Electrical Conductors Market For Power Industry Size 2025-2029

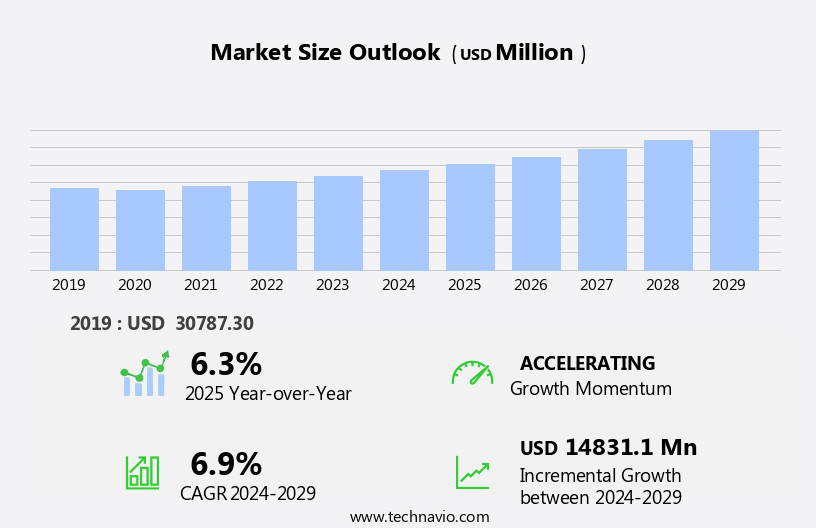

The electrical conductors market for power industry size is forecast to increase by USD 14.83 billion, at a CAGR of 6.9% between 2024 and 2029.

- The Electrical Conductors Market for the Power Industry is witnessing significant growth, driven by the increasing investment in power transmission and distribution infrastructure. This trend is further fueled by the rising sales of power cables due to the expanding power generation capacity and the growing demand for electricity in various industries and residential sectors. The market is evolving with the integration of superconductors, which enhance the efficiency of power transmission by reducing energy loss and enabling more sustainable electrical grids. However, the market faces challenges in laying and maintaining electrical power cables. These challenges include the high cost of installation and maintenance, the need for complex permitting processes, and the increasing demand for longer cable lengths to transmit power over greater distances.

- To capitalize on the market opportunities and navigate these challenges effectively, companies must focus on innovations in cable technology, such as the use of smart cables and advanced materials, to improve efficiency, reduce costs, and enhance durability. Additionally, collaborations and partnerships with regulatory bodies and industry associations can help streamline permitting processes and ensure compliance with safety regulations. Overall, the Electrical Conductors Market for the Power Industry presents significant growth potential, with companies that can address the challenges of installation and maintenance while delivering advanced cable solutions poised to gain a competitive edge.

What will be the Size of the Electrical Conductors Market For Power Industry during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The electrical conductors market in the power industry continues to evolve, driven by the dynamic nature of power generation and distribution. Power quality is a significant concern, with voltage regulation and IEC standards playing crucial roles in ensuring consistent electricity supply. Electrical grids incorporate various power sources, including hydroelectric, wind, and solar, necessitating the use of different types of conductors. Bundled conductors, AAC conductors, and aluminum conductors are employed in power transmission lines, while copper conductors are preferred for their electrical resistance and current carrying capacity in power distribution networks. High-frequency conductors and insulated conductors are essential components of smart grids, enabling efficient power flow and energy storage.

Power loss is a persistent issue, with corrosion protection, conductor splices, and insulation materials playing vital roles in minimizing it. Conductor installation, ANSI and IEEE standards compliance, and conductor testing are essential for maintaining the integrity of power distribution networks. Power plants require various types of conductors, including ACSR conductors, for voltage regulation and current carrying capacity. High-temperature conductors and superconducting conductors are used in specific applications for enhanced performance. Grounding systems, strain relief, electrical connectors, and termination hardware ensure electrical safety and power quality. Skin effect, proximity effect, and power loss are ongoing concerns in power transmission, necessitating continuous research and development in material science and insulation materials.

Renewable energy sources, such as solar power, require specialized conductors and insulation materials for optimal performance. Grid modernization and environmental impact are significant trends, with vibration dampers and cross-linked polyethylene (XLPE) insulation materials playing crucial roles in enhancing the performance and sustainability of power distribution networks. Conductor maintenance and energy efficiency are essential considerations for reducing operational costs and minimizing environmental impact.

How is this Electrical Conductors For Power Industry Industry segmented?

The electrical conductors for power industry industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Power transmission

- Power distribution

- Others

- Type

- Power cables

- Transformer

- Busbar

- Submarine power cables

- End-user

- Utilities

- Industrial

- Commercial

- Residential

- Material

- Copper conductors

- Aluminum conductors

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Application Insights

The power transmission segment is estimated to witness significant growth during the forecast period.

Electric conductors play a crucial role in power transmission by enabling the transfer of electrical energy from generation sources to end-users. The selection of conductors depends on various factors such as voltage regulation, transmission distance, environmental conditions, and cost considerations. IEC and ANSI standards guide the design and installation of electrical grids, ensuring compliance with safety and efficiency requirements. Power generation sources include hydroelectric, wind, solar, nuclear, and power plants, each requiring specific conductor types. For instance, hydroelectric power and high-voltage transmission lines often use bundled aluminum or copper conductors, while wind power employs ACSR or AAAC conductors.

Smart grids, which integrate renewable energy sources and energy storage, require high-frequency and high-temperature conductors, as well as insulated and cross-linked polyethylene (XLPE) insulation. Voltage regulation is essential for maintaining power quality and preventing power loss due to the proximity effect and corrosion. Conductor splices and termination hardware ensure proper connection and electrical safety. Grounding systems and strain relief protect against electrical surges and mechanical stress. Power transmission lines are subjected to environmental conditions, including temperature, humidity, and vibration, necessitating corrosion protection and vibration dampers. Grid modernization focuses on enhancing power distribution networks by integrating advanced technologies like superconducting conductors and conductor testing.

In the context of renewable energy sources, material science plays a significant role in developing advanced conductors with improved electrical resistance, current carrying capacity, and environmental impact. Conductor maintenance is essential for ensuring reliable power transmission and minimizing power loss. In conclusion, the power transmission industry is evolving to meet the growing global energy demand, driven by population growth, urbanization, and industrialization. Electric conductors, as the backbone of electrical grids, must adapt to these changes by offering improved performance, safety, and sustainability.

The Power transmission segment was valued at USD 19.1 billion in 2019 and showed a gradual increase during the forecast period.

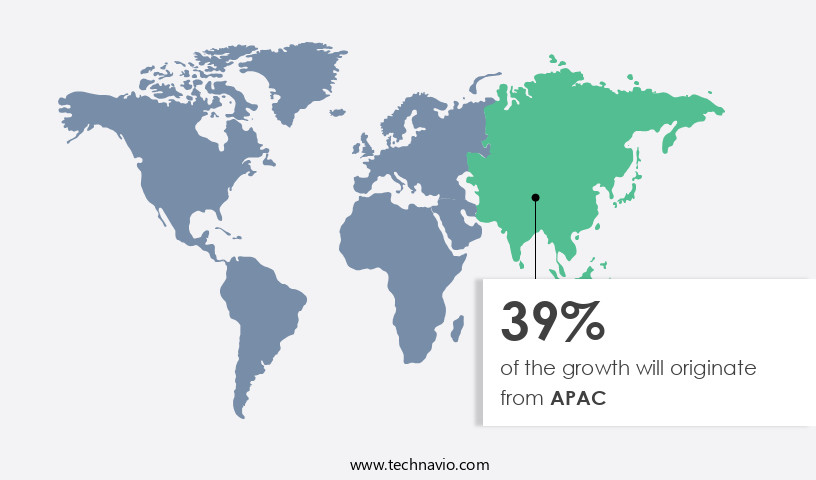

Regional Analysis

APAC is estimated to contribute 39% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the power industry, APAC is witnessing significant demand for electrical conductors due to the region's increasing electricity consumption. The growing population and rising standards of living have made electricity a necessity in many major countries. This trend has led several of these nations to allow private participation in the power sector. The need for electricity continues to escalate in response to population growth and rural electrification initiatives in developing countries. China holds a dominant position in the APAC the market, accounting for over half of the market share. IEC and ANSI standards guide the manufacturing and installation of various conductors, including copper, aluminum, and ACSR, for applications such as voltage regulation, power transmission, and distribution.

Hydroelectric power, wind power, and solar power are driving the adoption of smart grids and advanced conductor technologies like high-temperature, high-frequency, and superconducting conductors. Corrosion protection, conductor splices, and insulation materials like XLPE are crucial considerations in conductor design. Voltage regulation, power loss, and electrical safety are critical factors influencing conductor selection. Power plants, electrical grids, and power distribution networks require regular maintenance and upkeep, including conductor testing and termination hardware installation. Renewable energy sources like hydroelectric, wind, and solar power are subject to environmental impact assessments, and conductor materials must comply with relevant standards. Conductors play a vital role in power quality, power transmission, and energy efficiency, making them indispensable in the power industry's ongoing modernization efforts.

Market Dynamics

The Electrical Conductors Market is thriving, driven by demand for copper conductors and aluminum conductors in power cables and EV charging cables. Data center cabling supports high-performance computing, while high-conductivity alloys and fire-resistant cables enhance efficiency and safety. Sustainable conductor materials align with eco-conscious trends, boosting the power transmission market and EV charging infrastructure market. Key long-tail keywords like copper conductors for power transmission, aluminum conductors for EV charging, fire-resistant cables for data centers, eco-friendly conductor materials 2025, high-conductivity alloys for renewable energy, sustainable conductor materials for infrastructure, ACSR conductors for high-voltage lines, halogen-free insulation for power cables, lightweight conductor materials for industrial use, and smart grid conductors for energy efficiency drive innovation and market visibility.

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Electrical Conductors For Power Industry Industry?

- The significant increase in investment towards power transmission and distribution infrastructure serves as the primary catalyst for market growth.

- The electrical conductors market for the power industry is experiencing significant growth due to increasing investments in transmission and distribution networks. This trend is driven by the need to effectively transmit power to various electrical equipment throughout the network. Global investments in the transmission and distribution sectors create profitable opportunities for key players in the market. Furthermore, technological advancements and government investments in research and development for expanding transmission and distribution networks to facilitate power generation from renewable energy sources are opening new avenues for market expansion. Material science plays a crucial role in the development of electrical conductors, with advancements leading to the production of high-performance conductors such as AAAC conductors, ACSR conductors, underground conductors, superconducting conductors, and aluminum conductors.

- These conductors offer improved current carrying capacity, sag and tension resistance, and environmental impact reduction through the use of cross-linked polyethylene (XLPE) insulation and vibration dampers, termination hardware, and other advanced technologies. Ensuring compliance with industry standards is essential for electrical safety and market acceptance. Overall, the electrical conductors market for the power industry is poised for growth as the world transitions to a more sustainable energy future.

What are the market trends shaping the Electrical Conductors For Power Industry Industry?

- The power cables market is experiencing a significant growth trend. Sales of power cables are projected to increase in the upcoming period.

- The European energy market has witnessed significant growth in recent years, with a focus on improving energy security and increasing the use of renewable energy sources. In 2015, the European Commission invested ⬠530 million to establish a more integrated energy market and enhance energy security. By 2024, over half of the electricity generated in the EU is expected to come from renewable sources. To facilitate the transmission of large quantities of electricity across borders, high-voltage power cables are becoming a preferred choice. Power quality is a crucial factor in the selection of electrical conductors for power distribution networks. Skin effect and insulation materials play significant roles in ensuring efficient power transmission.

- Conductor maintenance is essential to ensure the longevity and reliability of power systems. Both bare conductors and insulated conductors have their advantages, with the choice depending on the specific application. HVDC power systems are economically viable for long-distance bulk power delivery. The European projects aim to remove hindrances to the growth of the internal energy market, including the implementation of HVDC power systems and upgrading existing power distribution networks. Solar power is another growing sector in the power industry, with energy storage solutions becoming increasingly important for efficient energy management. Insulated conductors are widely used in overhead power lines due to their ability to reduce power losses and improve power quality.

- Conductor testing is crucial to ensure the reliability and safety of power systems. The power industry is continuously evolving, with a focus on energy efficiency, power quality, and the integration of renewable energy sources. Nuclear power remains an essential part of the power mix, with ongoing research and development aimed at improving safety and efficiency.

What challenges does the Electrical Conductors For Power Industry Industry face during its growth?

- The growth of the electrical power industry is significantly impacted by the complexities and challenges inherent in installing and maintaining electrical power cables. These challenges, which include factors such as extreme weather conditions, terrain difficulties, and the need for continuous maintenance, present significant hurdles that must be addressed in order to ensure the reliable and efficient delivery of power to consumers.

- Electrical conductors play a crucial role in the power industry, particularly in the transmission and distribution of electricity from power plants to electrical grids. The selection and installation of conductors, such as bundled conductors and AAC conductors, are essential for optimal voltage regulation and minimizing power loss. However, the process is capital-intensive and complex, involving the careful consideration of various factors. The selection of a cable laying path is a significant challenge due to the need for minimal risk and easy access for maintenance. This process is especially important as cables are expected to last for at least 25 years.

- Obtaining permission from authorities to lay cables through different territories is also a complex and time-consuming process. Moreover, conductors must meet various standards, including IEC standards, for voltage regulation, lightning protection, and corrosion protection. In the context of renewable energy sources like hydroelectric power, wind power, and smart grids, conductors must also be designed to withstand harsh environments and extreme weather conditions. The installation process also requires the use of conductor splices and addressing issues like the proximity effect to ensure efficient power transfer. A life cycle assessment is necessary to evaluate the environmental impact of conductor selection and installation, making it a critical consideration for sustainable power generation.

Exclusive Customer Landscape

The electrical conductors market for power industry forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the electrical conductors market for power industry report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, electrical conductors market for power industry forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Co. - The company specializes in advanced electrical conductors, specifically the ACCR high capacity transmission conductor. This innovative product features a robust aluminum matrix core, delivering high strength and lightweight advantages for efficient power transmission.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Apar Industries Ltd.

- Cabelte SA

- Calmont Wire and Cable Inc.

- CMI Ltd.

- CTC Global Inc.

- Diamond Power Infrastructure Ltd.

- Finolex Cables Ltd.

- Furukawa Electric Co. Ltd.

- Gupta Power Infrastructure Ltd.

- HELUKABEL Romania Srl

- Hi tech Conductors (p) Ltd.

- KEI Industries Ltd.

- Lamifil NV

- Nexans SA

- Prysmian SpA

- Saudi Cable Co.

- Sterlite Power Transmission Ltd.

- Sumitomo Electric Industries Ltd.

- Taihan Cable and Solution Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Electrical Conductors Market For Power Industry

- In January 2024, ABB, a leading technology provider, launched its new high-performance aluminum conductor aluminum alloy (ACA) product, Alumacon Alfa, designed for high-voltage power transmission. This innovation is expected to reduce energy losses and improve the overall efficiency of power transmission networks (ABB Press Release).

- In March 2024, Siemens Energy and Enel Green Power signed a strategic partnership agreement to collaborate on the development, manufacturing, and installation of high-voltage direct current (HVDC) transmission lines. This collaboration aims to accelerate the transition to renewable energy sources and decarbonize power grids (Siemens Energy Press Release).

- In May 2024, Prysmian Group, a global leader in energy and telecom cable systems, announced the acquisition of General Cable Corporation, a significant player in the electrical wire and cable industry. This merger is expected to strengthen Prysmian's position in the North American market and expand its product portfolio (Prysmian Group Press Release).

- In April 2025, the European Union approved the new regulations for the Circular Economy Action Plan, which includes a target to recycle 85% of used electrical cables by 2030. This initiative is expected to boost the demand for recycled electrical conductors and contribute to the reduction of electronic waste (European Commission Press Release).

Research Analyst Overview

- The electrical conductors market in the power industry is experiencing significant advancements, driven by the integration of technology and data-driven solutions. Smart sensors and IoT sensors are increasingly being used for fault location and detection, enhancing grid stability and improving energy management systems. Power electronics and fiber optics play a crucial role in data transmission and network optimization, enabling real-time monitoring and analysis of power grids. Mechanical strength and fatigue resistance are essential considerations in conductor manufacturing, ensuring reliable performance under various operating conditions. Quality control and supply chain management are key focus areas for ensuring consistent product standards and timely delivery.

- 5G networks and big data are transforming the power industry, enabling advanced applications such as demand response, network security, and load balancing. Data analytics and artificial intelligence are being used to optimize conductor design and insulator materials for improved thermal stability and creep resistance. Remote monitoring and wireless communication are essential for digital twins and network security, allowing for real-time fault detection and network optimization. Network security is becoming increasingly important as power grids become more interconnected and digitized. In conclusion, the electrical conductors market for the power industry is undergoing significant changes, driven by advancements in technology, data analytics, and network optimization.

- Smart sensors, power electronics, fiber optics, and data transmission are key areas of focus, along with mechanical strength, quality control, and supply chain management. The integration of 5G networks, big data, and artificial intelligence is transforming the industry, enabling new applications and improving grid stability and efficiency.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Electrical Conductors Market For Power Industry insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

243 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.9% |

|

Market growth 2025-2029 |

USD 14831.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.3 |

|

Key countries |

US, China, India, Germany, Japan, France, UK, Canada, Italy, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Electrical Conductors Market For Power Industry Research and Growth Report?

- CAGR of the Electrical Conductors For Power Industry industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the electrical conductors market for power industry growth of industry companies

We can help! Our analysts can customize this electrical conductors market for power industry research report to meet your requirements.