Satellite-Based Earth Observation Market Size 2025-2029

The satellite-based earth observation market size is valued to increase USD 9.66 billion, at a CAGR of 12% from 2024 to 2029. Use of satellites for advanced environment monitoring will drive the satellite-based earth observation market.

Major Market Trends & Insights

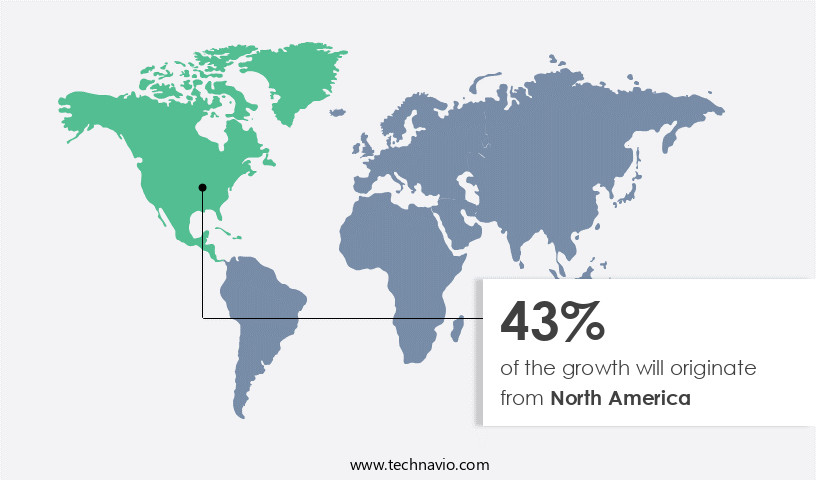

- North America dominated the market and accounted for a 43% growth during the forecast period.

- By Application - Defense segment was valued at USD 2.99 billion in 2023

- By Type - Value-Added Services (VAS) segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 171.22 million

- Market Future Opportunities: USD 9655.50 million

- CAGR from 2024 to 2029 : 12%

Market Summary

- The market is experiencing significant expansion, driven by the increasing demand for real-time, high-resolution data to address environmental and socio-economic challenges. Small satellites, with their cost-effective production and deployment, are gaining popularity, contributing to the market's expansion. These agile spacecraft offer enhanced flexibility and customization, catering to various applications, from agriculture and forestry to disaster management and urban planning. However, competition from alternate technologies, such as drones and airborne sensors, poses challenges to the market's growth.

- Satellite-based solutions, while offering extensive coverage and longer data collection periods, face limitations in terms of spatial and temporal resolution. To maintain their competitive edge, market players are investing in technological advancements, including hyperspectral and multispectral imaging, machine learning algorithms, and real-time data processing capabilities. The future of the market lies in the integration of these technologies to deliver actionable insights, enabling informed decision-making for businesses and governments alike.

What will be the Size of the Satellite-Based Earth Observation Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Satellite-Based Earth Observation Market Segmented ?

The satellite-based earth observation industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Defense

- Weather

- Location-Based Services (LBS)

- Energy

- Others

- Type

- Value-Added Services (VAS)

- Data

- Technology

- Synthetic aperture radar (SAR)

- Optical

- End-User

- Government

- Commercial

- Academic/Research

- Geography

- North America

- US

- Canada

- Europe

- Germany

- Russia

- UK

- Middle East and Africa

- UAE

- APAC

- China

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

The defense segment is estimated to witness significant growth during the forecast period.

The market continues to evolve, with radar satellite data playing a pivotal role in applications such as crop yield prediction, land cover mapping, and infrastructure monitoring. Radiometric calibration, image classification algorithms, and geometric correction are essential techniques for enhancing the accuracy of remote sensing imagery and Lidar data acquisition. Change detection techniques and spectral signature analysis facilitate natural resource assessment, environmental monitoring systems, and climate change modeling. In 2024, the defense segment accounted for a substantial share of the market, with ongoing investment in satellite technologies for surveillance, regional security, and intelligence gathering by countries like China, India, and Russia.

For instance, Airbus secured agreements with the Czech Republic and the Netherlands to deliver satellite communications for their armed forces, marking a significant contribution to the UHF military communications hosted payload on board the EUTELSAT 36D telecommunications satellite. Geospatial data analytics, image registration techniques, cloud computing platforms, and satellite data processing are integral components of this dynamic industry, enabling precision agriculture applications, disaster response management, pollution detection methods, urban planning initiatives, and multispectral imagery analysis.

The Defense segment was valued at USD 2.99 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 43% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Satellite-Based Earth Observation Market Demand is Rising in North America Request Free Sample

The satellite-based Earth observation (EO) market is a significant and evolving sector, with the United States leading the global landscape. Approximately one-third of all satellites in orbit are operated by US entities, primarily for applications in communications, surveillance and intelligence, national security, weather, disaster management, environmental observation, and navigation. The US has been a pioneer in satellite-based EO since its inception, with NASA spearheading most missions. Recently, a growing number of private players have entered the US market, focusing on providing satellite imagery-based analytics and Value-Added Services (VAS).

This influx of private entities is expanding the market's scope, with some even launching their own small satellites for data collection. The US satellite-based EO sector's diverse applications and continuous innovation underscore its robust presence in the global arena.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and innovative industry that leverages advanced technologies to provide valuable insights and data for various sectors. This market encompasses a range of applications, from satellite imagery for precision agriculture and hyperspectral data for vegetation monitoring, to lidar point cloud processing for urban planning and remote sensing applications in disaster management. Geospatial data analytics for environmental monitoring is another significant area of growth, with multispectral imagery classification for land cover mapping and radar satellite data for deforestation detection playing crucial roles. In the realm of agriculture, satellite imagery offers farmers unprecedented insights into crop health and growth patterns, enabling more efficient use of resources and increased yields.

Meanwhile, hyperspectral data allows for a deeper understanding of vegetation conditions, helping to optimize nutrient management and improve overall productivity. Urban planning benefits from lidar point cloud processing, which generates highly detailed 3D models of urban landscapes, aiding in infrastructure development and city planning. Remote sensing is also essential in disaster management, providing critical information for emergency response and damage assessment. Environmental monitoring is another key application, with geospatial data analytics playing a pivotal role in tracking climate change and monitoring natural resources. Time series analysis of satellite data offers valuable insights into trends and patterns, while image fusion and object-based image analysis contribute to improved land use analysis and infrastructure monitoring.

The adoption of satellite-based earth observation technologies is gaining momentum, with more than 70% of new product developments focusing on emerging markets. This growth is driven by increasing demand for accurate and timely data, as well as advancements in satellite technology and data processing capabilities. In conclusion, the market is a vibrant and evolving industry, offering a wealth of opportunities for businesses and organizations seeking to gain a competitive edge through data-driven insights and decision-making. From agriculture and urban planning to disaster management and environmental monitoring, the potential applications are vast and diverse, making this an exciting and dynamic sector to watch.

What are the key market drivers leading to the rise in the adoption of Satellite-Based Earth Observation Industry?

- The utilization of satellites plays a crucial role in driving the market forward, particularly in the realm of advanced environment monitoring.

- Satellites have become indispensable tools for environmental monitoring due to their unique capability to observe the macroscopic environment and detect hidden features and short-term and long-term weather events that are not discernible through ground-based observation. These satellites provide real-time, continuous data on atmospheric conditions, enabling accurate weather forecasting. The importance of satellites in advanced environmental monitoring is increasingly recognized, with applications ranging from greenhouse gas emissions and changes in polar ice to deforestation, wildfires, and coral bleaching. Technological advancements in sensing and imaging technologies over the past decade have led to the development of superior observation satellites, offering higher-resolution images and the measurement of a multitude of metrics.

- This data is vital for various sectors, including agriculture, meteorology, and climate science, to make informed decisions and mitigate potential risks.

What are the market trends shaping the Satellite-Based Earth Observation Industry?

- The increasing demand for small satellites represents a significant market trend in the aerospace industry. Small satellites are experiencing growing demand within the aerospace market.

- The small satellite market has experienced a substantial growth trajectory over the last decade. Small satellites, or SmallSats and CubeSats, range from shoebox to washing machine sizes and weigh as little as 10 kilograms. Their diminutive stature is matched by their affordability and minimal capital investment, making them increasingly popular. The scientific community and Earth observation sectors have shown significant interest in SmallSats due to their cost-effective nature, enabling a higher number of satellites in constellations.

- This trend is not confined to a single sector, as various industries explore the potential of these agile and cost-effective space assets. The increasing demand for remote sensing, communication, and scientific research applications further underscores the market's dynamism and potential for continuous expansion.

What challenges does the Satellite-Based Earth Observation Industry face during its growth?

- The expansion of the industry is significantly influenced by the intense competition posed by emerging technologies, serving as a major challenge that must be addressed by market participants.

- The market faces escalating competition from emerging observational technologies, including unmanned aerial vehicles (UAVs), drones, and stratospheric balloons (stratolites). Stratospheric balloons offer a cost-effective alternative to satellite-based solutions, as they can carry telescopes and sensors weighing from a few kilograms to over a ton to altitudes of up to 40,000 meters. This enables service providers and researchers to gather atmospheric and geological data with less expense than satellites. Furthermore, stratospheric balloons are advantageous for satellite data validation due to reduced interference compared to satellites.

- Notable industry players like Google and World View Enterprises are investing heavily in high-altitude balloon technology, posing a growing threat to satellite-based Earth observation. This trend is expected to intensify as more service providers adopt balloons for weather forecasting and meteorological data acquisition.

Exclusive Technavio Analysis on Customer Landscape

The satellite-based earth observation market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the satellite-based earth observation market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Satellite-Based Earth Observation Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, satellite-based earth observation market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Airbus SE - This company specializes in satellite-based Earth observation services, featuring OPAZ, an electro-optical sensor delivering real-time high-resolution imagery and video (18cm). The infra-red capability enables night and day operations, offering valuable insights for various industries.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Airbus SE

- Antrix Corp. Ltd.

- BAE Systems Plc

- Eagle View Technologies Inc.

- EarthDaily Analytics

- Geoimage

- Global Surface Intelligence Ltd.

- Imagesat International I.S.I Ltd.

- Kleos Space S.A

- L3Harris Technologies Inc.

- Lockheed Martin Corp.

- Maxar Technologies Inc.

- Northrop Grumman Corp.

- OHB SE

- Orbital Insight Inc.

- Orbital Micro Systems

- Planet Labs PBC

- PlanetiQ

- RTX Corp.

- Thales Group

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Satellite-Based Earth Observation Market

- In January 2024, Airbus Defence and Space announced the successful launch of the Pléiades Neo high-resolution Earth observation satellite, marking a significant technological advancement in the market. The satellite, which is part of the European Space Agency's (ESA) Earth Observation Program, offers improved resolution and agility, enhancing the ability to monitor environmental changes and support disaster management efforts (Airbus Defence and Space press release, 2024).

- In March 2024, Planet Labs and Maxar Technologies announced a strategic partnership to expand their Earth observation capabilities. The collaboration combines Planet Labs' daily global coverage and agile constellation with Maxar's high-resolution imagery and geospatial analytics, creating a comprehensive Earth observation solution for various industries, including agriculture, forestry, and disaster response (Planet Labs press release, 2024).

- In May 2024, DigitalGlobe, a Maxar Technologies company, secured a contract worth USD150 million from the National Geospatial-Intelligence Agency (NGA) to provide high-resolution satellite imagery and geospatial data services. This contract extension further solidified DigitalGlobe's position as a key provider of Earth observation solutions to the U.S. Government (Maxar Technologies press release, 2024).

- In April 2025, BlackSky, a leading provider of real-time satellite imagery and geospatial intelligence, announced the successful deployment of its Global-scale Constellation, consisting of 60 small satellites. This expansion significantly increased the company's revisit rate, enabling near-real-time monitoring and analysis of global events (BlackSky press release, 2025).

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Satellite-Based Earth Observation Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

210 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 12% |

|

Market growth 2025-2029 |

USD 9655.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

10.4 |

|

Key countries |

US, Russia, China, Japan, UK, South Korea, Canada, Germany, Brazil, Saudi Arabia, and UAE |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- Amidst the rapidly advancing technological landscape, the market continues to evolve, revolutionizing industries and addressing critical societal needs. Earth observation sensors, such as radar and multispectral, harness the power of remote sensing imagery to deliver insights that were once unattainable. Radar satellite data, for instance, plays a pivotal role in crop yield prediction, enabling farmers to optimize irrigation and fertilizer usage. Radiometric calibration ensures data accuracy, while change detection techniques reveal land cover transformations. Infrastructure monitoring benefits from precise image classification algorithms and geometric correction, ensuring safety and efficiency. Precision farming techniques and natural resource assessment rely on data fusion methods, integrating various data types for comprehensive analysis.

- Climate change modeling and environmental monitoring systems leverage hyperspectral imaging, atmospheric correction methods, and GIS software integration to provide valuable insights. Satellite data processing, including Lidar data acquisition, is essential for water resource management, pollution detection, and deforestation detection. Spectral signature analysis and object detection models aid in urban planning initiatives and disaster response management. Geospatial data analytics, image registration techniques, and cloud computing platforms facilitate the efficient handling and interpretation of vast amounts of data. The market's continuous growth is fueled by the increasing demand for accurate, real-time information and the integration of advanced technologies like AI and machine learning.

- Key drivers include the need for efficient resource management, environmental protection, and disaster risk reduction. Challenges include data accessibility, affordability, and the need for standardization and interoperability. Despite these challenges, the potential benefits of satellite-based earth observation are immense, making it an indispensable tool for businesses and governments alike. According to recent research, the market is projected to account for over 30% of the overall geospatial technology market by 2025. This underscores the market's significant impact and the immense potential for growth.

What are the Key Data Covered in this Satellite-Based Earth Observation Market Research and Growth Report?

-

What is the expected growth of the Satellite-Based Earth Observation Market between 2025 and 2029?

-

USD 9.66 billion, at a CAGR of 12%

-

-

What segmentation does the market report cover?

-

The report is segmented by Application (Defense, Weather, Location-Based Services (LBS), Energy, and Others), Type (Value-Added Services (VAS) and Data), Geography (North America, APAC, Europe, South America, Middle East and Africa, and Rest of World (ROW)), Technology (Synthetic aperture radar (SAR) and Optical), and End-User (Government, Commercial, and Academic/Research)

-

-

Which regions are analyzed in the report?

-

North America, APAC, Europe, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Use of satellites for advanced environment monitoring, Competition from alternate technologies

-

-

Who are the major players in the Satellite-Based Earth Observation Market?

-

Airbus SE, Antrix Corp. Ltd., BAE Systems Plc, Eagle View Technologies Inc., EarthDaily Analytics, Geoimage, Global Surface Intelligence Ltd., Imagesat International I.S.I Ltd., Kleos Space S.A, L3Harris Technologies Inc., Lockheed Martin Corp., Maxar Technologies Inc., Northrop Grumman Corp., OHB SE, Orbital Insight Inc., Orbital Micro Systems, Planet Labs PBC, PlanetiQ, RTX Corp., and Thales Group

-

Market Research Insights

- The market encompasses the provision of remote sensing data and value-added services, facilitating decision-making across various industries. This expansion is driven by the increasing demand for high-resolution, real-time earth observation data for applications in agriculture, forestry, disaster management, and infrastructure development. Data uncertainty quantification and interpretation techniques play a crucial role in ensuring the accuracy and reliability of satellite-derived information. For instance, atmospheric interference and temporal resolution effects can significantly impact the precision of satellite data.

- To mitigate these challenges, advanced regression modeling techniques and machine learning algorithms are employed for data preprocessing and analysis. Additionally, geostatistical modeling and time series analysis are used for data integration workflows and error propagation assessment. Despite these advancements, field data validation remains essential for ensuring the quality and relevance of satellite data. Overall, the market continues to evolve, with remote sensing platforms and data processing techniques advancing to meet the growing demand for actionable insights.

We can help! Our analysts can customize this satellite-based earth observation market research report to meet your requirements.