Emission Control Technology Market Size 2024-2028

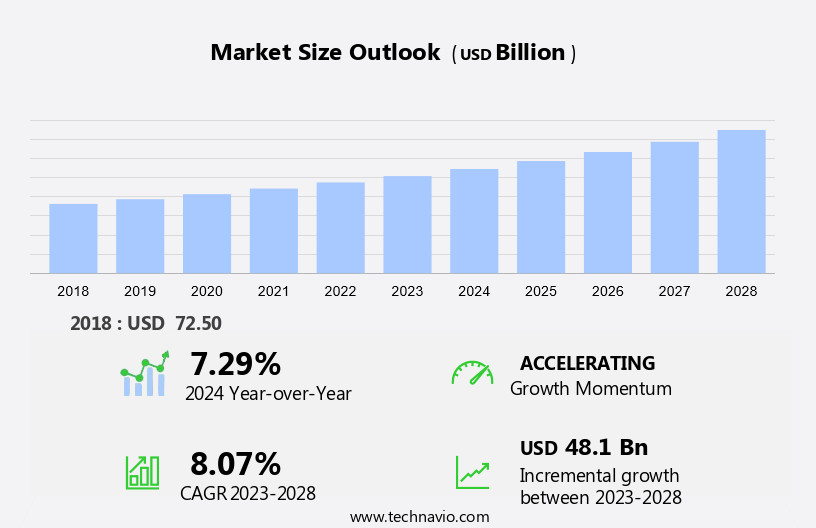

The emission control technology market size is forecast to increase by USD 48.1 billion at a CAGR of 8.07% between 2023 and 2028.

- The market is experiencing significant growth due to several key trends. Firstly, the increasing greenhouse gas emissions from industries continue to drive market demand. Secondly, the proliferation of Euro emission standards is pushing companies to adopt advanced emission control technologies. Lastly, the rising demand for electric vehicles is creating new opportunities for market participants. The market encompasses various technologies designed to reduce the release of pollutants, particularly nitrogen oxides (NOx) and hydrocarbons (HC), from combustion processes in both vehicular and industrial applications. These trends are expected to continue shaping the market dynamics In the coming years. Additionally, stringent regulations and growing awareness about environmental sustainability are also contributing to the market growth. Overall, the market is poised for steady expansion, driven by these key factors.

What will be the Size of the Emission Control Technology Market During the Forecast Period?

- Technologies include DPF (Diesel Particulate Filters), GPF (Gasoline Particulate Filters), DOC (Diesel Oxidation Catalysts), SCR (Selective Catalytic Reduction), EGR (Exhaust Gas Recirculation), and EGR systems. The market is driven by stringent emission regulations, such as Euro emission standards, and the growing emphasis on reducing vehicular particulate emissions.

- Additionally, the increasing adoption of IoT (Internet of Things) technology for real-time monitoring and analysis of emission levels is fueling market growth. The market's size is significant, with substantial profits generated from the production and implementation of these technologies. Pricing and competition remain key factors, with ongoing research and development, particularly In the areas of nanotechnology and electric vehicles, influencing market dynamics. The synthesis of data from various sources indicates a continuous trend towards more stringent emission control standards and the increasing importance of emission control technologies in reducing overall emissions and improving air quality.

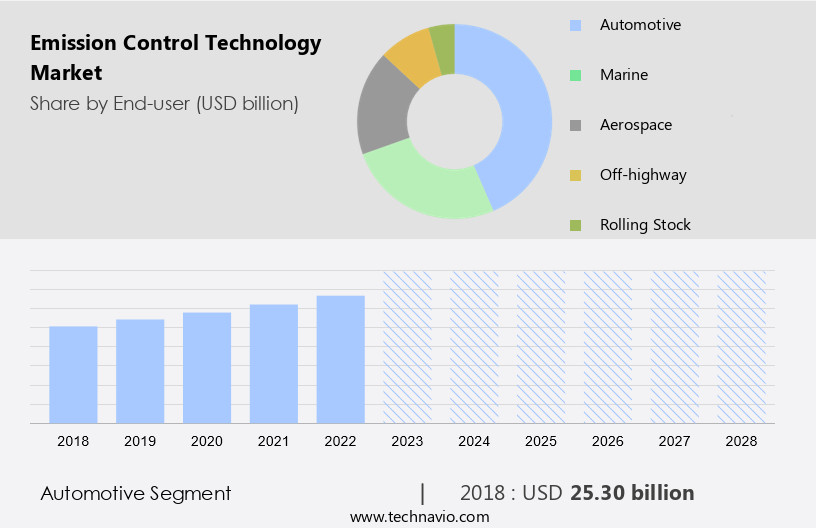

How is this Emission Control Technology Industry segmented and which is the largest segment?

The emission control technology industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Automotive

- Marine

- Aerospace

- Off-highway

- Rolling stock

- Type

- Gasoline

- Diesel

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- South America

- Middle East and Africa

- North America

By End-user Insights

- The automotive segment is estimated to witness significant growth during the forecast period. Emission control technologies are gaining significant importance due to increasing environmental regulations and the need for fuel-efficient, low-emission vehicles. Technologies such as DPF, GPF, DOC, SCR, EGR, and nanotechnology are being extensively used to reduce nitrogen oxides (NOx), carbon compounds, and particulate emissions from fuel-powered automobiles. In 2023, over 10.7 million new passenger cars were registered In the LAMEA region, with an average CO2 emission of 106.6 g CO2/km, representing a 1.4% reduction compared to the previous year. Electric vehicles and catalytic converters are also playing a crucial role in reducing emissions.

- The market for emission control components, including three-way catalysts, is expected to grow significantly due to increasing demand for fuel efficiency and stricter emission standards such as Euro 6 and 7. The market is highly competitive, with key players investing in research and development, pricing strategies, and promotions to gain a competitive edge.

Get a glance at the market report of share of various segments Request Free Sample

- The automotive segment was valued at USD 25.30 billion in 2018 and showed a gradual increase during the forecast period.

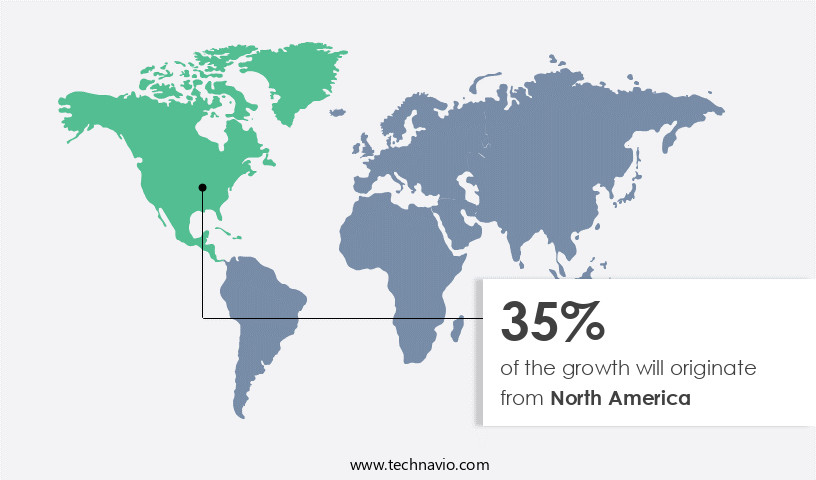

Regional Analysis

- North America is estimated to contribute 35% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The market in North America is projected to expand steadily by 2025, driven by stricter vehicular emission norms following the Volkswagen emission scandal in 2015. OEMs are responding by enhancing their emission control strategies to prevent future regulatory breaches.

For more insights on the market size of various regions, Request Free Sample

- Technologies such as DPF, GPF, DOC, SCR, EGR, and catalytic converters will witness increased demand to reduce CO, NOx, hydrocarbons, and particulate emissions from fuel-powered automobiles. Nanotechnology and IoT integration will further optimize emission control systems for improved fuel efficiency and reduced CO2 emissions. Electric vehicles are also expected to contribute significantly to the market growth. Investment pockets lie In the development of advanced emission control components, such as three-way catalysts and comprehensive emission control systems. Future estimations indicate a profitable market, with accurate data synthesis and timely market insights essential for market success.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Emission Control Technology Industry?

- The growing greenhouse gas emissions from industries is the key driver of the market. Emission control technology is a critical solution for mitigating the release of harmful pollutants, primarily nitrogen oxides (NOx) and carbon compounds, from both fuel-powered automobiles and industries. The use of various components, such as DPF (Diesel Particulate Filter), GPF (Gasoline Particulate Filter), DOC (Diesel Oxidation Catalyst), SCR (Selective Catalytic Reduction), EGR (Exhaust Gas Recirculation), and three-way catalysts, plays a significant role in reducing emissions. Nanotechnology is a promising area in emission control, offering enhanced efficiency and performance. The shift towards electric vehicles is also expected to impact the market, as they produce zero tailpipe emissions. However, the focus on fuel efficiency and CO2 emission reduction in fuel-powered automobiles continues to drive demand for advanced emission control technologies.

- The investment pockets In the market are vast, with future estimations indicating significant growth. The industrial sector, particularly energy-intensive industries, is a major contributor to greenhouse gas (GHG) emissions, with CO2 being a primary concern. NOx, SO2, hydrocarbons, and CO are the common air pollutants released from industries, posing health risks and environmental concerns. The competition in the market is intense, with various promotions and pricing strategies employed by key players. The market is comprehensive and accurate, providing valuable insights into the latest trends and developments. The integration of IoT in emission control systems is a significant development, enabling real-time monitoring and analysis of emissions. In summary, the market is essential for addressing the challenge of reducing pollutants from industries and automobiles. The market dynamics are influenced by various factors, including regulations, technological advancements, and consumer preferences. The market offers significant opportunities for investment and growth, making it an attractive area for businesses and investors.

What are the market trends shaping the Emission Control Technology Industry?

- The proliferation of Euro emission standards is the upcoming market trend. Emission control technologies have been a critical focus for the automotive industry to comply with stringent Euro emission standards. These regulations primarily target the reduction of CO, nitrogen oxides (NOx), hydrocarbons (HC), and vehicular particulate matter. Euro 6 emission standards, introduced in 2009, set the most recent and stringent limits for these pollutants. The technologies employed for emission control include Diesel Particulate Filters (DPF), Gasoline Particulate Filters (GPF), Catalytic Converters, Selective Catalytic Reduction (SCR), Exhaust Gas Recirculation (EGR), and Nanotechnology. These components work together to enhance fuel efficiency, improve CO2 emission, and reduce greenhouse gas emissions. Nitrogen oxides and hydrocarbons are significant contributors to air pollution from fuel-powered automobiles.

- Euro emission standards have been instrumental in setting limits for these emissions, with Euro 2, Euro 3, and Euro 6 being the most notable. Euro 2, established in 1997, introduced combined limits for nitrogen oxides and unburned hydrocarbons. Euro 3, established in 2000, added more regulations on diesel particulate matter limits and carbon monoxide limits. Electric vehicles and IoT are emerging trends In the automotive sector, offering potential investment pockets for emission control technology providers. Future estimations indicate continued growth In the demand for accurate and comprehensive emission control solutions as the focus on reducing greenhouse gas emissions intensifies. Gasoline Direct Injection (GDI) engines and industrial emission sources are other significant contributors to pollutant emissions. The market for emission control technologies is highly competitive, with various players offering innovative solutions to meet the evolving needs of the industry. Pricing and promotions are essential factors influencing market dynamics.

What challenges does the Emission Control Technology Industry face during its growth?

- The rising demand for electric vehicles is a key challenge affecting the industry growth. It is a critical component in reducing the environmental impact of fuel-powered automobiles and industrial processes. Technologies such as DPF, GPF, DOC, SCR, EGR, and nanotechnology are utilized to minimize nitrogen oxides, carbon compounds, and hydrocarbon emissions. Catalytic converters, a key component in emission control systems, utilize three-way catalysts to convert CO, NOx, and hydrocarbons into less harmful gases. The shift towards electric vehicles (EVs) is gaining momentum due to increasing concerns over greenhouse gas emissions and the need for improved fuel efficiency. Factors such as government subsidies, declining battery electric vehicle (BEV) prices, and the launch of cost-effective EV variants are driving the demand for EVs.

- Furthermore, the expansion of EV charging infrastructure, growing consumer awareness, and regulations on vehicular particulate emission are also contributing to the growth of the EV market. Investment pockets lie In the development of advanced emission control technologies for fuel-powered automobiles and industrial processes. Future estimations indicate that the demand for emission control components will continue to grow as governments worldwide enforce stricter emission standards, such as Euro emission standards. The Internet of Things (IoT) is also expected to play a significant role in optimizing emission control systems, leading to increased profit opportunities. In summary, the market is driven by the need to reduce greenhouse gas emissions and improve fuel efficiency.

- The increasing popularity of electric vehicles and the development of advanced emission control technologies for fuel-powered automobiles and industrial processes present significant investment opportunities. Accurate and comprehensive market data is essential for businesses looking to capitalize on these trends.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, market growth and forecasting, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry. The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Airex Industries Inc.

- American Air Filter Co. Inc.

- Andritz AG

- Babcock and Wilcox Enterprises Inc.

- BASF SE

- Camfil AB

- Donaldson Co. Inc.

- Doosan Lentjes GmbH

- DuPont de Nemours Inc.

- FLSmidth and Co. AS

- Fujian Longking Co. Ltd.

- GEA Group AG

- General Electric Co.

- Hamon S.A.

- John Wood Group PLC

- Mitsubishi Heavy Industries Ltd.

- Parker Hannifin Corp.

- PAS Solutions BV

- Sumitomo Heavy Industries Ltd.

- Thermax Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Emission control technology has emerged as a critical area of focus In the global industrial landscape, driven by growing concerns over the environmental impact of various industries and the need for sustainable development. This market encompasses a range of technologies designed to reduce the emission of harmful pollutants, particularly nitrogen oxides (NOx) and carbon compounds, from fuel-powered automobiles and industrial processes. The market is characterized by continuous innovation and advancements in technology. Catalytic converters, three-way catalysts, and selective catalytic reduction (SCR) systems are among the most widely used components in this domain. These technologies play a pivotal role in converting harmful emissions into less harmful substances before they are released into the atmosphere. Nanotechnology has emerged as a key trend In the market, offering enhanced efficiency and performance. Nanomaterials, with their unique properties, enable the development of more effective catalysts and filters, contributing to improved fuel efficiency and reduced CO2 emissions. The advent of electric vehicles (EVs) has also had a significant impact on the market. While EVs do not emit tailpipe emissions, they still contribute to greenhouse gas (GHG) emissions during the production of electricity used to charge their batteries. As such, the focus on emission control In the EV sector extends to the development of cleaner energy sources and more efficient energy storage systems.

The market is a dynamic and competitive landscape, with numerous players vying for market share. Competition is driven by factors such as pricing, investment pockets, and promotional activities. The market is further influenced by regulatory frameworks, such as Euro emission standards, which set stringent limits on vehicular NOx and particulate emissions. The Internet of Things (IoT) has also played a role In the evolution of the market. IoT-enabled systems enable real-time monitoring and analysis of emissions data, enabling more effective and targeted emission control strategies. The market is a comprehensive and accurate reflection of the global efforts to reduce pollution and mitigate the environmental impact of various industries. This market is expected to witness significant growth In the coming years, driven by increasing awareness and regulatory pressure, as well as advancements in technology. In the automotive sector, the focus on emission control extends to the production of fuel-efficient engines, which not only reduce CO2 emissions but also contribute to improved fuel economy. The development of gasoline direct injection (GDI) engines, for instance, has led to significant reductions in hydrocarbon emissions. The market is a global phenomenon, with various geographical regions contributing to its growth. The market is particularly strong in regions with high industrial activity and stringent emission regulations, such as Europe and Asia Pacific.

In summary, the market is a critical component of the global industrial landscape, driven by the need to reduce harmful emissions and mitigate the environmental impact of various industries. This market is characterized by continuous innovation and competition, with a focus on developing more efficient and effective emission control technologies. The future estimations for this market are promising, driven by regulatory pressure, technological advancements, and the growing awareness of the need for sustainable development.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

175 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.07% |

|

Market growth 2024-2028 |

USD 48.1 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.29 |

|

Key countries |

US, Germany, China, UK, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.