Electrical Explosion Proof Equipment Market Size 2024-2028

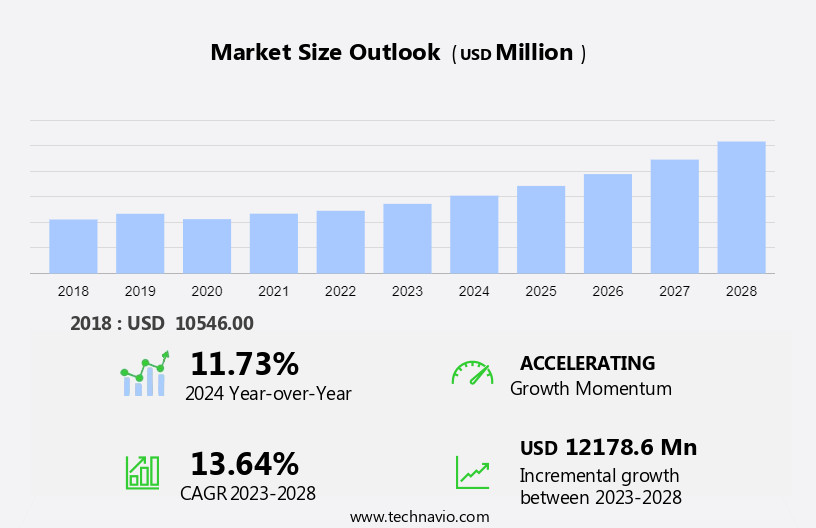

The electrical explosion proof equipment market size is forecast to increase by USD 12.18 billion at a CAGR of 13.64% between 2023 and 2028.

- The electrical explosion-proof equipment market is witnessing significant growth due to the increasing demand for safety in industrial operations. With the rise in industrialization and the implementation of stringent safety regulations, there is a growing focus on explosion prevention. The integration of wireless connectivity services, motion control, and HVAC systems further expands the market scope. However, planning and inspection challenges related to electrical explosion proofing remain a significant hurdle for market growth. Proper planning and regular inspections are crucial to ensure the safety and efficiency of electrical explosion-proof equipment. Failure to adhere to these requirements can lead to costly downtime, safety hazards, and potential damage to equipment and facilities. As the industrial sector continues to prioritize safety and compliance, the market for electrical explosion-proof equipment is expected to continue its growth trajectory.

What will be the Size of the Electrical Explosion Proof Equipment Market During the Forecast Period?

- The market encompasses a range of solutions designed to prevent and contain explosions in industries handling hazardous gas or vapor environments. Key market participants include manufacturers of electrical enclosures, flame arrestors, and integrated systems. The oil & gas industries and energy & power sectors are significant end-users, with oil & gas production being a primary focus due to the inherent risks involved.

- Electrification and automation in industrial sectors continue to drive demand for explosion-proof equipment. Government rules and regulations, particularly in hazardous handling regions, mandate the use of such equipment to ensure worker safety and operational efficiency. The market is also witnessing the integration of wireless connectivity services to enhance monitoring and control capabilities. Additionally, the pharmaceutical and chemical industries are increasingly adopting explosion-proof electrical and non-electrical fixtures and apparatus to mitigate risks In their operations.

How is this Electrical Explosion Proof Equipment Industry segmented and which is the largest segment?

The electrical explosion proof equipment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Industrial

- Non-industrial

- Type

- Flame-proof type

- Increased safety type

- Intrinsic safety type

- Positive-pressure type

- Others

- Geography

- APAC

- China

- India

- North America

- US

- Europe

- Germany

- Middle East and Africa

- South America

- APAC

By Application Insights

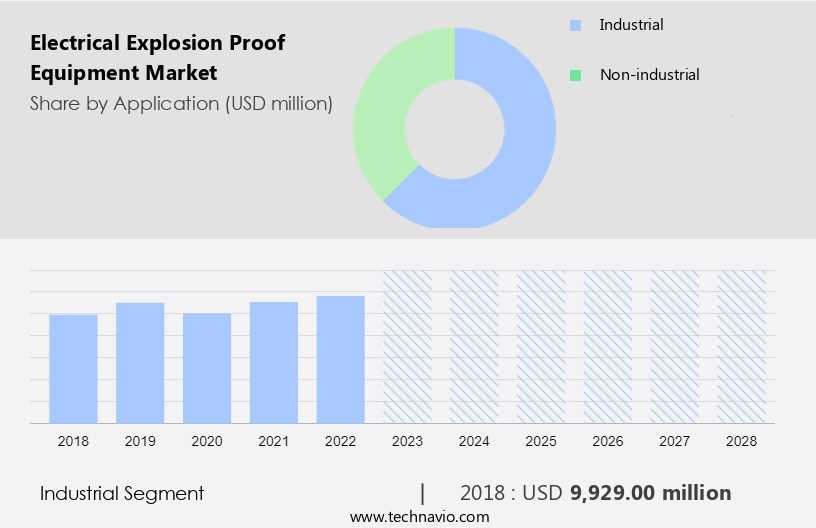

- The industrial segment is estimated to witness significant growth during the forecast period.

The market is poised for steady growth, driven by the increasing demand for industrial automation and the need for safety measures in various sectors. The power industry, in particular, is experiencing significant expansion due to rising energy requirements worldwide. This trend is attributed to improved connectivity in remote areas, increasing population, and disposable income. The shift towards renewable energy sources is also gaining momentum In the power industry, further boosting the market for explosion proof equipment. Industrial applications, including motion control, industrial automation, robotics, motors, generators, and integrated systems, will continue to be key end-users. Government regulations mandating safety standards in industrial sectors are further fueling market growth.

Get a glance at the Electrical Explosion Proof Equipment Industry report of share of various segments Request Free Sample

The Industrial segment was valued at USD 9.93 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

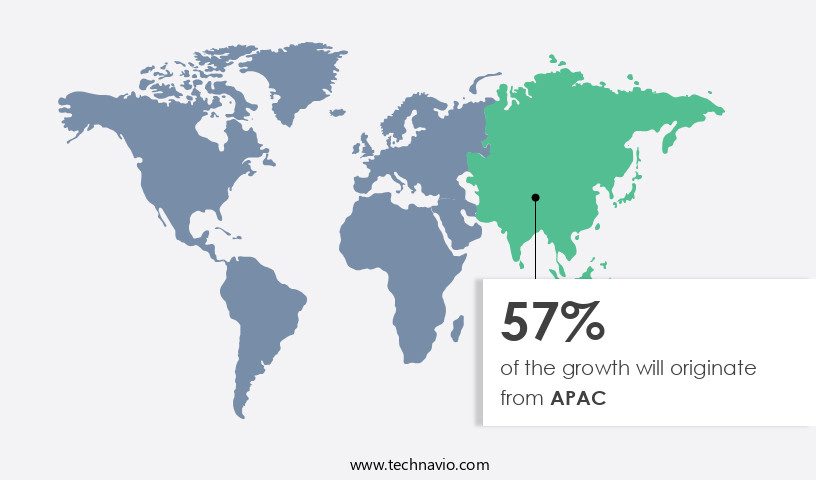

- APAC is estimated to contribute 57% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in APAC is projected to experience significant growth due to the increasing industrialization and infrastructure development In the region. The automotive industry's expansion, particularly in China and India, is a major contributor to this market's growth. In China, the shift towards electric vehicles to reduce pollution levels has led several automobile manufacturers to establish production facilities. In India, the rising purchasing power parity of the population has boosted the sales of automobiles, increasing the demand for explosion-proof equipment In the manufacturing sector. Tier 2 and Tier 3 manufacturers are meeting this demand by producing various explosion-proof equipment, including AC motors, DC motors, low-voltage motors, pumps, compressors, and blowers. Despite the lack of standardization, these manufacturers are ensuring the highest quality and safety standards to cater to the increasing demand.

Market Dynamics

Our electrical explosion proof equipment market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Electrical Explosion Proof Equipment Industry?

Increasing demand for safety in industrial operations is the key driver of the market.

- The market is witnessing significant growth due to the increasing prioritization of health, safety, and the environment in various industries. With an influx of young and inexperienced workers and the establishment of operations in remote locations, there is a heightened need for explosion prevention measures. The high cost of advanced machinery further underscores the importance of safeguarding equipment and workplaces. Explosion containment solutions, such as electrical enclosures and flame arrestors, play a crucial role in mitigating potential hazards. The oil & gas industries, mining sector, and chemical sector are among the primary consumers of explosion-proof equipment due to the inherent risks associated with their operations.

- Industrial automation, electrification, and robotics & discrete automation are driving the demand for electrical explosion proof equipment in industries like automation and manufacturing. Government rules and regulations governing hazardous handling regions necessitate the use of explosion-proof electrical fixtures and non-electrical fixtures. The lack of standardization In the market, however, poses a challenge to the market growth. The market comprises Tier 2 and Tier 3 manufacturers catering to various industries, including the aerospace industry, construction sites, and aircraft maintenance sites. The market encompasses a wide range of equipment, including AC motors, DC motors, low-voltage motors, pumps, compressors, blowers, and flameproof low-voltage motors.

What are the market trends shaping the Electrical Explosion Proof Equipment Industry?

A rising focus on explosion prevention is the upcoming market trend.

- The escalating concern for workplace safety in various industries, particularly those handling combustible materials or gases, has led to a heightened focus on explosion prevention. Electrical enclosures, flame arrestors, and other explosion containment devices have gained significant traction as essential safety measures. The oil & gas industries, mining sector, and chemical sector are among the key industrial sectors that have witnessed a rise In the adoption of electrical explosion proof equipment. Junction boxes, motion control systems, industrial automation, robotics, and discrete automation, motors, generators, and integrated systems are some of the major applications of electrical explosion proof equipment. The automation industry, in particular, has seen substantial growth due to the increasing demand for safety devices in industrial automation processes.

- The need to prevent explosions in industries is not only a matter of safety but also of cost savings. Explosions can lead to costly damages and prolonged downtime, making it essential for industries to invest in explosion prevention technologies. The market is expected to experience strong growth due to the increasing demand for safety devices in various industries. The energy and power industries play a crucial role in fuel and energy delivery, which in turn supports the pharmaceutical industry and chemical industry in their production processes. Electrical explosions can occur due to sparks or electric arc flashes, which can result in mine explosions, workplace mishaps, and fatalities. The handling of toxic substances, leaks, and combustible dust in industries such as mining, petrochemical, and construction sites necessitates the use of explosion-proof equipment.

What challenges does the Electrical Explosion Proof Equipment Industry face during its growth?

Planning and inspection challenges related to electrical explosion proofing is a key challenge affecting the industry's growth.

- In the industrial sector, the installation of explosion-proof equipment is a critical safety measure in hazardous handling regions, particularly In the oil & gas industries, mining sector, and chemical sector. End-users must meticulously plan the type of explosion-proof equipment and appropriate coverings for their specific application to prevent explosions caused by ignition sources. Simultaneously, companies supplying explosion-proof equipment must conduct thorough inspections of the industries to ensure the correct equipment is installed in suitable locations. Explosion prevention is achieved through electrical enclosures, flame arrestors, and explosion containment systems. These safety devices are essential in industries dealing with combustible gases or vapors, including natural resources like coal reserves and the aerospace industry in aircraft maintenance sites and construction sites.

- HVAC systems, lighting, surveillance, signaling techniques, and workplace mishaps such as mine explosions, all necessitate the use of explosion-proof equipment. The automation industry, including industrial automation, robotics & discrete automation, electrification, motion, and industrial sectors, also require explosion-proof equipment. Safety devices like flameproof low-voltage motors, AC motors, DC motors, pumps, compressors, blowers, and other manufacturing equipment are vital in handling combustible materials. However, lack of standardization, installation costs, and the presence of combustible dust in mining sites and the mining profession pose challenges. The petrochemical industries, mining sites, and other industries dealing with toxic substances and leaks also require stringent safety measures.

Exclusive Customer Landscape

The electrical explosion proof equipment market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the electrical explosion proof equipment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, electrical explosion proof equipment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

ABB Ltd. - The company is into manufacturing of electrical explosion proof equipment's with a wide range of low and high voltage motors and generators for all protection types, certified according to all major standards.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- Atexxo B.V.

- BARTEC Top Holding GmbH

- Eaton Corp. Plc

- Emerson Electric Co.

- Extronics Ltd.

- Flexpro Electricals Pvt. Ltd.

- Honeywell International Inc.

- Miretti Srl

- PATLITE Corp.

- Pepperl and Fuchs SE

- Potter Electric Signal Co. LLC

- R and M Electrical Group Ltd.

- R Stahl AG

- Rockwell Automation Inc.

- Siemens AG

- Supermec Pvt. Ltd.

- TRI FLP Engineers Pvt. Ltd.

- VIMEX

- WEG Equipamentos Eletricos S.A.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The electrical explosion-proof equipment market encompasses a range of products designed to prevent and contain explosions in industries that handle hazardous materials and environments. This market plays a crucial role in ensuring safety and productivity in various sectors, including oil and gas, mining, and the automation industry, among others. Explosion prevention is a critical concern in numerous industries, particularly those dealing with combustible gases or vapors. Electrical enclosures, junction boxes, and flame arrestors are essential components in this regard. These equipment types help contain and prevent the ignition of explosive mixtures, ensuring the safety of personnel and infrastructure.

Moreover, the oil and gas industries, mining sector, and chemical sector are significant consumers of explosion-proof equipment. The mining industry, for instance, is known for its inherently hazardous conditions, making explosion-proof equipment an essential investment. Similarly, the oil and gas industries deal with volatile substances, necessitating the use of flameproof equipment to prevent catastrophic incidents. The integration of wireless connectivity services and electrification in industrial automation, robotics, and discrete automation has led to an increased demand for explosion-proof equipment. This trend is particularly noticeable in industries such as aerospace, where aircraft maintenance sites require explosion-proof enclosures for electrical components.

Furthermore, electrical fixtures and non-electrical fixtures, including apparatus, are essential components of explosion-proof equipment. These devices help prevent the ignition of explosive gases or vapors, ensuring workplace safety in hazardous handling regions. The lack of standardization in this market, however, can lead to higher installation costs for end-users. The automation industry and various industrial sectors rely on explosion-proof equipment to ensure safety and productivity. Government rules and regulations play a significant role in driving the market for explosion-proof equipment, particularly in industries dealing with hazardous materials and environments. The market for explosion-proof equipment is diverse, with various types of equipment catering to different industries and applications.

|

Electrical Explosion Proof Equipment Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

181 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 13.64% |

|

Market Growth 2024-2028 |

USD 12.18 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

11.73 |

|

Key countries |

China, US, Germany, India, and Russia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Electrical Explosion Proof Equipment Market Research and Growth Report?

- CAGR of the Electrical Explosion Proof Equipment industry during the forecast period

- Detailed information on factors that will drive the Electrical Explosion Proof Equipment market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the electrical explosion proof equipment market growth of industry companies

We can help! Our analysts can customize this electrical explosion proof equipment market research report to meet your requirements.