Fire Pump Controllers Market Size 2025-2029

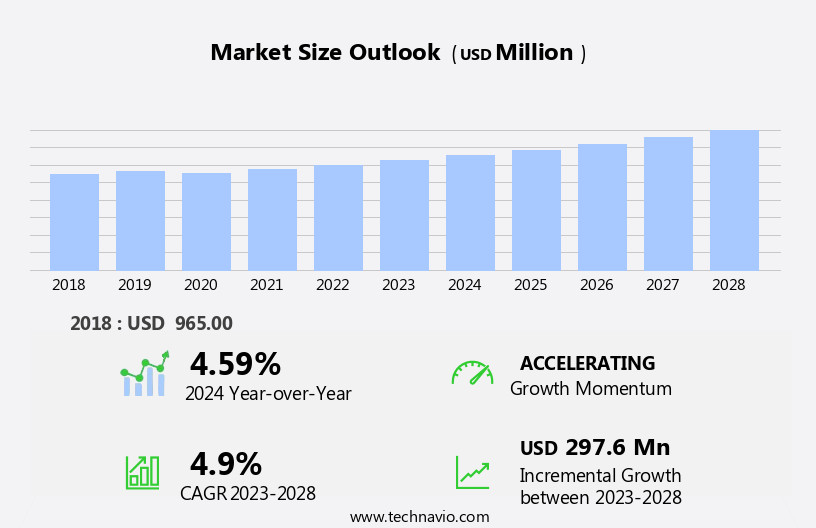

The fire pump controllers market size is forecast to increase by USD 317.9 million, at a CAGR of 5% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing adoption of IoT-enabled pump controllers. These advanced systems offer enhanced functionality, remote monitoring, and improved efficiency, making them a popular choice for fire safety applications. Another key trend is the emergence of Variable Frequency Drive (VFD) fire pump controllers, which offer energy savings and improved system performance. However, the market faces challenges due to the slowdown in industrial sector growth, which may impact demand for fire pump controllers in heavy industries. Fire pump efficiency is a significant concern, with innovations in energy recovery and variable frequency drives contributing to cost savings and reduced environmental impact.

- Companies in this market must navigate these challenges by focusing on innovation, cost competitiveness, and customer service to capitalize on the opportunities presented by the growing demand for advanced fire safety solutions.The construction sector, power generation, data centers, power plants, fuel storage facilities, manufacturing plants, warehouses, commercial buildings, and residential applications are among the key markets for fire pump controllers.

What will be the Size of the Fire Pump Controllers Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

- The fire pump controllers market encompasses various components and services, including fire pump parts, safety systems, design, installation, integration, automation, performance, innovation, efficiency, maintenance, testing, training, diagnostics, accessories, reliability, replacement, compliance, manufacturers, distributors, and repair. Fire pump technology continues to evolve, with a focus on enhancing safety, efficiency, and reliability. Fire pump systems are increasingly being integrated with building automation systems for centralized control and monitoring. Fire pump manufacturers prioritize compliance with regulations and certifications to ensure the highest safety standards. Fire pump suppliers offer training programs to equip professionals with the necessary skills for installation, maintenance, and repair. Fire pump testing and diagnostics play a crucial role in identifying potential issues and ensuring optimal performance.

- Fire pump maintenance and replacement are essential aspects of fire safety, with a growing emphasis on preventive measures and predictive analytics. Fire pump regulations and certification are subject to continuous updates, making it essential for stakeholders to stay informed and adapt accordingly. Fire pump performance and reliability remain top priorities, with ongoing research and development focused on improving durability and reducing downtime.

How is this Fire Pump Controllers Industry segmented?

The fire pump controllers industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Industrial

- Commercial

- Residential

- Type

- Electric

- Diesel

- Application

- Sprinkler systems

- Hydrant systems

- Water mist systems

- Foam systems

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

The industrial segment is estimated to witness significant growth during the forecast period. In response to the growing concerns surrounding workplace safety, particularly in industries that handle volatile materials such as oil and gas, chemical and petrochemical, and mining and metals, there has been a significant increase in the adoption of advanced fire safety equipment. Strict regulations imposed by governments and international agencies have mandated the use of explosion-proof and fire safety equipment in industrial settings. Fire safety innovation, including fire pump controllers, has gained prominence as a crucial component of industrial fire suppression systems. Fire pump controllers play a vital role in ensuring the safety of assets and workforce during manufacturing operations.

These controllers regulate the flow of water from the water supply system to the fire suppression systems, such as fire sprinkler systems, dry chemical systems, halon systems, and carbon dioxide systems. Fire safety technology, including pressure switches, level sensors, flow sensors, and alarm bells, integrated into these controllers, enable timely detection and response to potential fires. Fire suppression retrofits and maintenance, certified by UL listing and NFPA standards, are essential for the proper functioning of these systems. Fire protection consultants and contractors provide fire suppression design, installation, testing, and certification services. Fire safety training and fire protection engineering are integral components of maintaining a safe industrial environment.

Fire safety codes and regulations require regular fire drills, evacuation systems, and fire hydrants to ensure the readiness of the workforce in case of emergencies. Hose reels, standpipe systems, and clean agent systems are other essential fire safety equipment that complement fire pump controllers in providing comprehensive fire safety solutions. The market for fire safety equipment, including fire pump controllers, is expected to continue growing as industries prioritize workplace safety and adhere to stringent regulations.

The Industrial segment was valued at USD 421.30 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 39% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In APAC, the population boom housing over 4.3 billion people, or 60% of the global population, has led to an increase in industrial manufacturing activities. This population growth has fueled demand for various commodities, necessitating increased production capacity. Consequently, manufacturers have invested substantially in advanced fire safety systems for their facilities. Fire pump controllers play a crucial role in the seamless operation of these systems and associated safety measures. Fire safety innovation, including water mist systems, pressure switches, and fire suppression retrofits, is a priority for manufacturers to safeguard their assets and personnel. Fire suppression systems, such as those utilizing dry chemical, halon, carbon dioxide, and foam, are integral components of these advanced safety systems.

Control panels, fire alarm panels, and level sensors ensure efficient system monitoring and risk assessment. Fire safety codes, NFPA standards, and UL listings are essential guidelines for fire protection engineering and design. Fire protection contractors, consultants, and services are integral to the installation, maintenance, inspection, and certification of these systems. Fire safety training and technology, including fire hydrants, hose reels, and evacuation systems, are essential components of comprehensive fire safety strategies. Fire suppression testing, inspection, and certification are crucial for maintaining optimal system performance. Fire protection innovation continues to evolve, with advancements in flow sensors, pressure sensors, and flow switches enhancing system efficiency and reliability.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Fire Pump Controllers market drivers leading to the rise in the adoption of Industry?

- The proliferation of IoT-enabled pump controllers represents the primary market driver, significantly expanding their availability and usage. Fire pump controllers are an essential component of fire safety systems, ensuring the proper functioning of water mist systems, pressure switches, and fire suppression systems. The market for fire pump controllers is witnessing significant growth due to the increasing adoption of fire safety innovation in various industries. Fire suppression retrofits and the integration of advanced technologies, such as alarm bells and control panels, are driving the demand for fire pump controllers. IIoT technology is revolutionizing the fire safety industry by enabling real-time monitoring and predictive maintenance of fire suppression systems. This technology collects performance data from fire pump controllers and other associated systems, allowing for efficient data transfer and analysis through big data analytics.

- As a result, preventive measures can be taken in case of an outbreak, enhancing the overall efficiency of fire safety systems. Fire suppression maintenance is crucial to ensure the proper functioning of fire suppression systems, and the integration of IIoT technology in fire pump controllers facilitates proactive maintenance. UL listing is a mandatory certification for fire suppression systems, and the integration of IIoT technology ensures compliance with safety standards. Fire extinguishers and fire sprinkler systems are integral parts of fire safety systems, and the integration of advanced technologies, such as fire pump controllers, enhances their efficiency and reliability. The market for fire pump controllers is expected to continue growing as industries prioritize fire safety and automation to reduce operational costs and improve efficiency.

What are the Fire Pump Controllers market trends shaping the Industry?

- The emergence of Variable Frequency Drive (VFD) fire pump controllers represents a significant market trend in the fire safety industry. These advanced systems offer increased energy efficiency, improved pump performance, and enhanced safety features compared to traditional controllers. Fire pump controllers, equipped with variable frequency drives (VFDs), offer significant advancements in fire suppression systems. VFDs regulate motor frequency and voltage to maintain optimal pressure levels. When the desired pressure is reached, the VFD reduces motor speed, decreasing water pressure from the pump. This integration enhances energy efficiency, improves service quality, and reduces maintenance costs. Furthermore, VFD-integrated controllers provide enhanced safety by preventing equipment failure, ensuring consistent pressure delivery to connected sprinkler systems during fire drills. Fire risk assessments and safety codes mandate regular fire safety training, hose reels inspections, and testing of dry chemical systems and halon systems.

- Fire safety training is crucial to understanding proper usage of fire suppression equipment, while level sensors monitor water supply systems for adequate water levels. Strobe lights signal the activation of fire suppression systems, alerting individuals to evacuate or take necessary actions. Fire safety is a critical aspect of any business operation, and investing in advanced fire pump controllers can help mitigate potential risks and ensure compliance with safety regulations.

How does Fire Pump Controllers market face challenges during its growth?

- The industrial sector's growth is being significantly hindered by a deceleration in its own expansion, posing a major challenge to the economy as a whole. The market is projected to experience significant growth in the coming years. However, the expansion in certain regions may be hindered by industrial slowdowns and economic recessions. For instance, China, a significant market for fire pump controllers, has been impacted significantly due to a decrease in trade and a weakening currency. China, with its high industrial production output, has witnessed a decline in output growth. This downturn is attributed to the manufacturing overcapacity in the country. To mitigate this risk, the Chinese government plans to reduce excess capacity in industries such as steel, power, solar, and manufacturing.

- Fire safety technology, including fire pump controllers, plays a crucial role in fire protection systems. These systems consist of various components, such as fire hydrants, fire alarm panels, flow sensors, pressure sensors, carbon dioxide systems, and fire suppression design. Adherence to NFPA (National Fire Protection Association) standards is essential in the design and implementation of these systems. Fire protection consultants and engineers are responsible for ensuring the proper installation and certification of fire suppression systems, including evacuation systems. Fire suppression certification is a mandatory requirement for businesses to ensure the safety of their employees and assets. By investing in advanced fire safety technology and regular maintenance, businesses can protect their assets and minimize potential damage caused by fires.

Exclusive Customer Landscape

The fire pump controllers market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the fire pump controllers market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, fire pump controllers market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aline Pumps Sales and Service Pty Ltd - The company specializes in providing advanced fire pump controller solutions, including AlineSpares.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aline Pumps Sales and Service Pty Ltd

- ComAp AS

- Cummins Inc.

- Dynatek Instruments Pvt.Ltd

- Eaton Corp. plc

- Firetrol Inc.

- Flotronix Corp.

- Flowserve Corp.

- Grundfos Holding AS

- Hubbell Inc.

- Kirloskar Brothers Ltd.

- LOVATO Electric Spa

- Master Control Systems Inc.

- NAFFCO

- Nickerson Company Inc.

- Pentair Plc

- Schneider Electric SE

- SFFECO Global

- Tornatech Inc.

- Vertiv Holdings Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Fire Pump Controllers Market

- In March 2023, Honeywell International Inc. announced the launch of its new Fire-Guard XLS fire pump controller, designed to optimize fire protection system performance and reduce false alarms. This innovative solution uses advanced algorithms to analyze fire pump data, ensuring efficient operation and minimizing unnecessary interventions (Honeywell Press Release, 2023).

- In August 2024, Schneider Electric, a leading energy management and automation company, entered into a strategic partnership with Johnson Controls to integrate Schneider Electric's fire pump controllers into Johnson Controls' building management systems. This collaboration aims to provide customers with a more comprehensive fire safety solution and improved system interoperability (Schneider Electric Press Release, 2024).

- In January 2025, Siemens announced the acquisition of Fire Protection Systems Inc., a leading fire protection technology provider. This acquisition strengthens Siemens' presence in the fire safety market and adds Fire Protection Systems' advanced fire pump controller solutions to Siemens' portfolio (Siemens Press Release, 2025).

- In May 2025, the European Union passed new regulations mandating the installation of advanced fire pump controllers in all new commercial and residential buildings. These controllers must meet stringent performance standards, including faster response times and improved reliability, to enhance fire safety across Europe (European Commission Press Release, 2025).

Research Analyst Overview

The fire pump controller market is characterized by continuous evolution and dynamic market activities. Fire suppression innovation drives the demand for advanced technology in fire safety systems, leading to the development of water mist systems, pressure switches, and control panels. Fire suppression retrofits, alarm bells, and level sensors are integral components of fire risk assessment and fire drills. Strobe lights, fire pumps, and hose reels are essential elements of fire safety codes and regulations. Dry chemical systems, halon systems, and water supply systems are integral parts of comprehensive fire protection strategies. Fire safety training and certification are crucial for the effective implementation and maintenance of these systems.

The Fire Pump Controllers Market is evolving with advancements in fire pump automation, improving efficiency and response time. Enhanced fire pump diagnostics ensure fire pump reliability, minimizing failures during emergencies. Prioritizing fire pump safety, industries adhere to strict fire pump compliance and fire pump certification standards. Routine fire pump repair and timely fire pump replacement extend system longevity, while precise fire pump installation optimizes performance. Cutting-edge fire pump design enables seamless fire pump integration, supported by specialized fire pump accessories. Trusted fire pump distributors supply high-quality components, with comprehensive fire pump training equipping professionals for critical operations. Continued fire pump innovation drives market growth, ensuring advanced solutions for fire protection systems worldwide.

Fire protection consultants and contractors play a vital role in the design, installation, and certification of fire suppression systems. Pressure sensors, flow sensors, and UL listing are essential for ensuring the optimal performance of these systems. Fire safety technology is continually advancing, with the integration of carbon dioxide systems, foam systems, and evacuation systems. Fire protection engineering and design are critical in ensuring the effective implementation of fire suppression systems. NFPA standards and fire protection technology are continually evolving to meet the changing needs of various sectors. Fire hydrants, fire alarm panels, and standpipe systems are essential components of fire protection services.

The fire suppression market is a dynamic and evolving landscape, with ongoing innovation and development shaping the future of fire safety technology. Fire suppression testing and inspection are crucial for maintaining the effectiveness and reliability of these systems. The integration of various components, from fire suppression agents to fire protection services, is essential for ensuring comprehensive fire safety solutions.

Dive into Technavio's strong research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Fire Pump Controllers Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

224 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5% |

|

Market growth 2025-2029 |

USD 317.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.7 |

|

Key countries |

US, China, Japan, Germany, India, UK, Brazil, France, South Korea, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Fire Pump Controllers Market Research and Growth Report?

- CAGR of the Fire Pump Controllers industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the fire pump controllers market growth of industry companies

We can help! Our analysts can customize this fire pump controllers market research report to meet your requirements.