Fiber Optic Cable Market Size 2024-2028

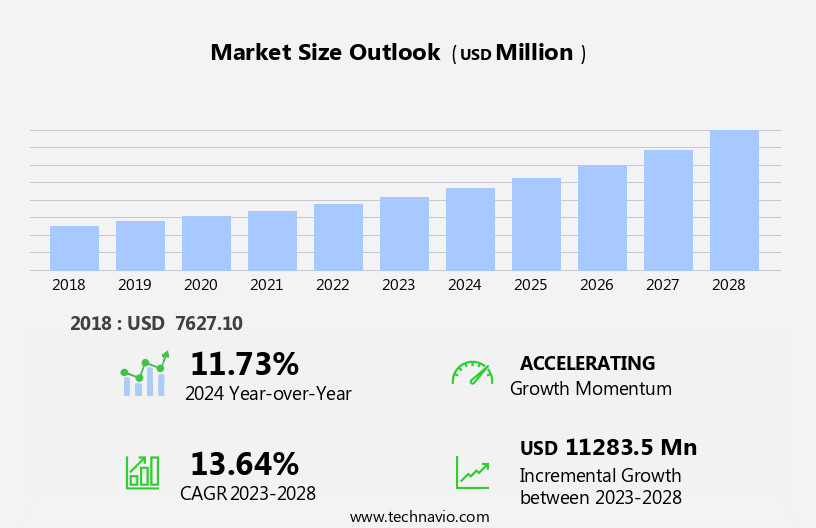

The fiber optic cable market size is forecast to increase by USD 11.28 billion at a CAGR of 13.64% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing demand for high-speed internet connectivity and the expansion of data centers. With the ongoing digital transformation, the global internet penetration rate continues to rise, leading to a surge in data traffic. This trend is particularly prominent in regions with large populations and developing economies, presenting substantial opportunities for market expansion. However, the high cost of fiber optic cable remains a significant challenge for market growth. Despite this, companies can capitalize on the market's potential by exploring innovative manufacturing techniques, implementing cost-effective production strategies, and collaborating with key industry players to share resources and expertise.

- Additionally, the ongoing development of advanced technologies, such as 5G networks and the Internet of Things (IoT), is expected to further fuel demand for fiber optic cables, creating new opportunities for market participants. Overall, the market offers significant growth prospects for companies willing to navigate the challenges and capitalize on the opportunities presented by the digital transformation and the increasing demand for high-speed connectivity.

What will be the Size of the Fiber Optic Cable Market during the forecast period?

- Fiber optic technology has become a cornerstone of modern communication systems, driving the growth of fiber optic networks worldwide. Fiber optic cabling, a crucial component of this infrastructure, facilitates high-speed data transmission through optical fiber cables. The fiber optic network market is witnessing significant expansion as businesses increasingly rely on reliable, secure, and high-capacity connectivity solutions. Fiber optic infrastructure's ability to support large data transfer and offer low latency makes it an essential element for various industries, including telecommunications, healthcare, finance, and education. Fiber optic transmission's increasing popularity is attributed to its capacity to handle vast amounts of data and its resistance to electromagnetic interference.

- The demand for fiber optic connectivity continues to escalate, with businesses recognizing its potential to improve operational efficiency and productivity. Optical fiber cables' versatility and scalability enable them to cater to the evolving needs of organizations, making them a preferred choice for long-haul and short-haul applications. Investments in fiber optic infrastructure are expected to increase as the market adapts to emerging trends, such as 5G networks, cloud computing, and the Internet of Things (IoT). These advancements will further boost the adoption of fiber optic technology, ensuring its continued relevance in the business landscape.

How is this Fiber Optic Cable Industry segmented?

The fiber optic cable industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Telecommunication

- Energy and power

- Healthcare

- Aerospace and defense

- Others

- Type

- Single-mode

- Multi-mode

- Geography

- North America

- US

- Europe

- Germany

- UK

- Middle East and Africa

- APAC

- China

- India

- South America

- Rest of World (ROW)

- North America

By End-user Insights

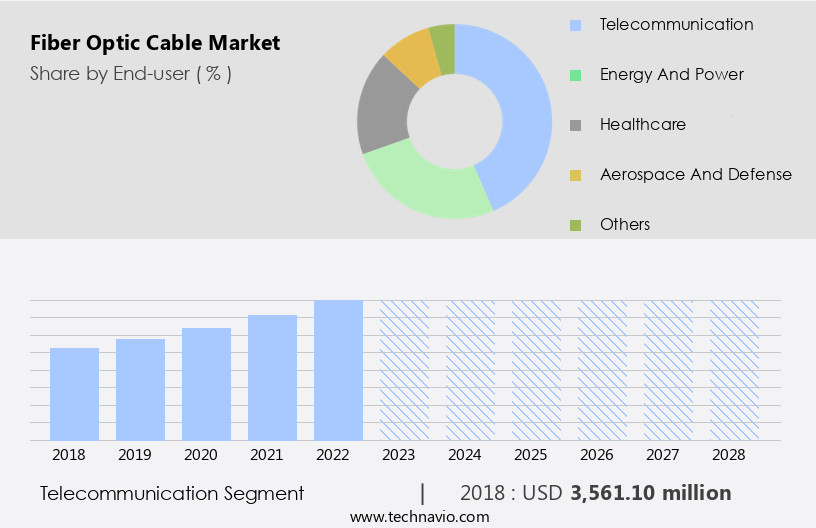

The telecommunication segment is estimated to witness significant growth during the forecast period.

In the realm of advanced technology, fiber optics continues to dominate data transmission, particularly in enterprise networking and high-speed internet. Fiber optic cables, comprised of both single-mode and multimode fibers, are integral components of modern data centers, enabling efficient and reliable data transmission. The telecommunications industry's preference for fiber optics is driven by its capacity to transmit vast amounts of data, offer high speed and bandwidth, and boast low attenuation. This makes it an indispensable tool for long-distance connections between various networks.

The unyielding demand for fiber optics in telecommunications arises from its unparalleled ability to provide better connections, superior performance, and immunity to electromagnetic interference. Furthermore, fiber optics are highly reliable and easily maintainable, making them an indispensable element in the evolving digital landscape.

Get a glance at the market report of share of various segments Request Free Sample

The Telecommunication segment was valued at USD 3.56 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

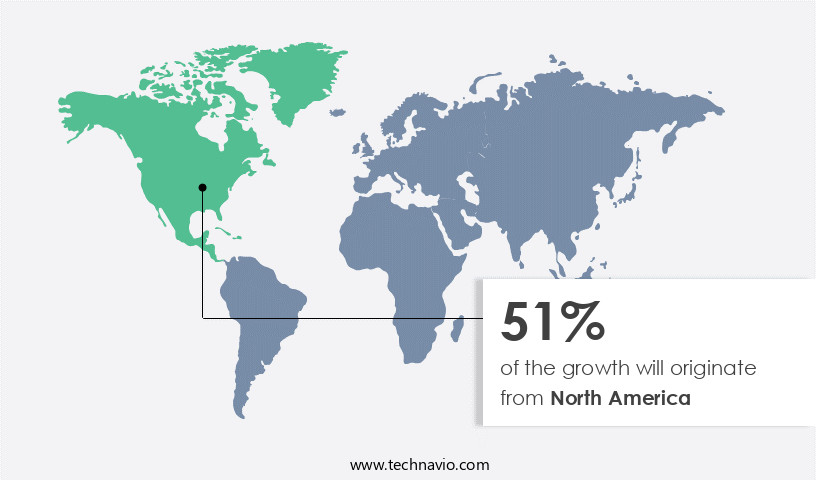

North America is estimated to contribute 51% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The North American market holds the largest share in the global fiber optic cable industry, driven by the surging demand for high-speed internet connectivity and the expanding IT and telecommunications sectors in the US and Canada. The food and beverage, energy and power, healthcare, and automotive manufacturing industries in this region are primary consumers of fiber optic cables due to the increasing need for intra and inter-data center communications. The availability of vast oil and gas reserves and advancements in offshore drilling technologies have further boosted exploration and drilling activities, leading to increased demand for fiber optic cables in the energy sector.

In enterprise networking, single-mode fiber is preferred for long-haul data transmission due to its ability to transmit data over long distances with minimal signal loss. Optical fiber's adoption in data centers is also on the rise due to its high bandwidth, low signal loss, and immunity to electromagnetic interference. The use of multimode fiber, on the other hand, is more common in local area networks (LANs) due to its cost-effectiveness and ability to transmit data over shorter distances. Overall, the market in North America is expected to continue its growth trajectory during the forecast period, driven by the increasing demand for high-speed internet connectivity and the expanding IT and telecommunications sectors.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Fiber Optic Cable Industry?

- Rise in Internet penetration and data traffic is the key driver of the market.

- The market is experiencing significant growth due to the increasing rates of Internet penetration and smartphone adoption. In developing countries, investments in healthcare and telecommunication sectors are on the rise, driven by robust distribution channels and efficient logistic services. This trend is fueling the demand for global shipping and cross-border e-commerce. Notably, m-commerce is gaining popularity in emerging economies where web-enabled mobile handsets serve as the primary source of Internet access for many people.

- With a population exceeding 4 billion, Asia holds the largest market share in this context. This growth can be attributed to the region's substantial consumer base and the rapid expansion of telecommunications infrastructure.

What are the market trends shaping the Fiber Optic Cable Industry?

- Proliferation of data centers is the upcoming market trend.

- Data centers have emerged as essential infrastructure for businesses in the digital age, as the exponential growth in data necessitates their establishment. Companies are increasingly constructing their data centers or leasing space to accommodate this trend. The shift towards cloud computing is further fueling the demand for data centers. Teraco, Africa's leading company-neutral data center and interconnection provider, recently announced the expansion of JB4 data center phase 2 in Johannesburg.

- Likewise, STT GDC, the largest telecommunications service provider, invested USD242 million in constructing two data centers in Pune, India. These investments underscore the market's dynamics, with businesses responding to the growing data needs and the strategic importance of reliable data infrastructure.

What challenges does the Fiber Optic Cable Industry face during its growth?

- High cost of fiber optic cable is a key challenge affecting the industry growth.

- The market is experiencing significant growth due to the advantages it offers, such as enormous data transfer capacity and high speed. Fiber optic cables enable businesses to monitor challenging conditions and collect real-time, highly accurate data. However, the cost of this technology remains a barrier for some businesses, as it can be expensive depending on the application, cable type, and operating conditions. The high cost makes it an unattainable solution for every business requiring real-time monitoring and sensing.

- Moreover, the entire fiber optic cable functions as a sensing element, making any defect or fault a potential issue. Repairing these issues in difficult environments and terrain conditions can be challenging. Despite these challenges, the benefits of fiber optic cables continue to drive their adoption in various industries.

Exclusive Customer Landscape

The fiber optic cable market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the fiber optic cable market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, fiber optic cable market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AMETEK Inc. - The company specializes in advanced fiber optic cable solutions, including telescopic, microscopic, beam delivery, and intricate systems. These offerings enable enhanced data transmission and precision applications. By utilizing cutting-edge technology, the company caters to diverse industries, ensuring optimal performance and reliability.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AMETEK Inc.

- Arabian Fiber Optic Cable Manufacturing LLC

- Bhuwal Insulation Cable Pvt. Ltd.

- Claron Fibre Optics Pvt. Ltd.

- Cross Co.

- Dron Edge India Pvt. Ltd.

- Fiberoptics Technology Inc.

- Finolex Cables Ltd.

- HFCL Ltd.

- HUBER SUHNER AG

- Hunan GL Technology Co. Ltd.

- igus GmbH

- Ningbo Cibo Communication Technology Co. Ltd.

- Orient Cables India Pvt. Ltd.

- Pratap Digital Communications Pvt. Ltd.

- Precision Fiber Products Inc.

- Prysmian Spa

- Sterlite Technologies Ltd.

- Vindhya Telelinks Ltd.

- Yangtze Optical Fibre and Cable Joint Stock Ltd. Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Fiber optic cables have become an essential component of modern enterprise networking, enabling high-speed data transmission and fueling the insatiable demand for reliable and efficient communication infrastructure. The fiber optic market encompasses various types of cables, including single-mode and multimode fibers, each catering to distinct applications and requirements. Single-mode fiber, characterized by its small core diameter, offers superior signal transmission quality and longer distances. This attribute makes it an ideal choice for long-haul data transmission applications, such as inter-city and international connectivity, and high-performance data centers. Single-mode fiber's ability to support higher bandwidths and lower attenuation makes it an indispensable asset in the ever-evolving landscape of high-speed internet and advanced networking solutions.

Multimode fiber, on the other hand, features a larger core diameter, enabling it to support multiple transmission modes. This attribute results in increased signal dispersion, limiting its use to shorter distances, typically within local area networks (LANs) and metropolitan area networks (MANs). Multimode fiber's cost-effectiveness and ease of installation make it a popular choice for applications that do not require the same level of bandwidth and transmission distance as single-mode fiber. The market's growth is driven by the increasing adoption of fiber optic technology in various industries, including telecommunications, data centers, and enterprise networking. The demand for high-speed internet and advanced networking solutions has led to a surge in the deployment of fiber optic infrastructure, particularly in data centers.

These facilities require high-capacity, low-latency connections to support the growing volume and complexity of data processing and storage. Moreover, the proliferation of the Internet of Things (IoT) and the increasing adoption of cloud services have further fueled the growth of the market. The IoT's vast network of interconnected devices generates massive amounts of data, necessitating the deployment of robust and efficient communication infrastructure to facilitate seamless data exchange and processing. Similarly, cloud services rely on fiber optic cables to provide the high-speed, reliable connections required for data transfer and processing. In conclusion, the market is experiencing robust growth, driven by the increasing demand for high-speed internet, advanced networking solutions, and the proliferation of IoT and cloud services.

Single-mode and multimode fibers cater to distinct applications, with single-mode fiber's superior transmission quality and longer distances making it an ideal choice for long-haul data transmission and high-performance data centers. The market's growth is expected to continue as the world's insatiable appetite for data and connectivity drives the deployment of advanced communication infrastructure.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

160 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 13.64% |

|

Market growth 2024-2028 |

USD 11283.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

11.73 |

|

Key countries |

US, Germany, China, UK, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Fiber Optic Cable Market Research and Growth Report?

- CAGR of the Fiber Optic Cable industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the fiber optic cable market growth of industry companies

We can help! Our analysts can customize this fiber optic cable market research report to meet your requirements.