Hydrocarbon Solvents Market Size 2024-2028

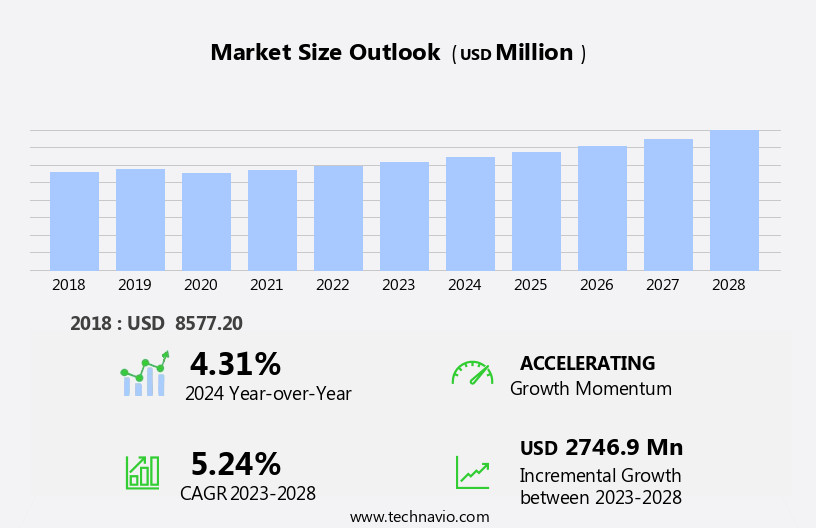

The hydrocarbon solvents market size is forecast to increase by USD 2.75 billion, at a CAGR of 5.24% between 2023 and 2028.

- The market is driven by advancements in extraction and refining processes of hydrocarbons, enabling the production of high-performance solvents with improved efficiency and productivity. This technological progression is a significant growth factor, as it enhances the solvents' ability to meet the evolving demands of various industries, such as pharmaceuticals, agriculture, and coatings. Moreover, the rise of digitalization and automation in hydrocarbon solvent manufacturing is transforming the industry landscape. This trend is facilitating the integration of advanced technologies, including artificial intelligence, machine learning, and the Internet of Things, to optimize production processes, reduce costs, and enhance product quality. However, the market faces challenges, including the high manufacturing cost of green and bio-based solvents, which limits their widespread adoption.

- Despite this, companies can capitalize on the growing demand for eco-friendly alternatives by investing in research and development to reduce production costs and improve the competitiveness of green hydrocarbon solvents. Additionally, strategic partnerships and collaborations with technology providers and raw material suppliers can help mitigate the challenges and position businesses for long-term success in the dynamic market.

What will be the Size of the Hydrocarbon Solvents Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market showcases a dynamic and evolving landscape, driven by the diverse applications across various sectors. These solvents, including coating, industrial cleaning, printing, extraction, chemical synthesis, solvent blends, cleaning, ink, solvent purification, aliphatic, aromatic, and oxygenated varieties, play a pivotal role in numerous industries. In petroleum refining, hydrocarbon solvents are utilized for degreasing and chemical processing. Their low boiling points enable efficient separation and purification processes. In industrial cleaning applications, they serve as effective degreasers and surface preparation agents, ensuring material compatibility and adherence to regulatory compliance. The printing industry relies on hydrocarbon solvents for ink formulation, while pharmaceutical manufacturing leverages their properties for solvent purification and synthesis.

Precision cleaning applications demand solvents with specific flash points and surface tension properties. The petrochemical industry, aerospace, automotive, and consumer products sectors also utilize hydrocarbon solvents extensively. However, concerns over environmental impact, solvent degradation, and health and safety continue to shape market dynamics. Market participants focus on innovations such as solvent recycling, stabilizers, and additives to address these challenges. The ongoing unfolding of market activities underscores the importance of continuous research and development to meet evolving industry demands.

How is this Hydrocarbon Solvents Industry segmented?

The hydrocarbon solvents industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Aromatic

- Aliphatic

- Others

- End-user

- Paints and coatings

- Adhesives

- Printing inks

- Others

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- India

- Rest of World (ROW)

- North America

By Type Insights

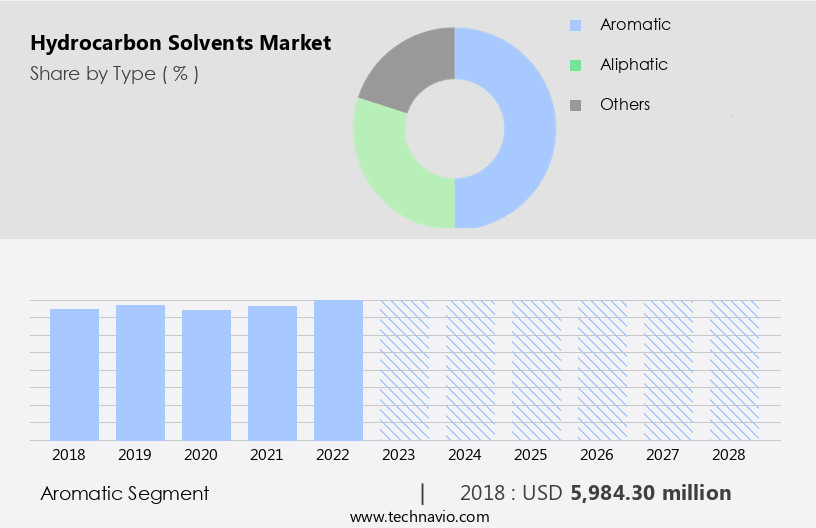

The aromatic segment is estimated to witness significant growth during the forecast period.

Aromatic hydrocarbon solvents, derived from petroleum refining and coal tar distillates, are essential feedstocks for various industries, including coating, industrial cleaning, printing, and chemical synthesis. Their unique properties, such as boiling point, vapor pressure, surface tension, and flash point, make them suitable for diverse applications. In the coating industry, aromatic solvents like xylene and toluene are used as solvents for paints and coatings due to their ability to dissolve resins and improve the flow and leveling of coatings. In industrial cleaning, they serve as degreasing agents for heavy-duty applications due to their high solvency power and low freezing points. Printing solvents, such as aromatic aliphatic blends, are used to clean printing plates and thin films, ensuring accurate and high-quality printing.

In chemical synthesis, aromatic hydrocarbons are used as building blocks for producing polymers, pharmaceuticals, and other chemicals. Solvent blends, which are mixtures of different solvents, are used for precision cleaning in various industries, including electronics manufacturing and aerospace applications. Pharmaceutical solvents, such as ethylene glycol and propylene glycol, are used as solvents in pharmaceutical manufacturing due to their low toxicity and high solvency power. Regulatory compliance and environmental impact are crucial factors driving the development of solvent recycling and solvent stabilizers in the industry. Metal cleaning applications require solvents with high solvency power and low surface tension, making aromatic hydrocarbons an ideal choice.

Application-specific solvents, such as halogenated solvents and oxygenated solvents, are used in specific industries, such as automotive and petrochemicals, respectively. The petrochemical industry's growth is a significant driver of the demand for aromatic hydrocarbons, as they are used to produce polymers, high-octane fuels, and fuel-performance additives. The demand for consumer products, such as packaging, automobiles, and adhesives, also impacts the demand for these hydrocarbons. Material compatibility is a critical factor in selecting the appropriate solvent for a given application, and solvent degradation is a concern that must be addressed through solvent purification and additives. In conclusion, aromatic hydrocarbon solvents play a vital role in various industries, from coating and industrial cleaning to chemical synthesis and pharmaceutical manufacturing.

Their unique properties and wide range of applications make them indispensable feedstocks in the production of polymers, fuels, and other chemicals. The demand for these hydrocarbons is influenced by factors such as industry growth, regulatory compliance, environmental impact, and material compatibility.

The Aromatic segment was valued at USD 5.98 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

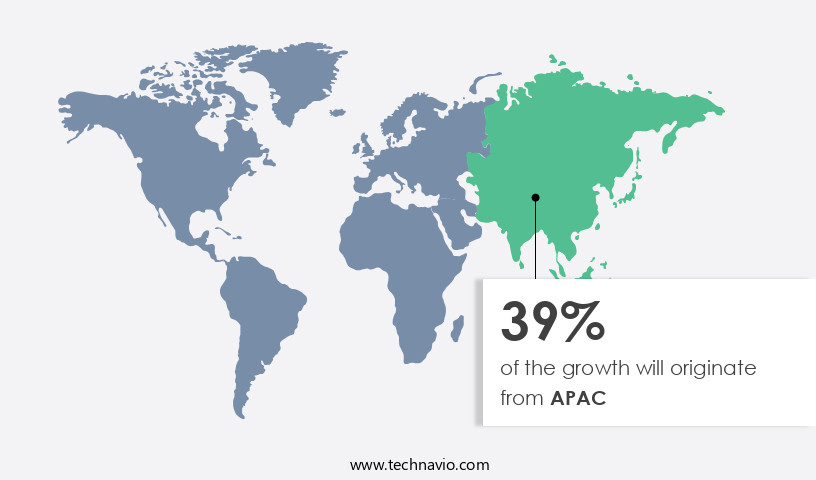

APAC is estimated to contribute 39% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the dynamic global market, hydrocarbon solvents play a significant role, particularly in APAC, where countries like China, India, Japan, and South Korea lead industries such as automobiles, electronics, chemicals, and textiles. This industrial dominance fuels the demand for hydrocarbon solvents, with applications ranging from coating solvents and industrial cleaning to printing solvents and surface preparation. Aromatic and aliphatic solvents, with varying boiling points and vapor pressures, cater to diverse industries. Petroleum refining and degreasing solvents are essential for chemical synthesis and solvent blends, while solvent purification and recycling ensure efficiency and environmental sustainability. Pharmaceutical manufacturing relies on hydrocarbon solvents for regulatory compliance and precision cleaning, while solvent additives and halogenated solvents cater to specific applications.

The petrochemical industry, consumer products, material compatibility, and electronic manufacturing industries also utilize hydrocarbon solvents extensively. Despite concerns regarding environmental impact and solvent degradation, the market continues to evolve, with solvent recovery and oxygenated solvents offering potential solutions. Hydrocarbon solvents' versatility and wide applicability make them indispensable in various industries, from pharmaceuticals to automotive applications, and from aerospace to coal tar distillates.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a significant sector in the chemical industry, characterized by the production, trade, and application of organic compounds primarily derived from petroleum. These solvents exhibit unique properties, such as high solvency power, low toxicity, and wide temperature ranges, making them indispensable in various industries. Key applications include paint and coatings, printing inks, pharmaceuticals, and agriculture. Major hydrocarbon solvents include mineral spirits, toluene, xylene, hexane, and ethyl acetate. Their versatility is showcased in their uses: mineral spirits in painting and cleaning, toluene in rubber production and adhesives, xylene in the synthesis of plastics and pharmaceuticals, hexane in the extraction of edible oils, and ethyl acetate in the food industry and as a solvent for cellulose acetate. Hydrocarbon solvents are also essential in the production of other chemicals, such as resins, polymers, and surfactants. Their role in the manufacturing process extends to the extraction, processing, and preservation of natural resources, including essential oils, fragrances, and natural rubber. The market is driven by the growing demand for these versatile chemicals in various industries, coupled with advancements in technology and increasing environmental concerns. Regulations and standards, such as REACH and GHS, influence the production, usage, and disposal of hydrocarbon solvents, ensuring their safe and sustainable application.

What are the key market drivers leading to the rise in the adoption of Hydrocarbon Solvents Industry?

- The significant progress in hydrocarbon extraction and refining techniques serves as the primary catalyst for market growth.

- The market has experienced significant growth due to advancements in extraction and refining processes. Supercritical carbon dioxide extraction, for instance, offers high selectivity and efficiency in extracting specific hydrocarbons without leaving residual solvents, making it beneficial for producing high-purity solvents. Ultrasonic-assisted extraction is another advancement that utilizes ultrasonic waves to enhance the extraction process, reducing the need for high temperatures and harsh chemicals. This leads to faster extraction times and higher yields of hydrocarbon solvents. Boasting a wide range of applications, hydrocarbon solvents are extensively used in various industries, including coating, printing, and industrial cleaning.

- In coating applications, they serve as crucial components in the production of paints and coatings, and adhesives. In printing, they act as essential solvents in ink formulations, ensuring optimal print quality. In industrial cleaning, they are employed as degreasing agents due to their ability to dissolve and remove grease and oil. Aromatic solvents, a type of hydrocarbon solvents, are widely used in surface preparation due to their low surface tension and high solvency power. Their ability to penetrate and dissolve contaminants makes them ideal for applications such as pre-treatment and cleaning of metal surfaces before painting. The properties of hydrocarbon solvents, including their boiling point and vapor pressure, play a significant role in their applications.

- For instance, solvents with lower boiling points and vapor pressures are preferred for applications requiring fast drying times, while those with higher boiling points and vapor pressures are suitable for applications where longer evaporation times are acceptable. Despite their numerous benefits, hydrocarbon solvents have faced criticism due to their environmental impact. Efforts are being made to develop and promote the use of alternative, eco-friendly solvents. However, the versatility and efficiency of hydrocarbon solvents continue to make them a preferred choice in various industries.

What are the market trends shaping the Hydrocarbon Solvents Industry?

- The rise of digitalization and automation is becoming increasingly prominent in the hydrocarbon solvent manufacturing industry. This trend is driven by the need for increased efficiency, productivity, and cost savings. Digital technologies such as automation, artificial intelligence, and the Internet of Things (IoT) are being adopted to optimize production processes, improve quality control, and enhance supply chain management. By leveraging these advanced technologies, manufacturers can streamline their operations, reduce downtime, and enhance their competitive position in the market.

- Hydrocarbon solvents play a significant role in various industries, including chemical synthesis, precision cleaning, and ink manufacturing. Extraction solvents are essential in the production of essential oils and pharmaceuticals, while aliphatic solvents are widely used in chemical processing. Solvent blends are common in various applications, such as cleaning and ink solvents. The demand for hydrocarbon solvents is driven by their ability to enhance manufacturing processes through automation. Robotic systems are increasingly used for handling and packaging solvents, ensuring precision and safety. Digital sensors and IoT devices enable real-time monitoring of production parameters, allowing for immediate adjustments to maintain optimal conditions.

- Moreover, data analytics and machine learning algorithms predict equipment failures before they occur, reducing downtime and maintenance costs. Automated systems optimize energy use in manufacturing processes, making them cost-effective and environmentally friendly. Flash point is a critical factor in the selection of solvents for various applications, and solvent purification techniques ensure the highest quality standards. In summary, hydrocarbon solvents are indispensable in various industries due to their unique properties and the benefits they bring to manufacturing processes. The integration of automation, digital technologies, and data analytics enhances their value proposition and drives market growth.

What challenges does the Hydrocarbon Solvents Industry face during its growth?

- The high manufacturing costs of green and bio-based hydrocarbon solvents pose a significant challenge to the industry's growth trajectory. These solvents, which are increasingly being adopted due to their eco-friendly and sustainable properties, carry a premium price tag compared to their conventional counterparts. This cost barrier may hinder the widespread adoption and integration of these solvents in various industries, potentially limiting the growth opportunities for companies operating in this sector.

- The market faces the challenge of higher prices for bio-based alternatives compared to traditional petroleum-derived chemicals. This is due to the limited availability and increased cost of feedstock for green and bio-based hydrocarbon solvents. These eco-friendly alternatives, derived from plant and animal sources such as carbohydrates, proteins, and vegetable oils, are essential for regulatory compliance in various industries, including metal cleaning, application-specific solvents for the petrochemical industry, solvent stabilizers for pharmaceutical manufacturing, and adhesive solvents. Recycling these solvents is crucial to offset their higher cost, as prices can be three to five times more than conventional hydrocarbon solvents.

- Oxygenated solvents and solvent additives also play significant roles in enhancing the performance and stability of hydrocarbon solvents. The market's growth is driven by the increasing demand for environmentally friendly and sustainable solutions, despite the challenges posed by the cost disparity.

Exclusive Customer Landscape

The hydrocarbon solvents market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the hydrocarbon solvents market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, hydrocarbon solvents market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

BASF SE - The company specializes in supplying hydrocarbon solvents, including Kollisolv PYR and n-Hexyldiglycol, enhancing product efficacy through advanced formulation technology.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BASF SE

- Chemex Organochem Pvt Ltd.

- Chevron Phillips Chemical Co. LLC

- Clariant AG

- Dow Inc.

- Eastman Chemical Co.

- Exxon Mobil Corp.

- Honeywell International Inc.

- Huntsman Corp.

- Idemitsu Kosan Co. Ltd.

- INEOS AG

- LyondellBasell Industries N.V.

- Neste Corp.

- Reliance Industries Ltd.

- Sasol Ltd.

- Shell plc

- SK geo centric Co Ltd

- Sydney Solvents

- TotalEnergies SE

- Univar Solutions Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Hydrocarbon Solvents Market

- In January 2024, INEOS, a leading global chemical company, announced the expansion of its Chocolate Bayou, Texas, facility to increase its production capacity of hydrocarbon solvents by 50%, as stated in their official press release. This expansion aims to cater to the growing demand for hydrocarbon solvents in various industries, such as coatings, pharmaceuticals, and agriculture.

- In March 2024, ExxonMobil Chemical and BASF Corporation formed a strategic collaboration to develop and commercialize a new line of hydrocarbon solvents using ExxonMobil's proprietary catalytic dehydrogenation technology. The partnership, as reported by Reuters, is expected to result in the production of high-performance solvents with improved sustainability and efficiency.

- In May 2024, LyondellBasell Industries N.V. completed the acquisition of A. Schulman, Inc., a leading global supplier of plastic compounds and resins, as announced in their SEC filing. This acquisition expanded LyondellBasell's portfolio to include a broader range of hydrocarbon solvents, enhancing their market position and capabilities in the industry.

- In April 2025, the European Chemicals Agency (ECHA) approved the renewal of the registration of ExxonMobil's Exxsol™ D40, a hydrocarbon solvent used in various applications, including coatings and adhesives. The approval, as stated in ExxonMobil's press release, ensures the continued availability and safe use of this product in Europe.

Research Analyst Overview

- The market encompasses a diverse range of products used in various industries for applications such as cleaning, extraction, and manufacturing. Occupational exposure to these solvents necessitates rigorous risk assessment and testing methods to ensure worker safety. Solvent waste management is a critical aspect of the market, with a focus on minimizing water pollution and soil contamination through effective disposal methods. Bio-based and green solvents are gaining traction due to their environmental benefits, as industry standards increasingly prioritize sustainability. Solvent handling procedures, including solvent engineering and solvent selection, play a significant role in mitigating air pollution and VOC emissions.

- Price volatility in the market influences solvent use and supply chain dynamics, necessitating innovative solvent formulation and technology to improve efficiency and reduce costs. Renewable solvents and sustainable solvent disposal methods are key areas of product innovation. Quality control and analysis techniques are essential for ensuring the safety and effectiveness of hydrocarbon solvents. Solvent technology advances continue to drive market demand, with a focus on reducing solvent use and improving solvent engineering for enhanced performance. Solvent selection and handling procedures must adhere to stringent industry standards to minimize risks associated with air and water pollution.

- The market for hydrocarbon solvents remains dynamic, with ongoing efforts to address environmental concerns and improve solvent technology.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Hydrocarbon Solvents Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

212 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.24% |

|

Market growth 2024-2028 |

USD 2746.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.31 |

|

Key countries |

China, US, Germany, India, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Hydrocarbon Solvents Market Research and Growth Report?

- CAGR of the Hydrocarbon Solvents industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the hydrocarbon solvents market growth of industry companies

We can help! Our analysts can customize this hydrocarbon solvents market research report to meet your requirements.