Electricity Trading Market Size 2025-2029

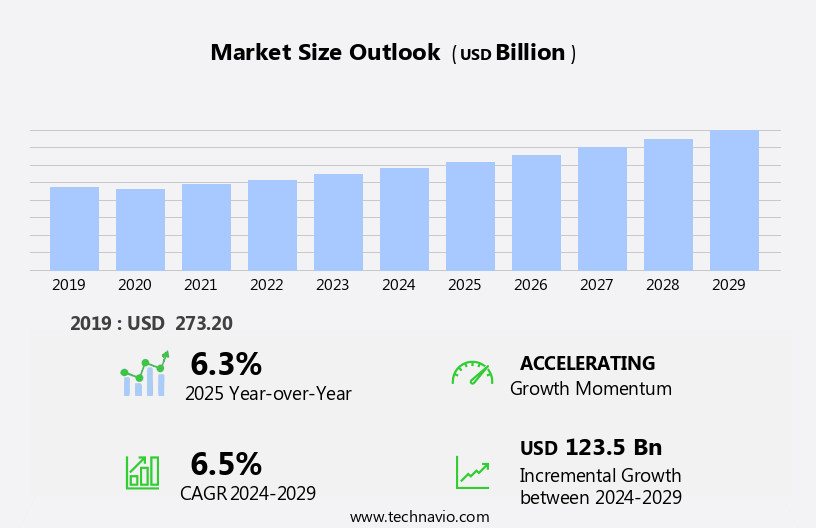

The electricity trading market size is forecast to increase by USD 123.5 billion at a CAGR of 6.5% between 2024 and 2029.

- The market is witnessing significant growth due to several key trends. The integration of renewable energy sources, such as solar panels and wind turbines, into the grid is a major driver. Energy storage systems are increasingly being adopted to ensure a stable power supply from these intermittent sources. Concurrently, the adoption of energy storage systems addresses key challenges like intermittency, enabling better integration of renewable sources, and bolstering grid resilience. Self-generation of electricity by consumers through microgrids is also gaining popularity, allowing them to sell excess power back to the grid. The entry of new players and collaborations among existing ones are further fueling market growth. These trends reflect the shift towards clean energy and the need for a more decentralized and efficient electricity system.

What will be the Size of the Electricity Trading Market During the Forecast Period?

- The market, a critical component of the global energy industry, functions as a dynamic interplay between wholesale energy markets and traditional financial markets. As a commodity, electricity is bought and sold through various trading mechanisms, including equities, bonds, and real-time auctions. The market's size and direction are influenced by numerous factors, such as power station generation data, system operator demands, and consumer usage patterns. Participants in the market include power station owners, system operators, consumers, and ancillary service providers. Ancillary services, like frequency regulation and spinning reserves, help maintain grid stability. Market design and news reports shape the market's evolution, with initiatives like the European Green Paper and the Lisbon Strategy influencing the industry's direction towards increased sustainability and competition.

- Short-term trading, through power purchase agreements and power distribution contracts, plays a significant role in the market's real-time dynamics. Power generation and power distribution are intricately linked, with the former influencing the availability and price of electricity, and the latter affecting demand patterns. Overall, the market is a complex, ever-evolving system that requires a deep understanding of both energy market fundamentals and financial market dynamics.

How is this Electricity Trading Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Day-ahead trading

- Intraday trading

- Application

- Industrial

- Commercial

- Residential

- Source

- Non-renewable energy

- Renewable energy

- Geography

- Europe

- Germany

- UK

- France

- Italy

- Spain

- APAC

- China

- India

- Japan

- South Korea

- North America

- US

- South America

- Middle East and Africa

- Europe

By Type Insights

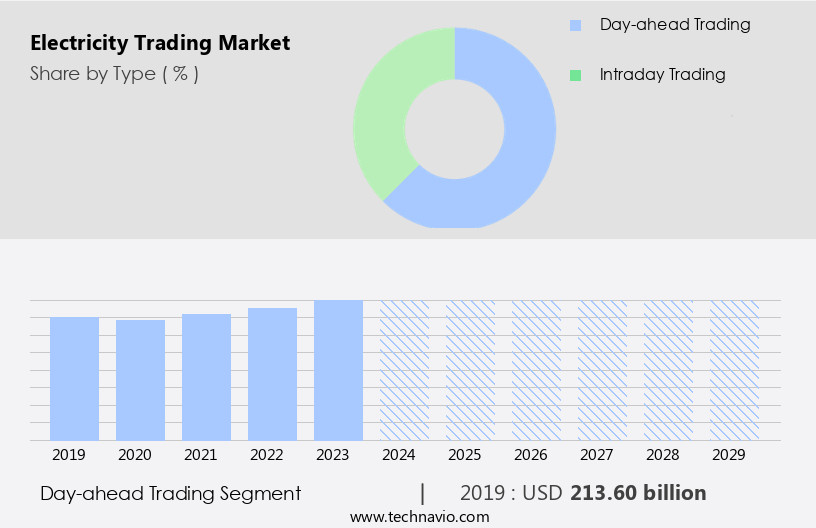

- The day-ahead trading segment is estimated to witness significant growth during the forecast period.

Day-ahead trading refers to the voluntary, financially binding forward electricity trading that occurs in exchanges such as the European Power Exchange (EPEX Spot) and Energy Exchange Austria (EXAA), as well as through bilateral contracts. This process involves sellers and buyers agreeing on the required volume of electricity for the next day, resulting in a schedule for everyday intervals. However, this schedule is subject to network security constraints and adjustments for real-time conditions and actual electricity supply and demand. Market operators, including ISOs and RTOs, oversee these markets and ensure grid reliability through balancing and ancillary services. Traders, including utilities, energy providers, and professional and institutional traders, participate in these markets to manage price risk, hedge against price volatility, and optimize profitability.

Key factors influencing electricity prices include weather conditions, fuel prices, availability, construction costs, and physical factors. Renewable energy sources, such as wind and solar power, also play a growing role in these markets, with the use of Renewable Energy Certificates and net metering providing consumer protection and incentives for homeowners and sustainable homes. Electricity trading encompasses power generators, power suppliers, consumers, and system operators, with contracts, generation data, and power station dispatch governed by market rules and regulations.

Get a glance at the Electricity Trading Industry report of share of various segments Request Free Sample

The day-ahead trading segment was valued at USD 213.60 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

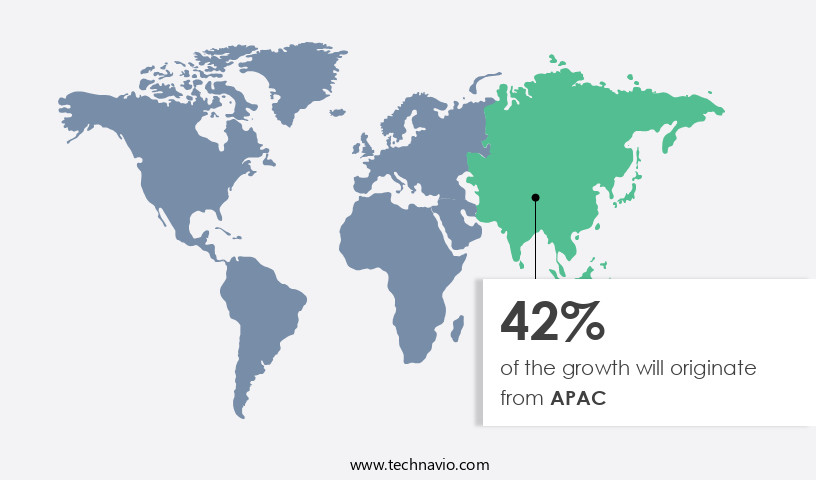

- APAC is estimated to contribute 42% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

Another region offering significant growth opportunities to companies is Europe. Europe is home to one of the largest markets globally, driven by rising electricity demand and the growing adoption of renewable energy sources. Europex, a non-profit organization representing exchange-based wholesale electricity and renewable electricity sector interests, plays a pivotal role in ensuring competitive pricing. These entities aim to expand their trade volumes through regulatory compliance and directives. The electricity sector in Europe is characterized by various market participants, including power generators, suppliers, consumers, system operators, and power stations.

Ancillary services like frequency, voltage, reserve power, and market coupling facilitate grid reliability and balancing. The European electricity market encompasses contracts, generation data, power purchase agreements, and power delivery timeframes. Renewable energy sources, such as wind and solar power, are increasingly integrated into the system, influencing the market dynamics. The market is governed by various regulations, including the European Green Paper and the Lisbon Strategy, promoting vertical integration and market coupling. Energy storage, virtual power plants, and subsidy schemes further impact the market landscape.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Electricity Trading Industry?

The rise in company collaborations is the key driver of the market.

- The market is experiencing significant growth due to escalating volumes in wholesale energy markets and increasing collaborations among power exchange companies worldwide. Europex, a non-profit association, represents European energy exchanges, advocating for the interests of exchange-based wholesale electricity, environmental, and gas sectors. The electricity sector's growth is driven by increasing electricity demand, leading to more trade volumes. Traditional financial markets, such as equities, bonds, and commodities, are merging with electricity markets, attracting professional and institutional traders.

- Market design, capital markets, and wholesale markets play crucial roles in the electricity sector, with market operators, ISOs, exchanges, and clearinghouses facilitating transactions. Electricity markets consist of day-ahead and real-time markets, with network topology, grid operations, and balancing essential components. Grid reliability, congestion, price differences, and economic activity influence electricity prices, which can impact consumer protection and profitability for generators and utilities. Renewable energy sources, such as wind and solar power, are gaining popularity, adding complexity to the electricity market. Market dynamics include factors like weather conditions, fuel prices, availability, construction costs, fixed costs, and physical factors. Ancillary services, such as frequency, voltage, reserve power, and market coupling, are essential for maintaining grid stability and ensuring efficient consumption.

What are the market trends shaping the Electricity Trading Industry?

The rise in the entry of new players is the upcoming market trend.

- Wholesale energy markets for electricity function similarly to traditional financial markets, facilitating the buying and selling of electricity through power exchanges. These markets offer various contract types, including spot contracts for the same day, next day, and weekly basis. Power exchanges provide a payment security mechanism, ensuring financial strength for both buyers and sellers. Intraday, day-ahead, and real-time markets operate within these systems. The electricity sector is experiencing significant growth, with many large companies entering the market.

- Market design involves various participants such as professional and institutional traders, regulators, utility companies, energy providers, and generators. The electricity market consists of bilateral markets, where generators sell electricity directly to load-serving entities, and ancillary services markets, providing frequency, voltage, and reserve power. The electricity system operates like a complex network topology, with power lines, substations, and grid operations ensuring grid reliability and balancing energy supply and demand through pricing mechanisms like locational marginal pricing and the clearing price. Factors such as weather conditions, fuel prices, availability, construction costs, and physical factors influence the market dynamics. Renewable energy sources like wind power and solar power play a growing role in the energy industry, with consumers increasingly focusing on sustainable homes and energy-efficient homes.

What challenges does the Electricity Trading Industry face during its growth?

Self-generation of electricity and growth in the adoption of microgrids is a key challenge affecting the industry growth.

- The markets involve the buying and selling of electricity as a commodity in wholesale markets, similar to traditional financial markets for equities, bonds, and commodities. Market design and operations are overseen by Independent System Operators (ISOs) and market operators, who ensure grid reliability, balancing, and price volatility management. Participants include utility companies, energy providers, professional and institutional traders, and generators, who sell their electricity to load-serving entities and consumers. The electricity market consists of day-ahead and real-time markets, where energy prices are determined based on locational marginal pricing, clearing price, and grid location. Market coupling and cross-border intraday trade enable efficient energy distribution and price differences, driving economic activity.

- Factors influencing electricity prices include weather conditions, fuel prices, availability, construction costs, and fixed costs. Microgrids and self-generation through renewable energy sources, such as wind and solar power, are emerging substitutes for electricity trading. These alternatives offer potential cost savings and energy independence but may require significant upfront investment and time to reach profitability. Energy storage solutions and virtual power plants can help manage the intermittency of renewable energy sources and provide ancillary services, such as frequency, voltage, and reserve power. ISO and market operators manage power plant dispatch, congestion, and price differences through contracts, power purchase agreements, and derivatives products, including energy futures and forwards.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, electricity trading market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Deutsche Borse AG- The company offers Electricity trading services under the subsidiary European Energy Exchange AG.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Axpo Holding AG

- BP Plc

- Danske Commodities AS

- Energy Trading Co. Sro

- Euronext N.V.

- European Energy Exchange AG

- Indian Energy Exchange Ltd.

- Intercontinental Exchange Inc.

- Japan Electric Power Exchange

- JSW Holdings Ltd.

- Manikaran Power Ltd.

- Next Kraftwerke GmbH

- NTPC Ltd.

- Power Exchange India Ltd.

- Statkraft AS

- Tata Power Co. Ltd.

- Uniper SE

- VECO Power Trading LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Wholesale energy markets represent a critical component of the global energy sector, bridging the gap between traditional financial markets and the physical supply of electricity. These markets facilitate the buying and selling of electricity as a commodity, enabling the efficient allocation of resources and ensuring grid reliability. Electricity, much like equities, bonds, and other commodities, is bought and sold based on real-time market conditions and forecasted supply and demand. Market design plays a significant role in the operation of these markets, with capital markets influencing the financial strength of utility companies and energy providers. The market is evolving with the integration of machine learning and demand response strategies, optimizing power grid efficiency and enabling more accurate predictions for energy supply and demand. Professional traders and institutional investors actively participate in electricity markets, employing various strategies to manage price volatility and maximize profitability.

Moreover, regulators oversee market operations, ensuring fair and transparent trading practices and maintaining grid reliability through balancing and the use of ancillary services. The electricity market landscape is complex, with multiple market types and players. Real-time markets and day-ahead markets facilitate the trading of electricity based on current and forecasted conditions, while bilateral markets allow for direct transactions between generators and load-serving entities. The electricity grid functions much like a highway system, with electricity pylons serving as transmission lines and substations acting as interchanges. The network topology and grid operations are essential to maintaining grid reliability and managing congestion.

Furthermore, market operators, exchanges, and clearinghouses facilitate the buying and selling of electricity, employing locational marginal pricing and other mechanisms to determine clearing prices based on grid location, marginal cost, energy cost, and congestion cost. Physical factors, such as weather conditions and fuel prices, significantly impact electricity markets. Renewable energy sources, including wind power and solar power, are increasingly playing a larger role in the energy mix, with private generation, net metering, and tax incentives driving their adoption. Consumer protection and independent system operators are crucial to ensuring a fair and efficient electricity market. Power plant dispatch, derivatives products, and energy storage are essential tools for managing electricity supply and demand.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

212 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.5% |

|

Market growth 2025-2029 |

USD 123.5 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.3 |

|

Key countries |

US, China, Germany, UK, France, Japan, India, Italy, Spain, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Electricity Trading Market Research and Growth Report?

- CAGR of the Electricity Trading industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, APAC, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the electricity trading market growth of industry companies

We can help! Our analysts can customize this electricity trading market research report to meet your requirements.