Americas Floating Production Systems (FPS) Market Size 2024-2028

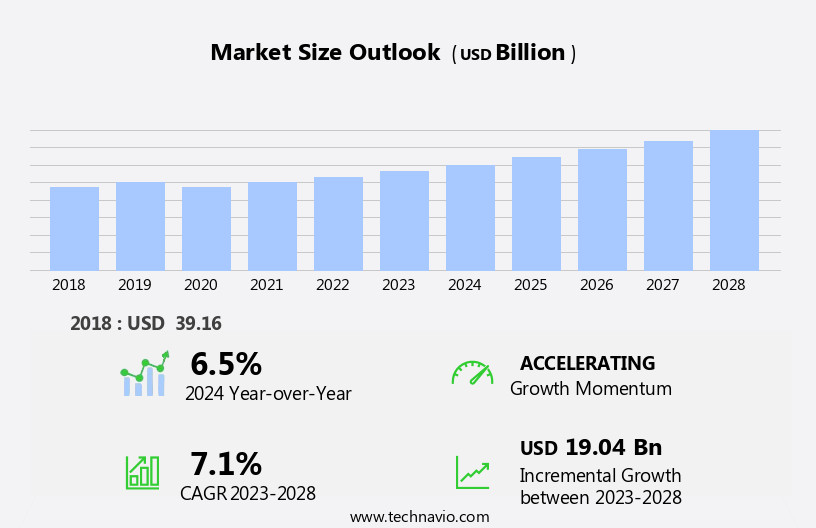

The americas floating production systems (fps) market size is forecast to increase by USD 19.04 billion at a CAGR of 7.1% between 2023 and 2028.

- The Floating Production Systems (FPS) market in the Americas is experiencing significant growth, driven primarily by the increasing demand for energy and the expansion of deepwater and ultra-deepwater projects. The region's abundant oil and gas reserves, particularly in the Gulf of Mexico, have led to a in offshore drilling activities. This trend is further fueled by the depletion of onshore reserves and the need to explore new frontiers to meet the growing energy demands of the Americas and beyond. However, the FPS market in the Americas is not without challenges. Environmental concerns arising from offshore oil and gas drilling continue to pose significant risks.

- Strict regulations and growing public pressure to reduce carbon emissions are pushing the industry towards more sustainable solutions. Additionally, the high capital costs associated with FPS installations and the complexity of deepwater projects can make them financially challenging. Companies seeking to capitalize on the opportunities presented by the FPS market in the Americas must navigate these challenges effectively. By investing in research and development of more efficient and environmentally friendly technologies, and by collaborating with regulatory bodies and stakeholders, they can mitigate risks and position themselves for long-term success.

What will be the size of the Americas Floating Production Systems (FPS) Market during the forecast period?

- The floating production systems (FPS) market in the Americas is experiencing significant growth due to the increasing exploration and production activities in offshore hydrocarbon fields. FPS units, including production platforms, living quarters, and processing facilities, are essential for extracting resources from deep water depths. These systems utilize buoyancy tanks, risers, and hoses to transfer hydrocarbons to shuttle tankers or via submarine pipelines. Key market drivers include the availability of substantial offshore oil and gas reserves, advancements in water depth capabilities, and the adoption of flexible production solutions such as soft pipes and mooring systems, including anchor piles, mooring buoys, and mooring cables.

- Additionally, the integration of advanced technologies like rotary joints and rigid arms enhances the efficiency and flexibility of FPS units. The FPS market in the Americas is expected to continue growing due to the ongoing expansion of offshore infrastructure and the increasing focus on maximizing resource recovery from mature fields. Public facilities, such as water treatment and gas compression, are also integral components of these systems, ensuring the safe and efficient production of hydrocarbons.

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- FPSO

- Semi-submersible

- SPAR

- TLP

- Others

- Geography

- Americas

By Type Insights

The fpso segment is estimated to witness significant growth during the forecast period.

Floating Production Systems (FPS), including Floating Production, Storage, and Offloading (FPSO) units, play a crucial role in the Life of Field of offshore hydrocarbon reserves. These production units, often converted oil tankers or purpose-built structures, facilitate the separation and treatment of crude oil, water, and gases from subsea wells. FPS Units are installed in offshore fields, enabling oil companies to extract resources from deeper water reservoirs. The FPS system consists of a rotary joint, mooring buoy, anchor pile, and various water (gas) equipment. It also includes a rigid arm, soft pipe, riser, and buoyancy tank for hydrocarbon storage. The FPS is tethered to the seabed through a mooring cable and anchoring system, including anchor chain and piles.

FPS Units cater to reservoir requirements, accommodating hydrocarbon specifications and processing requirements. They are suitable for water depths ranging from shallow to ultra-deep, making them versatile solutions for various field geologies. FPS Units are subject to ocean currents, weather, and other environmental characteristics. Modifications, upgrades, and maintenance are essential to ensure their continued efficiency and safety. Oil and gas production from FPS Units is transported via submarine pipelines or floating hoses to onshore facilities for further processing. The infrastructure also includes living facilities for personnel and onboard hydrocarbon storage. The FPS market dynamics are influenced by oil pricing, exploration, and the availability of infrastructure.

The market continues to evolve as oil companies seek to optimize production from hydrocarbon basins, focusing on maximizing efficiency and reducing costs.

Get a glance at the market share of various segments Request Free Sample

The FPSO segment was valued at USD 17.03 billion in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Americas Floating Production Systems (FPS) Market?

- Increase in demand for energy is the key driver of the market.

- Offshore oil and gas production plays a significant role in meeting the rising fuel demand in the US, with the EIA reporting an average consumption of 67.3 million bpd in 2022. Despite the challenges posed by the price volatility in crude oil, major oil and gas companies continue to invest in Exploration and Production (E and P) projects to meet this demand. The offshore segment, which is largely unexplored, offers vast potential for oil and gas production. The global crude oil price downturn had a major impact on deepwater projects, leading to a halt in operations for many.

- However, with the recovery of crude oil prices, these projects have resumed operations. The market dynamics of the Floating Production Systems (FPS) in the Americas are influenced by various factors, including oil price trends, regulatory policies, and technological advancements. FPS is a crucial technology for extracting oil and gas from offshore reserves, and its market is expected to grow due to the increasing demand for oil and gas and the ongoing efforts to optimize production costs.

What are the market trends shaping the Americas Floating Production Systems (FPS) Market?

- Increase in deepwater and ultra-deepwater projects is the upcoming trend in the market.

- Offshore oil and gas production has gained significant importance in the global energy sector due to rising crude oil prices. Following the success of shallow water drilling activities, companies are now exploring deepwater and ultra-deepwater drilling projects. The profitability of such projects hinges on an average crude oil price of around USD60/bbl. However, producing oil and gas from deepwater and ultra-deepwater fields is expensive and challenging due to the harsh weather conditions. According to the US Energy Information Administration (EIA), global oil and gas production from offshore and deepwater sites is projected to grow by 2% annually.

- This growth is driven by the increasing demand for energy and the need to tap into new sources of oil and gas. Despite the challenges, offshore production remains a lucrative business opportunity for companies willing to invest in the necessary infrastructure and technology.

What challenges does Americas Floating Production Systems (FPS) Market face during the growth?

- Environmental issues arising from offshore oil and gas drilling is a key challenge affecting the market growth.

- Offshore oil and gas drilling activities pose significant environmental risks, with potential threats including the accidental release of drilling fluids, pipeline leaks, spillages, and blowouts. Drilling fluids, used to support drilling and remove drill cuttings, can contain toxic substances that, if released into the ocean, can harm marine life. Additionally, normal drilling operations release toxic contaminants into both the air and water. These environmental concerns, coupled with the potential risks to the health and safety of workers, underscore the importance of implementing stringent safety measures and regulations in the offshore drilling industry.

- It is crucial for companies to prioritize environmental sustainability and worker safety in their operations to mitigate these risks and maintain the industry's reputation.

Exclusive Americas Floating Production Systems (FPS) Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BHP Group Ltd.

- BP Plc

- BW Offshore Ltd.

- Cenovus Energy Inc.

- Chevron Corp.

- Excelerate Energy Inc.

- Golar LNG Ltd.

- Hoegh LNG Holdings Ltd.

- MODEC Inc.

- Petroleo Brasileiro SA

- Saipem S.p.A.

- SBM Offshore NV

- Shell plc

- Suncor Energy Inc.

- Teekay Corp.

- TotalEnergies SE

- Yokogawa Electric Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The floating production system (FPS) market in the Americas is a critical segment of the global oil and gas industry, catering to the unique requirements of offshore hydrocarbon fields. These production units play a pivotal role in extracting and processing hydrocarbons from reservoirs located in deep water and challenging environmental conditions. FPS units encompass various components such as rotary joints, rigid arms, soft pipes, and buoyancy tanks. These systems enable the production of hydrocarbons from reservoirs with specific geological characteristics, ensuring initial production and subsequent modification as field conditions change. The hydrocarbon specification, water depths, and infrastructure requirements are essential factors influencing the design and implementation of FPS units.

Operators must consider reservoir requirements, such as hydrocarbon basins, seabed conditions, and processing requirements, when selecting an appropriate FPS solution. Mooring buoys, anchor piles, and mooring cables are essential components of FPS units, ensuring stability and safety in challenging ocean currents and weather conditions. FPS units can be repurposed or upgraded to accommodate changing production needs, extending their life of field. Water (gas) equipment, including risers, onboard hydrocarbon storage, and floats, are integral parts of FPS units. These systems facilitate the transportation and processing of hydrocarbons, ensuring efficient and cost-effective production. FPS units can be connected to public facilities via submarine pipelines, enabling the transfer of hydrocarbons to shuttle tankers for further processing and distribution.

The environmental characteristics of the offshore field play a significant role in the design and implementation of FPS units, with operators considering factors such as oil pricing and budget constraints. Well/subsea configuration and the configuration of the FPS unit are critical considerations in the design phase. Operators must ensure that the FPS unit can accommodate the specific wellstream requirements, including the handling of hydrocarbons and water, to maximize production efficiency and minimize downtime. In the FPS market, oil and gas companies invest heavily in the development and implementation of these systems to extract and process hydrocarbons from offshore fields.

The market dynamics are influenced by various factors, including oil pricing, exploration activities, and technological advancements. FPS units are a vital component of the oil and gas industry, enabling the production of hydrocarbons from challenging offshore environments. These systems offer flexibility and adaptability, ensuring efficient and cost-effective production while minimizing environmental impact.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

145 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.1% |

|

Market growth 2024-2028 |

USD 19.04 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.5 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Americas

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch