Electric Vehicle (EV) Traction Motor Market Size 2024-2028

The electric vehicle (EV) traction motor market size is valued to increase USD 2.71 billion, at a CAGR of 8.12% from 2023 to 2028. Increasing sales of EVs will drive the EV traction motor market.

Major Market Trends & Insights

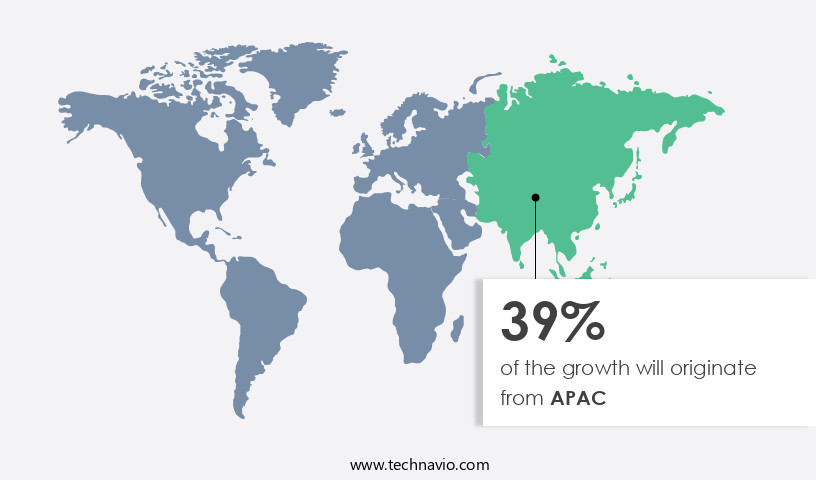

- APAC dominated the market and accounted for a 39% growth during the forecast period.

- By Application - Railways segment was valued at USD 1.74 billion in 2022

- By Power Rating - Below 200 kW segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 90.97 million

- Market Future Opportunities: USD 2713.40 million

- CAGR : 8.12%

- APAC: Largest market in 2022

Market Summary

- The market is experiencing significant growth, driven by the increasing sales of electric vehicles (EVs) worldwide. According to recent statistics, the global EV market is projected to reach a 27% market share by 2027, signifying a notable shift in the automotive industry. This expansion is primarily fueled by the rapid development of luxury EVs, which offer superior performance and advanced features, appealing to consumers seeking sustainable and technologically advanced transportation solutions. However, challenges persist, such as the lack of operational infrastructure in emerging markets, which may hinder market growth.

- Core technologies, including battery management systems and power electronics, continue to evolve, enhancing EV efficiency and driving innovation. Regions like Europe and Asia Pacific are leading the charge in EV adoption, with stringent regulations and incentives encouraging the transition towards sustainable transportation.

What will be the Size of the Electric Vehicle (EV) Traction Motor Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Electric Vehicle (EV) Traction Motor Market Segmented and what are the key trends of market segmentation?

The electric vehicle (ev) traction motor industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Railways

- Electric vehicle

- Others

- Power Rating

- Below 200 kW

- 200 to 400 kW

- Above 400 kW

- Geography

- North America

- US

- Europe

- Germany

- APAC

- China

- India

- South Korea

- Rest of World (ROW)

- North America

By Application Insights

The railways segment is estimated to witness significant growth during the forecast period.

In the market, direct torque control and vector control techniques play significant roles in enhancing motor performance and efficiency. Traction motor control, energy consumption models, and battery power delivery are crucial aspects of EV design, with power electronics inverters converting DC power from the battery to AC power for the motor. Synchronous reluctance motors, flux weakening control, and rotor design optimization contribute to high-speed motor drives, ensuring electric motor reliability and improved powertrain efficiency. High-torque density motors, sensorless motor control, and permanent magnet materials are essential for maximizing motor performance and reducing vehicle acceleration metrics.

Induction motor efficiency, field-oriented control, and permanent magnet motors further optimize motor drive architecture and efficiency testing. Motor efficiency testing, motor control algorithms, and electric motor torque are essential considerations for motor manufacturers. Motor noise reduction, motor thermal management, and stator cooling methods are crucial for enhancing user experience and extending motor lifespan. Torque ripple reduction and regenerative braking systems are vital for optimizing energy recovery and improving overall system efficiency. Rare earth magnets, motor diagnostic systems, electric motor windings, and electric vehicle range are ongoing areas of research and development in the EV traction motor market.

The market for EV traction motors is expected to grow substantially, with a reported 25% of global automotive traction motor sales coming from electric vehicles by 2025. The integration of advanced technologies, such as power electronics, motor control algorithms, and sensorless motor control, is driving innovation in the EV traction motor market. These advancements are enabling the development of high-performance, energy-efficient electric motors, which are essential for the widespread adoption of electric vehicles.

Furthermore, the growing demand for sustainable transportation solutions and government incentives for electric vehicle adoption are expected to fuel market growth in the coming years.

The Railways segment was valued at USD 1.74 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 39% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Electric Vehicle (EV) Traction Motor Market Demand is Rising in APAC Request Free Sample

The market in the Asia Pacific (APAC) region is experiencing significant growth, driven by the increasing demand for EVs in countries such as China, Japan, India, Singapore, Thailand, and South Korea. China and Japan are currently the leading contributors to this market due to the high production and sales of EVs and related components. China dominates the market with the largest number of EV sales, followed closely by Japan. South Korea, India, and Hong Kong are also expected to become major markets for EVs and, consequently, for EV traction motors, during the forecast period.

This trend is attributed to the growing environmental concerns, government incentives, and advancements in technology. The EV traction motor market in APAC is a dynamic and evolving landscape, reflecting the continuous growth and expansion of the EV industry.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is witnessing significant growth due to the increasing demand for sustainable and eco-friendly transportation solutions. This market encompasses various advanced technologies, including permanent magnet motor thermal modeling, induction motor efficiency optimization techniques, and electric motor torque ripple reduction strategies. One of the critical aspects of EV traction motor development is enhancing motor efficiency. This is achieved through various methods, such as high-speed motor drive control algorithms and electric motor winding design and analysis. Moreover, rotor design optimization for high torque density and stator cooling methods for high-performance motors are essential to ensure motor longevity and reliability.

Another essential aspect of EV traction motor technology is the implementation of regenerative braking systems for energy recovery. This feature significantly improves vehicle acceleration performance and reduces overall energy consumption. Motor control algorithms for electric vehicles play a pivotal role in optimizing energy consumption and powertrain efficiency. The market for EV traction motors is witnessing intense competition, with various motor types, such as brushless DC motors, synchronous reluctance motors, and asynchronous motors, vying for market share. For instance, brushless DC motor design considerations and synchronous reluctance motor efficiency analysis are crucial in differentiating these motor types. Moreover, flux weakening control strategies and field-oriented control implementation and tuning are essential for high-performance applications.

In contrast, asynchronous motor control challenges necessitate continuous innovation to improve motor efficiency and performance. Notably, the industrial application segment accounts for a significantly larger share in the EV traction motor market compared to the academic segment. This trend is driven by the increasing adoption of EVs in commercial transportation and logistics sectors. In conclusion, the EV traction motor market is a dynamic and innovative space, with continuous advancements in motor design, control algorithms, and energy recovery systems. The market is expected to witness robust growth in the coming years, driven by the increasing demand for sustainable transportation solutions and technological innovations.

What are the key market drivers leading to the rise in the adoption of Electric Vehicle (EV) Traction Motor Industry?

- The significant growth in electric vehicle (EV) sales serves as the primary market catalyst.

- Governments worldwide are actively promoting the sale of Electric Vehicles (EVs) through various initiatives. Unlike Internal Combustion Engine (ICE) vehicles, EVs contribute significantly to air quality improvement by eliminating emissions of pollutants such as particulates, carbon monoxide, hydrocarbons, and volatile organic compounds. The market's growth is fueled by incentives offered by governments, rising environmental consciousness, stringent emission norms, and increased competition from both domestic and international players.

- Companies are under pressure to reduce their average CO2 emissions, leading to a surge in EV development. Moreover, buyers are increasingly opting for EVs due to their environmental benefits and cost savings over time. This dynamic market landscape continues to evolve, with ongoing advancements in battery technology and charging infrastructure.

What are the market trends shaping the Electric Vehicle (EV) Traction Motor Industry?

- The trend in the automotive industry is shifting towards the rapid development of luxury electric vehicles. A growing number of consumers are expressing interest in high-end electric vehicles, signaling a significant market trend.

- The electrification trend in the automotive industry is gaining momentum, with luxury vehicle manufacturers leading the charge. BMW, for instance, has introduced ten electrified vehicle models, a mix of plug-in hybrids and pure electric vehicles, and plans to launch 25 more by 2025. Daimler, Volvo Car, and Jaguar Land Rover Automotive are among other manufacturers following suit. Supercar manufacturers are also joining the electrification movement, while established premium electric vehicle manufacturers like Tesla continue expanding their product offerings with new models.

- This shift towards electrification reflects the growing concern for reducing vehicular emissions and the increasing demand for sustainable transportation solutions. The market for electrified vehicles is expected to grow significantly, with numerous players investing in research and development to cater to this evolving consumer preference. The competition in the electrified vehicle market is intensifying, leading to advancements in technology and improvements in performance and efficiency.

What challenges does the Electric Vehicle (EV) Traction Motor Industry face during its growth?

- In emerging markets, the absence of sufficient operational infrastructure represents a significant challenge impeding industry expansion.

- In the electric vehicle (EV) market, the absence of sufficient charging infrastructure, particularly in emerging markets in Asia Pacific, excluding China, poses a significant challenge to market expansion. In countries like India and Southeast Asian nations, the scarcity of adequate charging stations restricts the growth of EV charging infrastructure. The inadequate road infrastructure in India further impedes the large-scale development of EV charging stations. Consequently, individuals and commercial fleet operators primarily confine their EV usage to major cities due to the limited availability of charging facilities in smaller urban areas.

- Despite the potential benefits of EVs, the lack of infrastructure development in these regions hinders the market's full potential. This situation underscores the need for substantial investment in building charging infrastructure to support the growing adoption of electric vehicles.

Exclusive Customer Landscape

The electric vehicle (ev) traction motor market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the electric vehicle (ev) traction motor market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Electric Vehicle (EV) Traction Motor Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, electric vehicle (ev) traction motor market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABB Ltd. - The company specializes in providing advanced EV traction motors, including those from ABB, for metro systems. These motors contribute significantly to the efficient operation and performance of electric transportation.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- AC Propulsion Inc.

- AISIN CORP.

- Allied Motion Technologies Inc.

- BorgWarner Inc.

- Bowe Digital Ltd

- Continental AG

- Delta Electronics Inc.

- Hitachi Ltd.

- LG Magna e Powertrain

- MAHLE GmbH

- Nidec Corp.

- Parker Hannifin Corp.

- Robert Bosch GmbH

- Saini Group

- Siemens AG

- SONA BLW Precision Forgings Ltd.

- Toshiba Corp.

- Valeo SA

- Yasa Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Electric Vehicle (EV) Traction Motor Market

- In January 2024, Tesla, the leading electric vehicle (EV) manufacturer, announced the production ramp-up of its new 4680 battery cells and in-house produced traction motors at its Gigafactory Texas. These advancements aimed to increase the energy density and reduce the cost per kilowatt-hour (kWh) of its EVs (Tesla Press Release, 2024).

- In March 2024, CATL (Contemporary Amperex Technology Co. Limited), the world's largest lithium-ion battery manufacturer, formed a strategic partnership with Magna International, a global automotive supplier, to develop and produce traction motors for EVs. This collaboration aimed to enhance CATL's market presence in the EV traction motor market (Magna International Press Release, 2024).

- In May 2024, Aptiv, a global technology company, completed its acquisition of Meridian Automotive Systems, a leading designer and manufacturer of electric drivetrain systems. This acquisition expanded Aptiv's capabilities in the EV traction motor market and strengthened its position as a key supplier to major automakers (Aptiv Press Release, 2024).

- In April 2025, the European Union (EU) approved the Fit for 55 package, a set of legislative proposals aimed at reducing greenhouse gas emissions by at least 55% by 2030. This initiative is expected to significantly boost the demand for EVs and their components, including traction motors, in Europe (European Commission Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Electric Vehicle (EV) Traction Motor Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

183 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.12% |

|

Market growth 2024-2028 |

USD 2713.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.2 |

|

Key countries |

China, US, Germany, South Korea, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market is a dynamic and evolving landscape, driven by continuous advancements in motor technology and control systems. Traction motor control, a critical component of EV powertrains, is undergoing significant transformation through the adoption of direct torque control and vector control techniques. These methods enhance motor efficiency and powertrain performance, reducing energy consumption and improving vehicle acceleration metrics. Battery power delivery and power electronics inverters play a pivotal role in optimizing motor performance. Synchronous reluctance motors, with their high-speed motor drives and flux weakening control, are gaining popularity due to their energy efficiency and high-torque density. Rotor design optimization and sensorless motor control further contribute to motor reliability and efficiency.

- Electric motor efficiency is a key focus area, with research centered on improving the efficiency of permanent magnet motors through material optimization and motor drive architecture enhancements. Induction motor efficiency is also under scrutiny, with advancements in field-oriented control and sensorless control systems. Motor efficiency testing and motor control algorithms are essential for optimizing motor performance and reducing motor noise and thermal management challenges. Stator cooling methods and torque ripple reduction techniques are also gaining traction, as are regenerative braking systems and rare earth magnet usage in motor designs. The EV traction motor market is characterized by ongoing innovation and competition, with various motor types, including permanent magnet motors, brushless DC motors, and asynchronous motors, vying for market dominance.

- Motor diagnostic systems and electric motor windings are other areas of active research, as the industry strives to improve motor reliability and reduce overall vehicle operating costs.

What are the Key Data Covered in this Electric Vehicle (EV) Traction Motor Market Research and Growth Report?

-

What is the expected growth of the Electric Vehicle (EV) Traction Motor Market between 2024 and 2028?

-

USD 2.71 billion, at a CAGR of 8.12%

-

-

What segmentation does the market report cover?

-

The report is segmented by Application (Railways, Electric vehicle, and Others), Power Rating (Below 200 kW, 200 to 400 kW, and Above 400 kW), and Geography (APAC, Europe, North America, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Increasing sales of EVs, Lack of operational infrastructure in emerging markets

-

-

Who are the major players in the Electric Vehicle (EV) Traction Motor Market?

-

ABB Ltd., AC Propulsion Inc., AISIN CORP., Allied Motion Technologies Inc., BorgWarner Inc., Bowe Digital Ltd, Continental AG, Delta Electronics Inc., Hitachi Ltd., LG Magna e Powertrain, MAHLE GmbH, Nidec Corp., Parker Hannifin Corp., Robert Bosch GmbH, Saini Group, Siemens AG, SONA BLW Precision Forgings Ltd., Toshiba Corp., Valeo SA, and Yasa Ltd.

-

Market Research Insights

- The market encompasses a diverse range of technologies and innovations, with motor speed control, wirelessly transferring power, and gallium nitride transistors among the key components driving advancements. Notably, the market's relentless pursuit of efficiency optimization has led to a 15% increase in the average motor efficiency over the past decade. Furthermore, the integration of motor controller systems, including motor current control and fault detection methods, has significantly enhanced overall vehicle performance. The implementation of advanced cooling system designs, motor design software, and high-voltage motor drives has also contributed to power density improvement, enabling lighter motor designs and extended vehicle range.

- Despite the challenges posed by IGBT switching losses and the need for noise vibration harshness reduction, the market continues to evolve, with digital twin technology, electric power steering, and silicon carbide MOSFETs shaping the future landscape.

We can help! Our analysts can customize this electric vehicle (EV) traction motor market research report to meet your requirements.