Urinary Incontinence Devices Market Size 2024-2028

The urinary incontinence devices market size is forecast to increase by USD 1.73 billion, at a CAGR of 10.4% between 2023 and 2028.

- The market is driven by the increasing prevalence of physical and medical conditions leading to urinary incontinence. With an aging population and rising incidences of chronic diseases, the demand for specialized urology care is on the rise. However, market growth faces challenges due to product recalls. These incidents can significantly impact market trust and consumer confidence, necessitating stricter regulatory oversight and quality control measures.

- Companies seeking to capitalize on market opportunities must prioritize product safety and reliability, while also addressing the unmet needs of an aging population and those with chronic conditions. Effective collaboration with healthcare providers and patient advocacy groups can also help build trust and drive market growth.

What will be the Size of the Urinary Incontinence Devices Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and the growing demand for effective solutions to manage this condition. This dynamic market encompasses a range of products and technologies, including post-surgical care devices, electronic monitoring systems, medical adhesives, drug delivery systems, and leakage detection systems. Continence product materials, such as superabsorbent polymers and biocompatible materials, play a crucial role in ensuring tissue compatibility and patient comfort. Surgically placed devices, like surgical implants and bladder training devices, offer long-term solutions for those with severe incontinence. External catheters, wearable sensors, and disposable undergarments provide discreet and convenient options for managing leakage.

Moreover, the integration of advanced technologies, such as pressure sensors, pH indicators, wireless monitoring, and neuro stimulation therapy, enhances the effectiveness of these devices. Fluid management systems, absorbent polymers, and moisture wicking fabrics contribute to improving patient comfort and reducing the risk of skin irritation. Continence management strategies, such as pelvic floor exercises and bladder control exercises, complement the use of these devices. Prophylactic treatment and reusable diapers offer cost-effective solutions for those with mild to moderate incontinence. The market's ongoing unfolding reflects the industry's commitment to developing innovative solutions that cater to the diverse needs of patients and healthcare providers.

How is this Urinary Incontinence Devices Industry segmented?

The urinary incontinence devices industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Urinary slings

- Neuromodulation devices

- Urinary catheters

- Geography

- North America

- US

- Canada

- Europe

- Germany

- UK

- APAC

- China

- Rest of World (ROW)

- North America

By Product Insights

The urinary slings segment is estimated to witness significant growth during the forecast period.

In the realm of post-surgical care, the market for urinary incontinence devices continues to evolve, with a focus on advanced technologies and solutions. Companies are developing a range of devices to address various types of incontinence, from stress incontinence urinary slings made with mesh or human tissue, to surgically placed devices that offer leakage management and continence management strategies. These solutions include electronic monitoring systems, medical adhesives, drug delivery systems, and leakage detection systems, all designed to enhance patient comfort and improve outcomes. Advancements in continence product materials, such as superabsorbent materials and biocompatible fabrics, are enabling the creation of more effective and comfortable disposable undergarments, reusable diapers, and continence pads.

Wearable sensors and wireless monitoring systems are also gaining popularity, offering real-time leakage detection and bladder capacity measurement. To cater to diverse patient needs, companies are exploring various technologies, including pressure sensors, fluid absorption rates, and sensor integration. Neuro stimulation therapy, skin barrier creams, and fluid management systems are also being employed to address the challenges of urinary incontinence. Additionally, prophylactic treatment and pelvic floor exercises are being integrated into continence management strategies to prevent incontinence and improve bladder control. The market for urinary incontinence devices is witnessing significant activity, with companies investing in research and development to create innovative solutions.

Mergers and acquisitions are also on the rise, as companies seek to expand their product portfolios and stay competitive. For instance, the American Medical Systems Mens Health and Prostate Health businesses merged with Boston Scientific Urology and Womens Health businesses to form the Boston Scientific Urology and Pelvic Health business. This strategic move is expected to drive growth and innovation in the market.

The Urinary slings segment was valued at USD 822.90 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

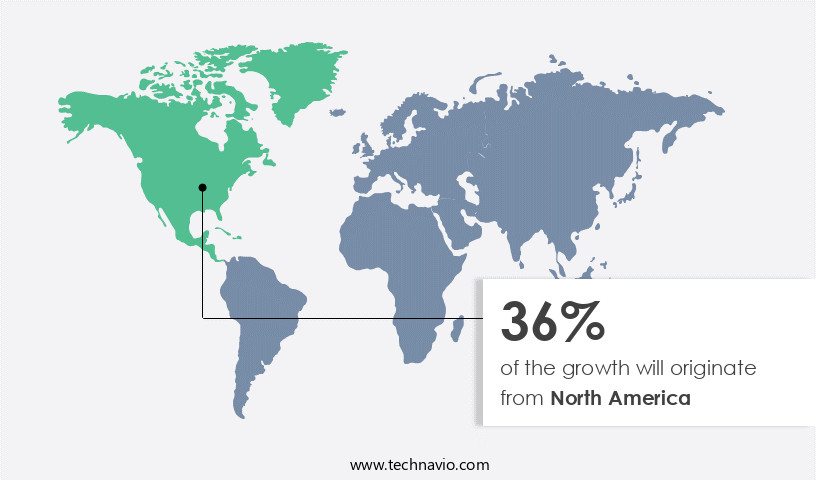

North America is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing notable expansion due to several key factors. The aging population and rising prevalence of conditions such as diabetes, urinary tract infections, and pregnancy are significant contributors to the market's growth. Furthermore, the increasing number of specialized urology hospitals and clinics, along with training sessions for healthcare professionals, is driving market expansion. Global and local companies, including Becton Dickinson and Co., A.M.I. GmbH, and Boston Scientific Corp., are increasingly present in the market, offering a range of solutions. These include electronic monitoring systems, medical adhesives, drug delivery systems, leakage detection systems, and various continence product materials.

Bladder training devices, pressure sensors, and fluid absorption rates are essential considerations, as is tissue compatibility and biocompatible materials. Superabsorbent materials, surgically placed devices, and leakage management strategies are also vital. Continence management strategies encompass external catheters, wearable sensors, disposable undergarments, surgical implants, pH indicators, continence pads, wireless monitoring, pelvic floor exercises, and bladder control exercises. Patient comfort technology, bladder capacity measurement, sensor integration, and various other advancements are shaping the market. Absorbent polymers, tens units, and incontinence briefs are additional offerings. Neuro stimulation therapy, skin barrier creams, fluid management systems, and various other solutions are also gaining traction.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Urinary Incontinence Devices Industry?

- The increasing prevalence of physical and medical conditions, such as stroke, multiple sclerosis, and diabetes, is the primary driver for the growth of the urinary incontinence market. This market expansion is attributed to the rising incidence and prevalence of these conditions, which often result in urinary incontinence as a symptom.

- Urinary incontinence, a common health issue, primarily affects older adults, particularly women, due to weakened pelvic and bladder muscles. However, it can also impact middle-aged adults with neurological disorders such as Parkinson's disease, diabetes, arthritis, spinal injuries, pregnancy, and menopause, which damage the nerves responsible for bladder control. The aging population's significant presence in both developed and developing countries will fuel the demand for urinary incontinence devices.

- These devices offer discreet and effective solutions, enabling individuals to maintain their dignity and independence. The prevalence of chronic diseases and increasing awareness about bladder control issues further contribute to the market's growth.

What are the market trends shaping the Urinary Incontinence Devices Industry?

- Focusing on specialized urology care is an emerging market trend.

- The market for urinary incontinence devices is experiencing significant growth due to the increasing prevalence of urological issues. To enhance urology care and expand product reach, companies are collaborating with healthcare providers such as hospitals, clinics, and ambulatory surgery centers (ASCs). Central Ohio Urology Group, a leading urology care provider, recently secured an investment from New MainStream Capital to strengthen its position in the industry. This partnership will facilitate Central Ohio Urology Group's growth through acquisitions, practice and ASC openings, provider recruitment, and infrastructure investment. Innovative technologies, such as electronic monitoring systems, medical adhesives, drug delivery systems, leakage detection systems, and bladder training devices, are transforming the market.

- These solutions employ advanced materials like pressure sensors and exhibit superior fluid absorption rates. Companies are also focusing on developing user-friendly devices that prioritize patient comfort and convenience. Moreover, the integration of technology in continence products is enabling real-time monitoring and analysis of patient data, enabling personalized care plans and improved treatment outcomes. These factors are expected to further fuel market growth in the coming years.

What challenges does the Urinary Incontinence Devices Industry face during its growth?

- Product recalls pose a significant challenge to industry growth, as companies must address safety concerns and restore consumer trust following the withdrawal of faulty products from the market.

- Urinary incontinence devices are essential for individuals seeking leakage management solutions. Companies manufacturing these devices must prioritize tissue compatibility and the use of superabsorbent materials to ensure user comfort and effectiveness. However, product recalls due to defects can negatively impact both demand and the company's reputation. For instance, in 2022, a urinary incontinence device produced by Medtronic Plc was recalled due to potential electrical component issues. This recall not only decreased demand for the product but also harmed Medtronic's reputation in the market. Continence management strategies encompass various solutions, including surgically placed devices, external catheters, wearable sensors, disposable undergarments, and surgical implants.

- Companies must focus on producing high-quality, reliable products to maintain consumer trust and confidence. Regulatory bodies like the US FDA play a crucial role in ensuring product safety and effectiveness by monitoring recalls and enforcing quality standards. In the competitive the market, companies must prioritize innovation and continuous improvement to meet the evolving needs of end-users. This may include investing in research and development, collaborating with healthcare professionals, and leveraging technology, such as wearable sensors and advanced materials, to create more effective and user-friendly solutions. By focusing on these areas, companies can differentiate themselves from competitors and maintain a strong market presence.

Exclusive Customer Landscape

The urinary incontinence devices market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the urinary incontinence devices market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, urinary incontinence devices market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

A.M.I. GmbH - This company specializes in advanced urinary incontinence solutions, including the sensiTVT and sensiTVT-A devices.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- A.M.I. GmbH

- B.Braun SE

- Becton Dickinson and Co.

- BioDerm Inc.

- Boston Scientific Corp.

- Caldera Medical Inc.

- Coloplast AS

- Control Flo Medical LLC

- ConvaTec Group Plc

- Cook Group Inc.

- Hollister Inc.

- Johnson and Johnson Inc.

- KARL STORZ SE and Co. KG

- Laborie

- Medtronic Plc

- Multigate Medical Products Pty Ltd.

- Teleflex Inc.

- UroDev Medical

- Zephyr Surgical Implants

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Urinary Incontinence Devices Market

- In January 2024, Medtronic plc, a global healthcare solutions company, announced the launch of its new InterStim⢠Micro Neuromodulation System for the treatment of overactive bladder and urinary retention. This advanced device offers improved patient comfort and convenience with its small size and rechargeable battery (Medtronic Press Release, 2024).

- In March 2024, Coloplast A/S, a Danish medical devices company, entered into a strategic partnership with Merck KGaA, a German pharmaceutical and life sciences company, to co-develop and commercialize a combination therapy for the treatment of urinary incontinence. This collaboration aims to improve patient outcomes by integrating Coloplast's medical devices with Merck's pharmaceutical offerings (Coloplast Press Release, 2024).

- In July 2024, NeoTract, Inc., a subsidiary of Teleflex Incorporated, received FDA approval for its UroLift® System for the treatment of male stress urinary incontinence. This minimally invasive, permanent implant system offers an alternative to traditional surgery and has shown significant improvements in patient outcomes (NeoTract Press Release, 2024).

- In May 2025, Boston Scientific Corporation announced the acquisition of Vessix Vascular, Inc., a privately held medical device company specializing in the development of minimally invasive solutions for the treatment of urinary incontinence. This acquisition strengthens Boston Scientific's position in the urology market and provides access to Vessix's proprietary technology for the treatment of neurogenic detrusor overactivity (Boston Scientific Press Release, 2025).

Research Analyst Overview

- The market encompasses a range of solutions designed to manage and prevent leakage for individuals experiencing this condition. Key trends include the integration of advanced technologies such as electrical stimulation for urethral closure and pressure relief systems for pelvic floor muscle rehabilitation. Product efficacy data plays a crucial role in selection, with sensors and leakage volume measurement systems providing valuable insights into treatment outcomes. Skin health is another critical consideration, with materials and design optimized for reducing irritation and enhancing comfort.

- Medical device regulations ensure stringent quality standards, while product testing and continual improvement in absorbent core design and sensor accuracy drive innovation. Incontinence care products span from disposable absorbent pads to catheters, with catheter materials and bladder volume monitoring systems catering to those requiring more invasive solutions. Surgical procedures and rehabilitation exercises are also integral components of comprehensive continence management strategies.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Urinary Incontinence Devices Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

171 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.4% |

|

Market growth 2024-2028 |

USD 1725.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

9.1 |

|

Key countries |

US, Germany, UK, Canada, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Urinary Incontinence Devices Market Research and Growth Report?

- CAGR of the Urinary Incontinence Devices industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the urinary incontinence devices market growth of industry companies

We can help! Our analysts can customize this urinary incontinence devices market research report to meet your requirements.