Food Flavors Market Size 2024-2028

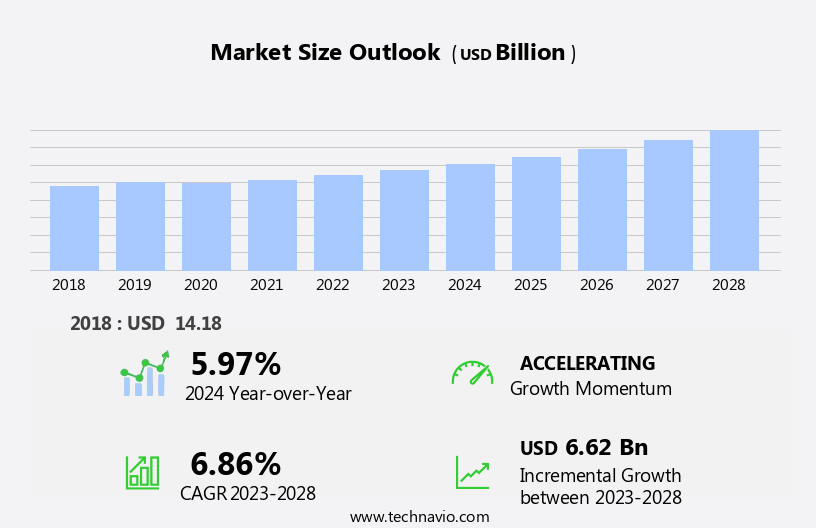

The food flavors market size is forecast to increase by USD 6.62 billion at a CAGR of 6.86% between 2023 and 2028.

- The market is experiencing significant growth, driven by the premiumization trend in the food and beverage industry. Consumers' increasing preference for high-quality, gourmet, and authentic flavors is propelling market expansion. Technological advances in the food flavor industry, such as the use of natural and artificial flavors, are enabling manufacturers to create innovative and complex taste profiles. Furthermore, the demand for functional food ingredients, particularly in dairy foods, bakery products, and ice cream, is fueling market growth. The integration of fresh herbs and other natural ingredients into food products, driven by the health and wellness trend, is also contributing to market expansion.

- However, stringent food safety regulations and guidelines pose challenges for market players, necessitating continuous investment in research and development to ensure compliance.

What will be the Size of the Food Flavors Market During the Forecast Period?

- In the dynamic and evolving world of food and beverage manufacturing, several key areas have emerged as crucial factors shaping market trends. Among these are flavor descriptors, spectroscopy, and profiles, which provide a standardized language for characterizing and understanding the complexities of food flavors. Flavor trademarks, release, and branding play essential roles in differentiating products and creating consumer loyalty. Taste receptors, extraction, and synthesis are at the heart of flavor development, while sensory evaluation, formulation, blending, and analysis ensure product consistency and quality.

- Flavor patents, modifiers, and enhancers protect intellectual property and extend the shelf life and sensory appeal of food products. Chromatography, synergists, masking, stabilization, notes, perception, communication, interaction, retention, and aroma compounds are all integral components of the flavor value chain. Flavor databases facilitate research and innovation, enabling companies to stay competitive and meet the evolving demands of consumers.

How is this Food Flavors Industry segmented and which is the largest segment?

The food flavors industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Natural flavors

- Synthetic flavors

- Organic flavors

- Application

- Beverages

- Dairy

- Confectionery

- End-use

- Food Processing

- Foodservice

- Household

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- Rest of World (ROW)

- North America

By Product Insights

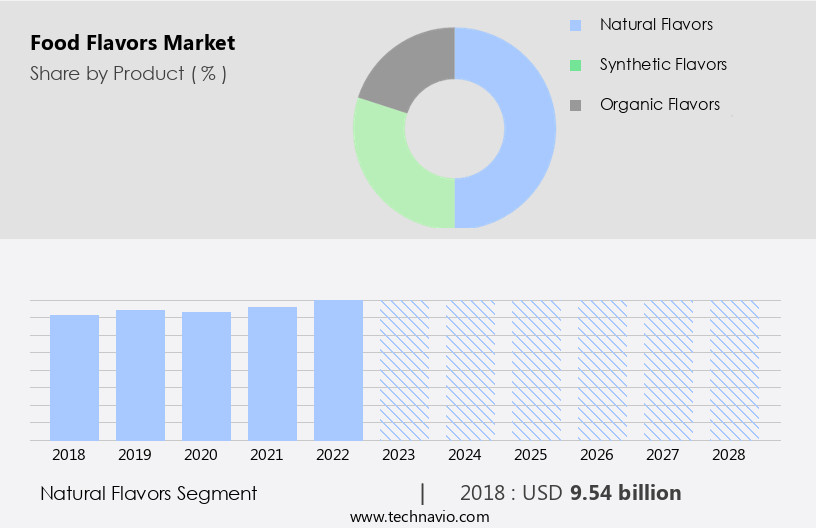

The natural flavors segment is estimated to witness significant growth during the forecast period.

Natural flavors, derived from various sources including herbs, spices, fruits, vegetables, dairy products, edible yeast, meat, and eggs, have gained significant traction in the global food industry. With increasing health consciousness among consumers and growing awareness about the potential health risks associated with artificial flavors, the demand for natural and organic flavors has surged. Europe, North America, and South America are leading regions driving this trend, with countries like Germany, France, the US, Canada, and Brazil witnessing notable growth. Natural flavors not only retain the original flavor and aroma of natural ingredients but also offer an appealing scent to various food products.

The confectionery, bakery, dairy, and beverage industries are major consumers of natural flavors. Flavor innovation, customization, and sustainability are key focus areas for companies in this sector. Flavor development and delivery systems, flavor profiles, and flavor safety are critical aspects of flavor technology. Organic, non-GMO, clean label, vegan, and kosher flavors are popular choices for consumers seeking healthier and ethically sourced options. Flavor regulations and research play a crucial role in ensuring the authenticity and stability of natural flavors. The meat industry and savory food sector also utilize natural flavors to enhance the taste and aroma of their products.

Flavor extracts, concentrates, and compounds are essential components of flavor systems, while flavor masking and authentication techniques are used to maintain consistency and quality. Fruit, sweet, vanilla, chocolate, and herbal flavors are among the most commonly used in food processing. Flavor trends indicate a shift towards plant-based and sustainable flavors, with a growing interest in exotic and ethnic flavors.

Get a glance at the market report of share of various segments Request Free Sample

The Natural flavors segment was valued at USD 9.54 billion in 2018 and showed a gradual increase during the forecast period.

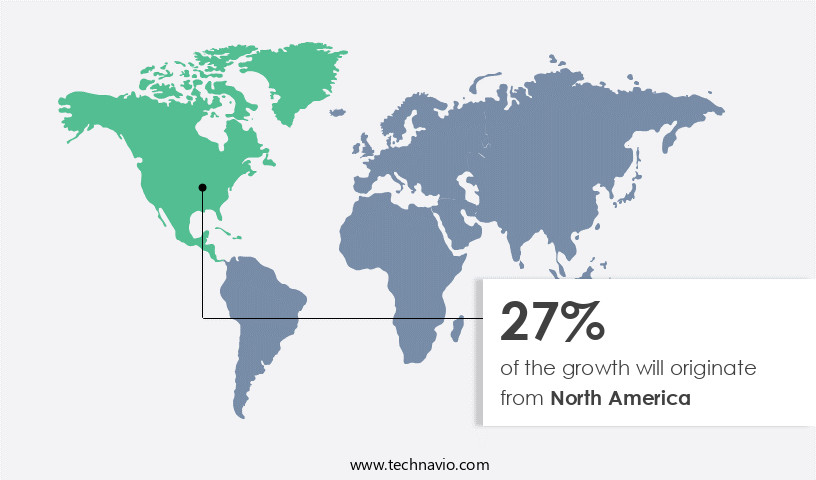

Regional Analysis

North America is estimated to contribute 27% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The North American the market is experiencing notable expansion due to the growing preference for organic food items incorporating natural flavors, particularly in the US and Canada. This trend is driven by the rising number of health-conscious consumers in the region who seek nutritious food options. Natural flavors are increasingly being adopted as key ingredients in organic food production, contributing significantly to market growth. The US market holds significant potential for growth, given the increasing demand for organic foods in the country. This shift towards natural flavors is evident in various industries, including confectionery, bakery, dairy, and beverage sectors.

The demand for clean label, non-GMO, and vegan flavors is also on the rise, influencing flavor development and delivery systems. Flavor innovation continues to be a crucial factor, with a focus on sustainability and regulatory compliance. The market encompasses a wide array of flavors, including sweet, savory, fruit, herbal, vanilla, chocolate, and spice flavors, as well as flavor extracts, concentrates, and compounds. Flavor safety and authenticity are paramount, with stringent regulations governing the use of natural and artificial flavors. The meat industry is another significant market, with a focus on flavor enhancers and masking agents. Overall, the North American the market is dynamic and evolving, reflecting consumer preferences and industry trends.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Food Flavors Industry?

Premiumization in food and beverage industry is the key driver of the market.

- The market is experiencing significant growth due to the increasing trend of premiumization in the food and beverage industry. Consumers are seeking high-quality products with unique and innovative flavors, leading manufacturers to focus on developing a wide range of premium flavors. This shift in consumer preferences has positively impacted the market, with companies offering halal, organic, and non-GMO flavors to cater to various dietary requirements. Flavor perception plays a crucial role in food and beverage consumption, and flavor technology is being used to enhance flavor delivery. The confectionery, bakery, dairy, savory, meat, beverage, and other industries are leveraging flavor systems to create new and exciting flavor profiles.

- Flavor development and customization are key areas of focus, with companies investing in flavor research and innovation to meet consumer demands. Flavor safety and stability are essential considerations in food processing, and companies are using natural ingredients and flavor compounds to create clean label solutions. Flavor authentication and sensory analysis are used to ensure flavor authenticity and consistency. The market also offers a range of flavor enhancers, masking agents, and flavor extracts to optimize taste and aroma. Flavor trends include the use of natural and herbal flavors, sweet and savory combinations, and sustainable and ethical sourcing.

- Regulations regarding flavor standards and labeling are also influencing market dynamics. companies are focusing on flavor sustainability and reducing the use of artificial flavors to meet consumer demands for healthier and more natural options. Overall, the market is dynamic and innovative, with companies continually pushing the boundaries to meet consumer preferences and expectations.

What are the market trends shaping the Food Flavors Industry?

Technological advances in food flavor industry is the upcoming market trend.

- The market is witnessing significant growth due to the increasing adoption of advanced flavor technology by numerous companies. This technology is being used to produce improved natural and synthetic flavors, ensuring stability and enhancing food perception. companies are investing heavily in research and development (R&D) activities to introduce innovation and technological advances. For instance, McCormick and Company Inc., based in the US, has conducted extensive R&D to develop advanced flavor systems. The demand for food flavors is increasing globally due to these technological advancements, driving market growth. Flavor development is a critical aspect of the food industry, particularly in sectors such as confectionery, bakery, dairy, beverage, savory, and meat.

- companies are focusing on creating flavor profiles that cater to various consumer preferences, including non-GMO, organic, and clean label. They are also offering customized flavor solutions to meet specific industry requirements. Flavor innovation is a key trend in the market, with companies introducing new flavor systems, concentrates, extracts, and compounds. Flavor safety and sustainability are also important considerations, with companies focusing on natural ingredients and reducing the use of artificial flavors and flavor enhancers. The food processing industry relies heavily on flavor chemistry to create complex flavor profiles. Sensory analysis and flavor authentication are essential to ensure the authenticity and consistency of food flavors.

- Spice flavors, fruit flavors, sweet flavors, natural flavors, herbal flavors, chocolate flavors, and vanilla flavors are some of the popular flavor categories. Flavor regulations play a crucial role in the market, with companies ensuring compliance with various flavor standards. Flavor masking is another important area of focus, with companies developing methods to mask unpleasant flavors in food products. Overall, The market is expected to continue growing due to increasing consumer demand for innovative and technologically advanced food products.

What challenges does the Food Flavors Industry face during its growth?

Stringent food safety regulations and guidelines is a key challenge affecting the industry growth.

- The market adheres to rigorous regulations to maintain flavor quality and ensure consumer safety. Compliance with these regulations can be challenging for manufacturers, potentially limiting market growth. Food flavors are classified into natural and artificial categories. Natural flavors, derived from natural sources, are gaining popularity due to consumer preference for clean label and organic products. Flavor development in the confectionery, bakery, dairy, and beverage industries relies on natural flavor profiles. Natural flavor systems are also used for flavor customization in savory applications. Non-GMO and organic flavors are essential in the market, with an increasing demand for vegan and halal flavors.

- Flavor innovation is crucial to cater to these trends, with flavor research focusing on flavor stability, delivery, and safety. Flavor technology plays a significant role in flavor delivery and masking, ensuring consistent taste in various food applications. Artificial flavors, despite controversy, continue to be used due to their cost-effectiveness and versatility. Flavor sustainability is a growing concern, with a focus on reducing waste and using renewable resources in flavor production. Flavor trends include the use of herbal, spice, and fruit flavors, as well as chocolate and vanilla. Flavor authentication and sensory analysis are essential for maintaining flavor standards, ensuring accurate representation and consumer satisfaction.

- Flavor enhancers and flavor compounds are used to optimize taste and aroma. The food processing industry relies on flavor technology for efficient production and consistent taste. Flavor chemistry is a critical aspect of flavor development, with ongoing research focusing on enhancing flavor profiles and creating new flavor compounds. Flavor safety is a top priority, with regulations ensuring the safety of both natural and artificial flavors. Flavor regulations vary by region, making it essential for manufacturers to stay informed and comply with local regulations.

Exclusive Customer Landscape

The food flavors market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the food flavors market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, food flavors market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Givaudan - The company specializes in providing food flavors that cater to nutritional and functional demands. One such offering is non-GMO chicory root fiber, which functions as a prebiotic. This ingredient enhances food products with added health benefits, making it a popular choice for manufacturers prioritizing consumer wellness.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Givaudan

- International Flavors & Fragrances

- Firmenich

- Symrise

- Mane

- Takasago International

- T. Hasegawa

- Sensient Technologies

- Robertet Group

- Huabao International

- Kerry Group

- McCormick & Company

- Bell Flavors & Fragrances

- Cargill

- ADM

- Frutarom Industries

- Nactis Flavours

- Synergy Flavors

- Blue Pacific Flavors

- Wild Flavors

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a diverse range of offerings, with various industries relying on innovative and customized solutions to cater to evolving consumer preferences. The role of flavors in food production extends beyond mere taste enhancement, as they contribute significantly to the overall sensory experience and product differentiation. Flavor perception plays a crucial role in consumer decision-making, with the ability to influence purchasing choices. As a result, flavor technology and delivery systems have gained increasing importance in the food industry. Confectionery, bakery, dairy, and beverage industries are among those that heavily invest in flavor development and innovation. Flavor systems continue to evolve, with a growing focus on non-GMO, organic, and clean label options.

Consumers' increasing demand for natural and sustainable ingredients has led to the development of flavor concentrates, extracts, and compounds derived from natural sources. Flavor customization is another key trend, as companies strive to meet the unique requirements of various markets and consumer segments. Savory, sweet, and fruit flavors are popular choices, with herbal and spice flavors gaining traction in certain regions. Flavor regulations and safety are critical considerations in the food industry. Flavor authentication and sensory analysis techniques are essential tools for ensuring product quality and consistency. Flavor stability and sustainability are also important factors, as companies seek to minimize waste and reduce their environmental footprint.

The food processing industry relies on advanced flavor chemistry to develop complex flavor profiles and mask unwanted tastes. Vanilla, chocolate, and fruit flavors are popular choices for their versatility and appeal. The meat industry also utilizes flavor technology to enhance the taste and texture of processed meat products. Flavor trends include the development of vegan and kosher flavors, as well as the use of natural flavor enhancers. Innovation continues to drive the market, with companies investing in research and development to create new and exciting flavor solutions. Flavor research and development efforts focus on improving taste, texture, and aroma, as well as addressing specific consumer needs and preferences.

Flavor sustainability is an emerging trend, with companies exploring alternative sourcing and production methods to reduce their environmental impact. The use of renewable resources and sustainable farming practices is becoming increasingly important, as consumers demand more transparency and accountability from food companies. In conclusion, the market is a dynamic and evolving industry, with a focus on innovation, sustainability, and consumer preferences. Flavor technology and delivery systems continue to advance, with a growing emphasis on natural, organic, and clean label options. Flavor regulations and safety remain critical considerations, while sensory analysis and flavor research drive product development and differentiation.

The market is expected to continue growing, as companies seek to meet the unique needs and demands of various industries and consumer segments.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

170 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.86% |

|

Market growth 2024-2028 |

USD 6.62 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.97 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Food Flavors Market Research and Growth Report?

- CAGR of the Food Flavors industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the food flavors market growth of industry companies

We can help! Our analysts can customize this food flavors market research report to meet your requirements.