Flow Cytometer Market Size 2024-2028

The flow cytometer market size is forecast to increase by USD 8.17 billion at a CAGR of 15.2% between 2023 and 2028.

- The market is experiencing significant growth due to several key trends. One of the primary drivers is the increasing expenditure on research and development (R&D) in various industries, including healthcare and biotechnology. Reagents, including fluorescently labeled antibodies, viability dyes, and calibration beads, enhance cellular property detection and quantification in applications such as cell sorting, apoptosis analysis, and immunophenotyping. This investment in R&D is leading to the development of advanced flow cytometers with improved capabilities and features. Another trend is the rising level of process automation in laboratories, which is increasing the adoption of flow cytometers for automating complex analysis tasks. However, the high cost of flow cytometer instruments remains a challenge for smaller organizations and research institutions. Despite this, the benefits of using flow cytometry for accurate and rapid analysis of cells and particles are driving market growth. The market analysis report provides a comprehensive overview of these trends and other factors influencing the growth of the market.

What will be the Size of the Flow Cytometer Market During the Forecast Period?

- The market encompasses instruments and associated reagents used for clinical diagnostics and life science research. This market is driven by the increasing demand for high-throughput screening and analysis in various applications, including morphologic and biomarker discovery, single-cell analysis, and biotechnology research. Flow cytometry is integral to stem therapy development, with applications in both allogeneic and autologous therapies. The technology enables the analysis of surface markers, proliferation assays, signaling pathways, apoptosis analysis, cycle analysis, and cancer diagnosis. Additionally, advancements in microfluidic technology, immunofluorescence staining, and sorting technology have expanded the capabilities of flow cytometry, making it an essential tool for research in immunology, viability assays, and other fields.

- Overall, the market is experiencing significant growth due to its versatility and ability to provide valuable insights in various research and diagnostic applications.

How is this Flow Cytometer Industry segmented and which is the largest segment?

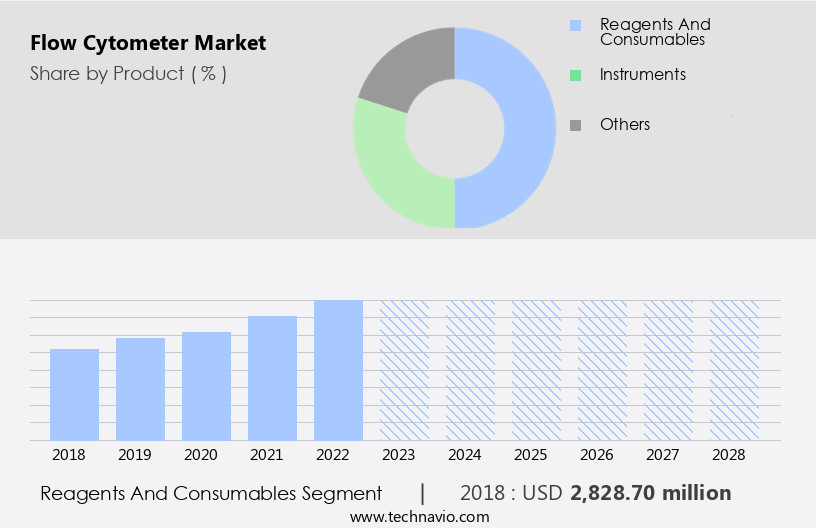

The flow cytometer industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Reagents and consumables

- Instruments

- Others

- End-user

- Pharmaceutical industry

- Health and diagnostic centers

- Others

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- Asia

- China

- Rest of World (ROW)

- North America

By Product Insights

- The reagents and consumables segment is estimated to witness significant growth during the forecast period. The market is driven by the essential role of reagents and consumables in clinical diagnostics, research, and biopharmaceutical industries. Consumables, including test tubes, sample vials, microplates, and sheath fluids, facilitate sample preparation, handling, and data acquisition, ensuring operational efficiency and maintaining sample integrity for accurate flow cytometric analyses. Applications in cancer research, infectious diseases, and radiation therapy are significant market growth areas. Collaborations between industry leaders like Cytek Biosciences and BD Biosciences in point-of-care diagnostics and automation technologies further advance the market. Multi-processing technologies, digital signal processing, and the near-infrared range expand flow cytometry's capabilities, benefiting biopharmaceutical research and cancer treatment.

Get a glance at the market report of various segments Request Free Sample

- The reagents and consumables segment was valued at USD 2.83 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

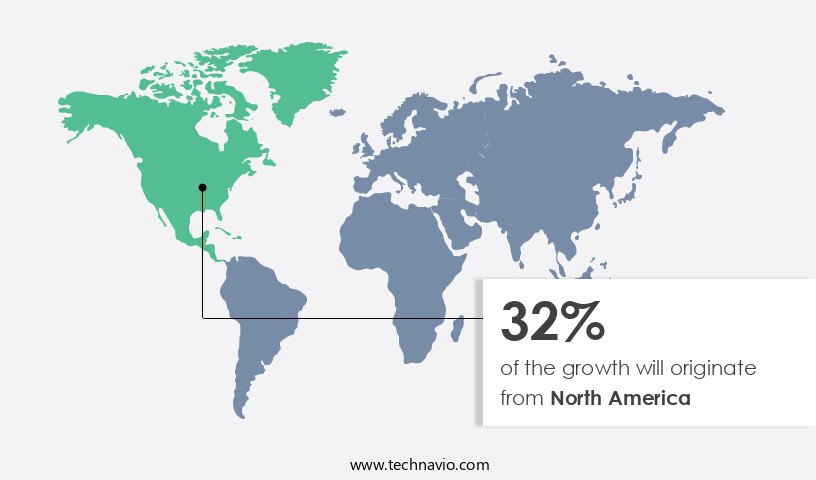

- North America is estimated to contribute 32% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

- The market in North America is experiencing significant growth due to several key factors. The increasing burden of chronic and infectious diseases, such as cancer, has led to a heightened demand for advanced diagnostic tools, including flow cytometers. Additionally, the growing presence of pharmaceutical companies and biotech firms In the region is driving research and development In the field of flow cytometry. This, in turn, is fueling the market's growth. Furthermore, the adoption of automation and digital signal processing technologies, as well as multi-processing capabilities, is enabling the development of point-of-care diagnostics and sort-capable image analysis systems. Collaborations between industry players and research institutions are also contributing to market expansion.

- The market is expected to continue growing due to the increasing demand for efficient and accurate diagnostic tools in cancer treatment and biopharmaceutical research, as well as the development of multiplex reagents and instruments capable of operating In the near-infrared range.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Flow Cytometer Industry?

- Increasing expenditure on R&D is the key driver of the market. The global flow cytometry market has experienced significant growth in research and development (R&D) expenditures over the past decade. This expansion is driven by the increasing prevalence and incidence of various diseases, including cancer, infectious diseases like COVID-19, heart diseases, chronic obstructive pulmonary disease (COPD), and dementia. Pharmaceutical companies are investing heavily in R&D to discover and develop novel drugs for a broad spectrum of therapeutic applications. Advanced technologies, such as near-ultraviolet (near UV), fluorescent activated sorting, sort-capable image analysis, digital signal processing, and multi-processing technologies, are in high demand to facilitate the development of these drugs. Collaborations between industry players and academic institutions are also on the rise to accelerate research and innovation In the field.

- Furthermore, the emergence of point-of-care diagnostics and cancer treatment technologies, such as radiation therapy, are expected to create new opportunities for market growth. The use of multiplex reagents and automation in flow cytometry is also gaining popularity in biopharmaceutical research, further fueling market expansion. The near-infrared range is an emerging area of interest in flow cytometry, offering improved sensitivity and specificity for the detection of various biomarkers. Overall, the global flow cytometry market is poised for continued growth due to the increasing demand for advanced technologies In the healthcare and biopharmaceutical industries.

What are the market trends shaping the Flow Cytometer market?

- Increasing level of process automation is the upcoming market trend.Flow cytometry, a technology utilized In the analysis of cells, is experiencing significant advancements in automation and digital integration. Instruments have evolved from manual sample preparation and loading to automated systems that prepare, load, and store samples, reducing the need for human intervention. These digital interfaces enable seamless integration with other devices and processes, increasing flexibility and efficiency. The near-UV and fluorescent activated sorting capabilities of flow cytometers are essential in cancer research and infectious disease diagnosis.

- Collaborations between industry leaders, such as Cytek Biosciences and BD Biosciences, have led to innovations like sort-capable image analysis and multi-processing technologies. The near-infrared range is also gaining popularity in radiation therapy and cancer treatment. Automation and digital signal processing are key drivers in biopharmaceutical research, enabling the use of multiplex reagents and point-of-care diagnostics. These advancements contribute to the continuous improvement and integration of flow cytometry into modern laboratory processes.

What challenges does the Flow Cytometer Industry face during its growth?

- High cost of instruments is a key challenge affecting the industry growth.The market is experiencing significant growth due to its increasing application in cancer research and diagnostics for infectious diseases. The technology's ability to perform sort-capable image analysis, fluorescent activated sorting, and digital signal processing In the near-ultraviolet and near-infrared range makes it an essential tool in biopharmaceutical research and radiation therapy for cancer treatment. Collaborations between key players and the cancer society have been instrumental in advancing the technology's capabilities.

- However, the high cost of flow cytometer instruments and associated reagents, markers, consumables, and accessories remains a significant barrier to market expansion. The average cost of a flow cytometer instrument ranges from USD 100,200 to USD 500,200, making it a substantial investment for research institutions and healthcare providers. Multi-processing technologies and multiplex reagents are expected to mitigate the high cost by enabling simultaneous analysis of multiple markers, increasing efficiency and reducing the overall cost per test. Automation and digital signal processing are also driving advancements In the field, making flow cytometry a valuable tool for point-of-care diagnostics.

Exclusive Customer Landscape

The flow cytometer market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the flow cytometer market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, flow cytometer market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry. The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- Agilent Technologies Inc.

- Amphasys AG

- Apogee Flow Systems Ltd.

- Becton Dickinson and Co.

- Bio Rad Laboratories Inc.

- Cytek Biosciences Inc.

- Danaher Corp.

- DiaSorin SpA

- Enzo Biochem Inc.

- Miltenyi Biotec B.V. and Co. KG

- Shenzhen Mindray BioMedical Electronics Co. Ltd

- OLS OMNI Life Science GmbH and Co. KG

- On-Chip Biotechnologies Co. Ltd.

- Sartorius AG

- Sony Group Corp.

- Stratedigm Inc.

- Sysmex Corp.

- Thermo Fisher Scientific Inc.

- Union Biometrica Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a diverse range of technologies and applications, driven by the increasing demand for accurate and high-throughput analysis of biological samples. This market is characterized by continuous innovation and collaboration among key players to address the evolving needs of various industries, including biopharmaceutical research and cancer diagnostics. Flow cytometry is a versatile analytical technique used to measure and analyze the physical and chemical characteristics of individual cells. The technology utilizes the principles of laser-induced fluorescence and digital signal processing to detect and quantify cellular components. This allows for the identification, sorting, and analysis of cells based on their size, granularity, and specific molecular markers.

One of the key trends In the market is the development of advanced technologies to expand the capabilities of the instrument. For instance, the use of multi-processing technologies and sort-capable image analysis enables the simultaneous measurement of multiple parameters, enhancing the overall efficiency and accuracy of the analysis. Additionally, the integration of automation and digital signal processing improves data acquisition and analysis, reducing the time and resources required for complex experiments. Another significant trend In the market is the expansion of the flow cytometer's applications beyond traditional research settings. For example, point-of-care diagnostics and cancer treatment are emerging fields where flow cytometry plays a crucial role.

In cancer diagnostics, flow cytometry is used for the detection and characterization of various types of cancer cells, including leukemia and lymphoma. In cancer treatment, the technology is employed for the monitoring of radiation therapy response and the assessment of immunotherapies. The market is also witnessing the development of new reagents and instrument designs to address specific applications. For instance, the use of fluorescent activated sorting and near-UV lasers enables the analysis of cells expressing low levels of fluorescence, while the implementation of near-infrared range lasers expands the ability to analyze cells with high autofluorescence. Collaborations and partnerships among key players are also driving innovation In the market.

These collaborations enable the sharing of expertise, resources, and technologies, leading to the development of new products and applications. For example, collaborations between instrument manufacturers and reagent suppliers facilitate the optimization of instrument performance and the development of new reagents for specific applications. Hence, the market is a dynamic and innovative field, driven by the increasing demand for accurate and high-throughput analysis of biological samples. The market is characterized by continuous innovation, collaboration, and the expansion of applications beyond traditional research settings. The development of advanced technologies, such as multi-processing and sort-capable image analysis, and the integration of automation and digital signal processing are key trends driving the growth of the market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

180 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 15.2% |

|

Market growth 2024-2028 |

USD 8.17 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

12.86 |

|

Key countries |

US, China, UK, Germany, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Flow Cytometer Market Research and Growth Report?

- CAGR of the Flow Cytometer industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the flow cytometer market growth of industry companies

We can help! Our analysts can customize this flow cytometer market research report to meet your requirements.