Energy Management In Railways Market Size 2024-2028

The energy management in railways market size is forecast to increase by USD 1.96 billion at a CAGR of 10.55% between 2023 and 2028.

- The energy management market in railways is experiencing significant growth due to the increasing demand for energy efficiency and sustainability In the transportation sector. Advanced technologies, such as energy storage systems and smart grid solutions, are being adopted to optimize energy consumption and reduce carbon emissions. However, the high cost of implementing and maintaining energy management systems remains a challenge for many railway operators. To address this, governments and private organizations are investing in research and development to create cost-effective and efficient energy management solutions. Additionally, stringent regulations and growing public awareness of environmental issues are driving the adoption of energy management systems In the railways industry. Overall, the market is expected to grow steadily over the next few years, as railway operators seek to reduce their carbon footprint and improve operational efficiency.

What will be the Size of the Energy Management In Railways Market During the Forecast Period?

- The market encompasses normal and electrified railways, including monorails, and is a significant contributor to the global transportation sector. The energy management market within this industry is gaining momentum due to the increasing focus on energy efficiency and the adoption of renewable energy sources. Freight and passenger rail operations consume substantial energy, making energy management a critical operational function. Railway networks employ software solutions for traffic management, ticketing, maintenance scheduling, and asset tracking to optimize energy usage.

- Smart grids are being integrated into the railway sector to facilitate two-way power flow, enabling regenerative braking and eco-driving techniques. The railway industry recognizes the importance of reducing its carbon footprint and is implementing various energy management strategies to minimize energy consumption. Overall, the railways market is experiencing growth, driven by the adoption of advanced technologies and the shift towards sustainable energy sources.

How is this Energy Management In Railways Industry segmented and which is the largest segment?

The energy management in railways industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Rolling stock and system

- Service

- Software

- End-user

- Freight rail

- Passenger rail

- Geography

- Europe

- Germany

- France

- North America

- US

- APAC

- China

- Japan

- South America

- Middle East and Africa

- Europe

By Type Insights

- The rolling stock and system segment is estimated to witness significant growth during the forecast period.

The railways sector is increasingly focusing on energy management to reduce carbon footprint and enhance operational efficiency. In the global railways market, the rolling stock and systems segment play a pivotal role in energy management. Advanced technologies, such as regenerative braking and eco-driving techniques, are being adopted to convert kinetic energy into electrical energy, which can be reused for various purposes. Smart grids and renewable energy integration are other strategies being implemented to optimize energy consumption. Freight and passenger rail operators are leveraging software solutions for traffic management, ticketing, maintenance scheduling, asset tracking, and real-time monitoring. Indian Railways, among others, is investing in artificial intelligence (AI) and cloud computing to improve energy management and passenger experience. Energy management strategies also include smart station management and renewable energy sources. Overall, the railway industry's focus on energy management is essential for environmental sustainability and operational excellence.

Get a glance at the market report of share of various segments Request Free Sample

The rolling stock and system segment was valued at USD 1.01 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

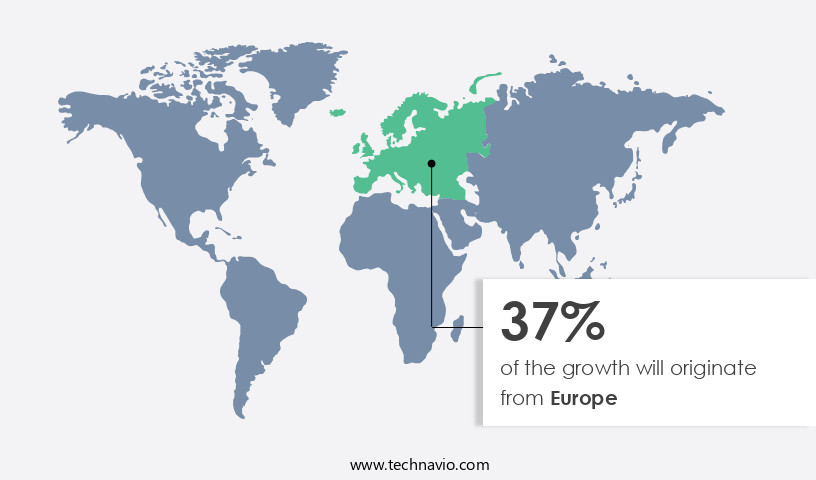

- Europe is estimated to contribute 37% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

Europe is a key player In the global railway energy management market, characterized by the implementation of energy-efficient technologies and practices to minimize carbon emissions and enhance sustainability. The extensive European railway network, spanning approximately 230,000 km, necessitates efficient energy management strategies to optimize energy consumption and reduce carbon footprint. Key drivers for the growth of the energy management market in European railways include the integration of renewable energy sources, smart grids, and advanced software solutions for traffic management, ticketing, maintenance scheduling, asset tracking, and real-time monitoring. Innovative energy management strategies, such as regenerative braking, eco-driving techniques, smart station management, and renewable energy integration, are increasingly being adopted to improve operational functions and enhance passenger experience. Artificial Intelligence (AI) and Cloud Computing are also being leveraged to streamline railway operations and promote environmental sustainability.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Energy Management In Railways Industry?

Increasing demand for energy efficiency and sustainability is the key driver of the market.

- The railway sector is embracing energy management strategies to enhance operational efficiency and reduce carbon footprint. Electrified railways and monorails are increasingly adopting energy management solutions to optimize energy consumption. Regenerative braking systems, a key component of these strategies, convert the energy generated during braking into electrical power. This power can be utilized to power onboard systems or fed back into the grid, thereby decreasing reliance on external energy sources. The integration of renewable energy sources, such as solar and wind, into railway networks is another significant trend. Smart grids and real-time monitoring systems enable the efficient distribution and management of energy.

- Furthermore, software solutions for freight and passenger rail traffic management, ticketing, maintenance scheduling, asset tracking, and smart station management are streamlining railway industry operations. Innovative solutions like eco-driving techniques and AI-assisted energy management systems are also gaining traction. The Indian Railways is leading the way in implementing these strategies, aiming for environmental sustainability and enhancing passenger experience.

What are the market trends shaping the Energy Management In Railways Industry?

Advancements in technology in railway sector is the upcoming market trend.

- The railway industry has witnessed significant advancements in energy management, driven by the adoption of smart technologies such as energy-efficient solutions, renewable energy integration, and real-time monitoring. Normal railways and electrified railways, including Monorail systems, have embraced the strategies to reduce their carbon footprint and optimize energy consumption. Smart grids and software solutions have become integral to the railway sector, enabling traffic management, ticketing, maintenance scheduling, asset tracking, and Innovative strategies, such as regenerative braking and eco-driving techniques, are being implemented to enhance energy efficiency. Smart station management and renewable energy integration are key areas of focus for railway operators.

- Real-time monitoring of energy usage and consumption patterns is facilitated by IoT devices and artificial intelligence (AI) systems. Cloud computing technology is also being leveraged to streamline operational functions and improve environmental sustainability. Passenger experience is another critical aspect of the railway industry, and it plays a vital role in enhancing it. By implementing energy-efficient practices, railways can offer a more comfortable and eco-friendly travel experience. Overall, the railway industry's commitment is a significant step towards creating a more sustainable and efficient transportation system.

What challenges does the Energy Management In Railways Industry face during its growth?

High cost of implementing and maintaining systems is a key challenge affecting the industry growth.

- The railway sector is embracing strategies to enhance environmental sustainability and operational efficiency. Electrified railways and monorails are leading the charge in this regard, integrating renewable energy sources and implementing advanced technologies such as smart grids and artificial intelligence (AI). Systems are essential for optimizing energy consumption in freight and passenger rail operations, with functions ranging from traffic management and ticketing to maintenance scheduling and asset tracking. One challenge to the adoption of systems in railways is their high implementation and maintenance costs. Smart meters, which provide real-time energy consumption data, are a crucial component of these systems but can be financially burdensome to install across an entire railway network, costing between USD 1,000 and USD 10.000 per unit.

- However, the benefits of energy efficiency, carbon footprint reduction, and improved passenger experience make the investment worthwhile. Innovative solutions, such as regenerative braking, eco-driving techniques, and smart station management, are also being explored to further optimize energy usage In the railway industry. Cloud computing and real-time monitoring are facilitating the integration of renewable energy sources and enhancing overall system performance.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, market growth and forecasting, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, energy management in railways market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- ALSTOM SA

- Caterpillar Inc.

- CONSTRUCCIONES Y AUXILIAR DE FERROCARRILES S.A.

- CRRC Corp. Ltd.

- General Electric Co.

- Hitachi Ltd.

- Honeywell International Inc.

- Ingeteam Corp. S.A.

- International Business Machines Corp.

- Knorr Bremse AG

- Mitsubishi Heavy Industries Ltd.

- REMC Ltd.

- Schneider Electric SE

- Siemens AG

- Thales Group

- The MathWorks Inc.

- Toshiba Corp.

- WAGO GmbH and Co. KG

- WESTINGHOUSE AIR BRAKE TECHNOLOGIES CORP.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The railway sector has been a significant contributor to the global transportation industry, providing an efficient and sustainable mode of transport for both freight and passenger movements. With the increasing focus on management and environmental sustainability, the railway industry has been exploring various strategies to reduce energy consumption and carbon footprint. It encompasses various operational functions, including traffic management, ticketing, maintenance scheduling, asset tracking, and strategies. The integration of renewable energy sources, such as solar, wind, and hydroelectric power, has become a key focus area for the railway industry. Electrified railways have been a popular choice for energy-efficient transportation, offering significant reductions in energy consumption compared to traditional diesel-powered trains. Monorails, with their streamlined design and automated operational functions, also offer energy savings through optimized energy usage and regenerative braking systems. Smart grids have emerged as a promising solution for managing energy consumption In the railway sector. These systems enable real-time monitoring and control of energy usage, allowing for the optimization of energy supply and demand. The use of artificial intelligence (AI) and cloud computing technologies further enhances the capabilities of smart grids, enabling predictive maintenance and energy forecasting.

Freight and passenger rail operations consume large amounts of energy, making it a critical aspect of railway network efficiency. Strategies such as eco-driving techniques, smart station management, and renewable energy integration have been implemented to reduce energy consumption and improve operational efficiency. Regenerative braking systems, which recapture energy during braking and store it for later use, have become increasingly common In the railway industry. These systems help to reduce energy consumption and improve overall energy efficiency. The railway industry's focus is not only driven by operational efficiency and cost savings but also by the need for environmental sustainability.

Thus, the integration of renewable energy sources and the adoption of innovative solutions, such as smart grids and AI-powered systems, are key areas of investment for the railway sector. Hence, the railway industry's focus is a critical aspect of its ongoing evolution. The integration of renewable energy sources, smart grids, and innovative solutions is driving operational efficiency, reducing energy consumption, and improving environmental sustainability. The railway sector's commitment is a testament to its role as a leader in sustainable transportation.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

192 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.55% |

|

Market growth 2024-2028 |

USD 1.96 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

9.28 |

|

Key countries |

US, France, China, Germany, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Energy Management In Railways Market Research and Growth Report?

- CAGR of the Energy Management In Railways industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the energy management in railways market growth of industry companies

We can help! Our analysts can customize this energy management in railways market research report to meet your requirements.