Functional Food Ingredients Market Size 2025-2029

The functional food ingredients market size is valued to increase USD 59.1 billion, at a CAGR of 7.6% from 2024 to 2029. Increased demand for functional food ingredients from probiotics segment will drive the functional food ingredients market.

Major Market Trends & Insights

- APAC dominated the market and accounted for a 37% growth during the forecast period.

- By Product - Probiotics and prebiotics segment was valued at USD 32.60 billion in 2023

- By Application - Food and beverages segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 97.43 billion

- Market Future Opportunities: USD 59.10 billion

- CAGR : 7.6%

- APAC: Largest market in 2023

Market Summary

- The market encompasses a dynamic and continuously evolving landscape, driven by the increasing consumer preference for healthier food options. Core technologies, such as encapsulation and microencapsulation, enable the production of functional foods with improved stability, bioavailability, and shelf life. The applications segment, led by the probiotics sector, is experiencing significant growth due to increased consumer awareness and demand for gut health benefits. The omega-3 fatty acids segment is another major application area, driven by the proven health benefits associated with these essential nutrients.

- However, the high cost of functional foods remains a significant challenge for market growth. The market is projected to reach a market share of 42.5% by 2025. This underscores the immense potential and opportunities in this market, making it an exciting space for industry players and investors alike.

What will be the Size of the Functional Food Ingredients Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Functional Food Ingredients Market Segmented and what are the key trends of market segmentation?

The functional food ingredients industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Probiotics and prebiotics

- Proteins and amino acid

- Dietary fibers

- Vitamins and minerals

- Others

- Application

- Food and beverages

- Pharmaceuticals

- Others

- Source

- Natural

- Synthetic

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

The probiotics and prebiotics segment is estimated to witness significant growth during the forecast period.

Functional food ingredients, particularly those with high dietary fiber content, are experiencing significant market growth due to their association with numerous health benefits. Probiotic fibers, such as inulin and oligofructose, are a key driver of this trend. These fibers act as prebiotics, promoting the growth of beneficial bacteria in the gut. Lactobacillus, Bifidobacterium, and Enterococcus are common probiotic strains found in fermented dairy products and supplements. Prebiotics, non-digestible fibers primarily sourced from fruits, vegetables, and whole grains, are another significant segment. They provide various health advantages, including enhanced absorption of calcium and magnesium, improved blood sugar control, and a decreased risk of colorectal cancer.

Synergistic ingredient effects, such as the combination of prebiotics and probiotics, further boost market potential. Bioactive compound analysis, microbial fermentation, and metabolic pathway analysis are crucial in understanding the functional properties of these ingredients. Preservation strategies, nutritional labeling regulations, and protein digestibility are essential considerations for manufacturers. Clinical trial data, ingredient encapsulation, enzyme activity assay, bioavailability studies, and solubility characteristics are all vital components of the functional food matrix. Consumer acceptance studies, purification processes, probiotic strains, antioxidant capacity, process optimization techniques, shelf-life extension techniques, and ingredient stability testing are ongoing areas of research and development. Omega-3 fatty acids, extracted using various methodologies, and quality control protocols are also integral to the market.

The Probiotics and prebiotics segment was valued at USD 32.60 billion in 2019 and showed a gradual increase during the forecast period.

Packaging technologies and sensory evaluation methods further contribute to the evolving nature of the functional food ingredients industry. The market for functional food ingredients is expected to grow substantially, with a projected increase of 15% in sales volume over the next three years. Additionally, the market value is anticipated to expand by 12% during the same period. These figures reflect the continuous unfolding of market activities and the industry's adaptability to emerging trends and consumer preferences.

Regional Analysis

APAC is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Functional Food Ingredients Market Demand is Rising in APAC Request Free Sample

The APAC region dominates the market, accounting for a significant market share in 2024. This region's leadership is due to the presence of numerous functional food ingredients and food additives manufacturers. Key contributors to the APAC market's revenue include China, Japan, India, and South Korea. The region's growth can be attributed to changing lifestyle trends and increasing disposable income, leading to a heightened demand for healthy dietary options. In response to this consumer preference, Ingredion launched FIBERTEX CF 500 and FIBERTEX CF 100, multi-benefit citrus fibers, in APAC in September 2024.

These fibers offer enhanced texturizing properties and a clean label, making them suitable for consumer-preferred products. The market's growth in APAC is expected to persist during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is witnessing significant growth as consumers increasingly seek healthier options and demand for nutritional enhancement in their daily diets. Prebiotic fibers, with their impact on the gut microbiome, are a key driving force in this market. For instance, soluble fibers like inulin and oligofructose have been shown to promote the growth of beneficial bacteria, leading to improved digestive health and immunity. Another essential category is omega-3 fatty acids, with their bioavailability in food being a critical factor. Enhancing the bioavailability of these essential fatty acids through encapsulation or micro-encapsulation technologies ensures optimal health benefits for consumers.

Protein digestibility also plays a pivotal role in satiety, and the market for functional food ingredients caters to this need with various protein sources and hydrolysates. Antioxidant capacity measurement methods, microbial fermentation kinetics, enzyme activity assay validation techniques, and sensory evaluation using descriptive analysis are crucial aspects of the market. Shelf-life extension using modified atmosphere packaging and ingredient standardization for functional foods are essential for maintaining product quality and consumer trust. Quality control protocols for bioactive compounds and the functional food matrix effect on ingredient stability are critical considerations for market players. Bioactive compound analysis using HPLC and nutritional labeling regulations for functional ingredients are other essential elements of the market.

Metabolic pathway analysis of functional ingredients and digestibility coefficient determination methods are vital for understanding the mechanisms behind their health benefits. More than 60% of new product developments in the market focus on improving the nutritional value and health benefits of existing food products. The industrial application segment accounts for a significantly larger share than the academic segment due to the commercial potential of functional food ingredients.

What are the key market drivers leading to the rise in the adoption of Functional Food Ingredients Industry?

- The probiotics segment's growing demand for functional food ingredients serves as the primary market driver.

- Probiotics hold the largest market share in the functional food ingredients sector, with their popularity driven by consumers' preference for balanced diets offering nutritional benefits. Probiotics, as live microorganisms, contribute to immunity enhancement and provide essential nutrients such as vitamin K, crucial for blood clotting. Yogurt, kefir, sauerkraut, tempeh, kimchi, certain cheeses, buttermilk, and fermented soybeans are popular probiotic food products. The segment's growth is underpinned by increasing health consciousness and the expanding food industry.

- Probiotics' versatility extends across various sectors, including food and beverages, dietary supplements, and pharmaceuticals. The market's dynamic nature reflects the evolving consumer preferences and ongoing research and development initiatives.

What are the market trends shaping the Functional Food Ingredients Industry?

- The trend in the market is characterized by a rising demand for food products rich in omega-3 fatty acids. Omega-3 fatty acids are increasingly sought after in food products.

- Omega-3 fatty acids, primarily sourced from fish oils and fish scales, face consumer resistance due to their unpleasant odor and taste. To address this challenge, manufacturers explore alternative sources such as algae, krill (zooplankton), and genetically modified (GM) plants. The global demand for omega-3-based products is escalating, driven by their health benefits in preventing diseases like arrhythmias, thrombosis, high blood pressure, and inflammation.

- The US Food and Drug Administration (FDA) approves the consumption of eicosatetraenoic acid and docosahexaenoic acid omega-3 fatty acids derived from these sources. This expanding demand and the identification of alternative omega-3 sources are anticipated to fuel the growth of the market significantly during the forecast period.

What challenges does the Functional Food Ingredients Industry face during its growth?

- The escalating costs of producing functional foods pose a significant challenge to the industry's growth trajectory.

- The market faces a significant challenge due to the high cost of functional foods, which is impeding its growth. Despite the projected expansion of functional food product sales, economic factors pose a considerable hurdle. Functional foods, including nutraceuticals and medical foods, are costlier than conventional alternatives due to factors such as distribution, storage, and transportation expenses, as well as the intricate extraction process.

- These costs result in functional foods being priced 30% to 500% higher than their conventional counterparts. Consequently, the high cost of functional foods will negatively impact the growth of the market.

Exclusive Technavio Analysis on Customer Landscape

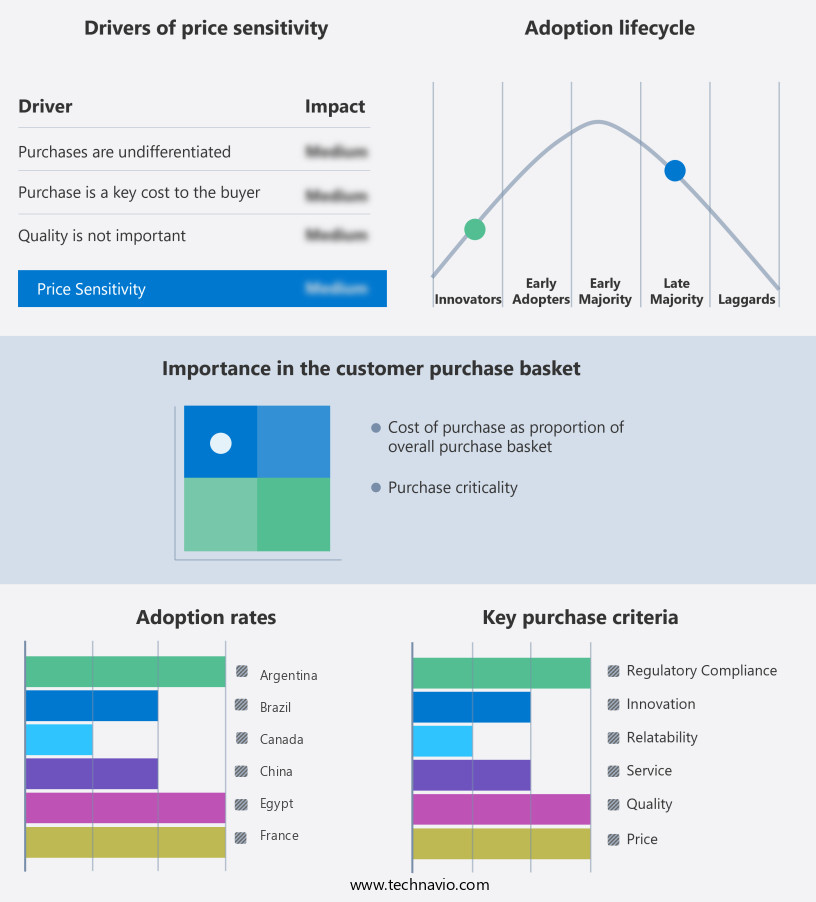

The functional food ingredients market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the functional food ingredients market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Functional Food Ingredients Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, functional food ingredients market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ADM - This company specializes in providing functional food ingredient solutions for various applications, including soups, beverages, bakery, and dairy products.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ADM

- Ajinomoto

- Arla Foods

- BASF SE

- Cargill

- Chr. Hansen

- Danone

- DSM

- FrieslandCampina

- General Mills

- Glanbia

- Ingredion

- International Flavors & Fragrances

- Kellogg's

- Kerry Group

- Nestlé

- PepsiCo

- Tate & Lyle

- TEIJIN

- Yakult

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Functional Food Ingredients Market

- In January 2024, Danone Manifesto Ventures, the venture capital arm of Danone, announced a strategic investment in Renewal Mill, a company specializing in plant-based functional ingredients, to expand its presence in the plant-based food market (Danone Manifesto Ventures Press Release).

- In March 2024, DSM, a global science-based company in Nutrition, Health and Sustainable Living, and Firmenich, the world's largest privately-owned fragrance and flavor company, entered into a strategic partnership to co-create and commercialize innovative taste and nutrition solutions for the food and beverage industry (DSM Press Release).

- In April 2025, BASF, the world's leading chemical producer, completed the acquisition of Solvay's human nutrition and pharmaceuticals business, significantly expanding its portfolio of functional ingredients and nutritional solutions (BASF Press Release).

- In May 2025, FDA approved the use of Lonza's Capsugel Vcaps Plus vegetarian capsules for use with Fortasyn Connect, a nutritional ingredient for infants and young children, enabling the company to expand its offerings in the market for pediatric nutrition (FDA Press Release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Functional Food Ingredients Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

233 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.6% |

|

Market growth 2025-2029 |

USD 59.1 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.2 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market is a dynamic and evolving landscape, driven by ongoing research and innovation in various areas. One significant focus is on dietary fiber content and absorption kinetics, with a growing interest in prebiotic fibers due to their ability to promote beneficial gut microbiota. Synergistic ingredient effects are also being explored, as the food industry seeks to optimize the nutritional value of functional foods. Bioactive compound analysis plays a crucial role in the development of new functional food ingredients. Microbial fermentation processes are used to produce these compounds, which can enhance metabolic pathway analysis and lead to improved preservation strategies.

- Nutritional labeling regulations continue to shape the market, with a focus on protein digestibility and clear communication of health benefits. Clinical trial data is essential for substantiating health claims and driving consumer acceptance. Ingredient encapsulation and enzyme activity assays help ensure bioavailability and efficacy. Solubility characteristics, purification processes, and formulation optimization are other critical factors in the functional food matrix. Probiotic strains are a key area of research, with antioxidant capacity and process optimization techniques being explored to enhance their benefits. Shelf-life extension and ingredient stability testing are also important considerations for manufacturers. Omega-3 fatty acids, extracted using various methodologies, are another class of functional ingredients that continue to gain popularity.

- Quality control protocols and packaging technologies are essential for maintaining ingredient integrity and ensuring consumer safety. Sensory evaluation methods are used to assess the acceptability of functional foods and optimize their taste and texture. The digestibility coefficient and microencapsulation methods are also important factors in the development of effective functional food ingredients. Ingredient standardization and formulation optimization are ongoing priorities, as the market continues to evolve and expand.

What are the Key Data Covered in this Functional Food Ingredients Market Research and Growth Report?

-

What is the expected growth of the Functional Food Ingredients Market between 2025 and 2029?

-

USD 59.1 billion, at a CAGR of 7.6%

-

-

What segmentation does the market report cover?

-

The report segmented by Product (Probiotics and prebiotics, Proteins and amino acid, Dietary fibers, Vitamins and minerals, and Others), Application (Food and beverages, Pharmaceuticals, and Others), Source (Natural and Synthetic), and Geography (APAC, North America, Europe, Middle East and Africa, South America, and Rest of World (ROW))

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Increased demand for functional food ingredients from probiotics segment, High cost of functional foods

-

-

Who are the major players in the Functional Food Ingredients Market?

-

Key Companies ADM, Ajinomoto, Arla Foods, BASF SE, Cargill, Chr. Hansen, Danone, DSM, FrieslandCampina, General Mills, Glanbia, Ingredion, International Flavors & Fragrances, Kellogg's, Kerry Group, Nestlé, PepsiCo, Tate & Lyle, TEIJIN, and Yakult

-

Market Research Insights

- The market encompasses a diverse range of components that enhance nutritional composition and provide various health benefits. According to industry estimates, the global market for functional food ingredients reached USD 65 billion in 2020. This growth is driven by increasing consumer demand for ingredients that reduce inflammation, support cognitive function enhancement, and offer immune system boosts. Ingredient sourcing plays a crucial role in the market, with a growing emphasis on ingredient interactions, health claim validation, and product labeling accuracy. Bioactive compound delivery systems, such as nanotechnology and encapsulation, are gaining popularity for their ability to improve nutrient bioavailability and oxidative stress reduction.

- However, challenges persist in ensuring ingredient traceability, adhering to food safety standards, and addressing scale-up challenges. Cost-effectiveness assessment, process validation studies, and formulation stability are essential considerations for market participants. Additionally, consumer perception and sensory attributes continue to influence purchasing decisions. Metabolic syndrome management, cardiovascular health benefits, gut microbiota modulation, and immune system support are key health areas addressed by functional food ingredients. Sustainability practices and product shelf-life are also crucial factors in the market's evolution.

We can help! Our analysts can customize this functional food ingredients market research report to meet your requirements.