Essential Oil Market Size 2024-2028

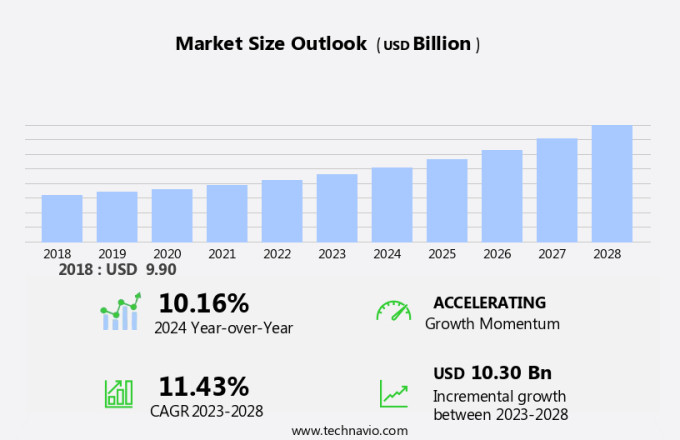

The essential oil market size is forecast to increase by USD 10.30 billion, at a CAGR of 11.43% between 2023 and 2028.

- The market is driven by the growing awareness and recognition of the numerous health benefits associated with these natural extracts. Essential oils are increasingly being used in various applications, including aromatherapy, cosmetics, and food industries, due to their therapeutic properties. A key trend in the market is the innovation in diffusion and delivery methods, enabling consumers to experience essential oils in new and convenient ways. The market encompasses a wide range of essential oils, including but not limited to lavender, peppermint, tea tree, eucalyptus, lemon, rosemary, chamomile, bergamot, ylang ylang, frankincense, geranium, clary sage, patchouli, sandalwood, citronella, clove, basil, cinnamon, oregano, lemongrass, juniper berry, grapefruit, orange, jasmine, thyme, rose, neroli, cedarwood, and fennel oils. However, this market faces challenges as well. The rising prevalence of counterfeit essential oils poses a significant threat, as these products may contain impurities or even harmful substances. Companies must ensure the authenticity and quality of their essential oils to maintain consumer trust and loyalty.

- To capitalize on market opportunities and navigate challenges effectively, businesses should focus on research and development, supply chain transparency, and consumer education. By staying abreast of emerging trends and addressing market challenges proactively, players in the market can position themselves for long-term success.

What will be the Size of the Essential Oil Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by the expanding applications across various sectors. Botanical ingredients are at the core of this industry, with digestive support and emotional well-being being significant areas of focus. Usage instructions and allergen-free oils are essential for ensuring safety and product differentiation. Natural perfumery, inhalation therapy, and skincare applications are key areas where essential oils find extensive usage. Batch testing and international standards ensure product quality and regulatory compliance. Pregnant women and those experiencing pain relief are among the target audiences for these natural remedies. Plant-based fragrances, vegan oils, and cruelty-free options cater to diverse consumer preferences.

Solvent extraction and steam distillation are common methods for essential oil extraction, while sustainable sourcing and organic certification add to the market's appeal. Product liability, safety precautions, and intellectual property are crucial aspects of the market. Essential oils offer respiratory support, circulatory benefits, and even cognitive function enhancement. Therapeutic grade oils and topical application find extensive use in massage therapy and stress relief. Marketing strategies, pricing, and customer loyalty are essential for businesses in this dynamic market. Essential oils provide antimicrobial, anti-inflammatory, and antioxidant properties, making them valuable in various industries. Brands prioritize quality control, aromatherapy diffusers, and clear labeling for consumer trust.

The market's continuous evolution reflects the ongoing unfolding of market activities and evolving patterns. Essential oils' versatility and potential health benefits make them a popular choice for individuals seeking natural alternatives.

How is this Essential Oil Industry segmented?

The essential oil industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Food and beverages

- Recreation

- Perfumes and others

- Distribution Channel

- Online

- Offline

- Geography

- North America

- US

- Canada

- Europe

- Germany

- The Netherlands

- APAC

- Japan

- India

- China

- South Korea

- South America

- Brazil

- Argentina

- Middle East and Africa

- UAE

- Rest of World (ROW)

- North America

By Application Insights

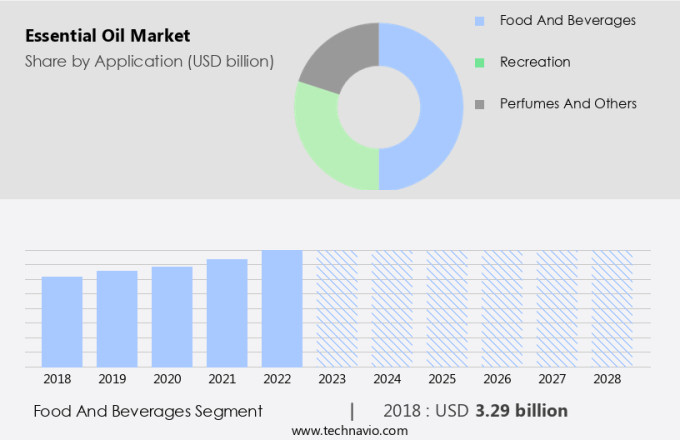

The food and beverages segment is estimated to witness significant growth during the forecast period.

Essential oils have gained significant popularity in various industries due to their natural benefits and versatile uses. In the product packaging sector, these oils are utilized for their aromatic properties to enhance consumer experience. For respiratory support, essential oils like eucalyptus and tea tree are incorporated into inhalation therapy products. Labeling of essential oils is crucial for product liability reasons, ensuring accurate information about the botanical ingredients, usage instructions, and potential allergens. Cold pressing and steam distillation are common methods for essential oil extraction, while therapeutic grade oils undergo additional quality control measures. Direct sales channels have emerged as a popular business model, allowing companies to reach customers directly and build customer loyalty.

Safety precautions and regulatory compliance are essential for marketing strategies, with international standards such as FDA regulations guiding the industry. Dark glass bottles are commonly used for essential oil storage to protect them from sunlight and oxidation. Clinical trials and scientific evidence support the therapeutic benefits of essential oils for digestive support, emotional well-being, pain relief, immune system support, and more. Sustainable sourcing practices and organic certification are essential for brand awareness and consumer trust. Essential oil blends offer product differentiation, with natural perfumery being a significant application. Pricing strategies vary based on factors such as sourcing, production, and marketing costs.

Essential oils have various applications in skincare, hair care, and massage therapy. Dilution guidelines ensure safe topical application. Essential oils cater to diverse target audiences, including pregnant women, people seeking pain relief, and those looking for plant-based fragrances. Quality control measures, including batch testing and intellectual property protection, are essential for maintaining product consistency and innovation. In summary, the market is dynamic and evolving, with various applications in food and beverages, product packaging, therapeutic uses, and fragrance industries. Essential oils offer numerous benefits, from health and wellness to consumer experiences, making them a valuable addition to various industries.

The Food and beverages segment was valued at USD 3.29 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

Europe is estimated to contribute 37% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

Essential oils have gained significant popularity in Europe due to their numerous health benefits and diverse applications in various industries. The pharmaceutical, cosmetics, and food and beverage sectors are witnessing a surge in demand for essential oils as an ingredient. Germany, the UK, France, and Spain are leading markets for these natural extracts. In the food and beverage industry, producers are innovating with new products that incorporate essential oils, while cosmetics companies are launching aromatherapy-infused skincare and personal care items. The aromatherapy market in Europe is thriving, particularly in countries like France, Germany, the UK, Austria, and Switzerland, where it is widely used as an alternative medicine.

Essential oils are extracted through methods such as cold pressing, steam distillation, and solvent extraction, ensuring therapeutic grade quality. Producers prioritize regulatory compliance, safety precautions, and labeling transparency. Brand awareness and customer loyalty are crucial in the essential oils market. Dark glass bottles preserve the oils' quality, and essential oil blends cater to various uses, such as respiratory support, digestive health, emotional well-being, and pain relief. Pricing strategies vary based on botanical ingredients, production methods, and brand reputation. Sustainable sourcing and cruelty-free practices are essential for brands seeking to differentiate themselves in the market. Essential oils are used for skincare applications, massage therapy, and sleep support.

Inhalation therapy and aromatherapy diffusers are popular methods for using essential oils for mood enhancement and stress relief. Regulatory bodies like the FDA and EU have established guidelines for essential oil usage and labeling. Essential oils have antimicrobial properties, antioxidant properties, and anti-inflammatory properties. They are also allergen-free and vegan, making them suitable for a wide range of consumers. Quality control and batch testing are essential to ensure the purity and potency of essential oils. Producers prioritize intellectual property protection and adhere to organic certification standards. Essential oils have a long shelf life when stored in a cool, dry place.

Marketing strategies focus on target audiences seeking natural, plant-based fragrances and holistic health solutions. Specialty stores and online retailers cater to this demand, offering a range of essential oils, carrier oils, and dilution guidelines.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Essential Oil Industry?

- The essential oils market is driven primarily by their recognized health benefits.

- Essential oils, derived from plants through cold pressing or steam distillation, have gained popularity for their numerous health benefits. These natural extracts, including lavender, basil, tea tree, and lemongrass, offer respiratory support and help alleviate stress, anxiety, and depression. Basil oil, for instance, contains eugenol, citronella, and linalool, which provide anti-inflammatory and analgesic properties, making it ideal for soothing skin inflammation and insect bites. Marketing strategies for essential oils emphasize product packaging, ensuring therapeutic grade quality, and regulatory compliance. Proper labeling and safety precautions are crucial to prevent product liability issues. Dark glass bottles protect the oils from sunlight, preserving their therapeutic properties.

- Essential oil blends offer various benefits, such as improved mood and relaxation. Pricing strategies and sustainable sourcing are essential to maintain brand awareness. Clinical trials and research contribute to the growing body of evidence supporting the health benefits of essential oils. Essential oil storage is crucial to maintain their quality and efficacy. Safety precautions, such as diluting essential oils before use and avoiding direct contact with the eyes and mucous membranes, are essential for safe usage.

What are the market trends shaping the Essential Oil Industry?

- The emerging trend in the market involves the innovation of diffusion and delivery methods for essential oils. This sector is experiencing significant growth due to advancements in technology and consumer demand.

- Essential oils, derived from botanical ingredients, have gained popularity in the US market for their various health benefits and uses in digestive support, emotional well-being, natural perfumery, and inhalation therapy. Usage instructions for these plant-based fragrances vary, and it is essential to note that some oils may be allergen-free while others may not. Product differentiation is key in this market, with offerings ranging from solvent extraction to steam distillation methods. The market adheres to international standards and FDA regulations to ensure safety and efficacy. Pregnant women and individuals with specific health conditions should consult healthcare professionals before use.

- Essential oils are used for pain relief, immune system support, and emotional well-being. Ultrasonic diffusers, an emerging innovation, offer a more effective and longer-lasting fragrance experience compared to traditional methods. These devices work by using ultrasonic vibrations to break down essential oils into microparticles, preserving their therapeutic properties. With built-in timers and automatic shut-off features, ultrasonic diffusers are convenient and require minimal maintenance.

What challenges does the Essential Oil Industry face during its growth?

- The proliferation of counterfeit essential oils poses a significant challenge to the industry's growth, as consumers are increasingly exposed to subpar products that undermine market credibility and trust.

- Essential oils, extracted from plants via steam distillation, are valued for their fragrances and therapeutic properties. However, the market growth is threatened by the prevalence of counterfeit products. These imitations, often made from cheap seed oils or adulterated with synthetics, can damage the reputation of reputable essential oil brands. For instance, lavender oil, a popular essential oil, is frequently adulterated with lavandin oil, which has distinct chemical properties and is commonly used in perfumery. Such deceptive practices can undermine customer loyalty and trust. To mitigate this issue, it's crucial for essential oil companies to prioritize quality control, intellectual property protection, and diligent labeling.

- Consumers, in turn, should be vigilant about purchasing essential oils from trusted sources, such as specialty stores or those certified organic. Additionally, following dilution guidelines ensures safe topical application. Essential oils offer various benefits, including antimicrobial, anti-inflammatory, and circulatory support properties, making them popular for aromatherapy diffusers, skincare applications, and hair care. Shelf life is another essential factor to consider when purchasing essential oils to ensure their potency and effectiveness. Cruelty-free oils are also gaining popularity among ethically-conscious consumers.

Exclusive Customer Landscape

The essential oil market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the essential oil market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, essential oil market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aliver Beauty

- Avi Naturals

- Biolandes SAS

- BMV Fragrances Pvt. Ltd.

- doTERRA International LLC

- Eden Botanicals

- Elysce

- Essential Oils Co

- Falcon

- Natural Sourcing LLC

- NHR Organic Oils

- Norex Flavours Pvt. Ltd.

- Organic Infusions

- Phoenix Aromas and Essential Oils LLC

- Plant Therapy Inc.

- Sydney Essential Oil Co. Pty Ltd.

- Takasago International Corp.

- The Lebermuth Co. Inc.

- Ultra International Ltd.

- VedaOils

- Vidya Herbs Pvt. Ltd.

- Young Living Essential Oils LC

- Enio Bonchev Production Ltd.

- Essential Oils of New Zealand Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Essential Oil Market

- In February 2023, doTerra, a leading essential oils company, announced the launch of their new line of Certified Pure Therapeutic Grade (CPTG) essential oils, featuring 12 new scents. This expansion aims to cater to the growing demand for natural aromatherapy solutions (doTerra Press Release, 2023).

- In October 2024, Young Living Essential Oils, another major player, formed a strategic partnership with a leading cosmetics company, L'Oréal, to integrate essential oils into their personal care product lines. This collaboration signifies the increasing popularity of essential oils in the cosmetics industry (Young Living Press Release, 2024).

- In March 2025, Dabur India, a leading Ayurvedic and natural health products company, completed the acquisition of a leading essential oils manufacturer, Essential Oils of India, for approximately USD150 million. This acquisition will significantly strengthen Dabur's position in the essential oils market (Business Standard, 2025).

- In June 2025, the European Union's European Chemicals Agency (ECHA) approved the use of certain essential oils as biocides, enabling their use in pesticides and other antimicrobial applications. This approval opens up new opportunities for essential oil producers and marketers in the European market (ECHA Press Release, 2025).

Research Analyst Overview

- The essential oil industry continues to evolve, with various segments gaining traction among consumers and businesses. Accreditation for essential oils is increasingly important, ensuring product authenticity and quality. In the retail sector, essential oil suppliers cater to diverse demands, offering products such as candles, soaps, and sprays. Wholesale distribution plays a significant role in the industry's growth, enabling businesses to stock a wide range of essential oils for various uses. Education and community are essential components of the market. Essential oil blogs and forums serve as platforms for sharing knowledge, experiences, and recipes. Aroma therapy, a popular application, contributes to the industry's expansion.

- Essential oil manufacturers prioritize safety, providing precautions and certification to ensure user safety. Blending essential oils is an art, and training programs offer valuable insights for both beginners and professionals. Essential oil reviews influence consumer decisions, highlighting product quality and benefits. Certification and accreditation are crucial for essential oil distributors to maintain market credibility. Essential oil kits, roll-ons, and recipes cater to diverse consumer preferences, expanding the market's reach.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Essential Oil Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

164 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.43% |

|

Market growth 2024-2028 |

USD 10.30 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

10.16 |

|

Key countries |

US, Canada, Japan, Germany, and The Netherlands |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Essential Oil Market Research and Growth Report?

- CAGR of the Essential Oil industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the essential oil market growth of industry companies

We can help! Our analysts can customize this essential oil market research report to meet your requirements.