Flare Gas Recovery System Market Size 2024-2028

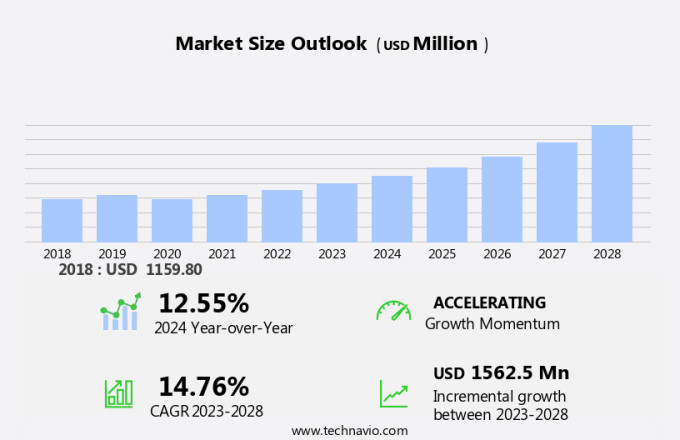

The flare gas recovery system market size is forecast to increase by USD 1.56 billion at a CAGR of 14.76% between 2023 and 2028. The market experiences significant growth due to the environmental and economic advantages it offers to petroleum refineries and Natural Gas Liquids (NGL) plants. The increasing production of natural gas from subsea oil and gas formations necessitates the adoption of advanced extraction processes, leading to the recovery of flare gas. This, in turn, reduces operational expenses for refineries and NGL plants. Skid-mounted systems, which incorporate compressor technology like liquid ring compressors, play a crucial role in the flare gas recovery process. However, the market faces challenges due to the lack of technology in underdeveloped and emerging economies. The report provides a comprehensive analysis of these trends and challenges, enabling stakeholders to make informed decisions and capitalize on opportunities in the market.

The market represents a significant opportunity for energy and industrial sectors to enhance their operational efficiency and reduce carbon emissions. This market focuses on the recovery and utilization of excess gas generated during the production of fossil fuels, particularly in power generation applications and industrial facilities such as refineries and chemical plants. Fossil fuel production processes, including natural gas production and refining, often result in the generation of flare gas. Traditionally, this excess gas has been burned off or flared, releasing carbon emissions into the atmosphere.

However, the adoption of flare gas recovery systems enables the capture and utilization of this gas, transforming it into a valuable energy source. These systems are designed to compress and transport the recovered gas to power generation applications or other industrial processes, increasing the overall efficiency of energy production. Operating pressure and flow rate are essential factors in the design and implementation of flare gas recovery systems. The systems must be able to handle the varying pressure and flow rates of the recovered gas, ensuring optimal performance and energy recovery.

In addition, the implementation of flare gas recovery systems not only enhances energy efficiency but also contributes to environmental sustainability by reducing carbon emissions. By capturing and utilizing excess gas instead of flaring it, these systems help minimize greenhouse gas emissions, aligning with global efforts to mitigate climate change. In summary, the market offers a promising solution for energy and industrial sectors to optimize their operations, enhance energy efficiency, and minimize carbon emissions. The integration of skid-mounted systems with compressor technology plays a vital role in the recovery and utilization of excess gas, ultimately contributing to a more sustainable and efficient energy landscape.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Capacity

- Very large

- Large

- Medium

- Small

- Geography

- North America

- Canada

- US

- Europe

- APAC

- China

- Middle East and Africa

- South America

- North America

By Capacity Insights

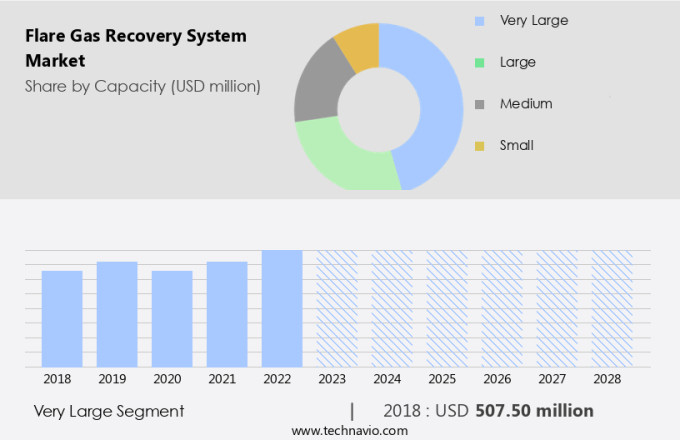

The very large segment is estimated to witness significant growth during the forecast period.Flare Gas Recovery Systems (FGRS) play a crucial role in natural gas production and refining processes by capturing and utilizing flared gas, thereby reducing carbon emissions and financial losses. The energy generated from this unmarketable natural gas can be utilized for energy co-generation, powering on-site operations or even sold back to the grid. The growing emphasis on environmental preservation initiatives is driving the demand for FGRS, as companies seek to minimize their carbon footprint and adhere to stricter regulations. Additionally, the increasing awareness of the negative environmental impact of industrial production processes is accelerating the adoption of FGRS. In the oil and natural gas sector, where energy efficiency and cost savings are key priorities, FGRS are becoming an essential investment for firms to maximize energy usage and minimize waste. As a result, the market for large-scale FGRS is poised for significant growth during the forecast period.

Get a glance at the market share of various segments Request Free Sample

The very large segment accounted for USD 507.50 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

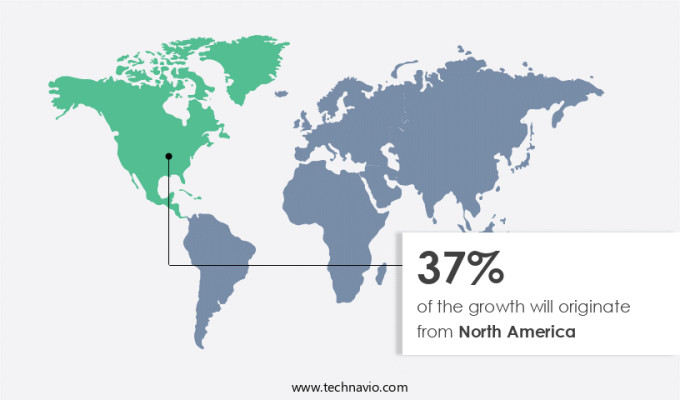

North America is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In the United States, offshore installations have become a significant contributor to the North American Flare Gas Recovery System (FGRS) market. With a high concentration of industrial developments, particularly in the oil and gas sector, the US generates a substantial amount of unburned gases, including hydrogen sulfide (H2S). To mitigate the environmental impact of these gases, it is essential to recover and utilize them before releasing them into the atmosphere. The expansion of the FGRS market in North America is primarily driven by the US and Canada. The growth is attributed to several factors, including the increase in oil and gas activities, the rising demand for downstream gas processing, and stringent regulations against the flaring of associated petroleum gases (APG) or natural gas liquids (NGLs).

Moreover, these factors have led to increased investments in constructing downstream gas processing plants (GPP) and distribution infrastructure. These developments are expected to continue throughout the forecast period, fueling the growth of the FGRS market in North America. The US and Canadian governments have implemented stringent regulations to minimize the environmental impact of flaring APG or NGLs. These regulations have created a favorable business environment for companies investing in FGRS technologies. Furthermore, the increasing demand for natural gas as a cleaner alternative to traditional energy sources has created new opportunities for the FGRS market. The market is expected to witness significant growth as companies invest in advanced technologies to recover and utilize these gases efficiently.

In conclusion, the FGRS market in North America, particularly in the US, is poised for significant growth due to the increasing demand for downstream gas processing and stringent regulations against flaring of APG or NGLs. The market is expected to witness strong growth in the coming years as companies invest in advanced technologies to recover and utilize these gases efficiently. The market is expected to witness significant growth due to the increasing demand for natural gas as a cleaner alternative to traditional energy sources. The US and Canadian governments' commitment to reducing emissions and promoting sustainable energy practices is expected to further fuel the growth of the FGRS market in the region.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Environmental and economic benefits to refineries is the key driver of the market. Flare Gas Recovery Systems (FGRS) play a significant role in refineries, offering both environmental and economic advantages. By recovering waste hydrocarbons, refineries can minimize the emission of harmful gases, such as hydrogen sulfide (H2S), which would otherwise be burned and released into the atmosphere during the flaring process. This reduction in emissions not only helps refineries meet environmental standards but also demonstrates a commitment to social responsibility and community goodwill. Moreover, the recovered gases, primarily composed of liquefied petroleum gases (LPGs), can be reused within the refinery, leading to a decrease in fuel gas costs. This cost reduction is in addition to potential savings from lower greenhouse gas (GHG) emissions or the sale of recovered gases.

Furthermore, implementing FGRS contributes to a refinery's sustainability efforts and enhances its reputation as a responsible corporate citizen. The use of compressor technology, such as skid-mounted liquid ring compressors, facilitates the efficient recovery and processing of these gases. By optimizing the operating pressure and flow rate, refineries can maximize the benefits of FGRS while minimizing energy consumption and operational costs.

Market Trends

Increasing in natural gas production is the upcoming trend in the market. The global natural gas market has experienced significant growth due to the expansion of petroleum refineries and the increase in natural gas production from sources such as shale formations and subsea oil and gas formations. The US, in particular, has seen an increase in natural gas production, with shale gas accounting for a growing percentage of the country's total output.

In addition, the extraction processes of natural gas from these formations require extensive gas treatment to remove impurities and extract natural gas liquids (NGLs). Flare gas recovery systems play a crucial role in this process by capturing and utilizing the flare gas that is typically released during the extraction process. The implementation of these systems not only reduces operational expenses but also minimizes the environmental impact of natural gas production. In conclusion, the growth in natural gas production, particularly in the US, has led to an increased demand for flare gas recovery systems in petroleum refineries and NGL plants. The ability to efficiently recover and utilize flare gas not only reduces operational expenses but also contributes to the overall sustainability of natural gas production.

Market Challenge

Lack of technology in underdeveloped and emerging economies is a key challenge affecting the market growth. Flare gas is generated as a byproduct of various industrial processes, such as those found in refineries and chemical plants. While utilizing flare gas for heat and power generation can be economically feasible in substantial quantities, it may not be a cost-effective solution for smaller facilities. Flaring, the practice of burning off unwanted gas, is a common method used in industrial settings. However, it poses a significant environmental concern as it releases a substantial amount of greenhouse gases, contributing significantly to global warming. The flare gas from the process unit is directed into a liquid ring compressor, along with process water.

Furthermore, the efficient recovery of flare gas is essential to minimize the environmental impact and improve overall plant efficiency. Despite the potential economic benefits, the high initial investment and operational costs associated with flare gas recovery systems may deter some facilities from implementing this technology. In conclusion, flare gas recovery is a crucial aspect of industrial operations, particularly in the oil and gas industry. While the environmental implications of flaring are a pressing concern, the implementation of flare gas recovery systems can help mitigate these issues and improve plant efficiency. However, the high upfront and operational costs may limit the adoption of these systems in smaller facilities.

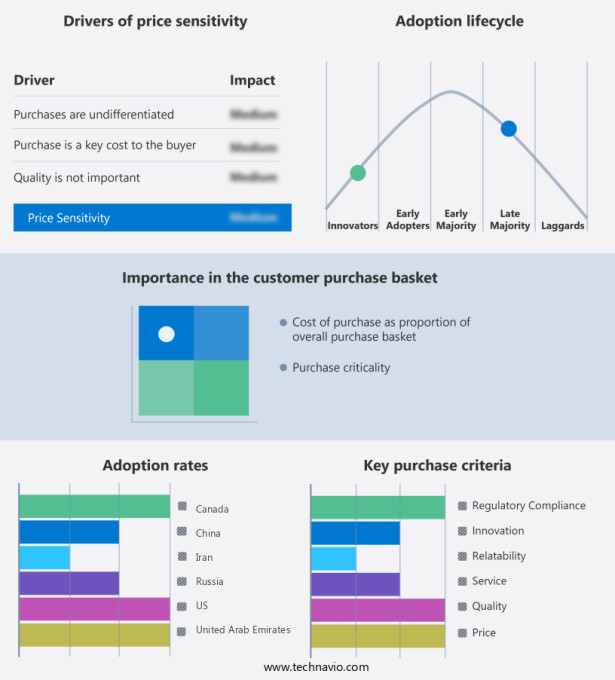

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

GENERON - The company designs and fabricates custom membrane flare gas recovery and removal systems.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- EMTIVAC Engineering Pty. Ltd.

- Baker Hughes Co.

- Honeywell International Inc.

- Ingersoll Rand Inc.

- Kavin Engineering And Services Pvt. Ltd.

- Koch Industries Inc.

- MAN Energy Solutions SE

- Ramboll Group AS

- SoEnergy International

- Srisen Energy Technology Co. Ltd

- Transvac Systems Ltd.

- Wartsila Corp.

- Zeeco Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses compressor technology designed for the efficient capture and utilization of excess gas generated during the production of fossil fuels. Skid-mounted systems, including liquid ring compressors, are commonly employed due to their ability to handle high operating pressures and flow rates. These systems find extensive applications in power generation, industrial facilities such as refineries and chemical plants, and natural gas processing plants. Gas flaring, a common practice in the oil and gas industry, is a significant contributor to the market's growth. This process, which involves burning off excess gas associated with crude oil production, results in financial loss and environmental impact.

Furthermore, the recovery of flare gas offers an opportunity to mitigate these issues by reducing operational expenses and minimizing carbon emissions. Small-scale facilities, including petroleum refineries and natural gas liquids (NGL) plants, also benefit from flare gas recovery systems. Subsea oil and gas formations and offshore reserves necessitate specialized solutions for gas treatment and processing. The refining process generates significant volumes of unmarketable natural gas, which can be harnessed through these systems for energy generation via co-generation applications, captive power, and environmental conservation activities. EHS guidelines and corporate social responsibility initiatives further prioritize the importance of flare gas recovery systems in minimizing environmental impact and improving plant efficiency. The market is expected to grow as the focus on reducing waste and optimizing resources continues to gain momentum.

Furthermore, the market is expanding as industries seek sustainable solutions for oil and gas production sites. Modular flare gas recovery systems are gaining traction, particularly for small facilities, offering flexibility and ease of installation. Skid mounted systems are ideal for both onshore and offshore installation, simplifying transport and setup. Medium flare gas recovery systems cater to mid-sized operations, while large and very large flare gas recovery systems are designed for gas production and processing facilities with higher flaring volumes. These systems help reduce H2S flaring and recover valuable gases, supporting natural gas consumption and energy co-generation. With increasing attention on refinery infrastructure, companies are investing in solution packages for storage tank vent recovery and captured applications to address design and installation complexities in both oil and gas extraction industries and imports. The market is expanding, driven by the need for more efficient gas management in both onshore and offshore installation. Medium flare gas recovery systems are increasingly used in captive applications, where recovered gas is converted into energy through energy co-generation, reducing waste and improving operational efficiency. These systems offer a complete solution package, tailored to meet the specific needs of various industries, helping to minimize flaring and maximize resource utilization. With growing environmental regulations and the push for sustainable practices, these systems are becoming integral in reducing emissions and improving the sustainability of oil and gas operations.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

141 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14.76% |

|

Market growth 2024-2028 |

USD 1.56 billion |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

12.55 |

|

Regional analysis |

North America, Europe, APAC, Middle East and Africa, and South America |

|

Performing market contribution |

North America at 37% |

|

Key countries |

US, United Arab Emirates, China, Russia, Canada, and Iran |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Baker Hughes Co., EMTIVAC Engineering Pty. Ltd., GENERON, Honeywell International Inc., Ingersoll Rand Inc., Kavin Engineering And Services Pvt. Ltd., Koch Industries Inc., MAN Energy Solutions SE, Ramboll Group AS, SoEnergy International, Srisen Energy Technology Co. Ltd, Transvac Systems Ltd., Wartsila Corp., and Zeeco Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch