Cell Sorting Market Size 2024-2028

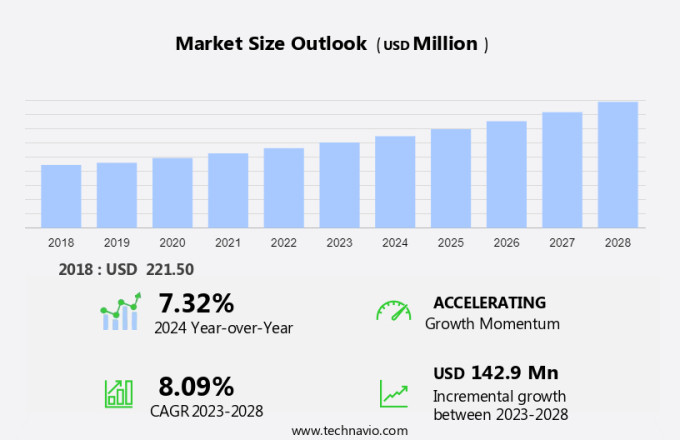

The cell sorting market size is forecast to increase by USD 142.9 billion at a CAGR of 8.09% between 2023 and 2028. The market is experiencing significant growth due to the increasing prevalence of chronic diseases, such as diabetes, and the subsequent demand for targeted therapies. Microfluidic technology, a key enabler of cell sorting, is gaining traction in healthcare and pharma industries for its ability to separate cells with high precision. This technology is particularly valuable in research applications, including genetic engineering and forensics. However, the market faces challenges, including the lack of adequately trained laboratory professionals and the high cost of equipment. In emerging economies, healthcare expenditure is on the rise, making the adoption of advanced cell sorting techniques increasingly attractive.

The market is witnessing significant research activities in the areas of cancer, HIV, Alzheimer's disease, and other chronic diseases. These conditions necessitate the need for novel therapeutics and better understanding of cells, leading to increased interest in cell sorting technologies. Funding and investments have been pouring into this sector due to its potential to revolutionize the pharmaceutical and biotechnology industries. According to recent reports, The market is expected to grow steadily, driven by advancements in cell sorting technologies and their applications in various industries.

The market holds immense potential in the pharmaceutical and biotechnology industries, particularly in the development of new therapeutics for chronic diseases such as diabetes. With the increasing incidences of these diseases, the demand for better diagnostic tools and targeted treatments is on the rise. Cell sorting technologies offer a promising solution to these challenges, making them a significant area of interest for researchers and investors alike. In conclusion, the market is poised for growth due to its applications in various research areas and industries. With continued research and investments, we can expect significant advancements in cell sorting technologies, leading to new discoveries and innovations in the field of pharmaceuticals and biotechnology.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Pharmaceutical and biotechnology companies

- Hospitals and clinical testing laboratories

- Others

- Technology

- Fluorescence-based droplet cell sorting

- Magnetic-activated cell sorting

- Micro-electromechanical systems

- Geography

- North America

- US

- Europe

- Germany

- UK

- Asia

- China

- Japan

- Rest of World (ROW)

- North America

By End-user Insights

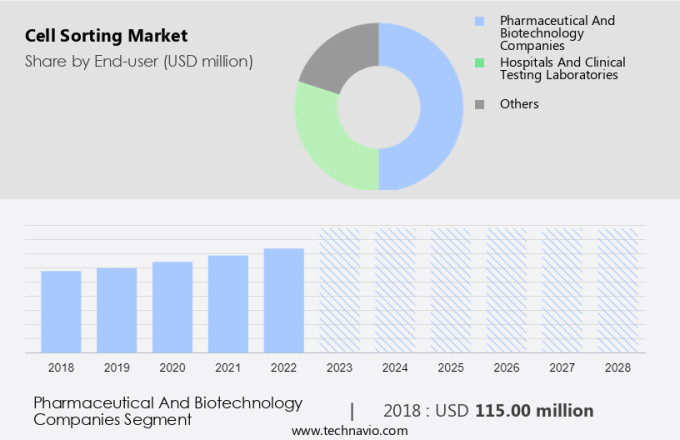

The pharmaceutical and biotechnology companies segment is estimated to witness significant growth during the forecast period. In the realm of pharmaceutical and biotechnology research, cell-based investigations hold significant importance for drug discovery, disease comprehension, and personalized medicine. The isolation of specific cell populations is essential for these studies, ensuring the precision and authenticity of the cells employed in experiments or therapies. This becomes particularly vital when dealing with infrequent cell populations or subgroups possessing distinctive traits. Two leading companies, Becton Dickinson and Danaher, dominate the international market. These corporations offer cell sorting apparatuses that cater specifically to the pharmaceutical and biotechnology sectors. Becton Dickinson provides the BD FACSAria cell sorter, a widely adopted instrument in research institutions, pharmaceutical companies, and biotechnology firms.

Investments and funding in the pharmaceutical and biotechnology sectors continue to grow, fueling research activities in various disease areas. The market is poised to benefit from this trend, as the demand for advanced cell sorting technologies increases. Companies like Becton Dickinson and Danaher are well-positioned to capitalize on this growth, given their expertise in providing cell sorting instruments to the pharmaceutical and biotechnology sectors. In conclusion, cell sorting is a critical technology in the pharmaceutical and biotechnology industry, enabling the isolation of specific cell populations for research and therapy applications. The increasing incidences of diseases like HIV, cancer, and Alzheimer's disease necessitate the development of advanced cell sorting technologies, driving investments and funding in this market.

Get a glance at the market share of various segments Request Free Sample

The pharmaceutical and biotechnology companies segment accounted for USD 115.00 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

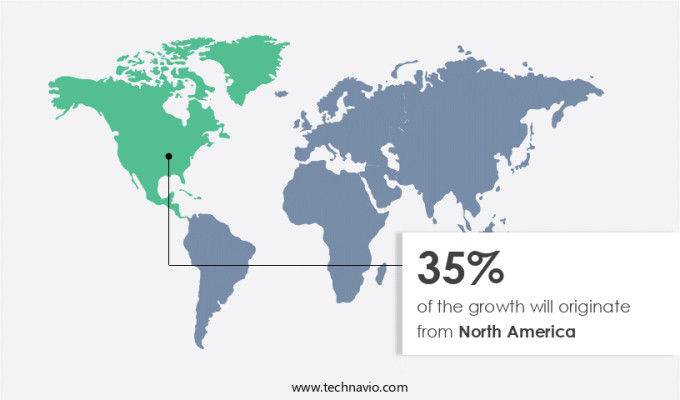

North America is estimated to contribute 35% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In North America, the market is experiencing significant growth in the United States, Canada, and Mexico. This expansion is attributed to increased government funding for cell-based research in these countries. The US, in particular, is an attractive investment destination due to financial support from organizations like the National Institutes of Health (NIH) and the Biomedical Advanced Research and Development Authority (BARDA). These entities provide funding to small businesses and companies focusing on the development of innovative therapeutics based on cells. Cell sorting technologies play a crucial role in this field, enabling researchers to isolate cells of interest based on variations in cell size, surface protein expression, and morphology. These advancements are essential for the progression of regenerative medicine research, particularly in the treatment of chronic diseases.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The increasing prevalence of chronic diseases is the key driver of the market. In the United States, the demand for cell sorting technology is escalating due to the rising prevalence of chronic diseases, such as diabetes and cancer. According to the Centers for Disease Control and Prevention (CDC), approximately 38.4 million Americans had diabetes in 2024, representing 11.6% of the population. Chronic diseases, including cancer, cardiovascular diseases (CVDs), autoimmune disorders, and infectious diseases, pose substantial challenges to healthcare systems. Cell sorting is an essential tool for medical researchers and scientists to separate distinct cells from a complex mixture, offering valuable insights into disease mechanisms, identifying biomarkers, and creating targeted therapies. Biotechnology and BioPharmaceutical industries are increasingly utilizing cell sorting techniques, such as single cell sorting, magnetic cell sorting, IsoRaft arrays, and DEParrays, to advance research and development in the field.

Flow cytometry is another widely used cell sorting technology that facilitates the analysis and separation of cells based on their physical and chemical properties. These advanced cell sorting technologies are pivotal in understanding the intricacies of various diseases and developing effective treatments. Cell sorting technology plays a critical role in the discovery and development of innovative treatments for chronic diseases, providing researchers with the ability to isolate and study specific cells, enabling a deeper understanding of disease mechanisms and the identification of potential biomarkers and therapeutic targets. This knowledge is crucial for creating targeted therapies and personalized medicine, ultimately improving patient outcomes and reducing healthcare costs.

Market Trends

The growing adoption of genetic engineering in forensic research is the upcoming trend in the market. In the realm of biology laboratories, the significance of cell sorting has grown substantially due to its role in cell isolation and molecular biological techniques. This technology is instrumental in various fields, including proteomics, where the analysis of single tumor cells is crucial. Cell Sorting Reagents and Cell Sorting Services are essential components of this technology, facilitating precise separation of cells based on specific characteristics. The increasing demand for advanced molecular biological analysis in research and diagnostic applications has driven the use of cell sorting. This technology allows for the identification and isolation of specific cell populations, enabling in-depth analysis of their biological functions.

In the US, as of April 2024, the homicide rate was 7.5 per 100,000 inhabitants. The increasing homicide rates have led to a ripple in investments in forensic research, emphasizing the importance of advanced technologies like cell sorting in this field. In conclusion, cell sorting technology plays a pivotal role in various applications, including molecular biological research and forensic investigations. Its ability to isolate specific cell populations based on distinct characteristics makes it an indispensable tool for scientists and investigators alike. With the growing demand for advanced molecular biological analysis, the future of cell sorting looks promising.

Market Challenge

The lack of trained laboratory professionals is a key challenge affecting the market growth. Cell sorting, a crucial technique in life sciences research and diagnostics, relies heavily on the accurate analysis of experimental results. The correlation of these results with the underlying hypothesis is equally significant. However, the adoption of cell sorting techniques, particularly in emerging economies, is hindered due to a lack of adequately trained laboratory personnel. In developing regions such as Asia, Africa, and South America, there is a scarcity of professionals with expertise in the latest microfluidic technologies and laboratory equipment. Furthermore, even in laboratories equipped with advanced diagnostic devices, the lack of adequate training for personnel can hinder optimal results.

This skill gap poses a challenge to the widespread adoption of cell sorting techniques, especially in the context of chronic diseases such as diabetes and the development of targeted therapies. Pharmaceutical companies and healthcare expenditure in these regions can significantly benefit from investing in training programs to bridge this gap and enhance the effectiveness of cell sorting applications.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Becton Dickinson and Co. - The company offers the facsdiscover S 8 cell sorter, which is designed to obtain insights on cell populations and characteristics that can be visually confirmed in real-time.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bio Rad Laboratories Inc.

- Bulldog-Bio Inc.

- Cell Microsystems Inc.

- Cytonome ST LLC

- Danaher Corp.

- Guandong Benice Intelligent Equipment Co.Ltd.

- Miltenyi Biotec B.V. and Co. KG

- Molecular Device LLC

- Namocell Inc.

- NanoCellect Biomedical Inc.

- On-Chip Biotechnologies Co. Ltd.

- Semco Infratech Pvt. Ltd.

- Sony Group Corp.

- STEMCELL Technologies Inc.

- Terumo Corp.

- Thermo Fisher Scientific Inc.

- Union Biometrica Inc.

- Xiamen Tmax Battery Equipments Ltd.

- Xiamen WinAck Battery Technology Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing research activities in the pharmaceutical and biotechnology sector, particularly in the areas of cancer, HIV, Alzheimer's disease, and other chronic diseases. Funding and investments in these areas have been strong, driving the demand for advanced cell sorting instruments and reagents and consumables. Cell sorting technologies, including microfluidics, magnetic cell sorting, isofluidic arrays, and deparrays, are of great interest in stem cell research, clinical applications, and healthcare institutions such as medical schools, hospitals testing laboratories, and research institutions. These technologies enable the isolation and characterization of cells based on variations in cell size, surface protein expression, morphology, and other parameters. Budgetary constraints and the need for skilled personnel can limit the adoption of cell sorting technologies in some laboratories.

However, product development and innovation, such as droplet cell sorting and single cell sorting, continue to drive market growth. Biotechnology and biopharmaceutical companies are also investing in cell sorting technologies for the development of novel therapeutics and targeted therapies. The market is expected to grow significantly due to the increasing healthcare expenditure in emerging economies and the rising incidences of cancer and other chronic diseases. Flow cytometry, a widely used cell sorting technology, is also gaining popularity in immunology research, drug discovery, and molecular biological techniques. Proteomics and single tumor cell analysis are other emerging areas of interest in the market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

162 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.09% |

|

Market Growth 2024-2028 |

USD 142.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.32 |

|

Regional analysis |

North America, Europe, Asia, and Rest of World (ROW) |

|

Performing market contribution |

North America at 35% |

|

Key countries |

US, China, Germany, UK, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Becton Dickinson and Co., Bio Rad Laboratories Inc., Bulldog-Bio Inc., Cell Microsystems Inc., Cytonome ST LLC, Danaher Corp., Guandong Benice Intelligent Equipment Co.Ltd., Miltenyi Biotec B.V. and Co. KG, Molecular Device LLC, Namocell Inc., NanoCellect Biomedical Inc., On-Chip Biotechnologies Co. Ltd., Semco Infratech Pvt. Ltd., Sony Group Corp., STEMCELL Technologies Inc., Terumo Corp., Thermo Fisher Scientific Inc., Union Biometrica Inc., Xiamen Tmax Battery Equipments Ltd., and Xiamen WinAck Battery Technology Co. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch