Gamma-Butyrolactone Market Size 2024-2028

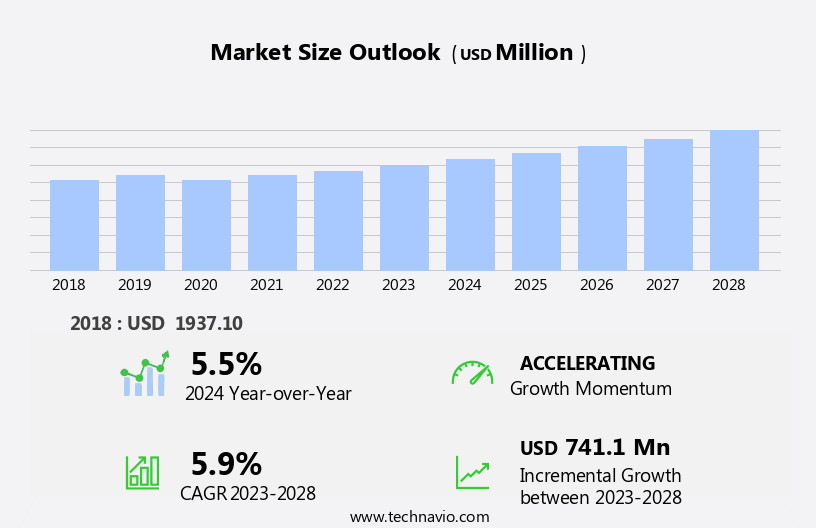

The gamma-butyrolactone market size is forecast to increase by USD 741.1 million at a CAGR of 5.9% between 2023 and 2028.

- The Gamma-Butyrolactone (GBL) market is experiencing significant growth driven by the beneficial properties of this chemical compound, which has led to its widespread adoption in various industries. One of the primary factors fueling market expansion is the increasing demand for battery electric vehicles (BEVs), as GBL is used as a solvent in the production of lithium-ion batteries. However, the market growth is not without challenges. Regulatory restrictions, particularly the ban of GBL in certain regions due to its potential health hazards, pose significant obstacles. Despite these challenges, companies seeking to capitalize on market opportunities can explore research and development of safer alternatives or focus on regions with more lenient regulations.

- Strategic partnerships and collaborations can also help navigate regulatory complexities and expand market reach. Overall, the GBL market presents both opportunities and challenges, requiring companies to stay informed of regulatory developments and invest in research and innovation to meet evolving industry demands.

What will be the Size of the Gamma-Butyrolactone Market during the forecast period?

- Gamma-butyrolactone (GBL) is a chemical compound with a structure similar to that of alcohol, which can lead to various health issues when misused. This organic compound, also known as 1,4-butanediol lactone, has been identified as a cause of drowsiness and central nervous system depression. Misuse of GBL can result in respiratory depression, withdrawal syndrome, hypersalivation, sedation, metabolic acidosis, tremor, myoclonus, bradycardia, ataxia, vomiting, gastrointestinal disturbances, and other adverse effects. Severe cases may lead to urinary incontinence, hypernatraemia, headache, toxicity, reduced tendon reflexes, insomnia, hyperglycaemia, confusion, dependence, coma, agitation, hypotension, and hypokalaemia. GBL's misuse often stems from its ability to act as a solvent and an anaesthetic agent.

- Dose escalation can exacerbate the severity of these symptoms, making it crucial for users to be aware of the potential risks associated with this compound. Given the health hazards associated with GBL, it is essential for businesses to adhere to strict safety protocols when handling this chemical. This includes proper storage, disposal, and employee training to minimize the risk of accidental exposure. Additionally, research and development efforts are ongoing to explore alternative, safer chemicals for industrial applications where GBL is currently used.

How is this Gamma-Butyrolactone Industry segmented?

The gamma-butyrolactone industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Dehydrogenation of 1 4 butanediol

- Hydrogenation of maleic anhydride

- Geography

- APAC

- China

- India

- Europe

- France

- Germany

- North America

- US

- South America

- Middle East and Africa

- APAC

By Type Insights

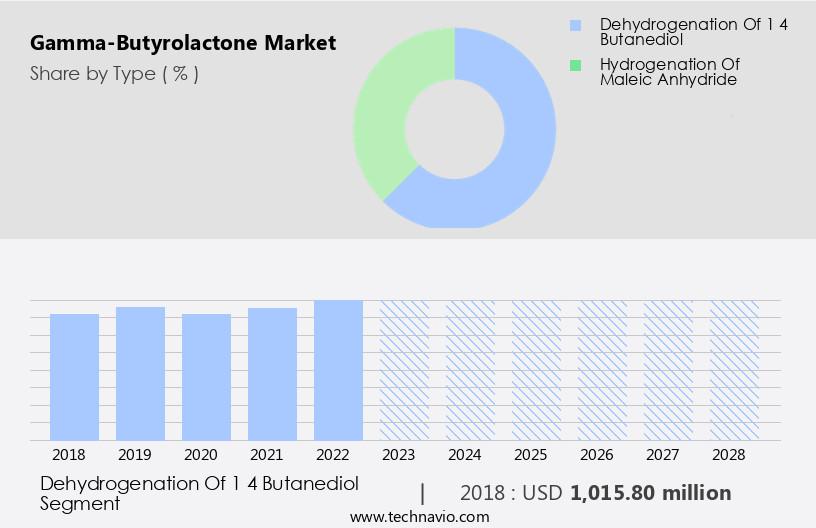

The dehydrogenation of 1 4 butanediol segment is estimated to witness significant growth during the forecast period.

The dehydrogenation of 1,4-butanediol is a crucial process in organic chemistry, resulting in the production of gamma-butyrolactone (GBL). This compound, synthesized from 1,4-butanediol, is employed extensively in the manufacturing of polymers, solvents, and other chemicals. The generation of GBL involves heating 1,4-butanediol under atmospheric pressure and temperatures ranging from 180°C to 300°C, in the presence of a copper catalyst. This process yields approximately 95% of GBL, which is subsequently purified using liquid-gas phase extraction. The global market for gamma-butyrolactone exhibits significant growth due to its wide application in various industries. For instance, GBL is a vital component in the production of lithium-ion batteries used in electronics and electric vehicles.

Moreover, it serves as a high-purity solvent in the manufacturing of capacitors and an anesthetic agent in the medical field. However, the production and utilization of GBL pose potential health risks. Consumption of GBL can lead to adverse effects such as confusion, drowsiness, coma, ataxia, hypersalivation, and tremor. Additionally, prolonged exposure to GBL may result in metabolic acidosis, hypotension, respiratory depression, agitation, gastrointestinal disturbances, bradycardia, sedatives, headache, insomnia, urinary incontinence, hypokalaemia, hypernatraemia, hypersalivation, myoclonus, and withdrawal syndrome. Despite these challenges, the demand for GBL remains strong due to its essential role in the sustainable society's development. The ongoing research and development efforts aim to minimize the health risks associated with its production and usage, ensuring the continued growth of the market.

The production of GBL occurs primarily in Okayama Prefecture, Japan, at the Okayama Plant in Kurashiki City. This facility is a significant contributor to the domestic market, which experiences continuous growth due to the increasing demand for GBL in various industries. In summary, the dehydrogenation of 1,4-butanediol leads to the production of gamma-butyrolactone, a versatile compound with extensive applications in various industries. Despite potential health risks, the market for GBL is expected to grow due to its importance in the sustainable society's development and ongoing research efforts to mitigate the associated risks.

Get a glance at the market report of share of various segments Request Free Sample

The Dehydrogenation of 1 4 butanediol segment was valued at USD 1015.80 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

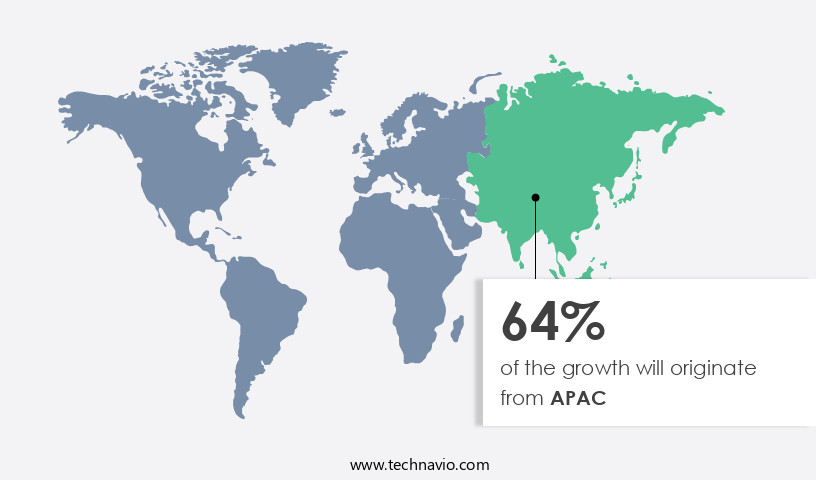

APAC is estimated to contribute 64% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

Gamma-butyrolactone (GBL), a high-purity solvent, is a significant player in various industries, including agrochemicals, pharmaceuticals, and electronics. In 2023, APAC held over 50% of the global market share. China and India, as major contributors, fueled the regional growth. China's dominance is due to the presence of leading companies and the expansion of end-user industries. GBL's versatility lies in its application across different industries and purity levels. Commercial-grade GBL is utilized in herbicides for agricultural applications. Conversely, high-purity GBL is essential for pharmaceuticals and textiles. However, the use of GBL comes with potential health risks, such as Confusion, Drowsiness, Ataxia, Coma, Withdrawal syndrome, Hypersalivation, Toxicity, and Dependence.

These risks are associated with overexposure or misuse, leading to conditions like Hypernatraemia, Hyperglycaemia, Hypokalaemia, Hypotension, Respiratory depression, Agitation, Gastrointestinal disturbances, Bradycardia, Sedatives, Headache, Insomnia, Urinary incontinence, Hypotension, and Hypersalivation. Moreover, GBL is an anesthetic agent and is used in the production of lithium-ion batteries, capacitors, and sedatives. Its application in the electronics industry, particularly in the production of EVs (electric vehicles), is on the rise due to the sustainable society's growing emphasis on reducing carbon emissions. However, the production process requires careful handling to prevent metabolic acidosis, Dose escalation, and Vomiting. The Okayama Plant in Kurashiki City, Okayama Prefecture, Japan, is a notable producer of GBL.

The plant's high production capacity contributes significantly to the domestic market. Despite these advancements, it is crucial to address the health risks associated with GBL to ensure safe and responsible usage.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Gamma-Butyrolactone Industry?

- Beneficial properties of GBL leading to its widespread adoption is the key driver of the market.

- Gamma-Butyrolactone (GBL), a colorless liquid with a weak odor and the simplest 4-carbon lactone, offers significant benefits due to its unique properties. These include a low freezing point, high boiling point, and electrical properties. These characteristics make GBL an indispensable ingredient in various industries. In the chemical sector, it is employed as an intermediate in producing methyl-2-pyrrolidone, 2-pyrrolidone, N-vinyl-2-pyrrolidone, and polyvinylpyrrolidone. In the agrochemical industry, GBL functions as a precursor for herbicides and a plant growth regulator.

- Furthermore, its low freezing point and high boiling point render it an essential raw material in the electrical industry. Consequently, GBL's wide range of applications underscores its importance in diverse sectors.

What are the market trends shaping the Gamma-Butyrolactone Industry?

- Growing demand for battery electric vehicles is the upcoming market trend.

- The global market for Gamma-Butyrolactone (GBL) is experiencing notable growth due to its increasing application in the battery electric vehicle industry. In 2020, over 10 million battery-electric vehicles were sold worldwide, and this number is projected to rise further due to advancements in electric vehicle technologies, enhanced charging infrastructure, and improving socioeconomic conditions. One of the significant applications of GBL is as an electrolyte solvent for capacitors and lithium batteries used in these vehicles.

- Consequently, the escalating demand for battery electric vehicles is anticipated to boost the consumption of GBL during the forecast period.

What challenges does the Gamma-Butyrolactone Industry face during its growth?

- Ban of GBL is a key challenge affecting the industry growth.

- Gamma-Butyrolactone (GBL) is a chemical compound that has gained attention due to its various applications. It is known to enhance athletic performance, improve sleep quality, and boost sexual performance and pleasure. Additionally, it aids in relieving depression and stress, prolonging life, promoting clear thinking, causing relaxation, and releasing growth hormones. However, it is crucial to note that when ingested, GBL transforms into gamma-hydroxybutyrate (GHB) in the stomach. GHB, also known as "liquid ecstasy," has been used in several cases to drug individuals. The combination of GBL and alcohol can be fatal, leading to severe side effects such as loss of bowel control, vomiting, mental changes, sedation, agitation, combativeness, memory loss, breathing and heart problems, fainting, seizures, coma, and even death.

- Due to these potential risks, several countries, including the US, Canada, and Sweden, have prohibited the manufacturing and selling of GBL and related products of GHB and butanediol. As a , it is essential to the potential risks associated with the use of GBL and encourage adherence to legal regulations.

Exclusive Customer Landscape

The gamma-butyrolactone market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the gamma-butyrolactone market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, gamma-butyrolactone market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ashland Inc. - The company introduces gamma butyrolactone under the brand name Blo, showcasing its commitment to delivering innovative chemical solutions. This compound, a gamma-hydroxy alpha-butyrolactone, is a versatile chemical used in various industries, including pharmaceuticals and agriculture. Its unique properties offer potential applications in solvents, intermediates, and synthesis processes. By introducing Blo, the company underscores its dedication to advancing chemical technology and contributing to industry progress.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ashland Inc.

- BASF

- Changxin Chemical Science Tech Co.

- Dairen Chemical Corp.

- Dycon Chemicals

- Genomatica Inc.

- Jigs Chemical Ltd.

- Mitsubishi Chemical Corp.

- Nan Ya Plastic Corp.

- Qingdao TaiHongDa Chemical Co. Ltd .

- Saudi International Petrochemical Company

- Shanxi Sanwei Group Co. Ltd

- Taj Pharmaceuticals Ltd.

- Zhejiang Realsun Chemical Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Gamma-butyrolactone (GBL), a high-purity solvent with a unique chemical structure, has been gaining significant attention in various industries due to its versatile applications. This organic compound, characterized by its distinct odor and viscous nature, has been utilized as a raw material in the production of various chemicals and consumer products. The global market for GBL is witnessing growth, driven by the increasing demand from the electronics industries, particularly in the manufacturing of lithium-ion batteries. The demand for these batteries is surging due to the growing popularity of electric vehicles (EVs) and the shift towards a sustainable society.

However, the use of GBL is not without its challenges. The compound is known to cause several health issues, including confusion, drowsiness, and in extreme cases, coma, hypernatraemia, and hypoglycaemia. These conditions can lead to withdrawal syndrome, ataxia, hypotension, respiratory depression, agitation, gastrointestinal disturbances, bradycardia, sedatives, headache, insomnia, urinary incontinence, hypersalivation, and tremor. Despite these health concerns, the domestic market for GBL remains strong due to its extensive use as a solvent in various industries. In Kurashiki City, Okayama Prefecture, Japan, there is an Okayama plant that specializes in the production of high-purity GBL. This plant has a significant production capacity, catering to both domestic and international demand.

The use of GBL as an anesthetic agent and sedative is another significant application area. However, its toxicity and potential for dependence have raised concerns among regulatory bodies and healthcare professionals. The compound can cause metabolic acidosis, vomiting, and dose escalation, leading to severe health complications. Despite these challenges, the market for GBL is expected to continue its growth trajectory, driven by the increasing demand from various industries. The compound's unique properties make it an indispensable ingredient in the production of capacitors, solvents, and other chemicals. As the world continues to transition towards a sustainable and electric future, the demand for GBL is expected to remain strong.

In , the market for GBL is a dynamic and evolving one, characterized by its versatile applications and unique properties. While the compound offers numerous benefits, its potential health risks cannot be ignored. As the industry continues to grow, it is essential to prioritize safety measures and regulatory compliance to mitigate the risks associated with GBL use.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

136 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.9% |

|

Market growth 2024-2028 |

USD 741.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.5 |

|

Key countries |

China, US, Germany, France, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Gamma-Butyrolactone Market Research and Growth Report?

- CAGR of the Gamma-Butyrolactone industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the gamma-butyrolactone market growth of industry companies

We can help! Our analysts can customize this gamma-butyrolactone market research report to meet your requirements.