Variable Frequency Drive (VFD) Market Size 2025-2029

The variable frequency drive (VFD) market size is valued to increase USD 8.14 billion, at a CAGR of 5.6% from 2024 to 2029. Presence of regulations that mandate use of VFDs in industries will drive the variable frequency drive (VFD) market.

Major Market Trends & Insights

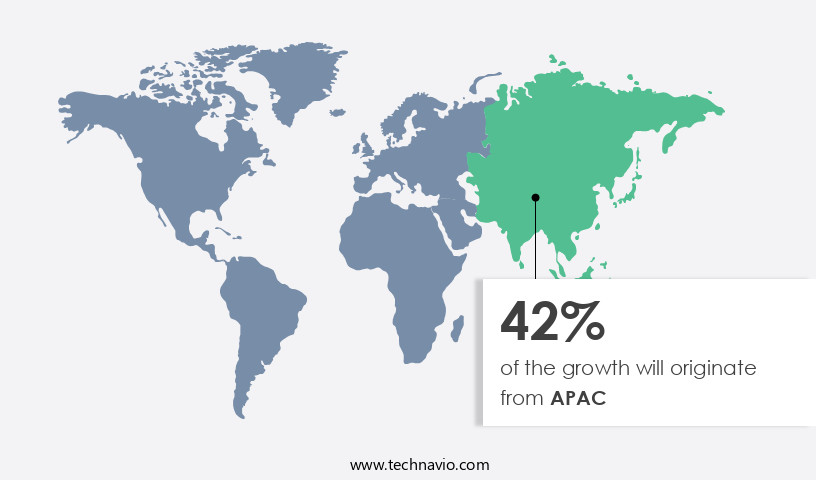

- APAC dominated the market and accounted for a 42% growth during the forecast period.

- By End-user - Food and beverage segment was valued at USD 5 billion in 2023

- By Type - Low voltage drives segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 55.02 million

- Market Future Opportunities: USD 8139.30 million

- CAGR from 2024 to 2029 : 5.6%

Market Summary

- The market encompasses the production, sales, and installation of frequency adjusting motor controllers. This market is characterized by continuous evolution, driven by the increasing adoption of energy-efficient technologies and the growing demand for power management systems in various industries. Core technologies, such as soft-starter and vector control, are key components of VFDs, enabling energy savings and improved motor performance. According to a recent study, the global VFD market share held by soft-starter technology was over 30% in 2020. Applications of VFDs span across industries like oil and gas, water and wastewater treatment, and HVAC, among others.

- However, the market faces challenges such as maintenance and reliability issues, which can lead to increased operational costs and downtime. Regulations mandating energy efficiency and the implementation of renewable energy sources further fuel the demand for VFDs. Technological advances, including the integration of artificial intelligence and the Internet of Things (IoT), are transforming the market by enhancing VFD functionality and enabling predictive maintenance. These trends underscore the dynamic nature of the VFD Market and its ongoing impact on various industries.

What will be the Size of the Variable Frequency Drive (VFD) Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Variable Frequency Drive (VFD) Market Segmented ?

The variable frequency drive (VFD) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Food and beverage

- Water and wastewater treatment

- Oil and gas

- Power generation

- Others

- Type

- Low voltage drives

- Medium voltage drives

- Application

- Pumps

- Fans and blowers

- Conveyors

- Compressors

- Others

- Geography

- North America

- US

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

The food and beverage segment is estimated to witness significant growth during the forecast period.

In the dynamic and evolving world of industrial automation, Variable Frequency Drives (VFDs) have become indispensable, particularly in the food and beverage sector. These drives offer precise motor speed control, enabling process optimization, reduced cycle times, and significant energy savings. With energy efficiency being a top priority for food and beverage manufacturers, VFDs adjust motor speed to match output demands, minimizing energy wastage during part-load and off-peak operations. The food and beverage industry heavily relies on motors for various processes, including mixing, blending, conveying, and packaging. VFDs' capabilities extend beyond motor speed control, offering features such as current limiting circuits, closed-loop control systems, servo motor control, and motor protection schemes.

Moreover, VFDs are integral to energy efficiency improvements, employing motor current sensing, sensorless vector control, and speed feedback mechanisms. They also provide direct torque control for variable torque applications, fan speed regulation, and thermal overload protection. VFDs' advanced torque control algorithms ensure overvoltage protection, while frequency control methods facilitate seamless integration with HVAC systems, DC motor drives, and compressor control systems. Additionally, VFDs' soft starting capabilities, inverter technology, harmonic reduction techniques, and power factor correction enhance motor performance and overall system efficiency.

The Food and beverage segment was valued at USD 5 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 42% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Variable Frequency Drive (VFD) Market Demand is Rising in APAC Request Free Sample

The market in the Asia Pacific (APAC) region is experiencing notable expansion, fueled by robust industrial growth and escalating demand for Medium-voltage and Low-voltage motors. Key contributors to this growth include China, Japan, India, Vietnam, South Korea, Malaysia, and Australia. These nations represent the largest markets for VFDs due to their significant investments in power, water and wastewater treatment, and food and beverage industries.

In February 2024, ABB India introduced the ACH180, a compact drive for HVACR systems, underscoring the market's continuous innovation. This compact drive offers advanced control for energy-efficient motors with a space-saving design, further solidifying the market's potential.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses a wide range of applications, from optimizing performance in industrial processes to implementing regenerative braking systems. VFDS play a pivotal role in industrial automation, particularly in variable torque applications, where they ensure efficient power transmission and reduce energy losses. In the realm of energy efficiency, VFDS contribute significantly by reducing harmonic distortion, a common issue in power systems. Advanced motor control techniques, such as PWM optimization and sensorless vector control, further enhance VFD performance and minimize motor heating. When it comes to motor protection, integrated VFD protection features are essential. These features ensure the longevity of motors by monitoring and controlling various parameters, such as overcurrent, overvoltage, and overheating.

The HVAC and refrigeration sectors heavily rely on VFDS for precise speed regulation and energy savings. In fact, more than 70% of new installations in these industries opt for VFD-enabled systems. VFD integration with PLC and SCADA systems enables seamless control and monitoring of industrial processes. Comparing control techniques, sensorless vector control and direct torque control each have their merits. While sensorless vector control offers advantages in terms of cost and simplicity, direct torque control provides better performance in high-torque applications. Cost-benefit analysis is crucial when selecting appropriate VFDS for specific tasks. Energy-saving measures using advanced VFD strategies can yield substantial cost savings over time.

Analyzing and mitigating harmonic distortion in VFD-based systems is another critical aspect, as it can lead to improved power quality and reduced equipment damage. In high-precision applications, VFDS play a significant role due to their ability to provide precise speed regulation. As the market continues to evolve, the focus is on designing efficient VFD systems for industrial applications, incorporating advanced feedback control mechanisms and current limiting circuits to ensure optimal performance and reliability.

What are the key market drivers leading to the rise in the adoption of Variable Frequency Drive (VFD) Industry?

- The implementation of regulations mandating the utilization of Variable Frequency Drives (VFDs) in industries is the primary market driver.

- The industrial motor market is undergoing a significant transformation due to evolving regulations mandating energy efficiency. For example, in the European Union, motors between 7.5 kW and 375 kW must be IE3-rated. While IE2-rated motors remain an option, they must be used with variable frequency drives (VFDs). This shift towards energy-efficient motors increases the overall capital expenditure (CAPEX) for industrial end-users, with IE3-rated premium efficiency motors costing up to 15%-20% more than IE1-rated electric motors.

- Consequently, the integration of VFDs to protect motors from voltage and harmonic current fluctuations has become a necessary investment. This trend underscores the continuous evolution of the industrial motor market, with a growing emphasis on energy efficiency and regulatory compliance.

What are the market trends shaping the Variable Frequency Drive (VFD) Industry?

- The trend in the market involves advancements in Visual Field Displays (VFDs). Technological innovations are driving the growth of VFD technology.

- Voltage Frequency Drives (VFDs) have evolved significantly, offering advanced control features that cater to various industrial applications. These features include sensorless vector control, torque control, and flux vector control, which ensure precise speed and torque regulation, dynamic performance enhancement, and improved process control. Safety is a top priority in industrial operations, and advanced VFDs incorporate built-in safety features such as safe torque off (STO), safe stop, and safe operating area monitoring. These safety measures adhere to international standards and regulations, ensuring overall system safety and reliability.

- Furthermore, modern VFDs support Ethernet and Industrial Internet of Things (IIoT) connectivity, enabling seamless integration with SCADA systems, PLCs, and cloud-based monitoring platforms. This connectivity empowers real-time data collection, analysis, and predictive maintenance, contributing to increased operational efficiency and productivity.

What challenges does the Variable Frequency Drive (VFD) Industry face during its growth?

- The growth of the industry is significantly impacted by maintenance and reliability challenges associated with Variable Frequency Drives (VFDs).

- Voltage Frequency Converters (VFDs) are essential components in various industries, employing complex electronic components like insulated gate bipolar transistors (IGBTs), capacitors, and control circuitry. Due to their intricate nature, VFD maintenance necessitates specialized expertise and equipment. Environmental factors, such as temperature, humidity, and dust, can adversely impact VFD performance and shorten component lifespan. To ensure optimal VFD functionality, regular inspections, testing, and preventive measures are vital. Technicians must check connections for any signs of corrosion or damage, inspect cooling fans for debris and proper airflow, and measure insulation resistance to assess component health.

- Software and firmware updates should be verified for compatibility and installed promptly to maintain system efficiency. Effective VFD maintenance not only extends component life but also minimizes downtime and reduces operational costs. By implementing proactive measures, businesses can mitigate potential issues before they escalate, ensuring uninterrupted performance and overall system reliability.

Exclusive Technavio Analysis on Customer Landscape

The variable frequency drive (vfd) market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the variable frequency drive (vfd) market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Variable Frequency Drive (VFD) Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, variable frequency drive (vfd) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABB Ltd. - This company specializes in providing advanced variable frequency drive solutions, including the Control Board RDCU 12C and Crane Software, as well as IGBT Modules. Their offerings cater to various industries, enhancing system efficiency and optimizing performance.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- Danfoss AS

- Eaton Corp. plc

- Emerson Electric Co.

- Fuji Electric Co. Ltd.

- General Electric Co.

- Hitachi Ltd.

- Honeywell International Inc.

- Invertek Drives Ltd

- Johnson Controls International Plc

- Mitsubishi Electric Corp.

- Nidec Corp.

- Rockwell Automation Inc.

- Schaffner Group

- Schneider Electric SE

- Siemens AG

- Spoc Automation Inc.

- Toshiba Corp.

- WEG S.A

- Yaskawa Electric Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Variable Frequency Drive (VFD) Market

- In January 2024, Siemens Energy and Mitsubishi Electric Corporation announced a strategic partnership to collaborate on the development and production of large-scale Variable Frequency Drives (VFDs) for the wind energy sector. This collaboration aimed to enhance their combined market presence and boost the efficiency of wind energy conversion systems (Reuters, 2024).

- In March 2024, Schneider Electric, a leading energy management and automation company, launched its new Masterpact MTZ VFD series, featuring advanced digital services and improved energy efficiency ratings. This expansion of their product portfolio further solidified their position in the global VFD market (Schneider Electric Press Release, 2024).

- In April 2025, ABB, a Swiss-Swedish multinational corporation, secured a significant order from Saudi Aramco for the supply of VFDs and associated digital services for a major oil refinery expansion project. This contract was valued at over USD100 million and underscored ABB's expertise in the energy sector (ABB Press Release, 2025).

- In May 2025, the European Union passed the new Ecodesign Regulation, which mandated the implementation of energy-efficient VFDs in various industrial applications by 2027. This regulatory initiative is expected to drive market growth and innovation in the European VFD market (European Commission Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Variable Frequency Drive (VFD) Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

242 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.6% |

|

Market growth 2025-2029 |

USD 8139.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.4 |

|

Key countries |

US, China, UK, India, Germany, Japan, France, South Korea, Brazil, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the realm of industrial automation, Variable Frequency Drives (VFDs) have emerged as a cornerstone technology, revolutionizing speed control in various applications. These drives, which include components such as conveyor belt control, current limiting circuits, and closed-loop control systems, have found extensive use in process control applications. Servo motor control and fan speed regulation are two common applications where VFDs have made a significant impact. By employing energy efficiency improvements like motor current sensing and sensorless vector control, VFDs optimize power consumption, reducing energy waste and operational costs. Moreover, VFDs have been instrumental in enhancing motor protection schemes through overvoltage protection, thermal overload protection, overcurrent protection, and regenerative braking systems.

- Fault detection algorithms and voltage regulation systems further augment their reliability and robustness. VFDs are not confined to AC motor drives alone; they also find extensive use in DC motor drives and HVAC systems integration. Industrial automation systems, including compressor control systems, pump control optimization, and soft starting capabilities, are significantly advanced by VFD technology. Harmonic reduction techniques and power factor correction are essential features of VFDs, ensuring optimal performance and compatibility with power grids. The adoption of inverter technology has been a key factor in the evolution of VFDs, enabling enhanced torque control algorithms and direct torque control for variable torque applications.

- In conclusion, the VFD market is a dynamic and evolving landscape, with ongoing advancements in technology and applications. From motor speed control to industrial automation systems, VFDs continue to play a pivotal role in optimizing energy efficiency, enhancing system performance, and reducing operational costs.

What are the Key Data Covered in this Variable Frequency Drive (VFD) Market Research and Growth Report?

-

What is the expected growth of the Variable Frequency Drive (VFD) Market between 2025 and 2029?

-

USD 8.14 billion, at a CAGR of 5.6%

-

-

What segmentation does the market report cover?

-

The report is segmented by End-user (Food and beverage, Water and wastewater treatment, Oil and gas, Power generation, and Others), Type (Low voltage drives and Medium voltage drives), Application (Pumps, Fans and blowers, Conveyors, Compressors, and Others), and Geography (APAC, Europe, North America, Middle East and Africa, and South America)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Presence of regulations that mandate use of VFDs in industries, Maintenance and reliability issues in VFDs

-

-

Who are the major players in the Variable Frequency Drive (VFD) Market?

-

ABB Ltd., Danfoss AS, Eaton Corp. plc, Emerson Electric Co., Fuji Electric Co. Ltd., General Electric Co., Hitachi Ltd., Honeywell International Inc., Invertek Drives Ltd, Johnson Controls International Plc, Mitsubishi Electric Corp., Nidec Corp., Rockwell Automation Inc., Schaffner Group, Schneider Electric SE, Siemens AG, Spoc Automation Inc., Toshiba Corp., WEG S.A, and Yaskawa Electric Corp.

-

Market Research Insights

- The market encompasses a diverse range of applications, including pumping system optimization, power quality improvement, motor protection, process automation, and vector control. This growth is driven by the increasing demand for energy savings, HVAC control, and servo drive applications. One significant advantage of VFDs is their ability to improve power quality by reducing harmonic distortion. For instance, a VFD used in a compressor control application can reduce total harmonic distortion (THD) from 25% to below 5%.

- In contrast, a conventional motor without a VFD can produce THD levels as high as 50%. These improvements lead to enhanced system reliability and reduced energy losses. Additionally, VFDs offer features such as current limiting, thermal management, and fault detection, making them an essential component in various industries.

We can help! Our analysts can customize this variable frequency drive (vfd) market research report to meet your requirements.