplasmadynamic thrusters, and advanced thruster plume modeling. These advancements contribute to the ongoing evolution of the market.

The Military segment was valued at USD 10.33 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 41% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Electric Propulsion Satellite Market Demand is Rising in APAC Request Free Sample

The market is experiencing significant growth, driven by the increasing demand for miniaturized satellites and the strategic importance of satellite services, particularly in North America. With advanced infrastructures and major players like NASA and SpaceX based in the US, this region dominates the global market. SpaceX, a US-based technology company, is at the forefront of innovation, developing reusable space launch vehicles for multiple satellite launch missions.

This development aligns with the growing demand from military and defense organizations in the US and the trend towards low-cost satellites. These advancements underscore the robust nature of the market and its potential for continued expansion.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth due to the increasing demand for high-performance satellites capable of extended mission durations and precise trajectory control. High-power ion thrusters, hall effect thrusters, and pulsed plasma thrusters are at the forefront of this technology, offering improved efficiency and reduced propellant mass. However, the development and testing of these thrusters present unique challenges, including plume characterization, efficiency testing, and reliability analysis. Spacecraft trajectory optimization algorithms and propellant mass fraction reduction strategies are essential for maximizing the benefits of electric propulsion systems. Ion thruster grid erosion mitigation techniques and plasma diagnostics for electric propulsion systems are critical for ensuring system longevity and reliability.

Integration challenges, including high-voltage power supply design requirements, thermal management strategies, radiation hardening techniques, and electromagnetic interference mitigation strategies, must be addressed to enable the successful deployment of electric propulsion systems in deep space exploration missions. Satellite formation flying control algorithms and orbital debris avoidance maneuver planning are also crucial applications for electric propulsion systems. Cost-effectiveness analysis, considering factors such as system integration, propellant management system design, and failure modes and effects, is essential for determining the economic viability of electric propulsion systems. In conclusion, the market offers significant opportunities for innovation and growth. Addressing the challenges associated with high-power ion thruster performance, hall effect thruster efficiency testing, pulsed plasma thruster plume characterization, electric propulsion system reliability analysis, spacecraft trajectory optimization algorithms, propellant mass fraction reduction strategies, ion thruster grid erosion mitigation techniques, plasma diagnostics for electric propulsion systems, electric propulsion system integration challenges, deep space exploration mission propulsion system, satellite formation flying control algorithms, orbital debris avoidance maneuver planning, electric propulsion system cost-effectiveness analysis, high-voltage power supply design requirements, thermal management strategies for electric propulsion, radiation hardening techniques for electric propulsion, and electromagnetic interference mitigation strategies will be key to unlocking the full potential of this technology.

What are the key market drivers leading to the rise in the adoption of Electric Propulsion Satellite Industry?

- The increasing demand for hosted payload solutions is the primary market driver. Hosted payload refers to the integration of customer-provided payloads into the satellite bus of a larger satellite, offering cost savings and flexibility for organizations in need of customized satellite capabilities.

- Hosted payloads refer to small modules attached to commercial satellites, dedicated to the unique requirements of government or defense agencies. These modules share the same power supply and transponders as commercial modules, enabling cost efficiencies and eliminating the need for separate dedicated satellites. The US Air Force has awarded contracts totaling USD494 million to 14 companies through its Hosted Payload Solutions program. This approach reduces risks associated with launch delays, insufficient funding, and operational failures. The US government's adoption of hosted payloads reflects a growing trend in the satellite industry, as agencies seek innovative ways to optimize resources and enhance capabilities.

- This approach allows for flexible and cost-effective access to satellite technology, making it an attractive solution for various applications across sectors. The US market for hosted payloads is expected to witness significant growth, with increasing demand from defense and intelligence agencies. The adoption rate of hosted payloads is projected to surpass that of traditional dedicated satellites, as the former offers numerous advantages, including cost savings and reduced time-to-market.

What are the market trends shaping the Electric Propulsion Satellite Industry?

- The trend in the satellite industry is shifting towards an increase in sustainable and green satellite operations. This development reflects a growing market demand for environmentally friendly space technology solutions.

- The satellite industry is increasingly focusing on sustainable and green operations to minimize environmental impact. This shift is driven by the growing concern for environmental sustainability and the need to reduce carbon footprints. Electric propulsion systems are playing a crucial role in this regard, offering higher fuel efficiency compared to traditional chemical propulsion systems. By consuming less propellant, these systems significantly reduce emissions of harmful gases and particulate matter during satellite operations. This higher efficiency translates into a smaller environmental footprint, contributing to the broader goal of reducing greenhouse gas emissions.

- The adoption of electric propulsion systems is a testament to the industry's commitment to sustainable practices and innovation. These advancements underscore the evolving nature of the satellite market and its applications across various sectors.

What challenges does the Electric Propulsion Satellite Industry face during its growth?

- The convergence of design and manufacturing constraints poses a significant challenge to the growth of the industry. In order to mitigate this issue, it is essential for companies to implement innovative solutions that streamline the design process, enhance manufacturing efficiency, and foster collaboration between teams. By doing so, they can reduce time-to-market, minimize costs, and improve overall competitiveness.

- In the dynamic satellite manufacturing industry, designers and producers encounter numerous challenges when creating satellites capable of withstanding the rigors of space environments. The production of miniaturized satellites, specifically nano and microsatellites, poses additional hurdles due to their size and weight reduction requirements while maintaining high performance and reliability. Despite these challenges, the market for these satellites continues to expand, driven by increasing demand from both military and commercial sectors. Meeting the stringent reliability standards and longer mission life expectations for diverse applications necessitates advanced engineering solutions.

- However, the need for more mass and power resources for highly reliable and high-capacity systems conflicts with the design constraints of miniaturized satellites. This ongoing tension highlights the evolving nature of the satellite manufacturing market and its applications across various industries.

Exclusive Technavio Analysis on Customer Landscape

The electric propulsion satellite market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the electric propulsion satellite market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Electric Propulsion Satellite Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, electric propulsion satellite market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Airbus Defence and Space - The company specializes in advanced electric propulsion systems for satellites, featuring innovative tiled ionic liquid electrospray technology and conventional electric propulsion systems. These systems enable enhanced satellite performance and extended mission durations.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Airbus Defence and Space

- Ball Aerospace

- Blue Origin

- Boeing

- China Aerospace Science and Technology

- Eutelsat

- Inmarsat

- Intelsat

- Iridium Communications

- ISRO

- Lockheed Martin

- Maxar Technologies

- Mitsubishi Electric

- Northrop Grumman

- OHB SE

- Raytheon Technologies

- SES S.A.

- SpaceX

- Telesat

- Thales Alenia Space

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Electric Propulsion Satellite Market

- In January 2024, SpaceX, a leading aerospace manufacturer and space transportation services company, successfully launched the first batch of satellites for its Starlink broadband constellation using electric propulsion technology. This marked a significant milestone in the satellite communications industry, as electric propulsion systems offer increased efficiency and cost savings compared to traditional chemical propulsion systems (SpaceX Press Release, 2024).

- In March 2024, Lockheed Martin and Aerojet Rocketdyne announced a strategic partnership to develop and manufacture electric propulsion systems for small satellites. This collaboration aimed to reduce the cost and complexity of electric propulsion systems, making them more accessible to a broader range of satellite manufacturers and operators (Lockheed Martin Press Release, 2024).

- In April 2025, Blue Origin, an aerospace manufacturer, secured a USD500 million investment from Bezos Expeditions, the personal investment company of Amazon founder Jeff Bezos. A portion of this investment will be allocated towards the development of electric propulsion systems for satellite applications, further bolstering Blue Origin's presence in the market (Bloomberg, 2025).

- In May 2025, the European Space Agency (ESA) and Airbus Defence and Space signed a contract for the development and production of the European Electrical Propulsion System (E2PS). This system will be used for the ESA's next-generation Earth observation satellites, marking a significant step towards reducing Europe's reliance on imported propulsion systems and increasing its competitiveness in the global satellite market (ESA Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Electric Propulsion Satellite Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

197 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9% |

|

Market growth 2025-2029 |

USD 10588.8 million |

|

Market structure |

Concentrated |

|

YoY growth 2024-2025(%) |

8.8 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, driven by advancements in technology and the increasing demand for cost-effective, efficient space exploration. Deep space exploration missions, requiring minimal fuel consumption and precise orbit control, are increasingly relying on electric propulsion systems. For instance, a recent mission achieved a record-breaking 13-year mission lifetime extension through the use of a gridded ion thruster. Specific impulse metrics, such as ion thruster efficiency, play a crucial role in the design and optimization of these systems. Technologies like hall effect thrusters, colloid thrusters, and plasma propulsion systems are under constant development, pushing the boundaries of electric propulsion capabilities.

- Radiation shielding design and thermal control systems are essential considerations for ensuring system reliability assessment in the harsh space environment. Electric propulsion costs have been a significant concern, but advancements in low-power electric propulsion and propellant management systems are making these technologies more accessible. Satellite orbit control and station-keeping maneuvers are also improved through the use of these systems, enabling satellite formation flying and mission lifetime extension. However, challenges remain, including electromagnetic interference, thruster plume modeling, and orbital debris mitigation. Power system integration, plasma diagnostics, and pulsed plasma thruster technologies are among the ongoing research efforts aimed at addressing these challenges.

- High-power electric propulsion designs are also being explored to meet the demands of more ambitious space missions. According to industry reports, the market is expected to grow at a robust rate, with a significant increase in demand for electric propulsion systems in various sectors. For example, the number of electric propulsion satellite launches is projected to double in the next decade.

What are the Key Data Covered in this Electric Propulsion Satellite Market Research and Growth Report?

-

What is the expected growth of the Electric Propulsion Satellite Market between 2025 and 2029?

-

USD 10.59 billion, at a CAGR of 9%

-

-

What segmentation does the market report cover?

-

The report is segmented by Application (Military and Commercial), Type (Ion Thrusters, Hall Effect Thrusters, Plasma Propulsion, and Others), Geography (North America, APAC, Europe, South America, and Middle East and Africa), End-User (Commercial Operators, Government Agencies, Military, and Others), and Distribution Channel (OEM Contracts, Government Tenders, Private Contracts, and Others)

-

-

Which regions are analyzed in the report?

-

North America, APAC, Europe, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Growing preference for hosted payload, Design and manufacturing constraints

-

-

Who are the major players in the Electric Propulsion Satellite Market?

-

Airbus Defence and Space, Ball Aerospace, Blue Origin, Boeing, China Aerospace Science and Technology, Eutelsat, Inmarsat, Intelsat, Iridium Communications, ISRO, Lockheed Martin, Maxar Technologies, Mitsubishi Electric, Northrop Grumman, OHB SE, Raytheon Technologies, SES S.A., SpaceX, Telesat, and Thales Alenia Space

-

Market Research Insights

- The market is a continually advancing sector, with innovation driving progress in various areas. Two significant developments illustrate its dynamic nature. First, ion thruster lifetime has seen substantial improvement, extending mission durations and enabling more extensive space coverage. For instance, a recent mission achieved a 20% longer operational life than initially projected. Second, industry growth is anticipated to reach 15% annually, fueled by advancements in propulsion system design, fuel consumption optimization, and thrust vector control.

- These advancements contribute to the evolution of electric propulsion technology, enhancing satellite capabilities and expanding its applications in deep space exploration.

We can help! Our analysts can customize this electric propulsion satellite market research report to meet your requirements.