Electrical Hospital Beds Market Size 2024-2028

The electrical hospital beds market size is forecast to increase by USD 1.01 billion at a CAGR of 6.35% between 2023 and 2028.

- The market is experiencing significant growth, driven by several key factors. The increasing number of hospital beds globally is a major growth driver, as electrical hospital beds offer advanced features and improved patient care compared to traditional beds. Additionally, the growth of medical tourism is fueling market expansion, as these beds are often preferred for their advanced functionality and comfort. Hospital beds, as hospital accessories and hospital supplies, play a crucial role In the overall hospital bed market, which includes rehabilitation equipment and medical furniture. However, the high cost of electrical hospital beds remains a challenge for the market, limiting their adoption in some healthcare facilities. Despite this, the market is expected to continue growing due to the increasing demand for advanced patient care and the ongoing development of more cost-effective solutions.

What will be the Size of the Market During the Forecast Period?

- The market encompasses a range of medical beds designed for patient care in healthcare facilities. These beds, which include Adjustable Beds and Patient Care Beds, are essential Hospital Room Equipment that prioritize Patient Comfort and Safety. Electric Beds, a type of Medical Furniture, offer various Hospital Bed Features and Functions, such as adjustable height, angle, and backrest, making them ideal for Intensive Care Units (ICUs) and Rehabilitation Centers.

- Patient Mobility is another crucial aspect of these beds, enabling easy transfer of patients and reducing the risk of injury. Medical Technology advances continue to influence the market, with innovations in Bedside Assistance, Patient Recovery, and Hospital Supplies enhancing patient care. The market is driven by the growing demand for advanced patient care solutions and the increasing population of elderly individuals requiring long-term care.

How is this Industry segmented and which is the largest segment?

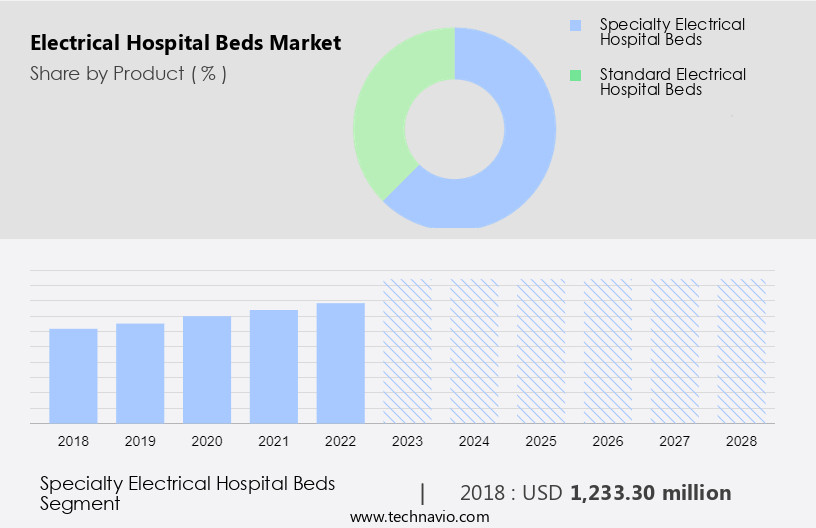

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Specialty electrical hospital beds

- Standard electrical hospital beds

- Type

- Semi-electric

- Fully electric

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- Asia

- China

- Rest of World (ROW)

- North America

By Product Insights

- The specialty electrical hospital beds segment is estimated to witness significant growth during the forecast period. The market encompasses a range of Medical beds designed for patient care in healthcare facilities. These beds, which include Adjustable beds, Patient comfort beds, Electric beds, Rehabilitation beds, ICU beds, Nursing beds, and Elderly care beds, are integral components of Hospital infrastructure. They offer Bedside assistance, enhancing patient mobility and safety, while ensuring optimal patient comfort. Medical devices and Hospital supplies, such as Medical furniture, Rehabilitation equipment, and Patient support systems, are often integrated into these beds. Hospital bed design features Electric technology, allowing for customizable functions and specifications tailored to Patient recovery needs. Hospital bed functions include adjustable height, tilt, and angle options, ensuring Patient safety and comfort during medical procedures and rehabilitation.

Get a glance at the market report of share of various segments Request Free Sample

The specialty electrical hospital beds segment was valued at USD 1.23 billion in 2018 and showed a gradual increase during the forecast period.

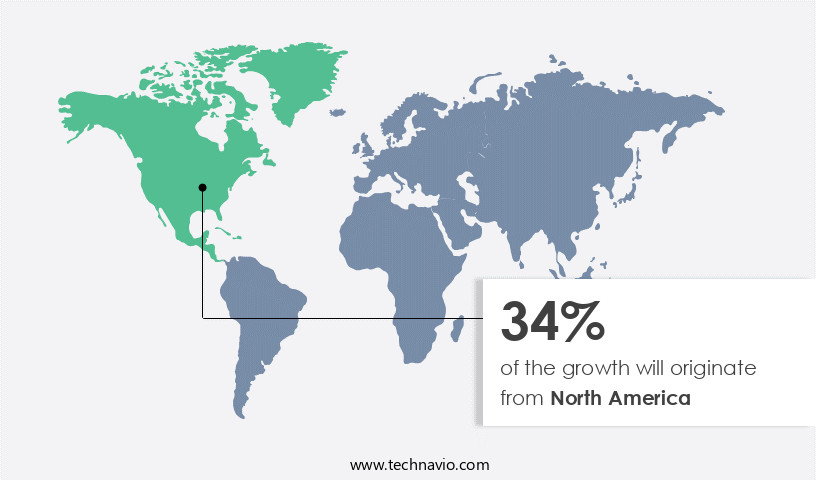

Regional Analysis

- North America is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The market encompasses a range of Medical beds designed for patient care in healthcare facilities. These beds, which include Adjustable beds, Patient care beds, Electric beds, Rehabilitation beds, ICU beds, Nursing beds, and Elderly care beds, are integral to the Hospital infrastructure. They offer Bedside assistance, enhancing Patient comfort and safety. Medical devices integrated into these beds, such as patient support systems and medical appliances, facilitate Patient mobility and recovery.

For more insights on the market size of various regions, Request Free Sample

Hospital accessories and supplies, including Hospital bed design, features, functions, and specifications, contribute to the effective delivery of Healthcare services. Rehabilitation equipment and medical furniture are essential components of these beds, offering Patient support during intensive care and patient recovery phases. Medical technology advances continue to influence Hospital bed innovations, enhancing Patient safety and improving overall Hospital bed functionality.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Electrical Hospital Beds Industry?

- Increase in number of hospital beds is the key driver of the market. In response to the rising demand for patient care services due to the increasing prevalence of chronic diseases and medical emergencies, hospitals are investing in advanced medical furniture, including electrical hospital beds. These beds, also known as adjustable beds, patient care beds, or electric beds, offer numerous benefits for patient comfort and safety. For instance, patients with heart failure require the head of the bed to be elevated above 30 degrees, which is easily achievable with electric beds. Moreover, these beds provide bedside assistance, enabling nurses and caregivers to attend to multiple patients efficiently. Rehabilitation beds, ICU beds, intensive care beds, nursing beds, elderly care beds, and other types of hospital beds are essential hospital infrastructure for healthcare facilities.

- These beds come with various features and functions, including patient support, hospital bed design, and hospital bed specifications, to facilitate patient recovery and ensure patient safety. Medical technology continues to innovate, leading to the development of medical appliances and healthcare services that enhance patient care.

What are the market trends shaping the Electrical Hospital Beds Industry?

- Growth of medical tourism is the upcoming market trend. In developing countries like India, China, and Thailand, the availability of high-quality medical care at lower costs attracts a significant number of patients from developed nations. This trend increases the demand for electrical hospital beds In these countries' healthcare facilities. For instance, fertility care is a growing area of focus due to the global decrease in fertility rates, with the OECD reporting a global average of 1.6 births per woman in 2020. Cross-border reproductive care (CBRC) is a popular choice for patients seeking affordable yet high-quality patient care. Hospital furniture, including electrical beds, plays a crucial role in patient care, offering adjustability for patient comfort and mobility.

- Medical beds, such as intensive care beds, rehabilitation beds, and nursing beds, are essential medical devices that cater to various patient needs. Hospital infrastructure continues to evolve, integrating advanced medical technology, hospital accessories, and hospital supplies to enhance patient support and safety. Hospital bed design and features cater to patient recovery, comfort, and functionality, making them indispensable medical appliances in healthcare services. Hospital bed innovations and technology continue to advance, offering improved patient care and outcomes.

What challenges does the Electrical Hospital Beds Industry face during its growth?

- High cost of electrical hospital beds is a key challenge affecting the industry growth. Electrical hospital beds, a type of advanced medical furniture, offer enhanced patient care with adjustable features for head, foot, and height positioning. These beds, classified as patient care beds and rehabilitation beds, are integral to healthcare facilities, including ICUs, nursing wards, and elderly care centers. Medical technology has significantly influenced hospital infrastructure by introducing electric beds, which offer improved patient comfort and mobility.

- However, the high cost of these beds, driven by electric motor control and other advanced features, may limit their affordability for some patients. Consequently, non-electric hospital beds, such as manual adjustable beds, serve as viable alternatives. This affordability concern may hinder the growth of the market during the forecast period. The market encompasses a range of hospital accessories and rehabilitation equipment, catering to patient support and safety. Innovations in hospital bed design and functions continue to prioritize patient recovery and patient-centric care, while adhering to hospital bed specifications and medical appliance standards.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amico Group of Companies

- Arjo AB

- Avante Australia Pty Ltd.

- Baxter International Inc.

- Famed Zywiec Sp. z o.o.

- Gendron Inc.

- Industrias H. Pardo SL

- Invacare Corp.

- Joerns Healthcare LLC

- Lars Medicare Pvt. Ltd.

- LINAK AS

- LINET Group SE

- Malvestio Spa

- Med Mizer Inc.

- Medical Depot Inc.

- Medline Industries LP

- Ostrich Mobility Instruments Pvt. Ltd.

- PARAMOUNT BED HOLDINGS CO. LTD.

- Stiegelmeyer GmbH and Co. KG

- Stryker Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a wide range of products, with Medical beds being a significant segment. Among these, Electric beds have gained immense popularity in Healthcare facilities due to their adjustable functionality and focus on Patient comfort. These beds, also known as Patient care beds, come under various categories such as Adjustable beds, Rehabilitation beds, ICU beds, Nursing beds, Elderly care beds, and more. Electric beds offer Bedside assistance, enhancing Patient mobility and safety. They are essential Medical devices used in Hospital infrastructure to cater to the needs of patients undergoing Intensive care, Patient recovery, or requiring additional support.

In addition, hospital bed design and features have evolved significantly, incorporating advanced technology like Patient support systems, Hospital bed specifications, and Hospital bed functions to ensure optimal patient care. Medical technology has played a pivotal role In the development of Hospital bed innovations, leading to the integration of Hospital bed technology and Hospital accessories into these beds. Rehabilitation equipment and Medical appliances are often integrated into these beds, making them versatile and indispensable in Healthcare services. In summary, Electrical Hospital Beds have become an integral part of the Medical furniture and Hospital supplies landscape, offering advanced Patient comfort, safety, and support while catering to the diverse needs of various healthcare facilities.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

164 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.35% |

|

Market growth 2024-2028 |

USD 1.01 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.95 |

|

Key countries |

US, Germany, UK, China, and Canada |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the Electrical Hospital Beds industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.