Predictive Maintenance (PdM) Market Size 2025-2029

The predictive maintenance (PdM) market size is valued to increase by USD 33.72 billion, at a CAGR of 33.5% from 2024 to 2029. Increased adoption of advanced analytics by SMEs owing to rise in cloud computing will drive the predictive maintenance (pdm) market.

Major Market Trends & Insights

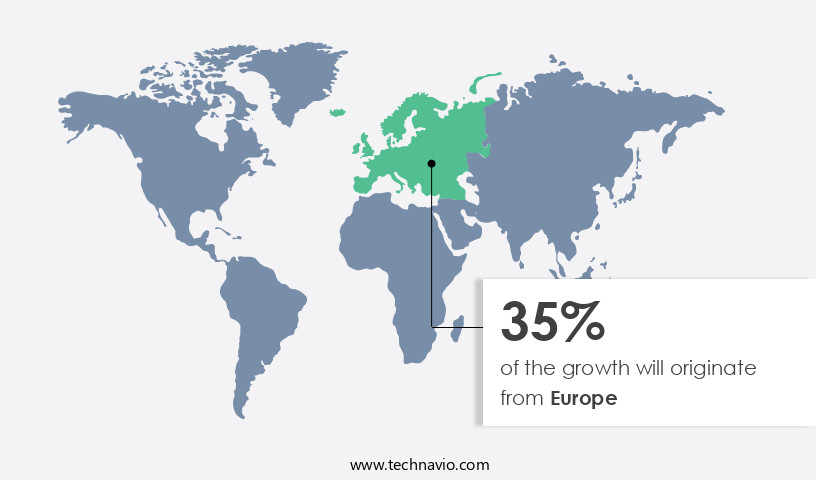

- Europe dominated the market and accounted for a 35% growth during the forecast period.

- By Component - Solutions segment was valued at USD 3.12 billion in 2023

- By Deployment - On-premises segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 996.28 million

- Market Future Opportunities: USD 33720.50 million

- CAGR from 2024 to 2029 : 33.5%

Market Summary

- The market is a dynamic and evolving domain, driven by the increasing adoption of advanced technologies such as artificial intelligence (AI) and the Internet of Things (IoT) in various industries. According to recent studies, the global market for predictive maintenance is expected to experience significant growth, with small and medium-sized enterprises (SMEs) leading the charge due to the rise in cloud computing. Advanced analytics, facilitated by these technologies, enable organizations to predict equipment failures before they occur, reducing downtime and maintenance costs.

- However, the market also faces challenges, including the lack of expertise and technical knowledge required to implement and effectively utilize these solutions. As of now, AI and machine learning algorithms account for over 30% of the predictive maintenance market share, highlighting their growing importance in this space.

What will be the Size of the Predictive Maintenance (PdM) Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Predictive Maintenance (PdM) Market Segmented ?

The predictive maintenance (pdm) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Component

- Solutions

- Service

- Deployment

- On-premises

- Cloud

- Technology

- IoT

- AI and machine learning

- Others

- Application

- Condition monitoring

- Predictive analytics

- Remote monitoring

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Component Insights

The solutions segment is estimated to witness significant growth during the forecast period.

Predictive maintenance (PdM) is a data-driven approach to equipment maintenance that leverages time series forecasting, big data processing, and AI-powered diagnostics to reduce equipment downtime and improve operational efficiency. PdM solutions utilize risk assessment methodologies, remote monitoring capabilities, fault detection systems, and preventive maintenance strategies to optimize maintenance scheduling and sensor network deployment. These technologies enable maintenance cost reduction through predictive maintenance software, machine learning algorithms, anomaly detection methods, and real-time monitoring systems. Deep learning applications and data analytics platforms play a crucial role in PdM by analyzing sensor data, identifying patterns, and predicting failures. IoT integration strategies and cloud-based solutions facilitate seamless data sharing and access, while data visualization dashboards provide actionable insights into asset performance.

Predictive modeling methods, such as statistical process control, are employed to assess the remaining useful life of assets and optimize maintenance activities. Vibration analysis techniques and prognostic health management are essential components of PdM, enabling early detection of potential issues and reducing the need for costly repairs. Condition-based maintenance and predictive maintenance software help organizations shift from reactive to proactive maintenance strategies, improving overall asset performance and reducing downtime. According to recent studies, the predictive maintenance market is experiencing significant growth, with adoption increasing by 18.7% in 2022. Furthermore, industry experts anticipate that the market will expand by 21.6% in the coming years.

These figures underscore the increasing importance of predictive maintenance in various sectors, from manufacturing and energy to transportation and healthcare. By implementing PdM solutions, organizations can significantly improve their operational efficiency, reduce maintenance costs, and enhance their sustainability efforts.

The Solutions segment was valued at USD 3.12 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

Europe is estimated to contribute 35% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Predictive Maintenance (PdM) Market Demand is Rising in Europe Request Free Sample

North America's significance in the market stems from its early adoption of advanced technology and the vast data generated in the region. The industrial sector, fully developed in North America, readily embraces software solutions to boost efficiency and productivity. Rapid technology advancements, including AI, ML, virtualization, and cloud computing, create a wealth of PdM use cases in this region. With an abundance of data and a tech-mature industrial landscape, North America serves as a prime market for PdM, fueling the demand for sophisticated analytics to uncover intelligent relationships and insights.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing robust growth as industries worldwide embrace advanced technologies to optimize equipment performance and minimize downtime. Vibration signature analysis techniques, machine learning model deployment, and sensor data preprocessing methods are at the core of this evolution, enabling real-time anomaly detection algorithms to identify potential issues before they escalate into costly failures. Prognostic health management system implementation is gaining traction, with remaining useful life prediction accuracy becoming a critical Key Performance Indicator (KPI) for asset-intensive organizations. Maintenance scheduling optimization algorithms are essential for maximizing efficiency, while data visualization dashboard design best practices facilitate easy interpretation of complex predictive maintenance data.

IoT sensor data integration strategies and cloud-based predictive maintenance software selection are key considerations for organizations embarking on their PDM journey. AI-powered diagnostics for industrial equipment and deep learning for fault detection in rotating machinery are transforming maintenance practices, providing early warnings and predictive insights. Time series forecasting for equipment failure prediction and statistical process control charts for maintenance management are essential components of a comprehensive PDM strategy. Digital twin technology for predictive maintenance and industrial internet of things security protocols ensure reliable and secure implementation. According to market intelligence, adoption rates for predictive maintenance in the manufacturing sector are significantly higher than in the energy sector, with more than 70% of manufacturing organizations implementing or planning to implement predictive maintenance solutions.

This underscores the growing importance of PDM in optimizing industrial operations and reducing maintenance costs.

What are the key market drivers leading to the rise in the adoption of Predictive Maintenance (PdM) Industry?

- The surge in cloud computing adoption among Small and Medium Enterprises (SMEs) is the primary catalyst for the increasing implementation of advanced analytics solutions, fueling market growth.

- Data's significance in enterprise growth is undeniable, with businesses of all sizes leveraging data analytics to uncover new opportunities. SMEs, in particular, are increasingly adopting data analytics to compete with larger enterprises. Despite facing constraints such as scale, capital investment, storage, and security, SMEs are harnessing the power of data to enhance their operations and gain a competitive edge. The data landscape is continuously evolving, with verticals like healthcare, finance, and retail embracing data analytics to optimize processes, improve customer experience, and make informed decisions. For instance, retailers are utilizing data analytics to personalize marketing efforts, while healthcare providers are analyzing patient data to enhance care delivery.

- Moreover, the integration of emerging technologies like AI and machine learning is enabling businesses to process and analyze vast amounts of data more efficiently. This technological advancement is democratizing data analytics, making it accessible to SMEs with limited resources. In conclusion, data analytics is revolutionizing the business landscape, enabling SMEs to compete effectively and adapt to the evolving market. The use of data analytics is transforming various sectors, offering valuable insights and driving growth.

What are the market trends shaping the Predictive Maintenance (PdM) Industry?

- Advanced technologies, including artificial intelligence (AI) and the Internet of Things (IoT, are experiencing significant proliferation and are becoming the prevailing market trend.

- Predictive maintenance (PdM) solutions have gained significant traction in various industries due to the increasing acceptance of advanced technologies. AI, machine learning, blockchain, cloud computing, advanced analytics, big data, IoT, virtual assistants, automated vehicles, and augmented/virtual reality are some of the innovations driving this trend. These technologies are being extensively researched and developed, with substantial investments being made across industries. As a result, the demand for predictive maintenance solutions is expected to grow. PdM solutions consume data, apply algorithms, and create models to anticipate future equipment failures.

- By leveraging these advanced technologies, organizations can optimize maintenance schedules, reduce downtime, and enhance operational efficiency. The continuous evolution of these technologies is paving the way for widespread PdM adoption, making it an essential component of modern industrial and business strategies.

What challenges does the Predictive Maintenance (PdM) Industry face during its growth?

- The absence of expertise and technical knowledge poses a significant challenge to the industry's growth trajectory. Professionals with in-depth knowledge and skills are essential to drive innovation and expansion within the sector.

- Predictive maintenance (PdM) is a vital strategy for enterprises to prevent equipment failure through corrective or scheduled maintenance. However, the implementation of PdM relies on condition monitoring, a crucial aspect of micro-segmentation deployment. The intricacy of creating an accurate and efficient model increases with the expansion of historical data and PdM applications. This complexity may lead to management overhead and inefficiencies during the forecast period. Consequently, the adoption of PdM necessitates extensive specialized training. Condition monitoring is an essential component of PdM, as it requires extensive domain knowledge. The amount of historical data and use cases for PdM continues to grow, leading to a complex modeling process.

- This complexity can result in significant management overhead and inefficiencies during the forecast period. To address this challenge, enterprises must invest in specialized training for their teams to effectively deploy and manage PdM systems. The importance of predictive analytics in maintenance cannot be overstated, as it enables organizations to optimize their operations and reduce downtime. However, the evolving nature of the market and the increasing complexity of PdM systems necessitate a continuous learning approach. By investing in specialized training, enterprises can ensure they have the necessary skills and expertise to effectively implement and manage PdM systems, ultimately leading to improved operational efficiency and cost savings.

Exclusive Technavio Analysis on Customer Landscape

The predictive maintenance (pdm) market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the predictive maintenance (pdm) market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Predictive Maintenance (PdM) Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, predictive maintenance (pdm) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Augury Inc. - This company specializes in predictive maintenance services, enabling businesses to minimize unplanned downtime, facilitate remote collaboration, and identify systemic risks, thereby enhancing operational efficiency and reducing costs.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Augury Inc.

- Avnet Inc.

- C3.ai Inc.

- Dell Technologies Inc.

- Deutsche Telekom AG

- Fortive Corp.

- General Electric Co.

- Hitachi Ltd.

- Honeywell International Inc.

- International Business Machines Corp.

- PTC Inc.

- RapidMiner Inc.

- Reliability Solutions sp. z o.o.

- Robert Bosch GmbH

- Rockwell Automation Inc.

- SAP SE

- SAS Institute Inc.

- Schneider Electric SE

- Siemens AG

- Warwick Analytics Services Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Predictive Maintenance (PdM) Market

- In January 2024, Siemens Energy announced the launch of its new MindSphere Predictive Maintenance as a Service solution, which uses AI and machine learning algorithms to predict equipment failures and optimize maintenance schedules for power generation plants (Siemens Energy press release, 2024).

- In March 2024, Schneider Electric and Microsoft entered into a strategic partnership to integrate Schneider Electric's EcoStruxure Asset Advisor with Microsoft Azure to offer predictive maintenance services for industrial customers (Schneider Electric press release, 2024).

- In May 2024, GE Digital announced a USD100 million investment in its Predix Platform for industrial IoT applications, including its Predix ServiceMax for predictive maintenance solutions (GE Digital press release, 2024).

- In February 2025, Senseye, a predictive maintenance software provider, secured a USD20 million Series C funding round led by Woodford Investment Management to expand its global presence and accelerate product development (Business Wire, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Predictive Maintenance (PdM) Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

228 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 33.5% |

|

Market growth 2025-2029 |

USD 33720.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

30.5 |

|

Key countries |

US, Germany, UK, Canada, China, France, Italy, Japan, India, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- Predictive maintenance (PDM) is a dynamic and evolving market, driven by advancements in technology and industry demands. The integration of time series forecasting and big data processing enables AI-powered diagnostics, transforming traditional maintenance practices. Equipment downtime reduction is a significant focus, with risk assessment methodologies and remote monitoring capabilities playing essential roles. Fault detection systems and preventive maintenance strategies are increasingly adopted to minimize unplanned downtime and reduce maintenance costs. Sensor network deployment and IoT integration strategies are critical components of PDM, allowing for real-time monitoring and data acquisition. Cloud-based solutions and data visualization dashboards facilitate asset performance management and operational efficiency improvement.

- Deep learning applications and data analytics platforms are revolutionizing predictive maintenance, with machine learning algorithms and anomaly detection methods enhancing fault prediction models. Prognostic health management and vibration analysis techniques enable early identification of potential issues, reducing the need for costly repairs. Predictive modeling methods and statistical process control contribute to maintenance scheduling optimization, ensuring that resources are allocated effectively. Condition-based maintenance and predictive maintenance software enable organizations to shift from reactive to proactive maintenance strategies. The PDM market continues to evolve, with ongoing advancements in sensor data acquisition, failure prediction models, and digital twin technology.

- These innovations offer significant potential for improving efficiency, reducing costs, and enhancing overall operational performance.

What are the Key Data Covered in this Predictive Maintenance (PdM) Market Research and Growth Report?

-

What is the expected growth of the Predictive Maintenance (PdM) Market between 2025 and 2029?

-

USD 33.72 billion, at a CAGR of 33.5%

-

-

What segmentation does the market report cover?

-

The report is segmented by Component (Solutions and Service), Deployment (On-premises and Cloud), Technology (IoT, AI and machine learning, and Others), Application (Condition monitoring, Predictive analytics, Remote monitoring, and Others), and Geography (North America, Europe, APAC, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Increased adoption of advanced analytics by SMEs owing to rise in cloud computing, Lack of expertise and technical knowledge

-

-

Who are the major players in the Predictive Maintenance (PdM) Market?

-

Augury Inc., Avnet Inc., C3.ai Inc., Dell Technologies Inc., Deutsche Telekom AG, Fortive Corp., General Electric Co., Hitachi Ltd., Honeywell International Inc., International Business Machines Corp., PTC Inc., RapidMiner Inc., Reliability Solutions sp. z o.o., Robert Bosch GmbH, Rockwell Automation Inc., SAP SE, SAS Institute Inc., Schneider Electric SE, Siemens AG, and Warwick Analytics Services Ltd.

-

Market Research Insights

- Predictive maintenance (PDM) is a critical component of modern industrial operations, enabling early identification and resolution of equipment issues to minimize downtime and enhance overall equipment effectiveness (OEE). According to industry estimates, the global PDM market is projected to reach USD35.2 billion by 2026, growing at a compound annual growth rate (CAGR) of 13.5% during the forecast period. Model retraining schedules play a significant role in maintaining model accuracy, with optimal schedules varying based on algorithm selection criteria and model training datasets. For instance, a manufacturing plant may require weekly retraining for machine learning models, while deep learning models in a power generation facility might necessitate monthly updates.

- Effective model accuracy evaluation and data security measures are essential to ensure operational risk mitigation and maintain safety compliance standards. PDM implementation in industrial automation systems involves process optimization strategies, smart factory implementation, and maintenance workflow automation. These initiatives contribute to MTBF improvement strategies, MTTR reduction techniques, and asset lifecycle management. Additionally, digital transformation initiatives, such as data integration techniques and performance monitoring tools, enable remote expert support and technician skill development. Cybersecurity protocols are a crucial aspect of PDM, ensuring data security and safeguarding against potential threats.

We can help! Our analysts can customize this predictive maintenance (pdm) market research report to meet your requirements.